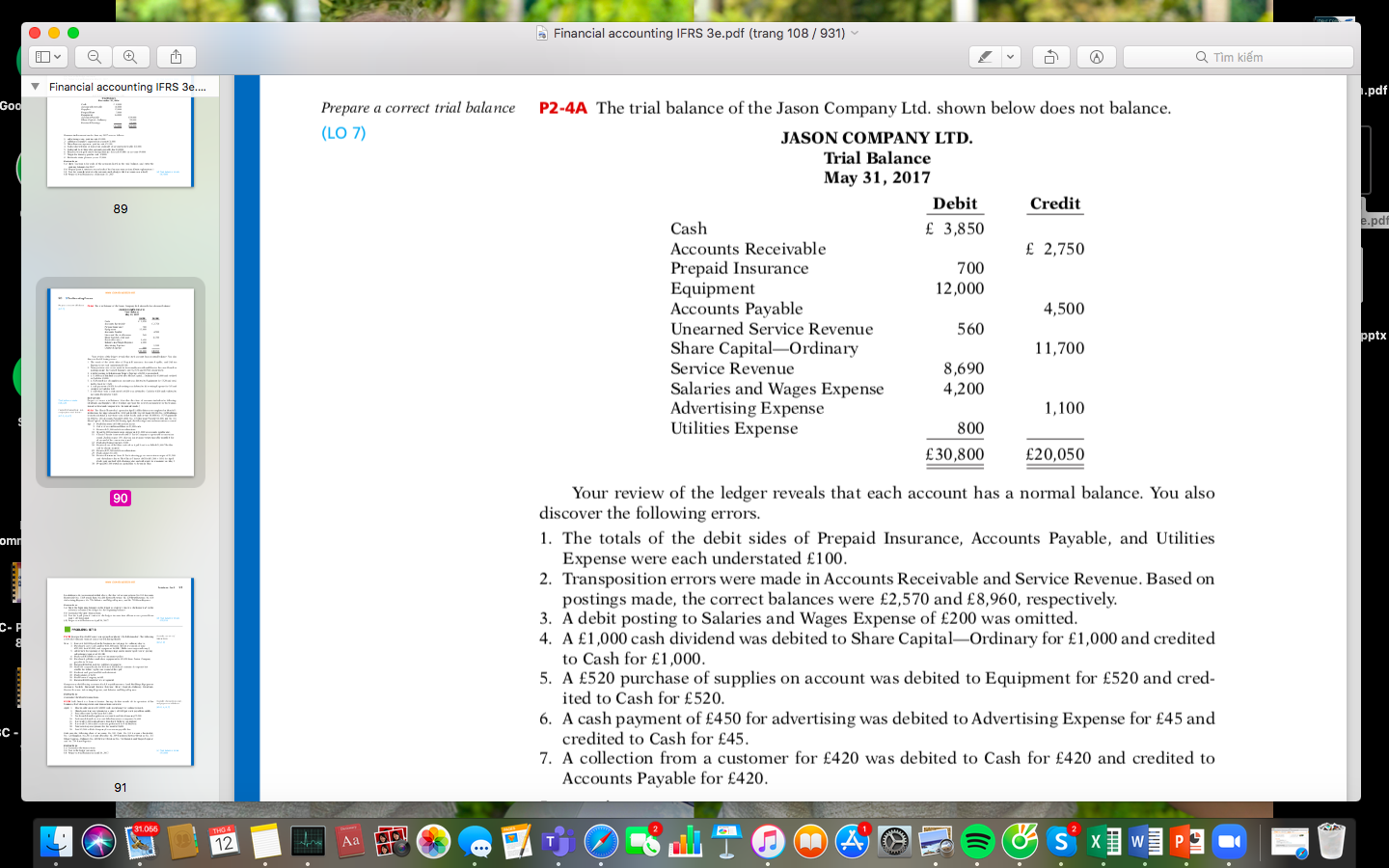

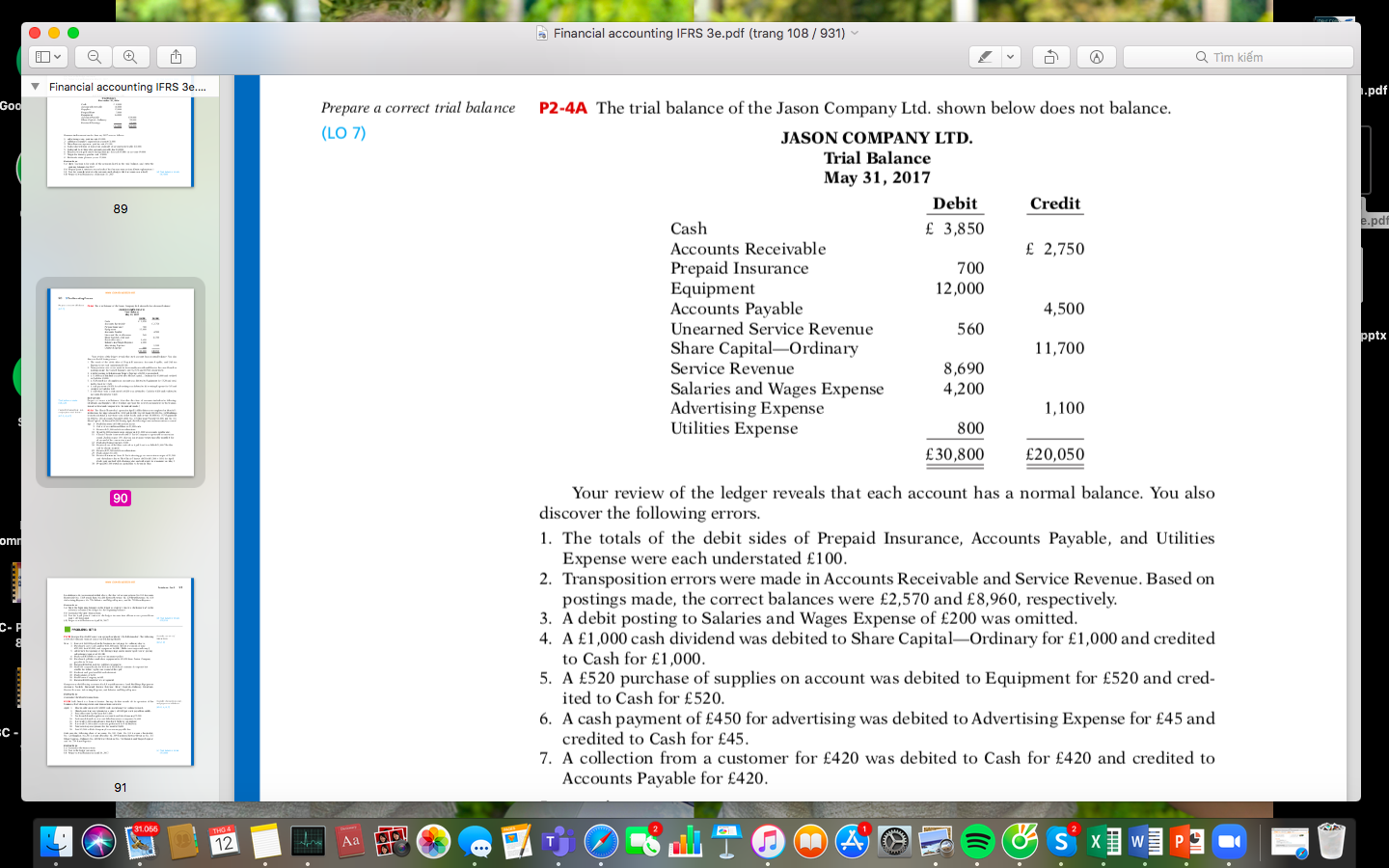

Financial accounting IFRS 3e.pdf (trang 108 / 931) 2 v @ Q Tm kim Financial accounting IFRS 3e.... ..pdf Goo Prepare a correct trial balance (LO 7) e.pdf 700 P2-4A The trial balance of the Jason Company Ltd. shown below does not balance. JASON COMPANY LTD. Trial Balance May 31, 2017 Debit Credit Cash 3,850 Accounts Receivable 2,750 Prepaid Insurance Equipment 12,000 Accounts Payable 4,500 Unearned Service Revenue 560 Share Capital-Ordinary 11,700 Service Revenue 8,690 Salaries and Wages Expense 4,200 Advertising Expense 1,100 Utilities Expense 800 30,800 20,050 pptx 90 omn Your review of the ledger reveals that each account has a normal balance. You also discover the following errors. 1. The totals of the debit sides of Prepaid Insurance, Accounts Payable, and Utilities Expense were each understated 100. 2. Transposition errors were made in Accounts Receivable and Service Revenue. Based on postings made, the correct balances were 2,570 and 8,960, respectively. 3. A debit posting to Salaries and Wages Expense of 200 was omitted. 4. A 1,000 cash dividend was debited to Share Capital-Ordinary for 1,000 and credited to Cash for 1,000. 5. A 520 purchase of supplies on account was debited to Equipment for 520 and cred- ited to Cash for 520. 6. A cash payment of 450 for advertising was debited to Advertising Expense for 45 and credited to Cash for 45. 7. A collection from a customer for 420 was debited to Cash for 420 and credited to Accounts Payable for 420. 