Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial accounting 3Rrd year Financial accounting 3Rrd year Question Seven CRISPY organisas events and music festivals throughout the USA and in July 2017 made two

Financial accounting 3Rrd year

Financial accounting 3Rrd year

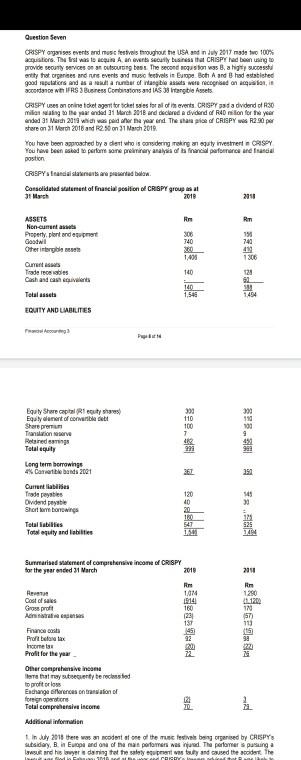

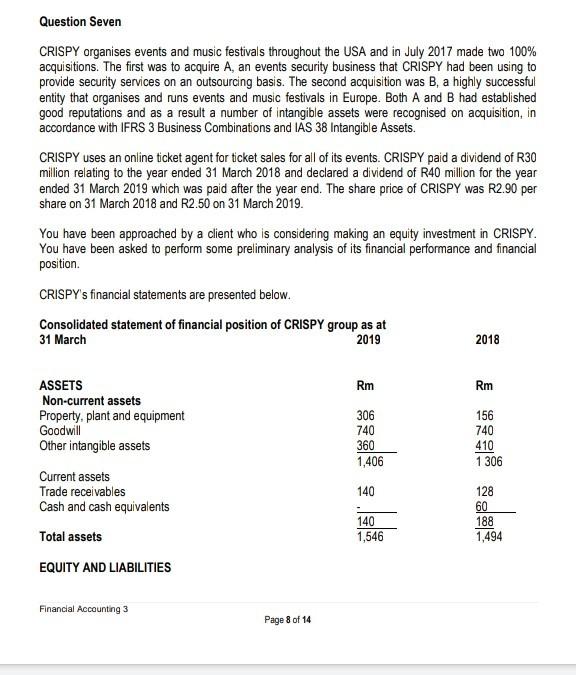

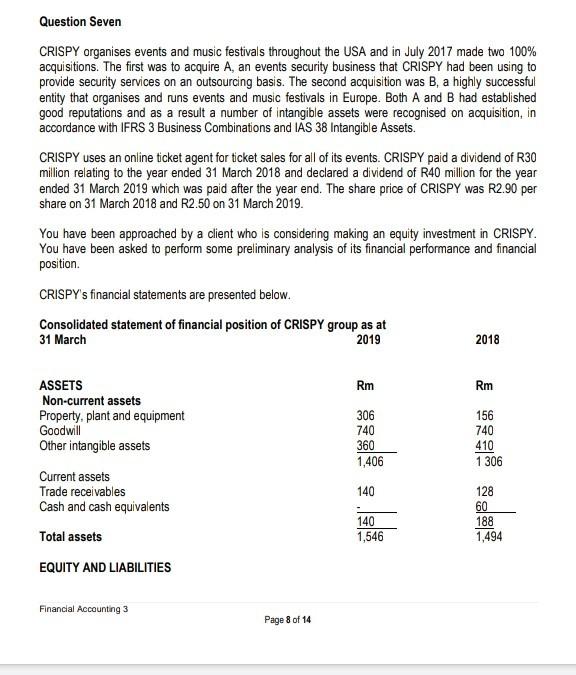

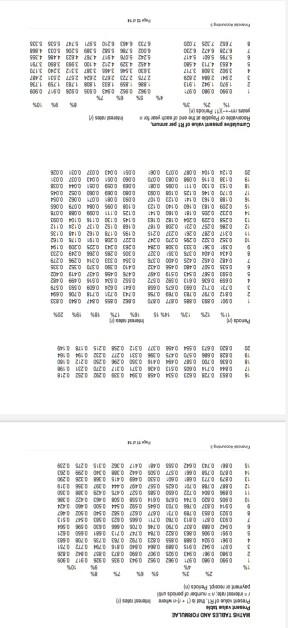

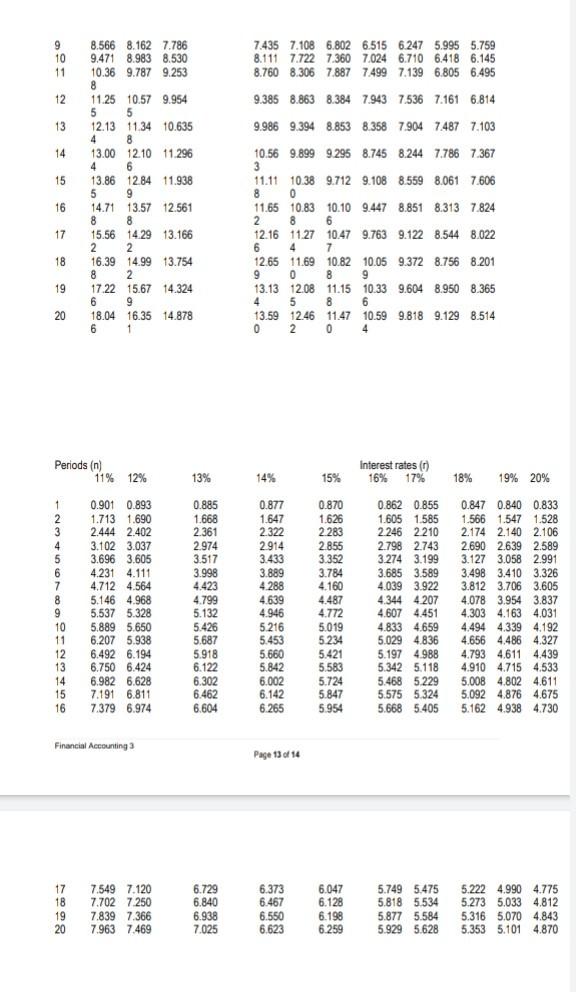

Question Seven CRISPY organisas events and music festivals throughout the USA and in July 2017 made two 100% acquisitions. The first was to quis A an even secally business I CRISPY had bong to provide security SEVICES srbs. The second stor s B. a hoy successo etty tutorgernes and events and moves in BoBot Aand had established accordance with IFRS 3 Business Combinations and IAS 33 little Assets good a an actor, in CRISPYR on online cheaper torchet sales for all of in events CRISPY sa dviderd of R30 million in the year anded 21 March 2018 and declared adviced RAD milion for the year anded 31 March 2013 with a paid for the year and The shans i CRISPY W R290 store on 31 Vieron 2018 and 290 on 31 March 2010 You have been approached by a dent who is considering rare al aguty investment CRISPY You have been perform some premiery analysis of space and facial postion CRISPYSandalias spread balow Canselidated statement of financialion CRISPY growth 2010 2018 Im RT 306 740 191 740 40 1306 1,490 ASSETS Non-cament Property, plontenderet Gawit Oferimerih Current Trade recibes es - Cash and can events Total asseta EQUITY AND LIABILITES 20 2 140 140 1,546 1454 Equy Share capital Regutse Egalement of con Share premium Translation are Penedig 300 110 100 7 10 10 900 9 991 361 292 Long term borrowings 4x Carble bands 2001 Current liables Trada pestiles Dividend payable Shortbonowing Total abilities Total equity and abilities 120 40 100 34 Summarised statement of comprehensive income of CRISPY for the yearned 1 March 2010 2011 10M 1290 Costela 1514 22.120 Gross profit 160 120 Adina 1221 ST) 131 ) Finance costs 45 9 Probota Income Profit for the you Other comprehensive non bara tatrayendy terecsed Exchange Serences on translation of foreign priore Total comprehensive income Additional information In July 2015 there was not of one of the braised by CRISPY subsidiary, B in Europe and an of the nas pomers was the performers pastanga Les are his wearing that the safety etupan u and caused the sidst the Question Seven CRISPY organises events and music festivals throughout the USA and in July 2017 made two 100% acquisitions. The first was to acquire A, an events security business that CRISPY had been using to provide security services on an outsourcing basis. The second acquisition was B, a highly successful entity that organises and runs events and music festivals in Europe. Both