Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Accounting - Prof. Benjamin Segal Practice Quiz 2 I will not lie, cheat or steal to gain an academic advantage, or tolerate those who

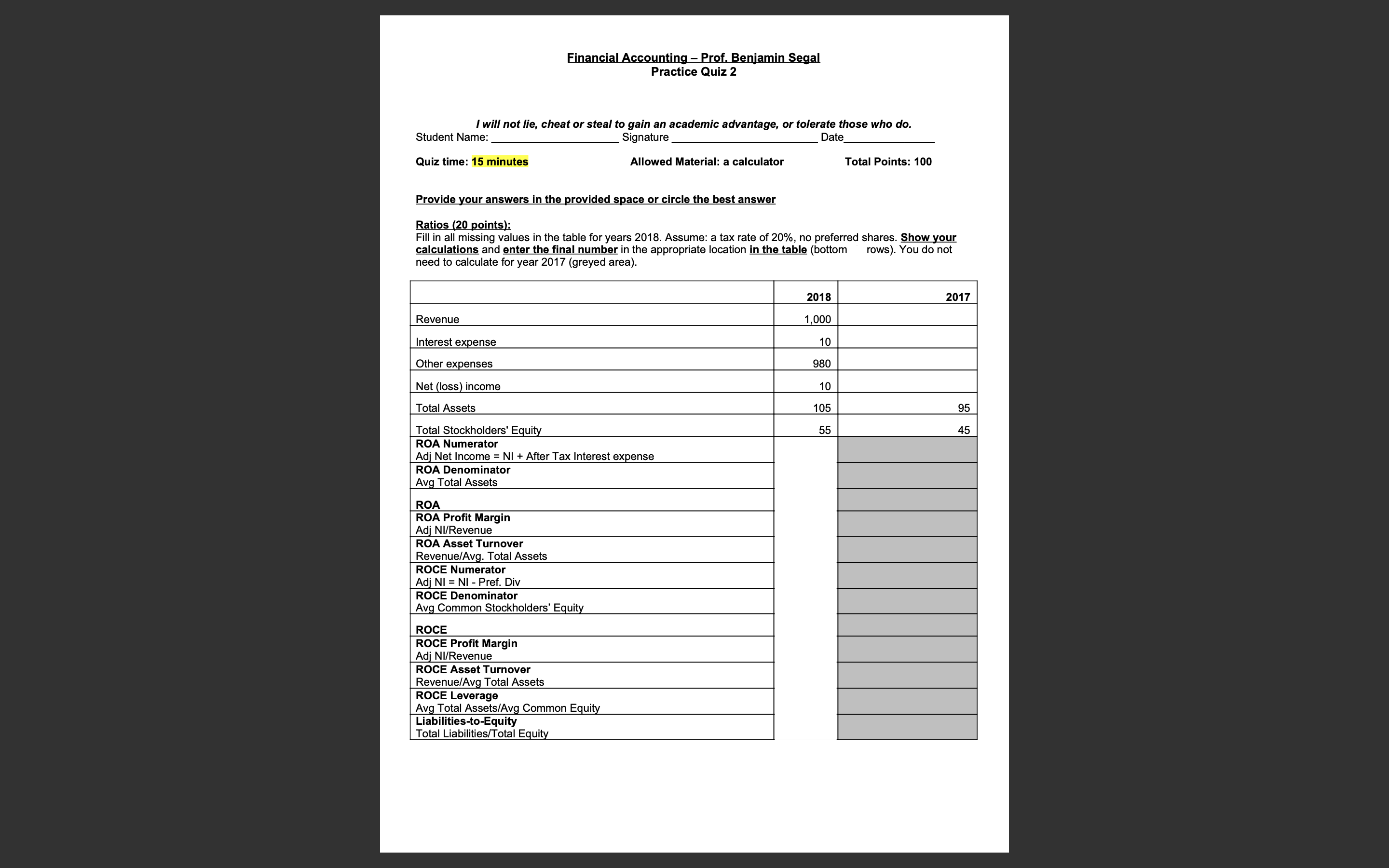

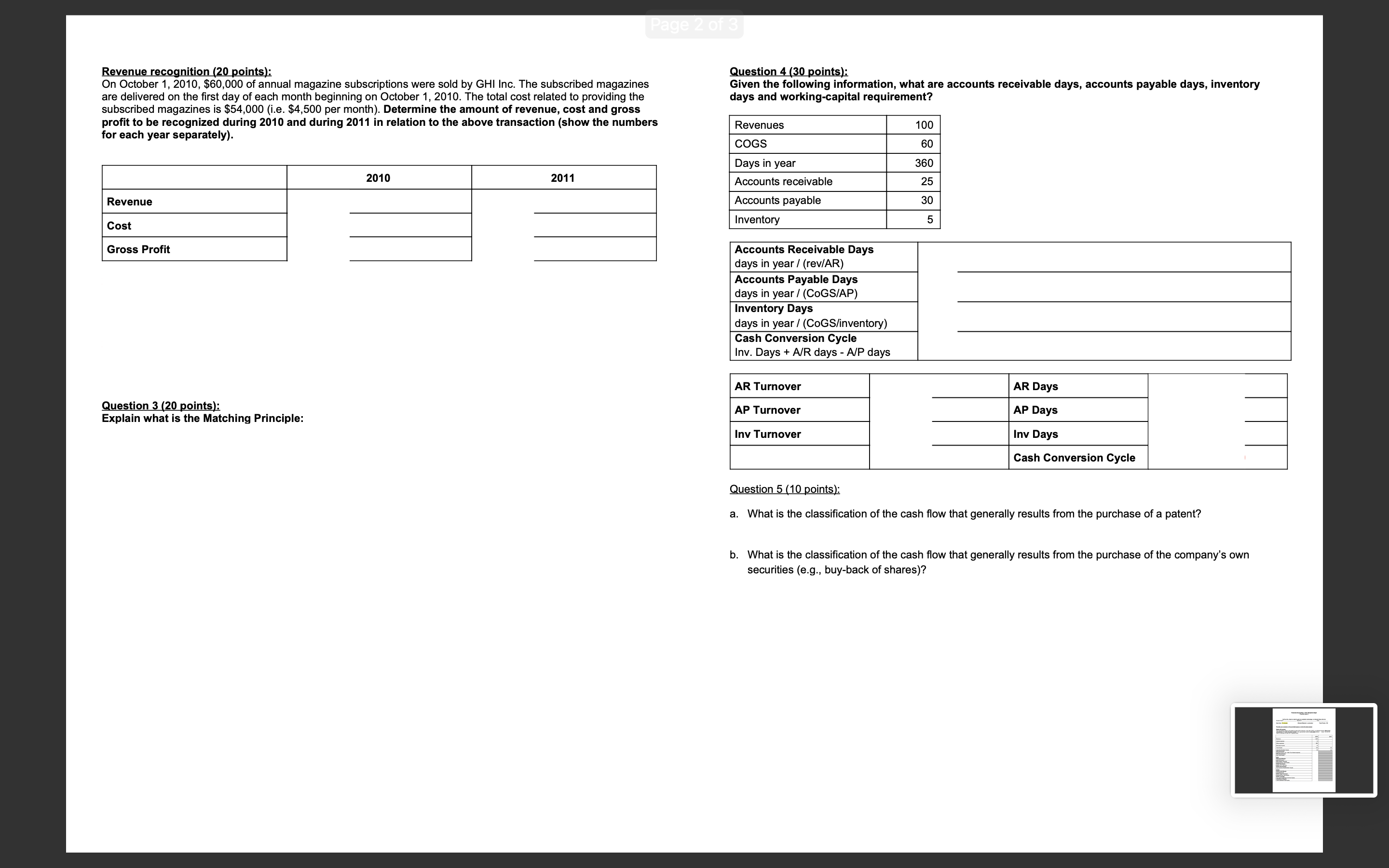

Financial Accounting - Prof. Benjamin Segal Practice Quiz 2 I will not lie, cheat or steal to gain an academic advantage, or tolerate those who do. Student Name: Signature Date Quiz time: 15 minutes Allowed Material: a calculator Total Points: 100 Provide your answers in the provided space or circle the best answer Ratios (20 points): Fill in all missing values in the table for years 2018. Assume: a tax rate of 20%, no preferred shares. Show your calculations and enter the final number in the appropriate location in the table (bottom rows). You do not need to calculate for year 2017 (greyed area). Revenue recognition (20 points): On October 1, 2010, $60,000 of annual magazine subscriptions were sold by GHI Inc. The subscribed magazines are delivered on the first day of each month beginning on October 1, 2010. The total cost related to providing the subscribed magazines is $54,000 (i.e. $4,500 per month). Determine the amount of revenue, cost and gross profit to be recognized during 2010 and during 2011 in relation to the above transaction (show the numbers for each year separately). Question 3 (20 points): Explain what is the Matching Principle: Question 4 ( 30 points): Given the following information, what are accounts receivable days, accounts payable days, inventory days and working-capital requirement? Question 5 (10 points): a. What is the classification of the cash flow that generally results from the purchase of a patent? b. What is the classification of the cash flow that generally results from the purchase of the company's own securities (e.g., buy-back of shares)? Financial Accounting - Prof. Benjamin Segal Practice Quiz 2 I will not lie, cheat or steal to gain an academic advantage, or tolerate those who do. Student Name: Signature Date Quiz time: 15 minutes Allowed Material: a calculator Total Points: 100 Provide your answers in the provided space or circle the best answer Ratios (20 points): Fill in all missing values in the