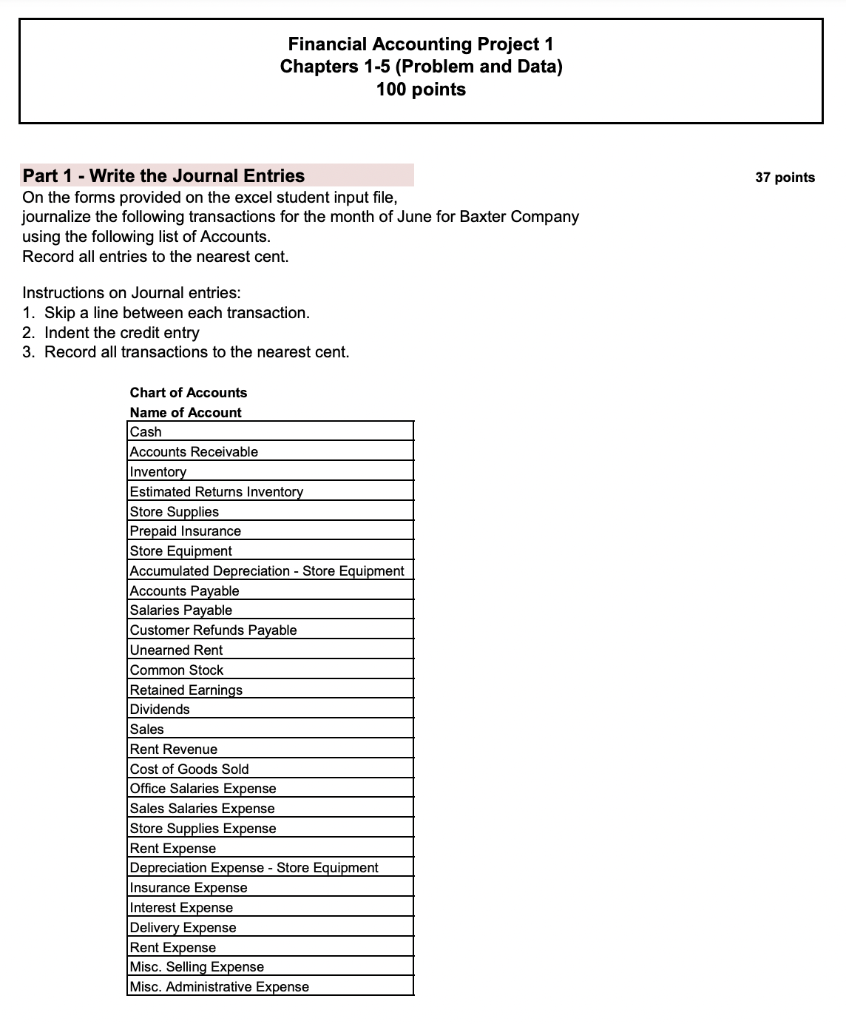