A and B had established good reputations and as a result a number of intangible assets were recognised on acquisition, in accordance with IFRS 3 Business Combinations and IAS 38 Intangible Assets. CRISPY uses an online ticket agent for ticket sales for all of its events. CRISPY paid a dividend of R30 million relating to the year ended 31 March 2018 and declared a dividend of R40 million for the year ended 31 March 2019 which was paid after the year end. The share price of CRISPY was R2.90 per share on 31 March 2018 and R2.50 on 31 March 2019. You have been approached by a client who is considering making an equity investment in CRISPY. You have been asked to perform some preliminary analysis of its financial performance and financial position CRISPY's financial statements are presented below. Consolidated statement of financial position of CRISPY group as at 31 March 2019 2018 Rm Rm ASSETS Non-current assets Property, plant and equipment Goodwill Other intangible assets 306 740 360 1,406 156 740 410 1 306 140 Current assets Trade receivables Cash and cash equivalents Total assets 140 1,546 128 60 188 1,494 EQUITY AND LIABILITIES Financial Accounting 3 Page 8 of 14 foreign operations (2) Total comprehensive income 70 79 Additional information 1. In July 2018 there was an accident at one of the music festivals being organised by CRISPY's subsidiary, B, in Europe and one of the main performers was injured. The performer is pursuing a lawsuit and his lawyer is claiming that the safety equipment was faulty and caused the accident. The lawsuit was filed in February 2019 and at the year-end CRISPY's lawyers advised that B was likely to lose the case but at that time no reliable estimate of the likely payout could be made. Details of the lawsuit and its cause were provided in a note to the financial statements as a contingent liability. Financial Accounting 3 Page 9 of 14 2. Following the accident in July 2018, CRISPY invested in new safety equipment for all of its entities. Several key performers have expressed concerns, however, about performing at an event that is due to be held in Europe in May 2019. The directors believe that the bad publicity that Breceived following the accident had a negative effect on revenue generated by B in the year to 31 March 2019. The directors concluded, however, that no impairment of the goodwil in B was required as the issue was a one-off and had been addressed by the investment in the new equipment 3. The investment in the new safety equipment resulted in CRISPY avoiding significant repairs which had been a large part of administrative expenses in previous years. Required: Calculate the following ratios for CRISPY for the year ended 31 March 2019, including comparatives: (a) Earnings per share (b) Price/earnings ratio (c) Dividend yield (3 marks) (d) Analyse the financial performance of CRISPY for the