FINANCIAL ACCOUNTING

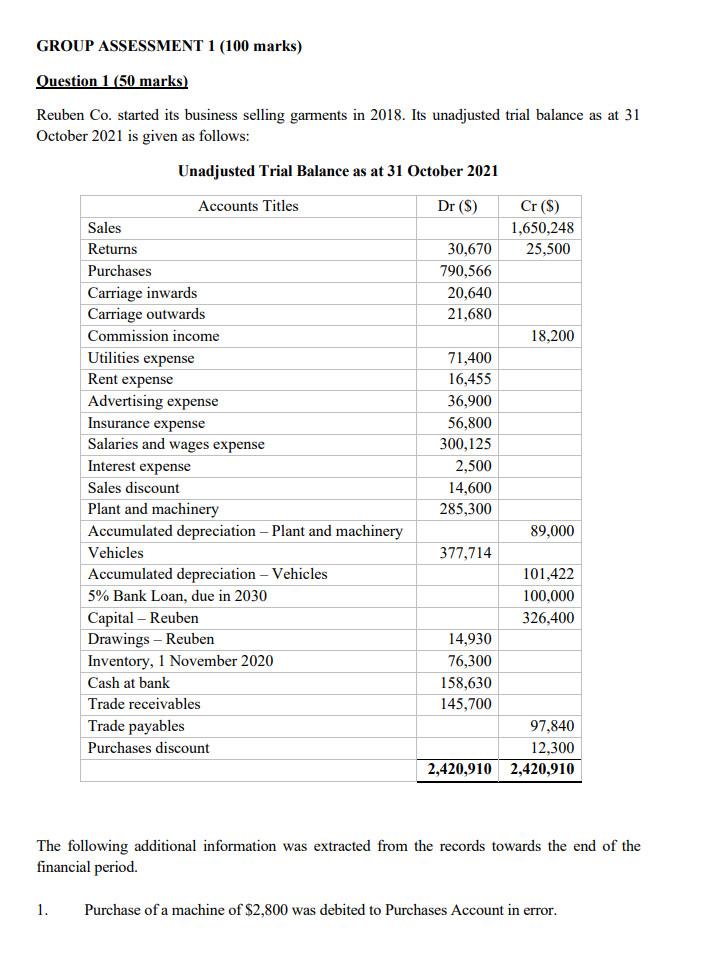

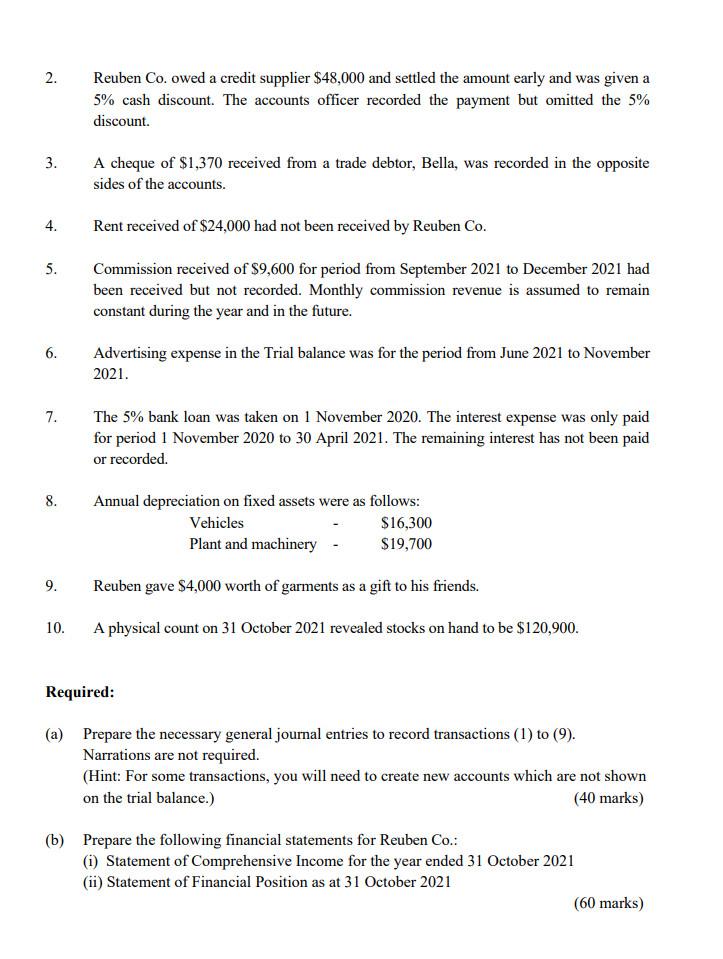

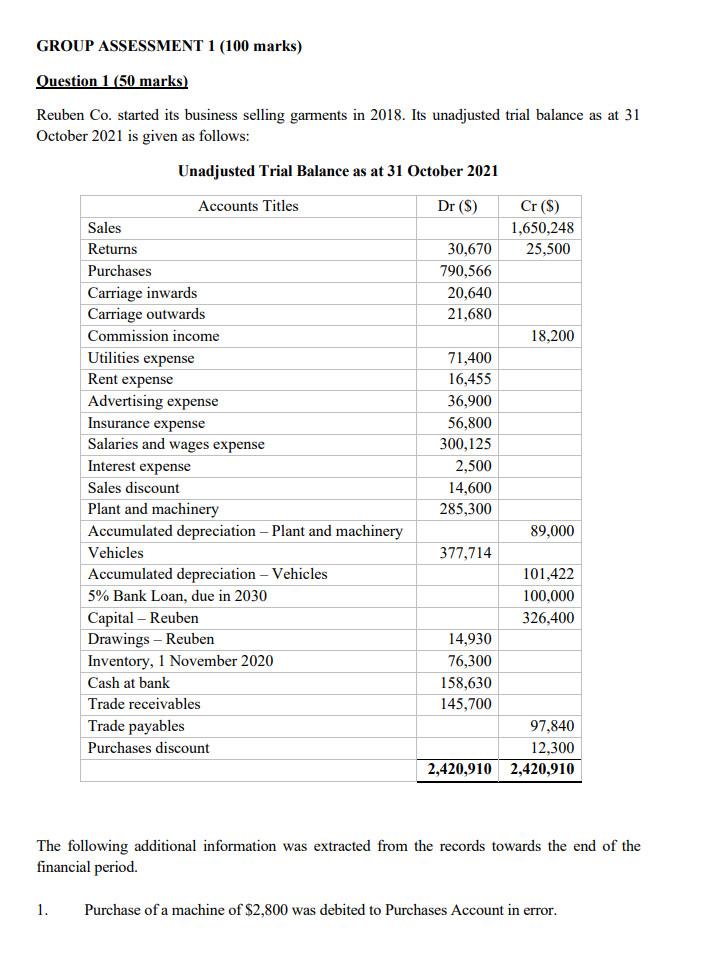

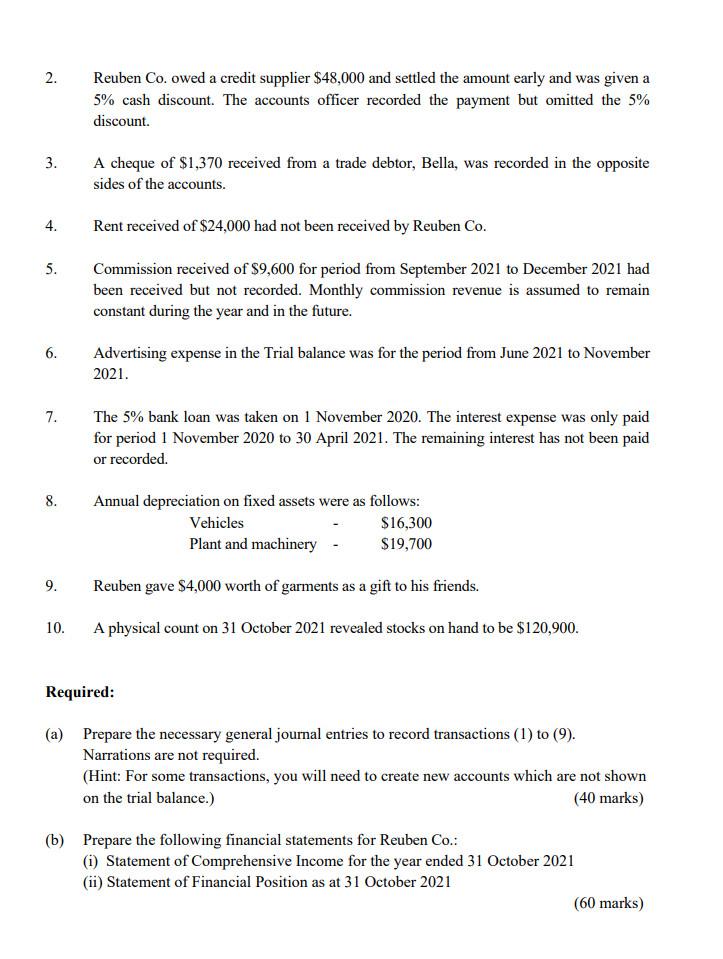

GROUP ASSESSMENT 1 (100 marks) Question 1 (50 marks) Reuben Co. started its business selling garments in 2018. Its unadjusted trial balance as at 31 October 2021 is given as follows: Unadjusted Trial Balance as at 31 October 2021 Accounts Titles Sales Returns Purchases Carriage inwards Carriage outwards Commission income Utilities expense Rent expense Advertising expense Insurance expense Salaries and wages expense Interest expense Sales discount Plant and machinery Accumulated depreciation - Plant and machinery Vehicles Accumulated depreciation - Vehicles 5% Bank Loan, due in 2030 Capital - Reuben Drawings - Reuben Inventory, 1 November 2020 Cash at bank Trade receivables Trade payables Purchases discount Dr ($) Cr (S) 1,650,248 30,670 25,500 790,566 20,640 21,680 18,200 71,400 16,455 36,900 56,800 300,125 2,500 14,600 285,300 89,000 377,714 101,422 100,000 326,400 14,930 76,300 158,630 145,700 97,840 12,300 2,420,910 2,420,910 The following additional information was extracted from the records towards the end of the financial period. 1. Purchase of a machine of $2,800 was debited to Purchases Account in error. 2. Reuben Co. owed a credit supplier $48,000 and settled the amount early and was given a 5% cash discount. The accounts officer recorded the payment but omitted the 5% discount. 3. A cheque of $1,370 received from a trade debtor, Bella, was recorded in the opposite sides of the accounts. 4. Rent received of $24,000 had not been received by Reuben Co. 5. Commission received of $9,600 for period from September 2021 to December 2021 had been received but not recorded. Monthly commission revenue is assumed to remain constant during the year and in the future. 