table for years 2018. Assume: a tax rate of 20%, no preferred shares. Show your calculations and enter the final number in the appropriate location in the table (bottom rows). You do not need to calculate for year 2017 (greyed area). Revenue recognition (20 points): On October 1, 2010, $60,000 of annual magazine subscriptions were sold by GHI Inc. The subscribed magazines are delivered on the first day of each month beginning on October 1, 2010. The total cost related to providing the subscribed magazines is $54,000 (i.e. $4,500 per month). Determine the amount of revenue, cost and gross profit to be recognized during 2010 and during 2011 in relation to the above transaction (show the numbers for each year separately). Question 3 (20 points): Explain what is the Matching Principle: Question 4 ( 30 points): Given the following information, what are accounts receivable days, accounts payable days, inventory days and working-capital requirement? Question 5 (10 points): a. What is the classification of the cash flow that generally results from the purchase of a patent? b. What is the classification of the cash flow that generally results from the purchase of the company's own securities (e.g., buy-back of shares)

Financial Accounting - Prof. Benjamin Segal Practice Quiz 2 I will not lie, cheat or steal to gain an academic advantage, or tolerate those who do. Student Name: Signature Date Quiz time: 15 minutes Allowed Material: a calculator Total Points: 100 Provide your answers in the provided space or circle the best answer Ratios (20 points): Fill in all missing values in the table for years 2018. Assume: a tax rate of 20%, no preferred shares. Show your calculations and enter the final number in the appropriate location in the table (bottom rows). You do not need to calculate for year 2017 (greyed area). Revenue recognition (20 points): On October 1, 2010, $60,000 of annual magazine subscriptions were sold by GHI Inc. The subscribed magazines are delivered on the first day of each month beginning on October 1, 2010. The total cost related to providing the subscribed magazines is $54,000 (i.e. $4,500 per month). Determine the amount of revenue, cost and gross profit to be recognized during 2010 and during 