year ended 31 March 2019 and its financial position at that date based on the information provided. (Your analysis should include discussion relating to the ratios calculated in (a). A further 5 marks are available for the calculation of other relevant ratios.) (18 marks) (e) Discuss what additional information your client could obtain in order to help him arrive at a decision about whether or not to invest. (4 marks) MAIS TALES AND FORMULA Presentatie Proteol.net rerumber of preds pat Pero 11 0.2 0.2 0.90 09368 0917 508 oss 07 08 09 10 11 0015 0 0316 074 077 0751 789 738 58 DBE 0.8 011) 1421 0 0.7 0.79 000 960 999 9964 0.03 00 081 0.7 8 00 99512 0303 0.88 0.789 01 0.67 0.17 0.5 S4 2.2.4 0:34 0.7 0.7 0.8 0.64 0.50 0.544 500 364 090 019 0.76 DOLOG 05 00 00 002 0. T22 00 05 07 0.473 33 OBR? 0.18 0.005 0.587 0.400 0.44 22:35 Bato DBS me 0.6 0.80 0.68 0.415 2 2 DA 05 06 OST OSOB 04200 200 DBU DO 612 0580 247 931 02 0339 9 ti 11 12 11 14 15 18 1 11 2 0.853 0.24 0.23 0.534 045 04 03 02 0252 0218 DM 07 06 05 04 0.371 09179742319 OM DTDOOS 04 03 02 928 92124 D628 0.6 0.570 0.2 0.3 0.331 0212 9.290 6594 164 D.33 0.63 0.554 0.45 0.327 8.312 0.258 2215 0.78 46 Pad 11 WN15 1 1 D.S0G 0.02 0.480 0.45 0.422 0.4820452 0425 0.400 0.375 041 10 0.305 0.3 0.327 10 171 082 086 0.8476.941 0.888 NO 0.71 0.78 0.694 064 04 0.60 0.50 0.575 052 0534 064 0.40 02 D:48 0.437 0411 0.462 040 0.9 0.30 0.382 0 0354 0.33 0.31 0.29 0.279 0305 0295 020 0.249 0.239 0.33 0.23 0.23 0.20 0.194 0.22 0.20 0.0172 0.168 0173 0.162 0.148 0.136 0.152 0.11 0.134 0112 0.18 0.14 0.000 0129 0.11 0.0 0.0 0.0 0108 0.0 0.054 0.079 0066 0.00 0.00 0.00 0.002 0.054 0.00 0.00 0.00 0.003 0045 DES D 1 004 00 0.00 0.06 0.04 0.002 0.034 0.06 0.043 0.037 0.021 0.00 11 19 12 13 14 15 0286 0297 0.22 0.208 0.18 0.358 0228 0204 0.112 0312 0.20 0.18 0.10 0.14 0209 0.18 0.10 0.10 0.123 0.18 0.163 014 0132 0.107 0.10 0.148 0.13 0.00 0.00 0.15 0.10 0.111 000 DO 01 00 0.00 0.00 0.134 0.164 0.07 0.00 0.00 17 11 19 Cameo Rann Racordare -11 1 1 2 4 3 0.00 0.00 0.902 1980 1942 1913 2012.04 2009 3.2 3 3.717 4850 4.713 450 5.7 5.60 5.412 6.721 6.42 6230 773 1000 292 2 0 0 0 0 0.0 336 859 1883 188 189 1299 1.1% 275 2773 207 208 2.671 31 7487 1650 146 14133 132 134 217 4212 4.130 3989 3880 3.79 524 0 497 498 4823 1486 4366 0257 25.35305 30034 670 6.70 371 377 559 3:18 1 9 10 11 7.435 7.108 6.802 6.515 6.247 5.995 5.759 8.111 7.722 7.360 7.024 6.710 6.418 6.145 8.760 8.306 7.887 7.499 7.139 6.805 6.495 12 9.385 8.863 8.384 7.943 7.536 7.161 6,814 13 9.986 9.394 8.853 8.358 7.904 7487 7.103 14 15 8.566 8.162 7.786 9.471 8.983 8.530 10.36 9.787 9.253 8 11.25 10.57 9.954 5 5 12.13 11.34 10.635 4 8 13.00 12.10 11.296 4 6 13.86 12.84 11.938 5 9 14.71 13.57 12.561 8 8 15.56 14.29 13.166 2 2 16.39 14.99 13.754 8 2 17.22 15.67 14.324 6 9 18.04 16.35 14.878 6 16 17 10.56 9.899 9295 8.745 8.244 7.786 7.367 3 11.11 10.38 