6. Advertising expense in the Trial balance was for the period from June 2021 to November 2021. 7. The 5% bank loan was taken on 1 November 2020. The interest expense was only paid for period 1 November 2020 to 30 April 2021. The remaining interest has not been paid or recorded. 8. Annual depreciation on fixed assets were as follows: Vehicles $16,300 Plant and machinery $19,700 9. Reuben gave $4,000 worth of garments as a gift to his friends. 10. A physical count on 31 October 2021 revealed stocks on hand to be $120,900. Required: (a) Prepare the necessary general journal entries to record transactions (1) to (9). Narrations are not required. (Hint: For some transactions, you will need to create new accounts which are not shown on the trial balance.) (40 marks) (b) Prepare the following financial statements for Reuben Co.: (1) Statement of Comprehensive Income for the year ended 31 October 2021 (ii) Statement of Financial Position as at 31 October 2021 (60 marks) GROUP ASSESSMENT 1 (100 marks) Question 1 (50 marks) Reuben Co. started its business selling garments in 2018. Its unadjusted trial balance as at 31 October 2021 is given as follows: Unadjusted Trial Balance as at 31 October 2021 Accounts Titles Sales Returns Purchases Carriage inwards Carriage outwards Commission income Utilities expense Rent expense Advertising expense Insurance expense Salaries and wages expense Interest expense Sales discount Plant and machinery Accumulated depreciation - Plant and machinery Vehicles Accumulated depreciation - Vehicles 5% Bank Loan, due in 2030 Capital - Reuben Drawings - Reuben Inventory, 1 November 2020 Cash at bank Trade receivables Trade payables Purchases discount Dr ($) Cr (S) 1,650,248 30,670 25,500 790,566 20,640 21,680 18,200 71,400 16,455 36,900 56,800 300,125 2,500 14,600 285,300 89,000 377,714 101,422 100,000 326,400 14,930 76,300 158,630 145,700 97,840 12,300 2,420,910 2,420,910 The following additional information was extracted from the records towards the end of the financial period. 