Financial Accounting:

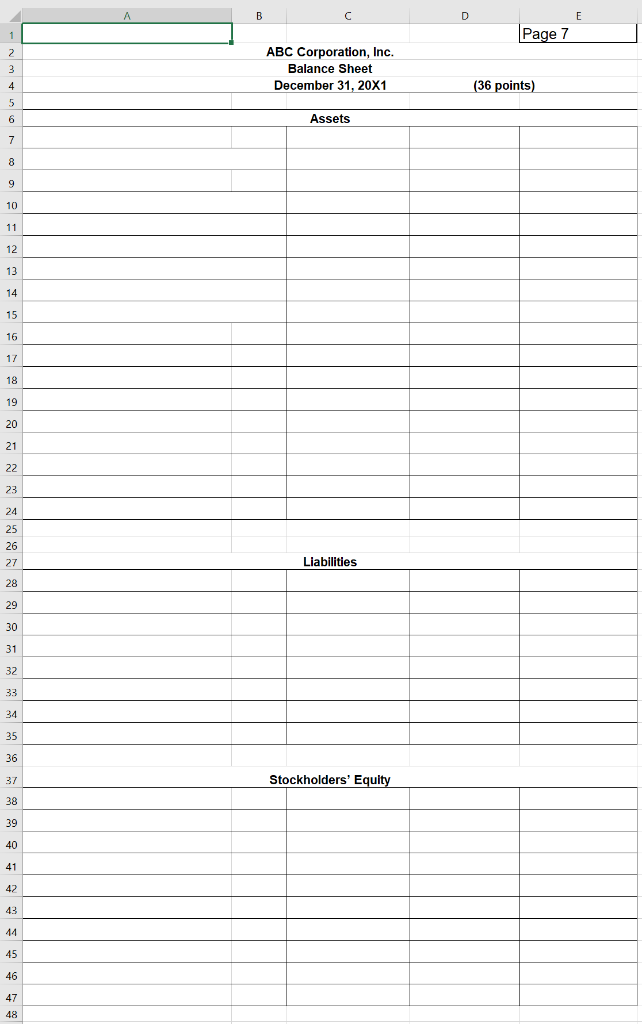

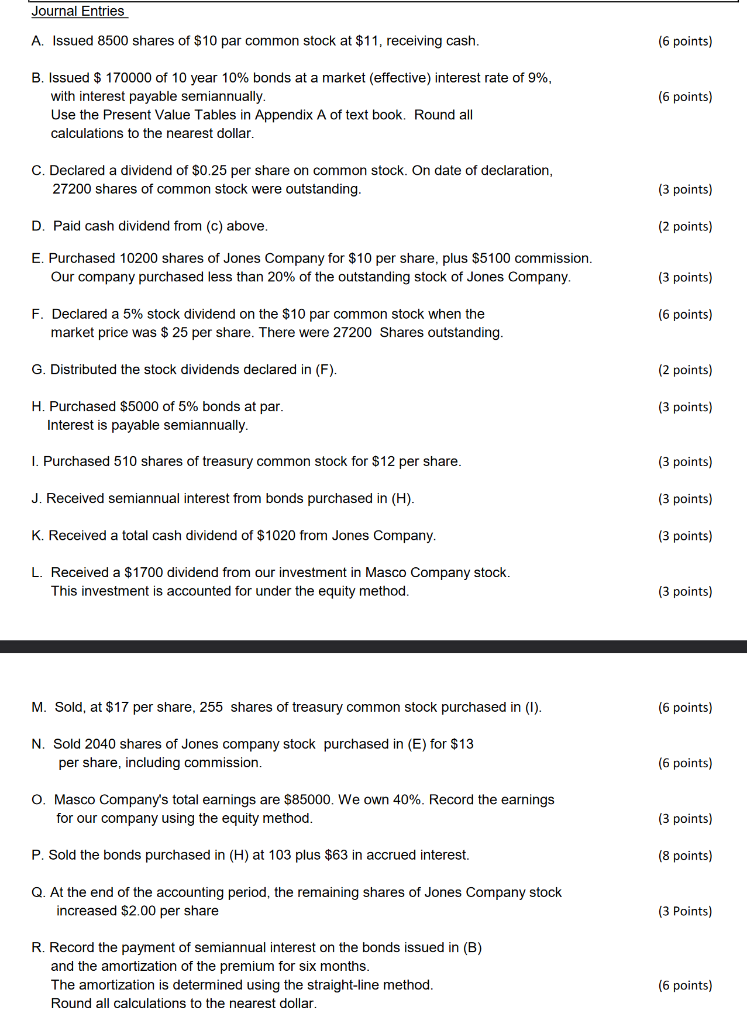

I only need help with the balance sheet

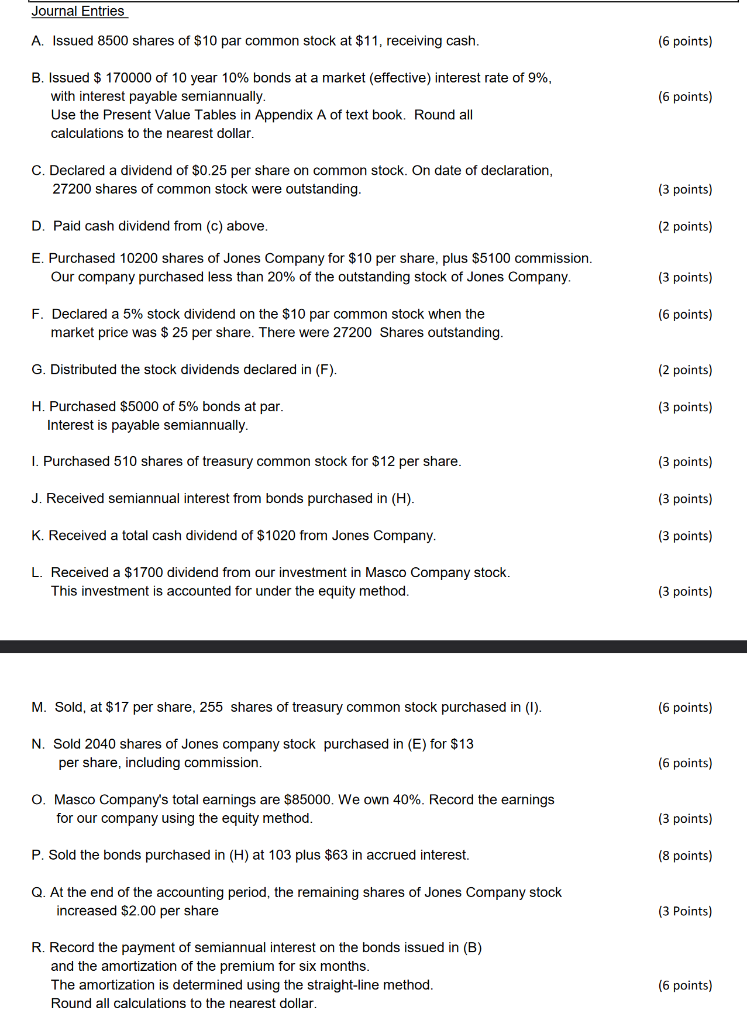

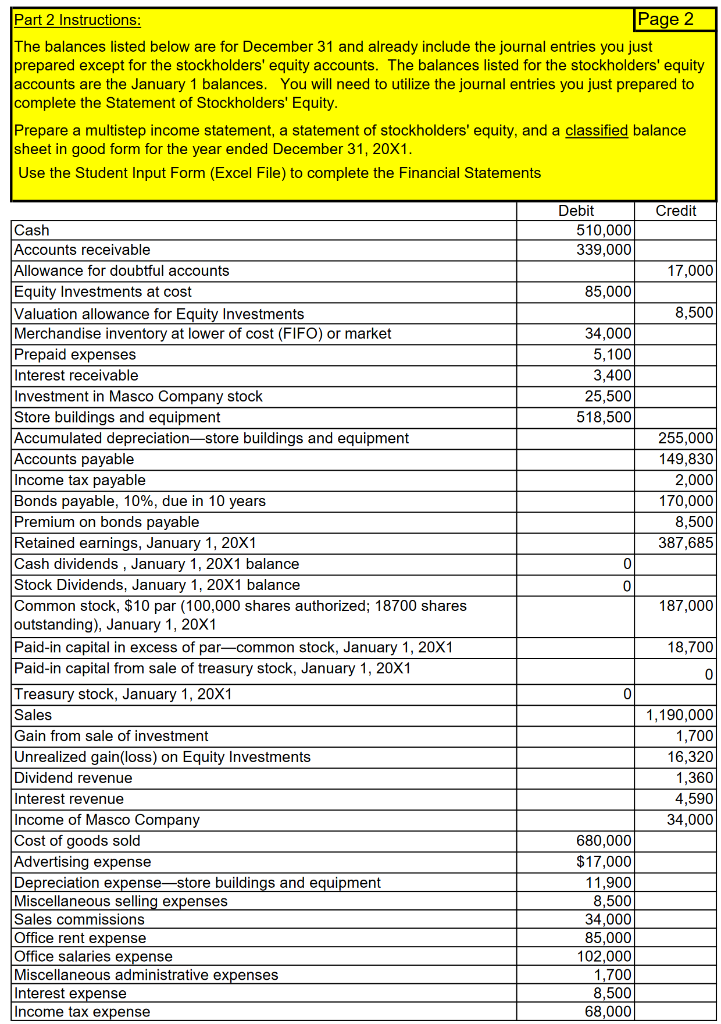

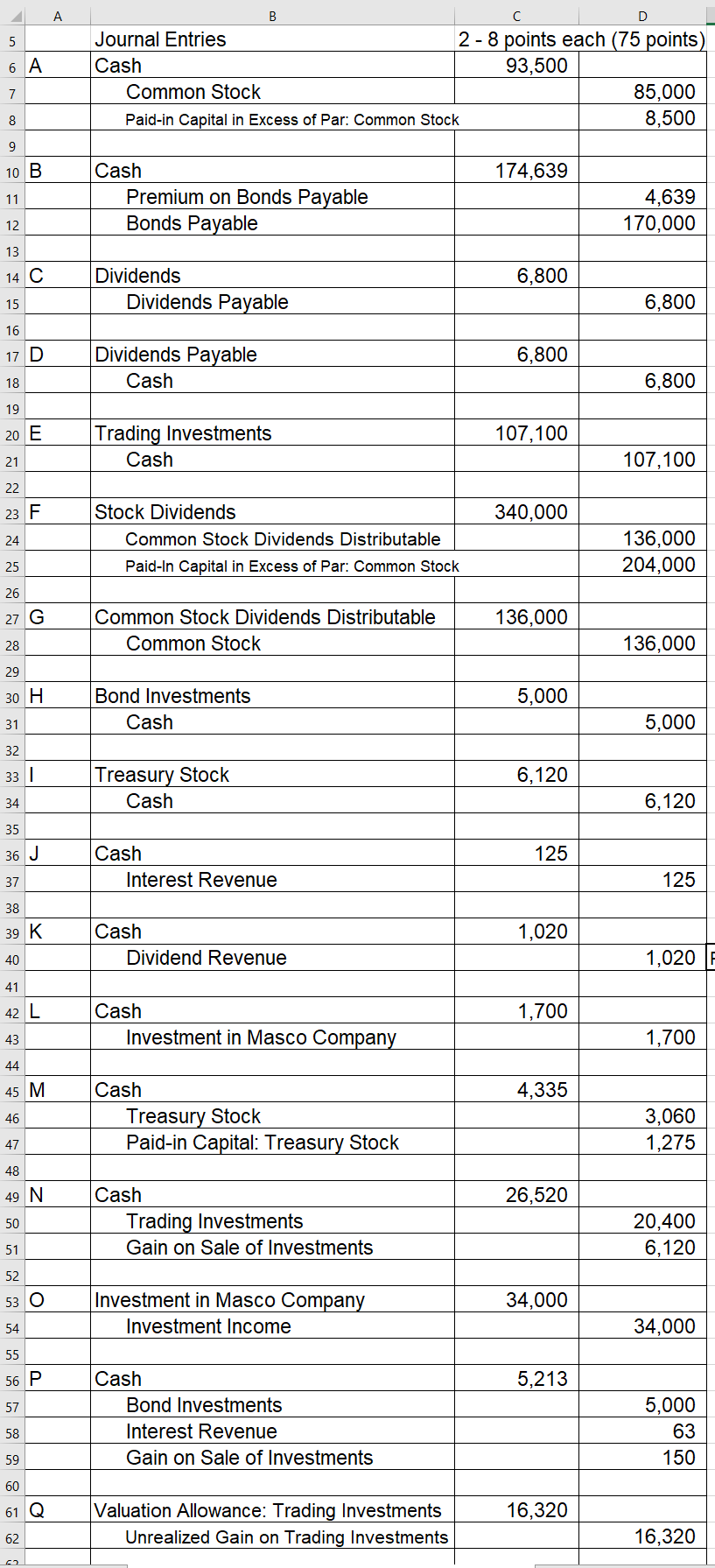

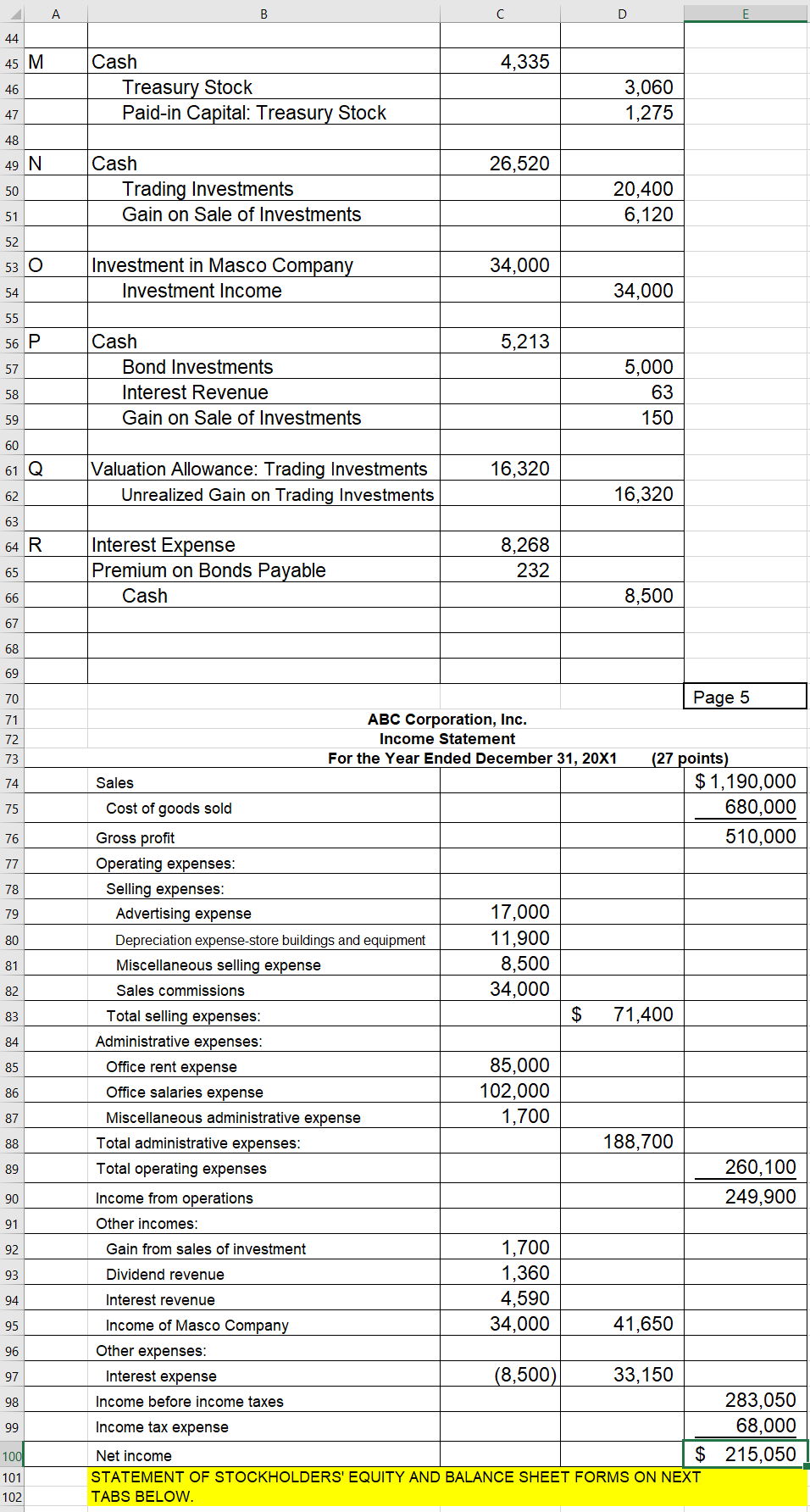

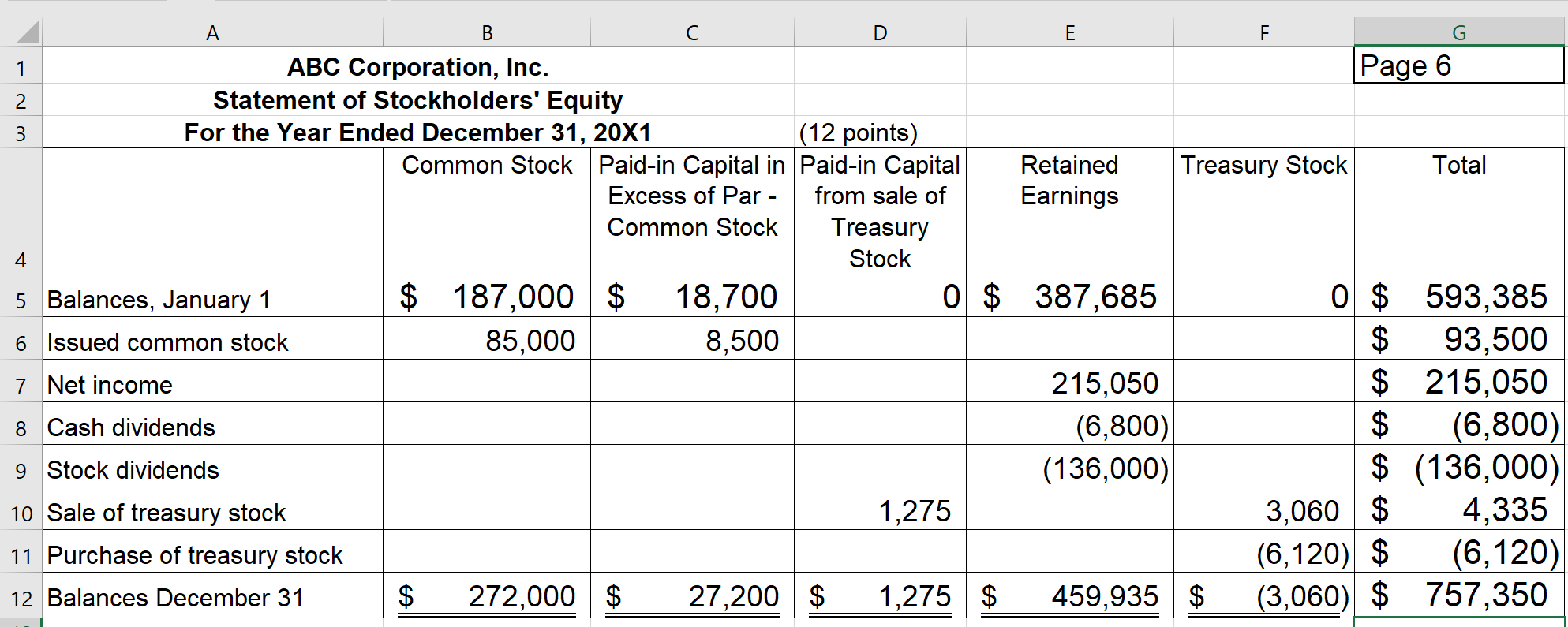

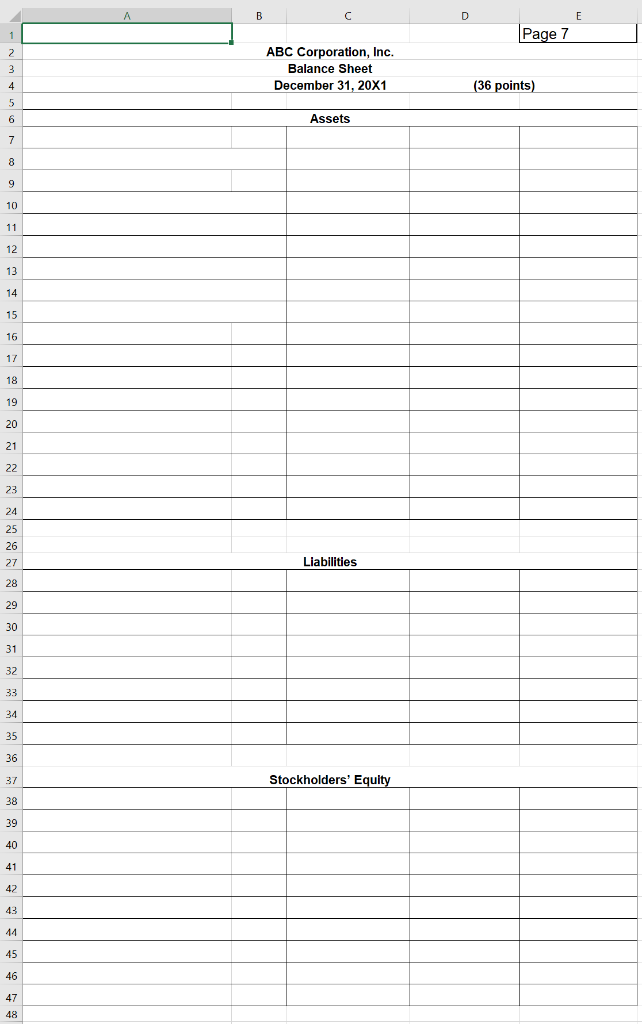

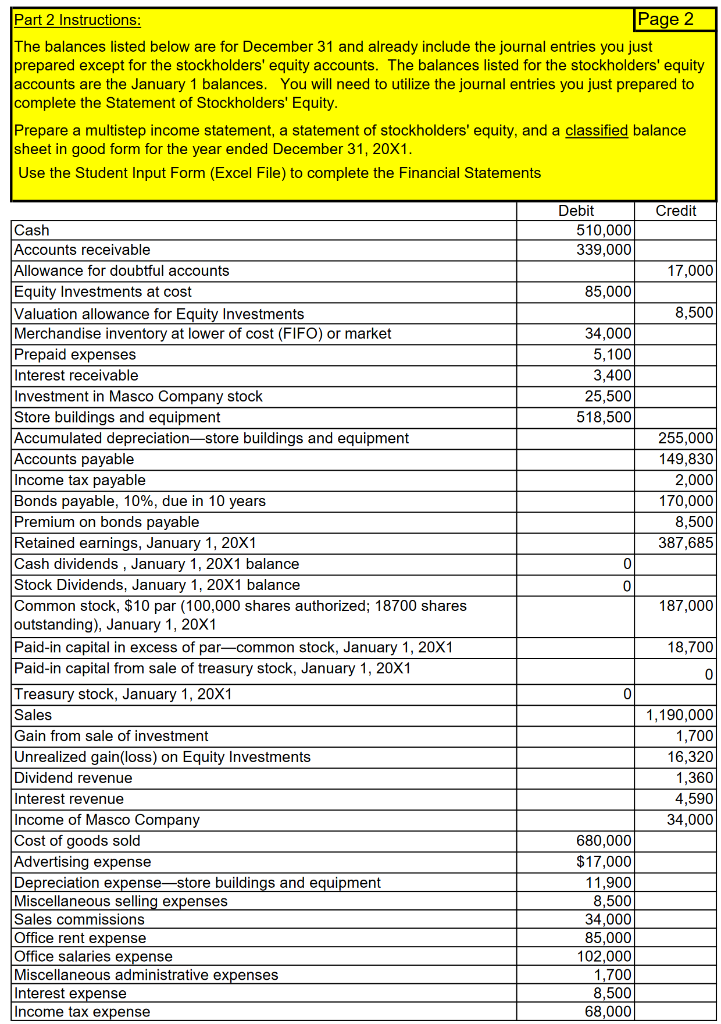

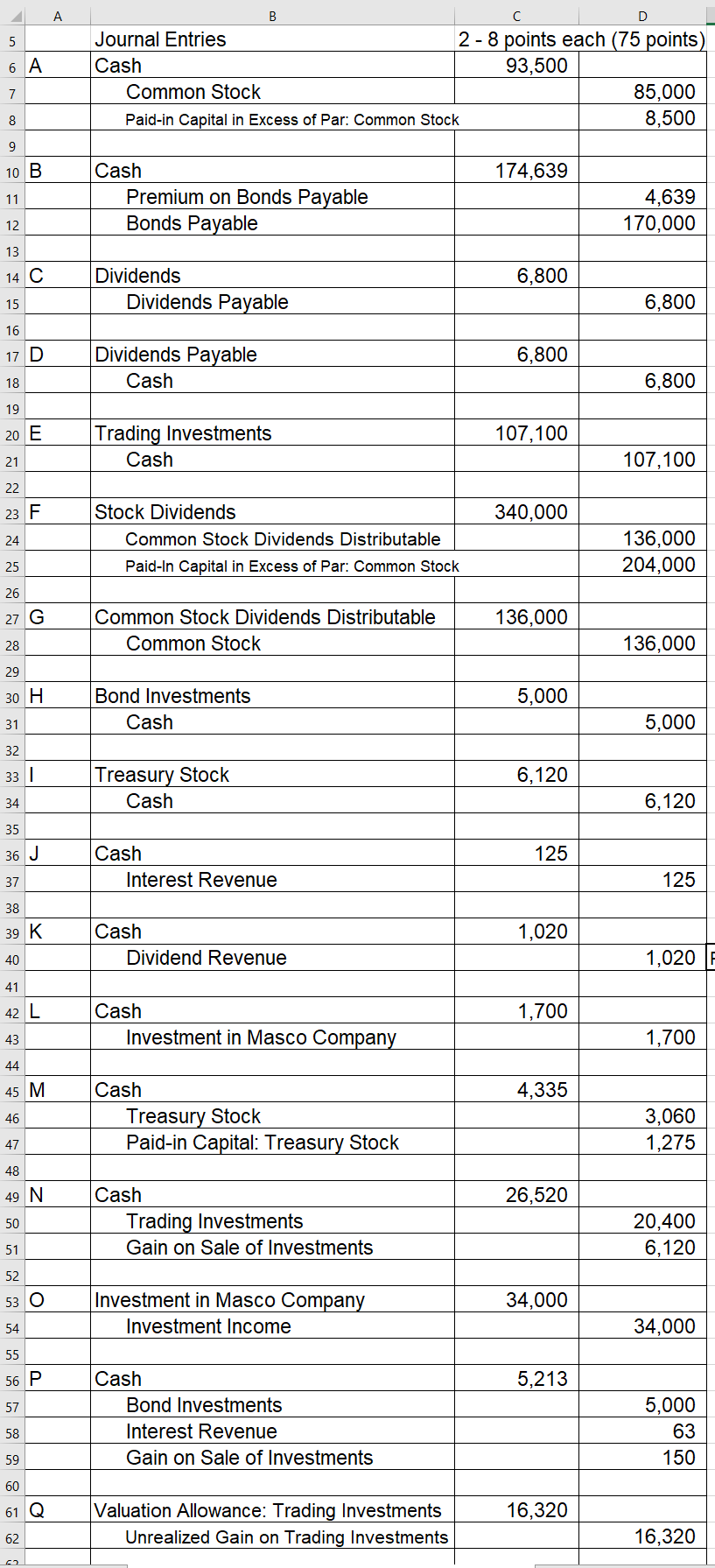

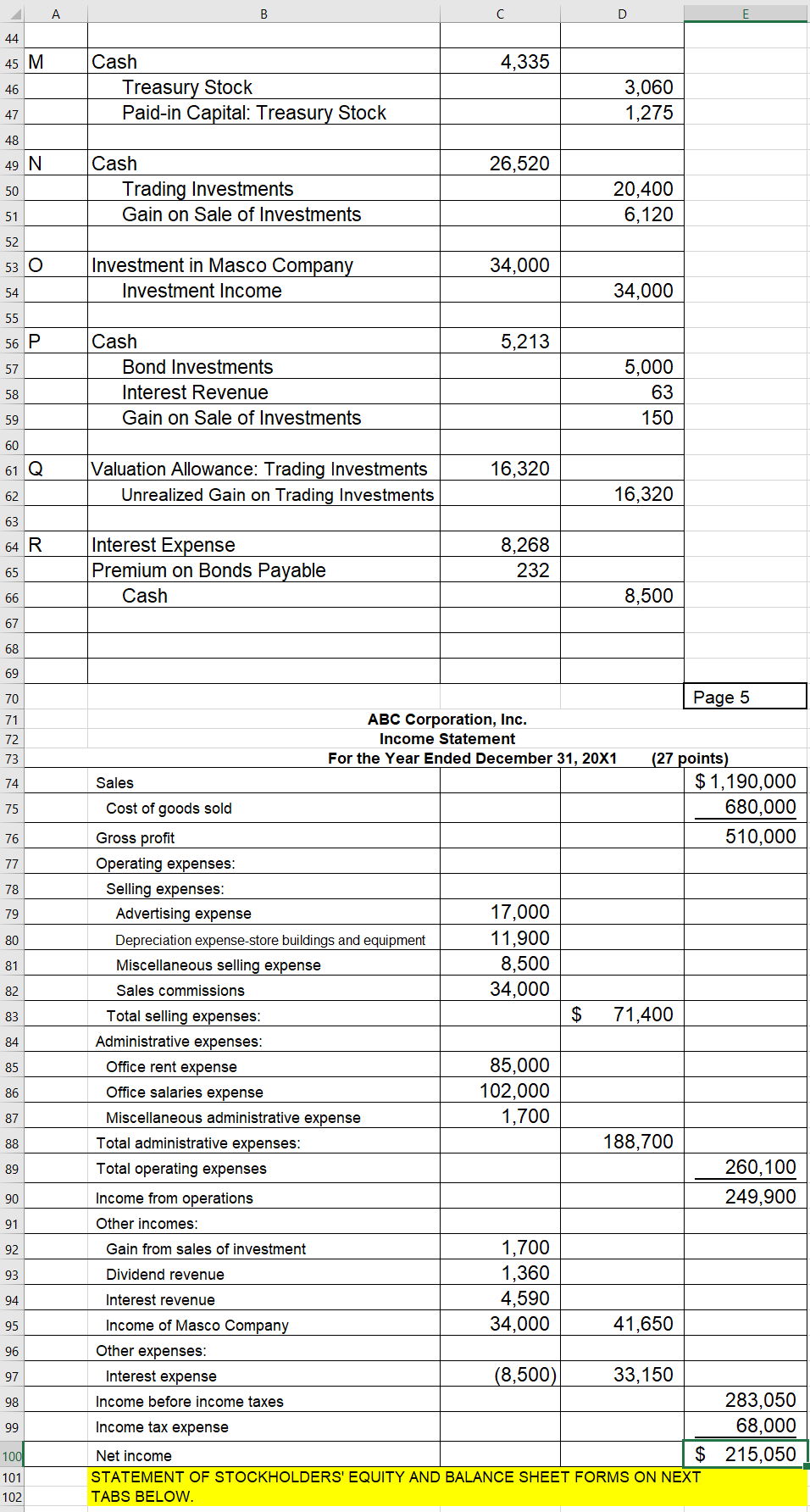

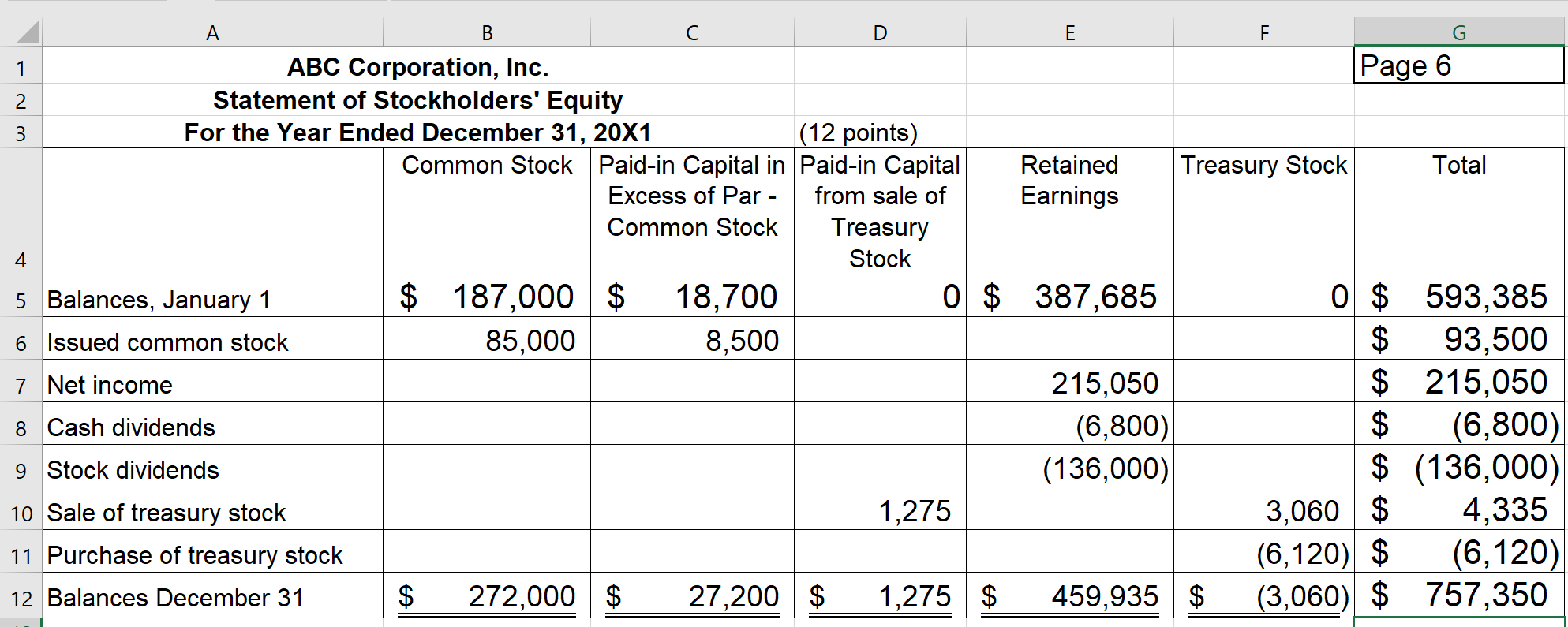

A B C D E 1 Page 7 2 3 ABC Corporation, Inc. Balance Sheet December 31, 20X1 4 (36 points) 5 6 6 Assets 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 Liabilities 28 29 30 31 32 33 34 35 36 37 Stockholders' Equity 38 39 40 41 42 43 44 45 46 47 48 Journal Entries A. Issued 8500 shares of $10 par common stock at $11, receiving cash. (6 points) B. Issued $ 170000 of 10 year 10% bonds at a market (effective) interest rate of 9%, with interest payable semiannually. Use the Present Value Tables