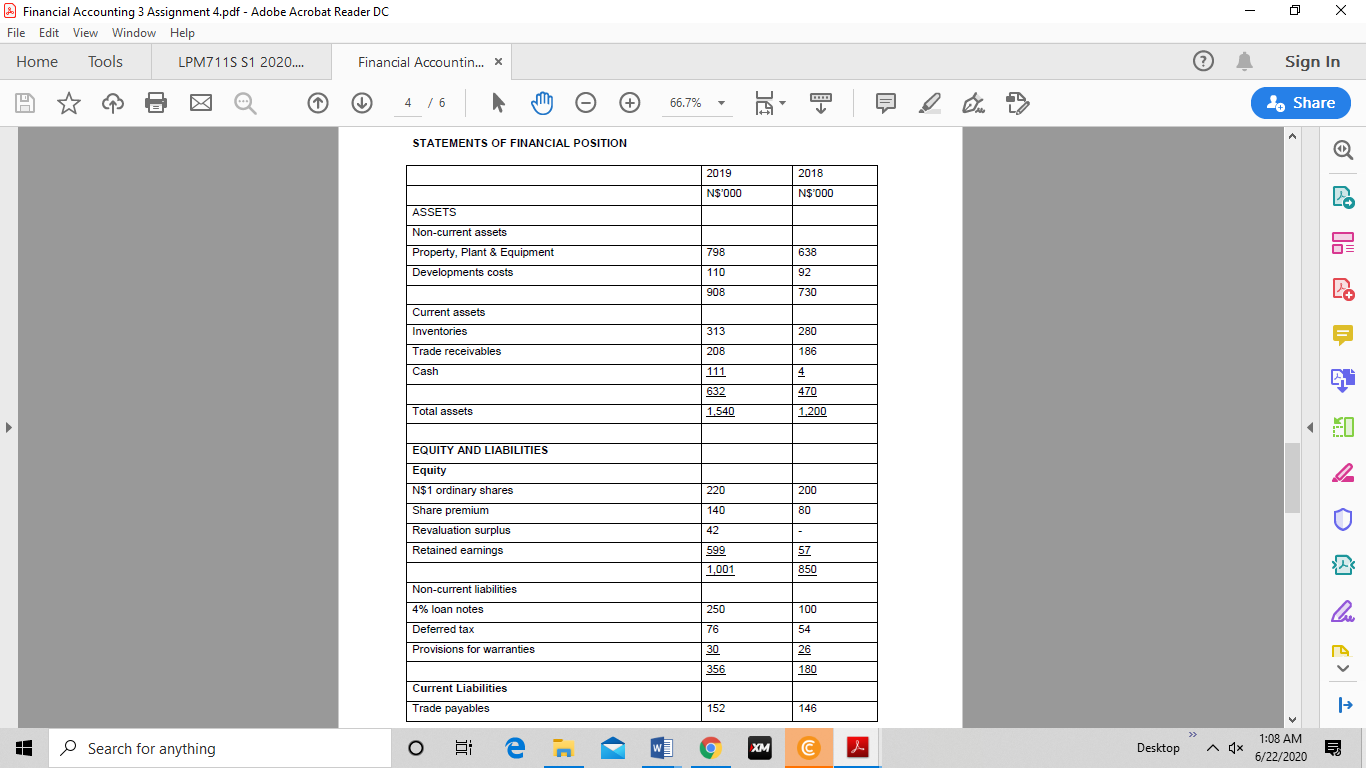

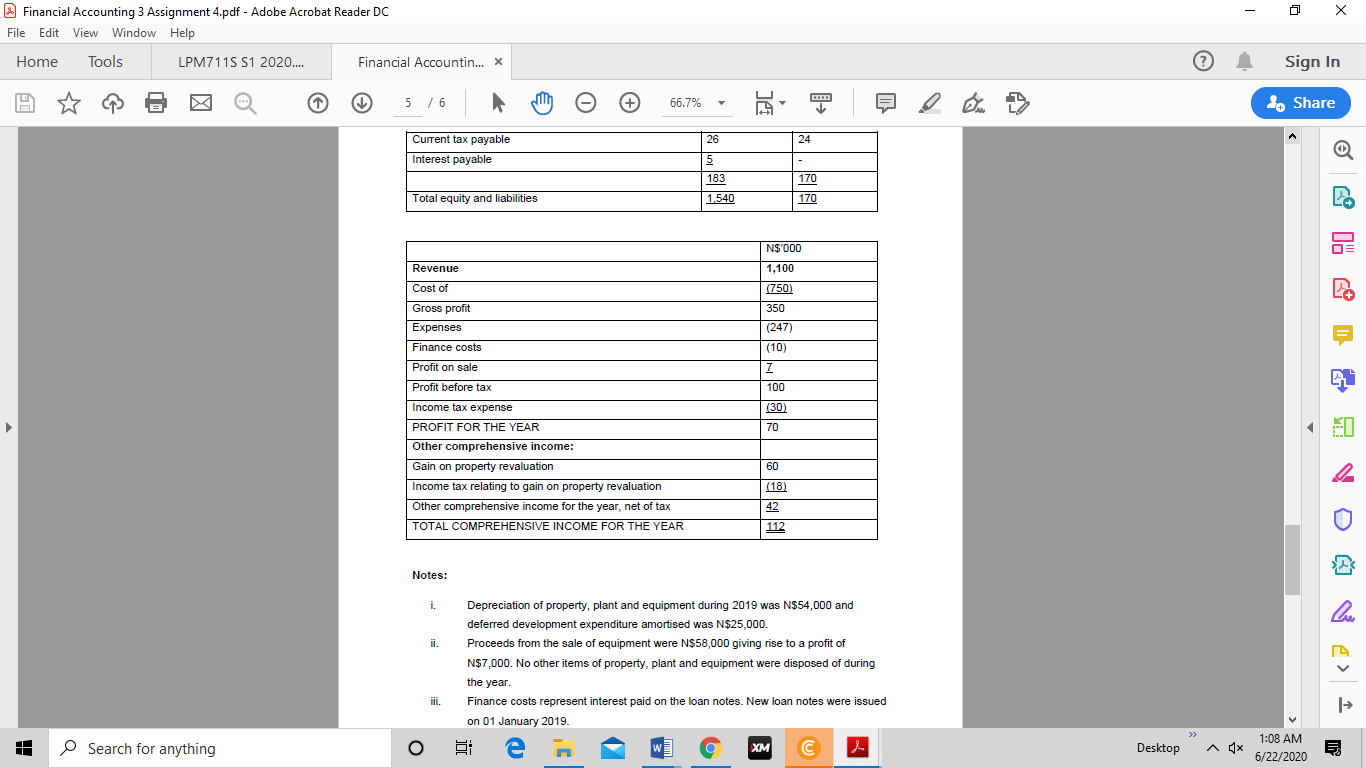

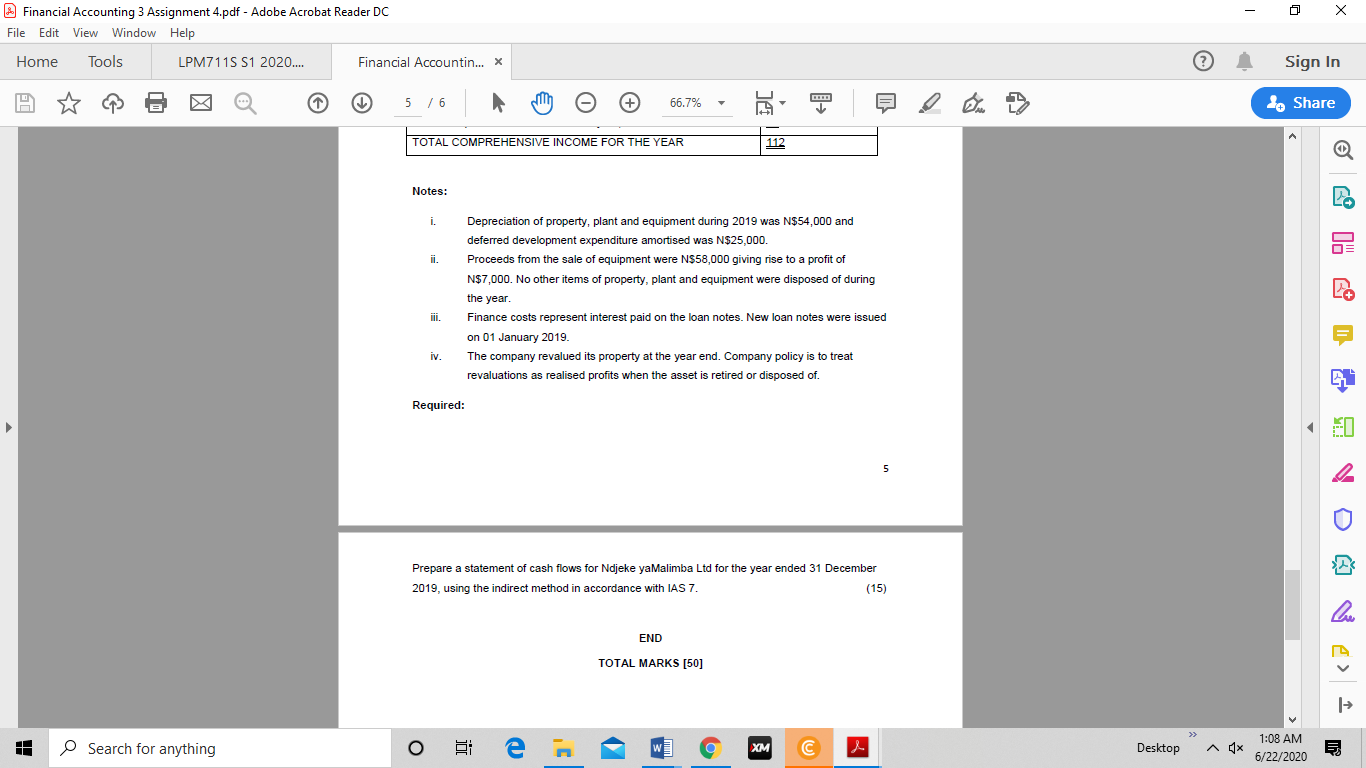

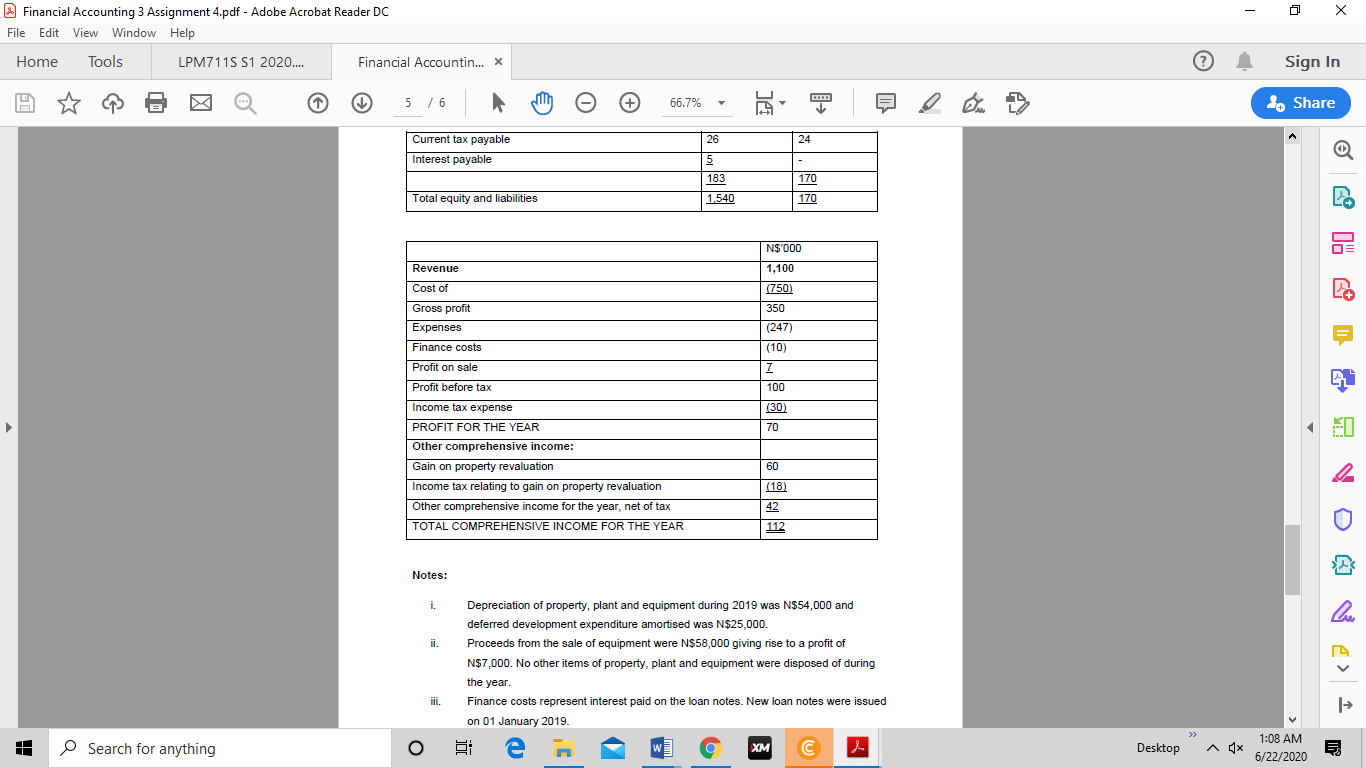

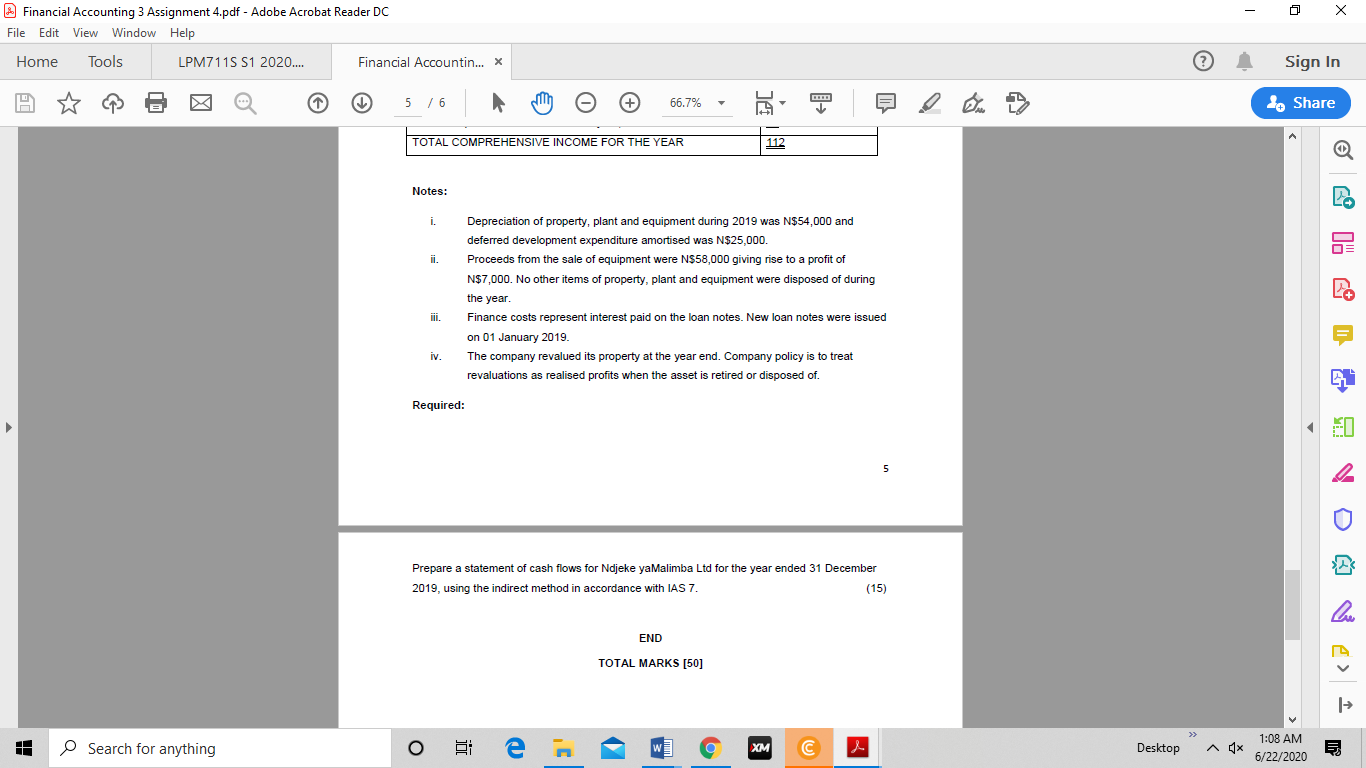

- Financial Accounting 3 Assignment 4.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools LPM7115 S1 2020.... Financial Accountin... X Sign In C 4 / 6 66.7% Share STATEMENTS OF FINANCIAL POSITION 2019 2018 N$'000 N$'000 ASSETS Non-current assets 798 638 Property, Plant & Equipment Developments costs 110 92 908 730 Current assets 313 280 Inventories Trade receivables 208 186 Cash 111 EL 632 470 Total assets 1.540 1.200 220 200 EQUITY AND LIABILITIES Equity N$1 ordinary shares Share premium Revaluation surplus Retained earings 140 80 42 599 1,001 57 850 Non-current liabilities 4% loan notes 100 250 76 Deferred tax 54 Provisions for warranties 30 356 26 180 Current Liabilities Trade payables 152 146 IH Search for anything O e w a XM C Desktop ^ cx 1:08 AM 6/22/2020 - Financial Accounting 3 Assignment 4.