2011 in relation to the above transaction (show the numbers for each year separately). Question 3 (20 points): Explain what is the Matching Principle: Question 4 ( 30 points): Given the following information, what are accounts receivable days, accounts payable days, inventory days and working-capital requirement? Question 5 (10 points): a. What is the classification of the cash flow that generally results from the purchase of a patent? b. What is the classification of the cash flow that generally results from the purchase of the company's own securities (e.g., buy-back of shares)? Financial Accounting - Prof. Benjamin Segal Practice Quiz 2 I will not lie, cheat or steal to gain an academic advantage, or tolerate those who do. Student Name: Signature Date Quiz time: 15 minutes Allowed Material: a calculator Total Points: 100 Provide your answers in the provided space or circle the best answer Ratios (20 points): Fill in all missing values in the table for years 2018. Assume: a tax rate of 20%, no preferred shares. Show your calculations and enter the final number in the appropriate location in the table (bottom rows). You do not need to calculate for year 2017 (greyed area). Revenue recognition (20 points): On October 1, 2010, $60,000 of annual magazine subscriptions were sold by GHI Inc. The subscribed magazines are delivered on the first day of each month beginning on October 1, 2010. The total cost related to providing the subscribed magazines is $54,000 (i.e. $4,500 per month). Determine the amount of revenue, cost and gross profit to be recognized during 2010 and during 2011 in relation to the above transaction (show the numbers for each year separately). Question 3 (20 points): Explain what is the Matching Principle: Question 4 ( 30 points): Given the following information, what are accounts receivable days, accounts payable days, inventory days and working-capital requirement? Question 5 (10 points): a. What is the classification of the cash flow that generally results from the purchase of a patent? b. What is the classification of the cash flow that generally results from the purchase of the company's own securities (e.g., buy-back of shares) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started