in Appendix A of text book. Round all calculations to the nearest dollar. (6 points) C. Declared a dividend of $0.25 per share on common stock. On date of declaration, 27200 shares of common stock were outstanding. (3 points) D. Paid cash dividend from (c) above. (2 points) E. Purchased 10200 shares of Jones Company for $10 per share, plus $5100 commission. Our company purchased less than 20% of the outstanding stock of Jones Company. (3 points) (6 points) F. Declared a 5% stock dividend on the $10 par common stock when the market price was $ 25 per share. There were 27200 Shares outstanding. G. Distributed the stock dividends declared in (F). (2 points) H. Purchased $5000 of 5% bonds at par. Interest is payable semiannually. (3 points) 1. Purchased 510 shares of asury common stock for $12 per share. (3 points) J. Received semiannual interest from bonds purchased in (H). (3 points) K. Received a total cash dividend of $1020 from Jones Company. (3 points) L. Received a $1700 dividend from our investment in Masco Company stock. This investment is accounted for under the equity method. (3 points) M. Sold, at $17 per share, 255 shares of treasury common stock purchased in (). (6 points) N. Sold 2040 shares of Jones company stock purchased in (E) for $13 per share, including commission. (6 points) O. Masco Company's total earnings are $85000. We own 40%. Record the earnings for our company using the equity method. (3 points) P. Sold the bonds purchased in (H) at 103 plus $63 in accrued interest. (8 points) Q. At the end of the accounting period, the remaining shares of Jones Company stock increased $2.00 per share (3 Points) R. Record the payment of semiannual interest on the bonds issued in (B) and the amortization of the premium for six months. The amortization is determined using the straight-line method. Round all calculations to the nearest dollar. (6 points) Part 2 Instructions: Page 2 The balances listed below are for December 31 and already include the journal entries you just prepared except for the stockholders' equity accounts. The balances listed for the stockholders' equity accounts are the