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools LPM7115 S1 2020.... Financial Accountin... X Sign In 5 / 6 66.7% 7 do Share 26 24 Current tax payable Interest payable 5 183 170 Total equity and liabilities 1,540 170 N$'000 Revenue 1,100 (750) 350 Cost of Gross profit Expenses Finance costs (247) (10) Profit on sale 7 EL Profit before tax 100 (30) 70 Income tax expense PROFIT FOR THE YEAR Other comprehensive income: Gain on property revaluation Income tax relating to gain on property revaluation Other comprehensive income for the year, net of tax TOTAL COMPREHENSIVE INCOME FOR THE YEAR 60 (18) 42 112 Notes: i. ii. Depreciation of property, plant and equipment during 2019 was N$54,000 and deferred development expenditure amortised was N$25,000. Proceeds from the sale of equipment were N$58,000 giving rise to a profit of N$7,000. No other items of property, plant and equipment were disposed of during the year. Finance costs represent interest paid on the loan notes. New loan notes were issued on 01 January 2019. e XM C iii. IH Search for anything W Desktop ^ cx 1:08 AM 6/22/2020 - Financial Accounting 3 Assignment 4.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools LPM7115 S1 2020.... Financial Accountin... X Sign In 5/6 66.7% Share TOTAL COMPREHENSIVE INCOME FOR THE YEAR 112 Notes: i. ii. Depreciation of property, plant and equipment during 2019 was N$54,000 and deferred development expenditure amortised was N$25,000. Proceeds from the sale of equipment were N$58,000 giving rise to a profit of N$7,000. No other items of property, plant and equipment were disposed of during the year. Finance costs represent interest paid on the loan notes. New loan notes were issued on 01 January 2019. The company revalued its property at the year end. Company policy is to treat revaluations as realised profits when the asset is retired or disposed of. ji. iv. EL Required: 5 Prepare a statement of cash flows for Ndjeke yaMalimba Ltd for the year ended 31 December 2019, using the indirect method in accordance with IAS 7. (15) END TOTAL MARKS [50] 1 IH Search for anything o w O XM C Desktop 1:08 AM 6/22/2020 - Financial Accounting 3 Assignment 4.