1. Purchase of a machine of $2,800 was debited to Purchases Account in error. 2. Reuben Co. owed a credit supplier $48,000 and settled the amount early and was given a 5% cash discount. The accounts officer recorded the payment but omitted the 5% discount. 3. A cheque of $1,370 received from a trade debtor, Bella, was recorded in the opposite sides of the accounts. 4. Rent received of $24,000 had not been received by Reuben Co. 5. Commission received of $9,600 for period from September 2021 to December 2021 had been received but not recorded. Monthly commission revenue is assumed to remain constant during the year and in the future. 6. Advertising expense in the Trial balance was for the period from June 2021 to November 2021. 7. The 5% bank loan was taken on 1 November 2020. The interest expense was only paid for period 1 November 2020 to 30 April 2021. The remaining interest has not been paid or recorded. 8. Annual depreciation on fixed assets were as follows: Vehicles $16,300 Plant and machinery $19,700 9. Reuben gave $4,000 worth of garments as a gift to his friends. 10. A physical count on 31 October 2021 revealed stocks on hand to be $120,900. Required: (a) Prepare the necessary general journal entries to record transactions (1) to (9). Narrations are not required. (Hint: For some transactions, you will need to create new accounts which are not shown on the trial balance.) (40 marks) (b) Prepare the following financial statements for Reuben Co.: (1) Statement of Comprehensive Income for the year ended 31 October 2021 (ii) Statement of Financial Position as at 31 October 2021 (60 marks)