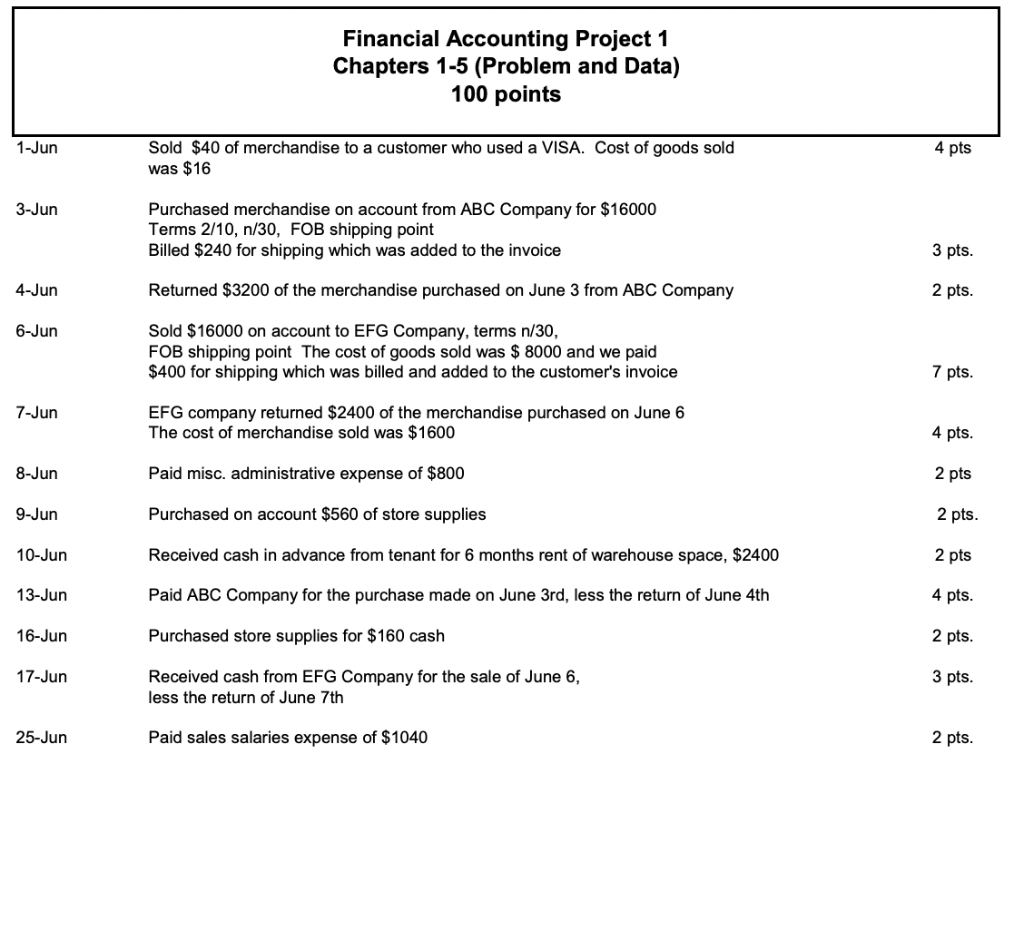

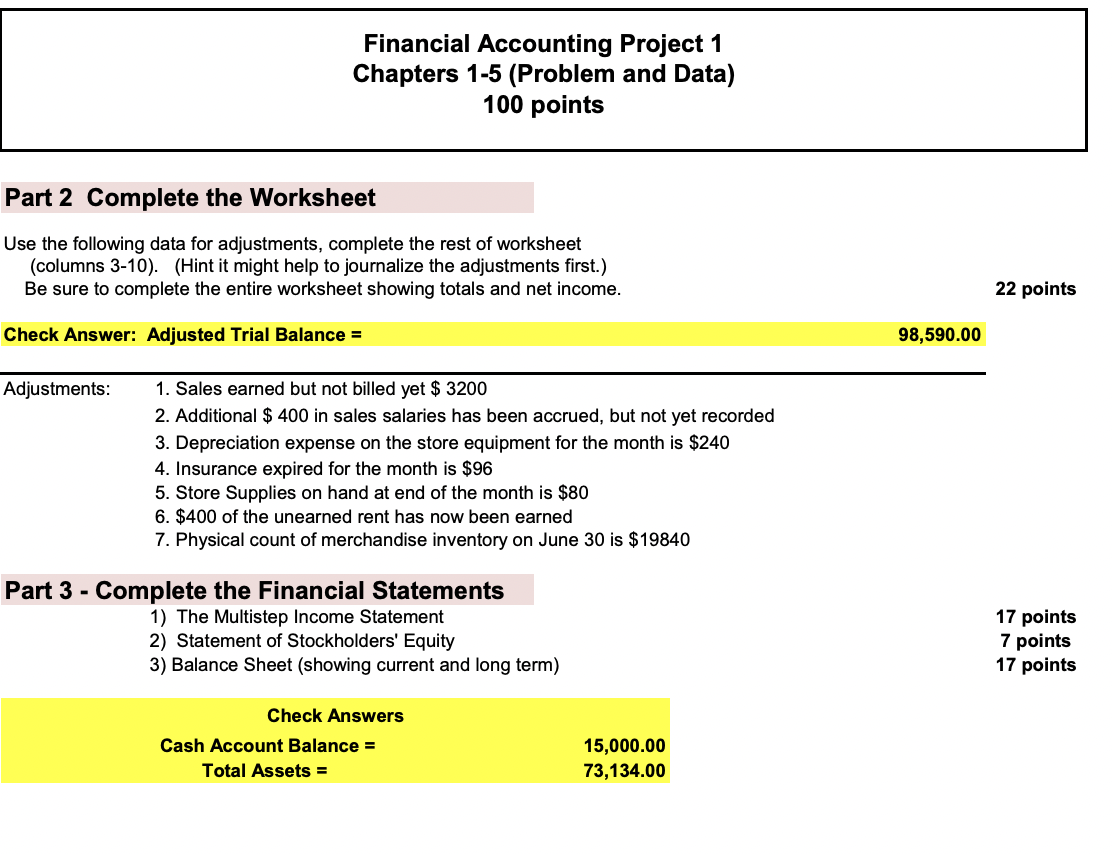