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools LPM7115 S1 2020.... Financial Accountin... X Sign In C 4 / 6 66.7% Share STATEMENTS OF FINANCIAL POSITION 2019 2018 N$'000 N$'000 ASSETS Non-current assets 798 638 Property, Plant & Equipment Developments costs 110 92 908 730 Current assets 313 280 Inventories Trade receivables 208 186 Cash 111 EL 632 470 Total assets 1.540 1.200 220 200 EQUITY AND LIABILITIES Equity N$1 ordinary shares Share premium Revaluation surplus Retained earings 140 80 42 599 1,001 57 850 Non-current liabilities 4% loan notes 100 250 76 Deferred tax 54 Provisions for warranties 30 356 26 180 Current Liabilities Trade payables 152 146 IH Search for anything O e w a XM C Desktop ^ cx 1:08 AM 6/22/2020 - Financial Accounting 3 Assignment 4.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools LPM7115 S1 2020.... Financial Accountin... X Sign In 5 / 6 66.7% 7 do Share 26 24 Current tax payable Interest payable 5 183 170 Total equity and liabilities 1,540 170 N$'000 Revenue 1,100 (750) 350 Cost of Gross profit Expenses Finance costs (247) (10) Profit on sale 7 EL Profit before tax 100 (30) 70 Income tax expense PROFIT FOR THE YEAR Other comprehensive income: Gain on property revaluation Income tax relating to gain on property revaluation Other comprehensive income for the year, net of tax TOTAL COMPREHENSIVE INCOME FOR THE YEAR 60 (18) 42 112 Notes: i. ii. Depreciation of property, plant and equipment during 2019 was N$54,000 and deferred development expenditure amortised was N$25,000. Proceeds from the sale of equipment were N$58,000 giving rise to a profit of N$7,000. No other items of property, plant and equipment were disposed of during the year. Finance costs represent interest paid on the loan notes. New loan notes were issued on 01 January 2019. e XM C iii. IH Search for anything W Desktop ^ cx 1:08 AM 6/22/2020 - Financial Accounting 3 Assignment 4.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools LPM7115 S1 2020.... Financial Accountin... X Sign In 5/6 66.7% Share TOTAL COMPREHENSIVE INCOME FOR THE YEAR 112 Notes: i. ii. Depreciation of property, plant and equipment during 2019 was N$54,000 and deferred development expenditure amortised was N$25,000. Proceeds from the sale of equipment were N$58,000 giving rise to a profit of N$7,000. No other items of property, plant and equipment were disposed of during the year. Finance costs represent interest paid on the loan notes. New loan notes were issued on 01 January 2019. The company revalued its property at the year end. Company policy is to treat revaluations as realised profits when the asset is retired or disposed of. ji. iv. EL Required: 5 Prepare a statement of cash flows for Ndjeke yaMalimba Ltd for the year ended 31 December 2019, using the indirect method in accordance with IAS 7. (15) END TOTAL MARKS [50] 1 IH Search for anything o w O XM C Desktop 1:08 AM 6/22/2020