9.712 9.108 8.559 8.061 7.606 8 0 11.65 10.83 10.10 9.447 8.851 8.313 7.824 2 8 6 12.16 11.27 10.47 9.763 9.122 8.544 8.022 6 4 7 12.65 11.69 10.82 10.05 9.372 8.756 8.201 9 0 8 9 13.13 12.08 11.15 10.33 9.604 8.950 8.365 4 5 8 6 13.59 12.46 11.47 10.59 9.818 9.129 8.514 0 2 04 18 19 20 Periods (n) 11% 12% 13% 14% 15% Interest rates (0) 16% 17% 18% 19% 20% 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 0.901 0.893 1.713 1.690 2.444 2.402 3.102 3.037 3.696 3.605 4.231 4.111 4.712 4.564 5.146 4.968 5.537 5.328 5.889 5.650 6.207 5.938 6.492 6.194 6.750 6.424 6.982 6.628 7.191 6.811 7.379 6.974 0.885 1.668 2.361 2974 3.517 3.998 4.423 4.799 5.132 5.426 5.687 5.918 6.122 6.302 6.462 6.604 0.877 1.647 2322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 5.660 5.842 6.002 6.142 6.265 0.870 1.626 2283 2855 3.352 3.784 4.160 4.487 4.772 5.019 5234 5.421 5.583 5.724 5.847 5.954 0.862 0.855 1.605 1.585 2246 2210 2.798 2.743 3274 3.199 3.685 3.589 4.039 3.922 4.344 4.207 4.607 4.451 4.833 4.659 5.029 4.836 5.197 4.988 5.342 5.118 5.468 5229 5.575 5324 5.668 5.405 0.847 0.840 0.833 1.566 1.547 1.528 2.174 2.140 2.106 2.690 2.639 2.589 3.127 3.058 2.991 3.498 3.410 3.326 3.812 3.706 3.605 4.078 3.954 3.837 4.303 4.163 4.031 4.494 4.339 4.192 4.656 4.486 4.327 4.793 4.611 4.439 4.910 4.715 4.533 5,008 4.802 4.611 5.092 4.876 4.675 5.162 4.938 4.730 Financial Accounting 3 Page 13 of 14 17 18 19 20 7.549 7.120 7.702 7.250 7.839 7.366 7.963 7.469 6.729 6.840 6.938 7.025 6.373 6.467 6.550 6.623 6.047 6.128 6.198 6.259 5.749 5.475 5.818 5.534 5.877 5.584 5.929 5.628 5.222 4.990 4.775 5.273 5.033 4.812 5.316 5.070 4.843 5.353 5.101 4.870 Question Seven CRISPY organisas events and music festivals throughout the USA and in July 2017 made two 100% acquisitions. The first was to quis A an even secally business I CRISPY had bong to provide security SEVICES srbs. The second stor s B. a hoy successo etty tutorgernes and events and moves in BoBot Aand had established accordance with IFRS 3 Business Combinations and IAS 33 little Assets good a an actor, in CRISPYR on online cheaper torchet sales for all of in events CRISPY sa dviderd of R30 million in the year anded 21 March 2018 and declared adviced RAD milion for the year anded 31 March 2013 with a paid for the year and The shans i CRISPY W R290 store on 31 Vieron 2018 and 290 on 31 March 2010 You have been approached by a dent who is considering rare al aguty investment CRISPY You have been perform some premiery analysis of space and facial postion CRISPYSandalias spread balow Canselidated statement of financialion CRISPY growth 2010 2018 Im RT 306 740 191 740 40 1306 1,490 ASSETS Non-cament Property, plontenderet Gawit Oferimerih Current Trade recibes es - Cash and can events Total asseta EQUITY AND LIABILITES 20 2 140 140 1,546 1454 Equy Share capital Regutse Egalement of con Share premium Translation