January 1 balances. You will need to utilize the journal entries you just prepared to complete the Statement of Stockholders' Equity. Prepare a multistep income statement, a statement of stockholders' equity, and a classified balance sheet in good form for the year ended December 31, 20X1. Use the Student Input Form (Excel File) to complete the Financial Statements Credit Debit 510,000 339,000 17,000 85,000 8,500 34,000 5,100 3,400 25,500 518,500 255,000 149,830 2,000 170,000 8,500 387,685 0 0 187,000 Cash Accounts receivable Allowance for doubtful accounts Equity Investments at cost Valuation allowance for Equity Investments Merchandise inventory at lower of cost (FIFO) or market Prepaid expenses Interest receivable Investment in Masco Company stock Store buildings and equipment Accumulated depreciation-store buildings and equipment Accounts payable Income tax payable Bonds payable, 10%, due in 10 years Premium on bonds payable Retained earnings, January 1, 20X1 Cash dividends , January 1, 20X1 balance Stock Dividends, January 1, 20X1 balance Common stock, $10 par (100,000 shares authorized; 18700 shares outstanding), January 1, 20X1 Paid-in capital in excess of parcommon stock, January 1, 20X1 Paid-in capital from sale of treasury stock, January 1, 20X1 Treasury stock, January 1, 20X1 Sales Gain from sale of investment Unrealized gain(loss) on Equity Investments Dividend revenue Interest revenue Income of Masco Company Cost of goods sold Advertising expense Depreciation expense-store buildings and equipment Miscellaneous selling expenses Sales commissions Office rent expense Office salaries expense Miscellaneous administrative expenses Interest expense Income tax expense 18,700 0 1,190,000 1,700 16,320 1,360 4,590 34,000 680,000 $17,000 11,900 8,500 34,000 85,000 102,000 1,700 8,500 68,000 B C 5 6 A D Journal Entries 2 - 8 points each (75 points) Cash 93,500 Common Stock 85,000 Paid-in Capital in Excess of Par: Common Stock 8,500 7 8 9 10 B 174,639 11 Cash Premium on Bonds Payable Bonds Payable 4,639 170,000 12 13 14 C 6,800 Dividends Dividends Payable 15 6,800 16 17 D 6,800 Dividends Payable Cash 18 