Answered step by step

Verified Expert Solution

Question

1 Approved Answer

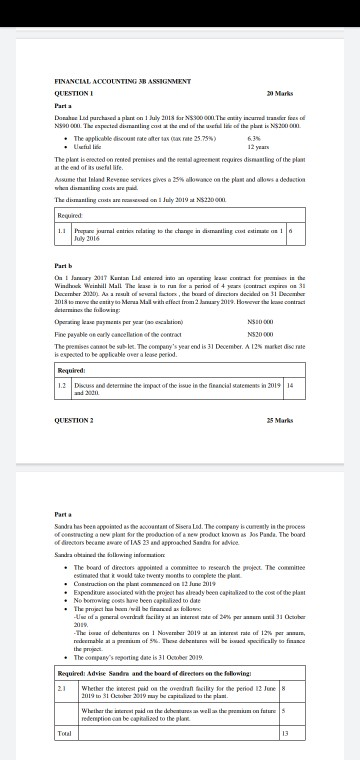

FINANCIAL ACCOUNTING 3B ASSIGNMENT QUESTION I Marks Parta Donate ad purchased a part on 1 July 2018 for NS300 L The aut incurred trader fresh

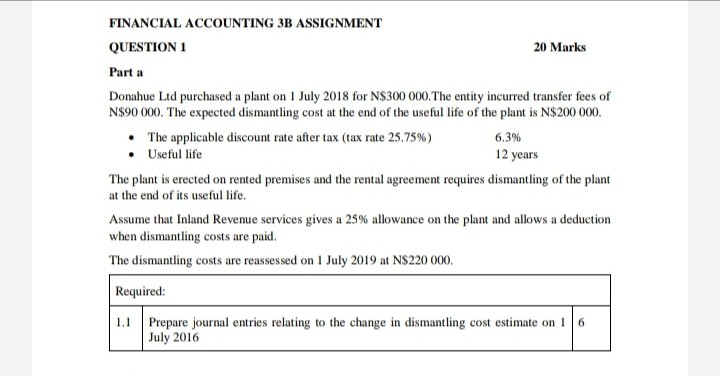

FINANCIAL ACCOUNTING 3B ASSIGNMENT QUESTION I Marks Parta Donate ad purchased a part on 1 July 2018 for NS300 L The aut incurred trader fresh NSHOCOL. The expected distraling at the end of the wetul lite od the part i 2000. . The applicabile discount rate atter was tax rate 25.78%) 63 12 years The plant is noted creme premises and the real agremes requires dismantling of the plan at the end of its life. Assume that and Reverse services gives a 25% allowance on the past and obesa dalectiva when diamantinguts are paid The dismantling code are seved on July 2019 a 22000 1.1 Papua jarral entries relating to July 2016 charge in citramiling | Part De 1 January 2017 Xantan Lad entendimento la retrato premises in the Windluck Weinbill Mall The leasetti a period of 4 yees contract expire 31 December 2009. As a real fotos, the board of director decided on 31 December 2018 is mee dentayo Maru Mall with effect from 2. fry 2019. However the lane contract determine the following Opening lease payments per year las cation NSIO Fine payable on caly cancellation of the contract NS30000 The premises comme be sulkes. The company's year end is 31 December. A 128 kedi me is expected to be applicable over alone period. Required 1.2 Discuss and determine the impact of the issue in the financial statements in 201914 and 2000 QUESTION 25 Marks Parta Sandra has been appointed as the coast of Sira Ld. The company is currently in the process cting a new plan for the production of a new product known as Los Panda. The board directors became aware of IAS 23 and approached Sandre for advice Sastra obtained the following inden The board of directors opened a comie to research the project. The cominee we work cake Twenty to complete the plan Construction on the pas commenced on 12 2019 Expenditure we associated with the project has already been capitalized to the cos olhe plant No borowing costs We been captilized to date . The program will be finered as follow Llunda general overdrat facilty at an interest rate of 20% per annum til 31 October The two of us on November 2019 neret rate of 12% per mm redeemable at a prem of these denim will head citically define ther The company's dates Ohr 2019 Required Adsise Sandra and the board of directes co the flowing 2.1 Whether the interest paid on the overall facility for the period 12 June 2019 to 31 October 2010 may be capitalands the plani. Whether the interent paid to the domes a well the premium in futures redemption can be to the po Total 13 FINANCIAL ACCOUNTING 3B ASSIGNMENT QUESTION 1 20 Marks Part a Donahue Ltd purchased a plant on 1 July 2018 for N$300 000. The entity incurred transfer fees of N$90 000. The expected dismantling cost at the end of the useful life of the plant is N$200 000. The applicable discount rate after tax (tax rate 25.75%) 6.3% Useful life 12 years The plant is erected on rented premises and the rental agreement requires dismantling of the plant at the end of its useful life. Assume that Inland Revenue services gives a 25% allowance on the plant and allows a deduction when dismantling costs are paid. The dismantling costs are reassessed on 1 July 2019 at N$220 000, Required: 1.1 Prepare journal entries relating to the change in dismantling cost estimate on 16 July 2016

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started