are Penedig 300 110 100 7 10 10 900 9 991 361 292 Long term borrowings 4x Carble bands 2001 Current liables Trada pestiles Dividend payable Shortbonowing Total abilities Total equity and abilities 120 40 100 34 Summarised statement of comprehensive income of CRISPY for the yearned 1 March 2010 2011 10M 1290 Costela 1514 22.120 Gross profit 160 120 Adina 1221 ST) 131 ) Finance costs 45 9 Probota Income Profit for the you Other comprehensive non bara tatrayendy terecsed Exchange Serences on translation of foreign priore Total comprehensive income Additional information In July 2015 there was not of one of the braised by CRISPY subsidiary, B in Europe and an of the nas pomers was the performers pastanga Les are his wearing that the safety etupan u and caused the sidst the Question Seven CRISPY organises events and music festivals throughout the USA and in July 2017 made two 100% acquisitions. The first was to acquire A, an events security business that CRISPY had been using to provide security services on an outsourcing basis. The second acquisition was B, a highly successful entity that organises and runs events and music festivals in Europe. Both A and B had established good reputations and as a result a number of intangible assets were recognised on acquisition, in accordance with IFRS 3 Business Combinations and IAS 38 Intangible Assets. CRISPY uses an online ticket agent for ticket sales for all of its events. CRISPY paid a dividend of R30 million relating to the year ended 31 March 2018 and declared a dividend of R40 million for the year ended 31 March 2019 which was paid after the year end. The share price of CRISPY was R2.90 per share on 31 March 2018 and R2.50 on 31 March 2019. You have been approached by a client who is considering making an equity investment in CRISPY. You have been asked to perform some preliminary analysis of its financial performance and financial position CRISPY's financial statements are presented below. Consolidated statement of financial position of CRISPY group as at 31 March 2019 2018 Rm Rm ASSETS Non-current assets Property, plant and equipment Goodwill Other intangible assets 306 740 360 1,406 156 740 410 1 306 140 Current assets Trade receivables Cash and cash equivalents Total assets 140 1,546 128 60 188 1,494 EQUITY AND LIABILITIES Financial Accounting 3 Page 8 of 14 foreign operations (2) Total comprehensive income 70 79 Additional information 1. In July 2018 there was an accident at one of the music festivals being organised by CRISPY's subsidiary, B, in Europe and one of the main performers was injured. The performer is pursuing a lawsuit and his lawyer is claiming that the safety equipment was faulty and caused the accident. The lawsuit was filed in February 2019 and at the year-end CRISPY's lawyers advised that B was likely to lose the case but at that time no reliable estimate of the