6,800 19 20 E 107,100 Trading Investments Cash 21 107,100 22 23 F 340,000 24 Stock Dividends Common Stock Dividends Distributable Paid-In Capital in Excess of Par: Common Stock 136,000 204,000 25 26 27 G 136,000 Common Stock Dividends Distributable Common Stock 28 136,000 29 30 H 5,000 Bond Investments Cash 31 5,000 32 33 | 6,120 Treasury Stock Cash 34 6,120 35 36 J 125 Cash Interest Revenue 37 125 38 39 K 1,020 Cash Dividend Revenue 40 1,020 41 42 L 1,700 Cash Investment in Masco Company 43 1,700 44 45 M 4,335 46 Cash Treasury Stock Paid-in Capital: Treasury Stock 3,060 1,275 47 48 49 N 26,520 50 Cash Trading Investments Gain on Sale of Investments 20,400 6,120 51 52 53 O 34,000 Investment in Masco Company Investment Income 54 34,000 55 56 P 5,213 57 Cash Bond Investments Interest Revenue Gain on Sale of Investments 58 5,000 63 150 59 60 61 Q 16,320 Valuation Allowance: Trading Investments Unrealized Gain on Trading Investments 62 16,320 A B D 44 45 M 4,335 46 Cash Treasury Stock Paid-in Capital: Treasury Stock 3,060 1,275 47 48 49 N 26,520 50 Cash