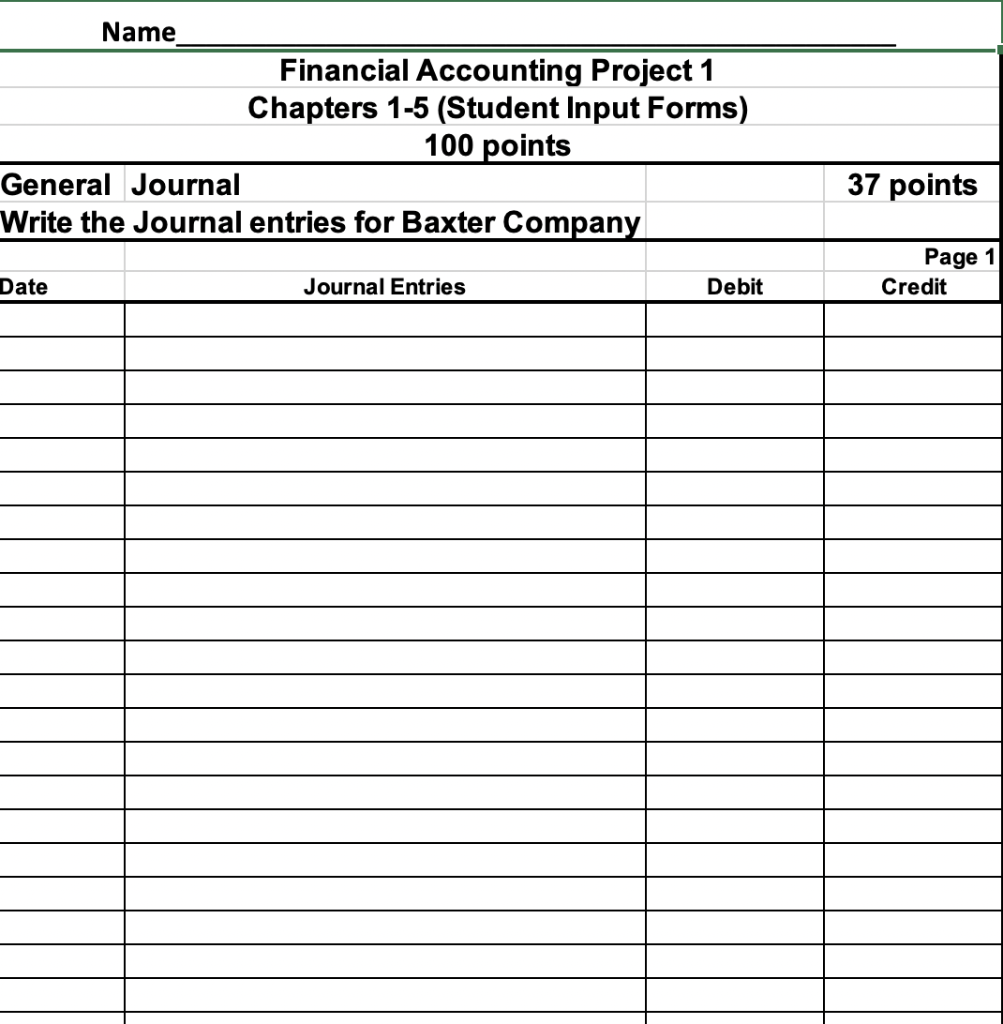