likely payout could be made. Details of the lawsuit and its cause were provided in a note to the financial statements as a contingent liability. Financial Accounting 3 Page 9 of 14 2. Following the accident in July 2018, CRISPY invested in new safety equipment for all of its entities. Several key performers have expressed concerns, however, about performing at an event that is due to be held in Europe in May 2019. The directors believe that the bad publicity that Breceived following the accident had a negative effect on revenue generated by B in the year to 31 March 2019. The directors concluded, however, that no impairment of the goodwil in B was required as the issue was a one-off and had been addressed by the investment in the new equipment 3. The investment in the new safety equipment resulted in CRISPY avoiding significant repairs which had been a large part of administrative expenses in previous years. Required: Calculate the following ratios for CRISPY for the year ended 31 March 2019, including comparatives: (a) Earnings per share (b) Price/earnings ratio (c) Dividend yield (3 marks) (d) Analyse the financial performance of CRISPY for the year ended 31 March 2019 and its financial position at that date based on the information provided. (Your analysis should include discussion relating to the ratios calculated in (a). A further 5 marks are available for the calculation of other relevant ratios.) (18 marks) (e) Discuss what additional information your client could obtain in order to help him arrive at a decision about whether or not to invest. (4 marks) MAIS TALES AND FORMULA Presentatie Proteol.net rerumber of preds pat Pero 11 0.2 0.2 0.90 09368 0917 508 oss 07 08 09 10 11 0015 0 0316 074 077 0751 789 738 58 DBE 0.8 011) 1421 0 0.7 0.79 000 960 999 9964 0.03 00 081 0.7 8 00 99512 0303 0.88 0.789 01 0.67 0.17 0.5 S4 2.2.4 0:34 0.7 0.7 0.8 0.64 0.50 0.544 500 364 090 019 0.76 DOLOG 05 00 00 002 0. T22 00 05 07 0.473 33 OBR? 0.18 0.005 0.587 0.400 0.44 22:35 Bato DBS me 0.6 0.80 0.68 0.415 2 2 DA 05 06 OST OSOB 04200 200 DBU DO 612 0580 247 931 02 0339 9 ti 11 12 11 14 15 18 1 11 2 0.853 0.24 0.23 0.534 045 04 03 02 0252 0218 DM 07 06 05 04 0.371 09179742319 OM DTDOOS 04 03 02 928 92124 D628 0.6 0.570 0.2 0.3 0.331 0212 9.290 6594 164 D.33 0.63 0.554 0.45 0.327 8.312 0.258 2215 0.78 46 Pad 11 WN15 1 1 D.S0G 0.02 0.480 0.45 0.422 0.4820452 0425 0.400 0.375 041 10 0.305 0.3 0.327 10 171 082 086 0.8476.941 0.888 NO 0.71 0.78 0.694 064 04 0.60 0.50 0.575 052 0534 064 0.40 02 D:48 0.437 0411 0.462 040 0.9 0.30 0.382 0 0354 0.33 0.31 0.29 0.279 0305 0295 020 0.249 0.239 0.33 0.23 0.23 0.20 0.194 0.22 0.20 0.0172 0.168 0173 0.162 0.148 0.136 0.152 0.11 0.134 0112 0.18 0.14 0.000 0129 0.11 0.0 0.0 0.0 0108 0.0 0.054 0.079 0066 0.00 0.00 0.00 0.002 0.054 0.00 0.00 0.00 0.003 0045 DES D 1 004 00 0.00 0.06 0.04 0.002 0.034 0.06 0.043 