Trading Investments Gain on Sale of Investments 20,400 6,120 51 52 53 O 34,000 Investment in Masco Company Investment Income 54 34,000 55 56 P 5,213 57 Cash Bond Investments Intere Revenue Gain on Sale of Investments 58 5,000 63 150 59 60 61 Q 16,320 Valuation Allowance: Trading Investments Unrealized Gain on Trading Investments 62 16,320 63 64 R Interest Expense Premium on Bonds Payable Cash 8,268 232 65 66 8,500 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 Page 5 ABC Corporation, Inc. Income Statement For the Year Ended December 31, 20X1 (27 points) Sales $ 1,190,000 Cost of goods sold 680,000 Gross profit 510,000 Operating expenses: Selling expenses: Advertising expense 17,000 Depreciation expense-store buildings and equipment 11,900 Miscellaneous selling expense 8,500 Sales commissions 34,000 Total selling expenses: $ 71,400 Administrative expenses: Office rent expense 85,000 Office salaries expense 102,000 Miscellaneous administrative expense 1,700 Total administrative expenses: 188,700 Total operating expenses 260,100 Income from operations 249,900 Other incomes: Gain from sales of investment 1,700 Dividend revenue 1,360 Interest revenue 4,590 Income of Masco Company 34,000 41,650 Other expenses: Interest expense (8,500) 33,150 Income before income taxes 283,050 Income tax expense 68,000 Net income $ 215,050 STATEMENT OF STOCKHOLDERS' EQUITY AND BALANCE SHEET FORMS ON NEXT TABS BELOW. 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 A B D G 1 3 E F ABC Corporation, Inc. Page 6 2 Statement of Stockholders' Equity For the Year Ended December 31, 20X1 (12 points) Common Stock Paid-in Capital in Paid-in Capital Retained Treasury Stock Total Excess of Par - from sale of Earnings Common Stock Treasury 4 Stock 5 Balances, January 1 $ 187,000 $ 18.700 0 $ 387,685 0 $ 593,385 6 Issued common stock 85,000 8,500 $ 93,500 7 Net income 215,050 $ 215,050 8 Cash dividends (6,800) $ (6,800) 9 Stock dividends (136,000) $ (136,000) 10 Sale of treasury stock 1,275 3,060 $ 4,335 11 Purchase of treasury stock (6,120) $ (6,120) 12 Balances December 31 $ 272,000 $ 27,200 $ 1,275 $ 459,935 $ (3,060) $ 757,350