91 Financial accounting IFRS 3e.pdf (trang 108 / 931) 2 v @ Q Tm kim Financial accounting IFRS 3e.... ..pdf Goo Prepare a correct trial balance (LO 7) e.pdf 700 P2-4A The trial balance of the Jason Company Ltd. shown below does not balance. JASON COMPANY LTD. Trial Balance May 31, 2017 Debit Credit Cash 3,850 Accounts Receivable 2,750 Prepaid Insurance Equipment 12,000 Accounts Payable 4,500 Unearned Service Revenue 560 Share Capital-Ordinary 11,700 Service Revenue 8,690 Salaries and Wages Expense 4,200 Advertising Expense 1,100 Utilities Expense 800 30,800 20,050 pptx 90 omn Your review of the ledger reveals that each account has a normal balance. You also discover the following errors. 1. The totals of the debit sides of Prepaid Insurance, Accounts Payable, and Utilities Expense were each understated 100. 2. Transposition errors were made in Accounts Receivable and Service Revenue. Based on postings made, the correct balances were 2,570 and 8,960, respectively. 3. A debit posting to Salaries and Wages Expense of 200 was omitted. 4. A 1,000 cash dividend was debited to Share Capital-Ordinary for 1,000 and credited to Cash for 1,000. 5. A 520 purchase of supplies on account was debited to Equipment for 520 and cred- ited to Cash for 520. 6. A cash payment of 450 for advertising was debited to Advertising Expense for 45 and credited to Cash for 45. 7. A collection from a customer for 420 was debited to Cash for 420 and credited to Accounts Payable for 420. 91