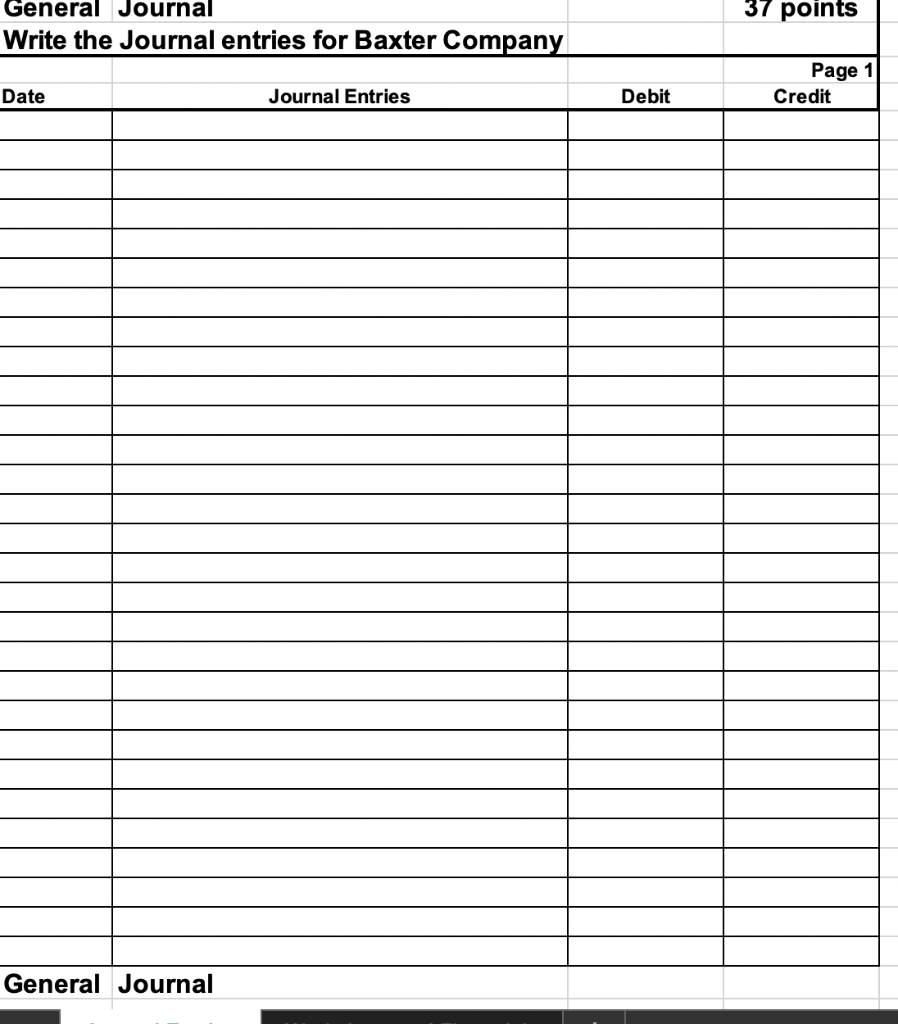

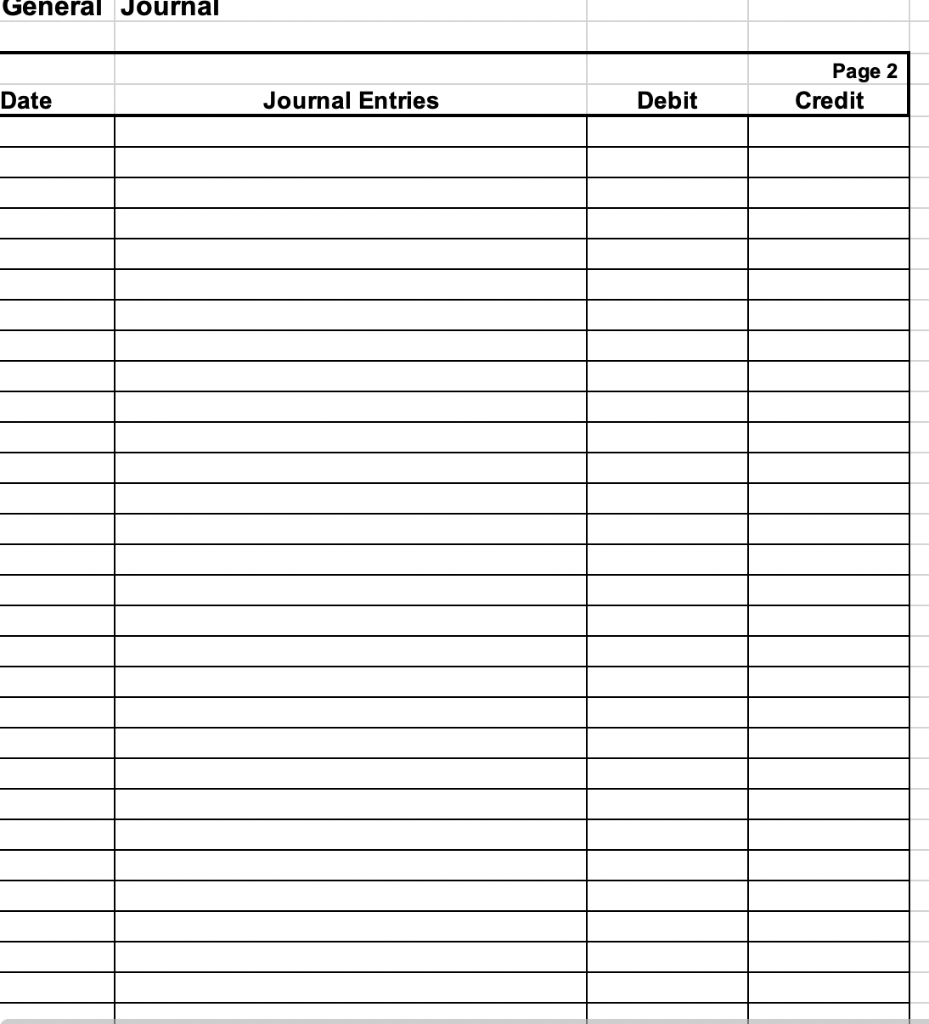