0.037 0.021 0.00 11 19 12 13 14 15 0286 0297 0.22 0.208 0.18 0.358 0228 0204 0.112 0312 0.20 0.18 0.10 0.14 0209 0.18 0.10 0.10 0.123 0.18 0.163 014 0132 0.107 0.10 0.148 0.13 0.00 0.00 0.15 0.10 0.111 000 DO 01 00 0.00 0.00 0.134 0.164 0.07 0.00 0.00 17 11 19 Cameo Rann Racordare -11 1 1 2 4 3 0.00 0.00 0.902 1980 1942 1913 2012.04 2009 3.2 3 3.717 4850 4.713 450 5.7 5.60 5.412 6.721 6.42 6230 773 1000 292 2 0 0 0 0 0.0 336 859 1883 188 189 1299 1.1% 275 2773 207 208 2.671 31 7487 1650 146 14133 132 134 217 4212 4.130 3989 3880 3.79 524 0 497 498 4823 1486 4366 0257 25.35305 30034 670 6.70 371 377 559 3:18 1 9 10 11 7.435 7.108 6.802 6.515 6.247 5.995 5.759 8.111 7.722 7.360 7.024 6.710 6.418 6.145 8.760 8.306 7.887 7.499 7.139 6.805 6.495 12 9.385 8.863 8.384 7.943 7.536 7.161 6,814 13 9.986 9.394 8.853 8.358 7.904 7487 7.103 14 15 8.566 8.162 7.786 9.471 8.983 8.530 10.36 9.787 9.253 8 11.25 10.57 9.954 5 5 12.13 11.34 10.635 4 8 13.00 12.10 11.296 4 6 13.86 12.84 11.938 5 9 14.71 13.57 12.561 8 8 15.56 14.29 13.166 2 2 16.39 14.99 13.754 8 2 17.22 15.67 14.324 6 9 18.04 16.35 14.878 6 16 17 10.56 9.899 9295 8.745 8.244 7.786 7.367 3 11.11 10.38 9.712 9.108 8.559 8.061 7.606 8 0 11.65 10.83 10.10 9.447 8.851 8.313 7.824 2 8 6 12.16 11.27 10.47 9.763 9.122 8.544 8.022 6 4 7 12.65 11.69 10.82 10.05 9.372 8.756 8.201 9 0 8 9 13.13 12.08 11.15 10.33 9.604 8.950 8.365 4 5 8 6 13.59 12.46 11.47 10.59 9.818 9.129 8.514 0 2 04 18 19 20 Periods (n) 11% 12% 13% 14% 15% Interest rates (0) 16% 17% 18% 19% 20% 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 0.901 0.893 1.713 1.690 2.444 2.402 3.102 3.037 3.696 3.605 4.231 4.111 4.712 4.564 5.146 4.968 5.537 5.328 5.889 5.650 6.207 5.938 6.492 6.194 6.750 6.424 6.982 6.628 7.191 6.811 7.379 6.974 0.885 1.668 2.361 2974 3.517 3.998 4.423 4.799 5.132 5.426 5.687 5.918 6.122 6.302 6.462 6.604 0.877 1.647 2322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 5.660 5.842 6.002 6.142 6.265 0.870 1.626 2283 2855 3.352 3.784 4.160 4.487 4.772 5.019 5234 5.421 5.583 5.724 5.847 5.954 0.862 0.855 1.605 1.585 2246 2210 2.798 2.743 3274 3.199 3.685 3.589 4.039 3.922 4.344 4.207 4.607 4.451 4.833 4.659 5.029 4.836 5.197 4.988 5.342 5.118 5.468 5229 5.575 5324 5.668 5.405 0.847 0.840 0.833 1.566 1.547 1.528 2.174 2.140 2.106 2.690 2.639 2.589 3.127 3.058 2.991 3.498 3.410 3.326 3.812 3.706 3.605 4.078 3.954 3.837 4.303 4.163 4.031 4.494 4.339 4.192 4.656 4.486 4.327 4.793 4.611 4.439 4.910 4.715 4.533 5,008 4.802 4.611 5.092 4.876 4.675 5.162 4.938 4.730 Financial Accounting 3 Page 13 of 14 17 18 19 20 7.549 7.120 7.702 7.250 7.839 7.366 7.963 7.469 6.729 6.840 6.938 7.025 6.373 6.467 6.550 6.623 6.047 6.128 6.198 6.259 5.749 5.475 5.818 5.534 5.877 5.584 5.929 5.628 5.222 4.990 4.775 5.273 5.033 4.812 5.316 5.070 4.843 5.353 5.101 4.870

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started