Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FINANCIAL ACCOUNTING II On October 1 , 2 0 2 1 , The Dontfalemy Company made the following investments: 2 , 1 0 0 shares

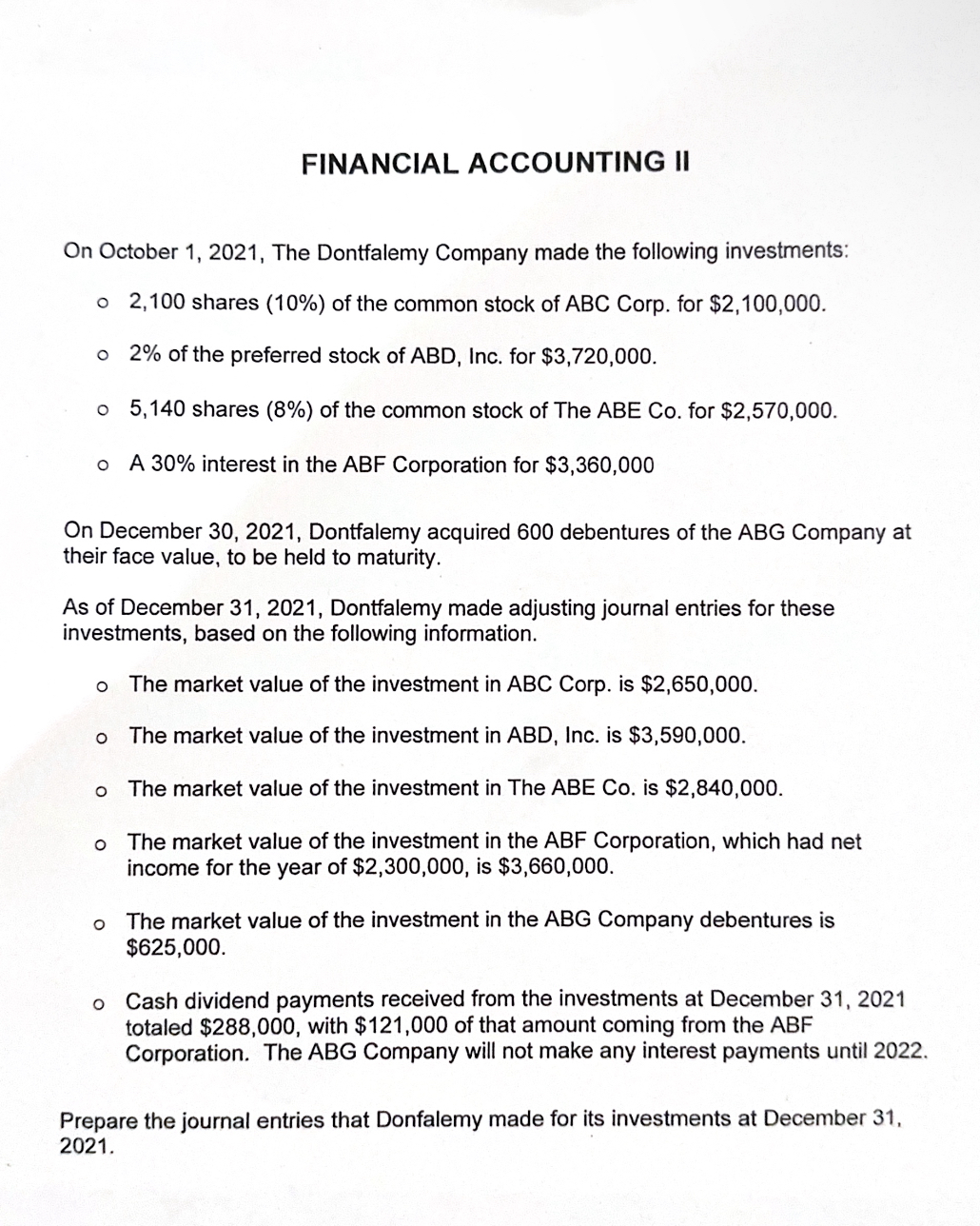

FINANCIAL ACCOUNTING II

On October The Dontfalemy Company made the following investments:

shares of the common stock of ABC Corp. for $

of the preferred stock of ABD, Inc. for $

shares of the common stock of The ABE Co for $

A interest in the ABF Corporation for $

On December Dontfalemy acquired debentures of the ABG Company at

their face value, to be held to maturity.

As of December Dontfalemy made adjusting journal entries for these

investments, based on the following information.

The market value of the investment in ABC Corp. is $

The market value of the investment in ABD, Inc. is $

The market value of the investment in The ABE Co is $

The market value of the investment in the ABF Corporation, which had net

income for the year of $ is $

The market value of the investment in the ABG Company debentures is

$

Cash dividend payments received from the investments at December

totaled $ with $ of that amount coming from the ABF

Corporation. The ABG Company will not make any interest payments until

Prepare the journal entries that Donfalemy made for its investments at December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started