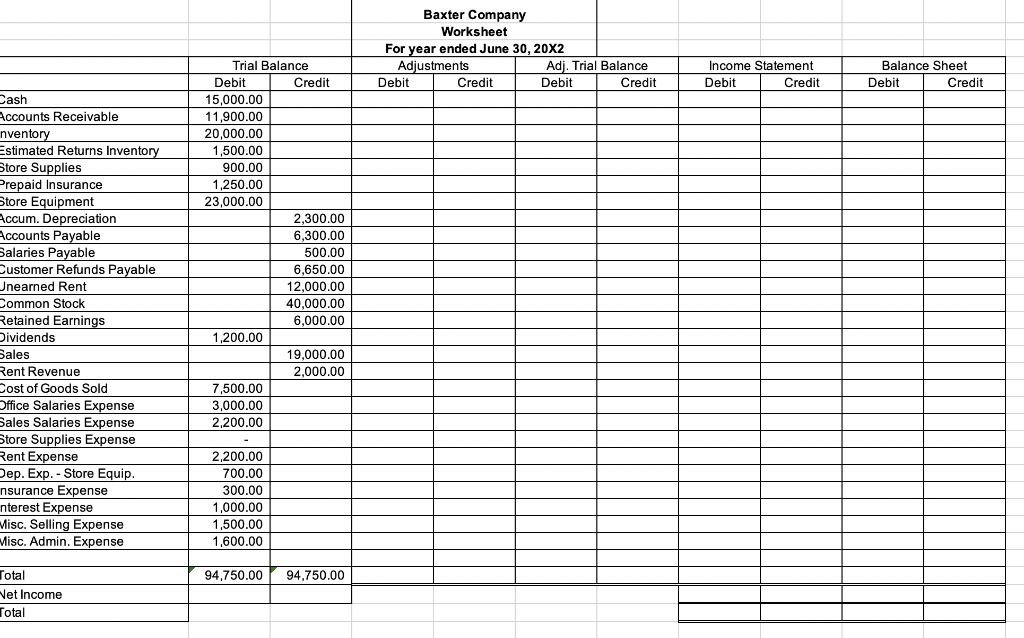

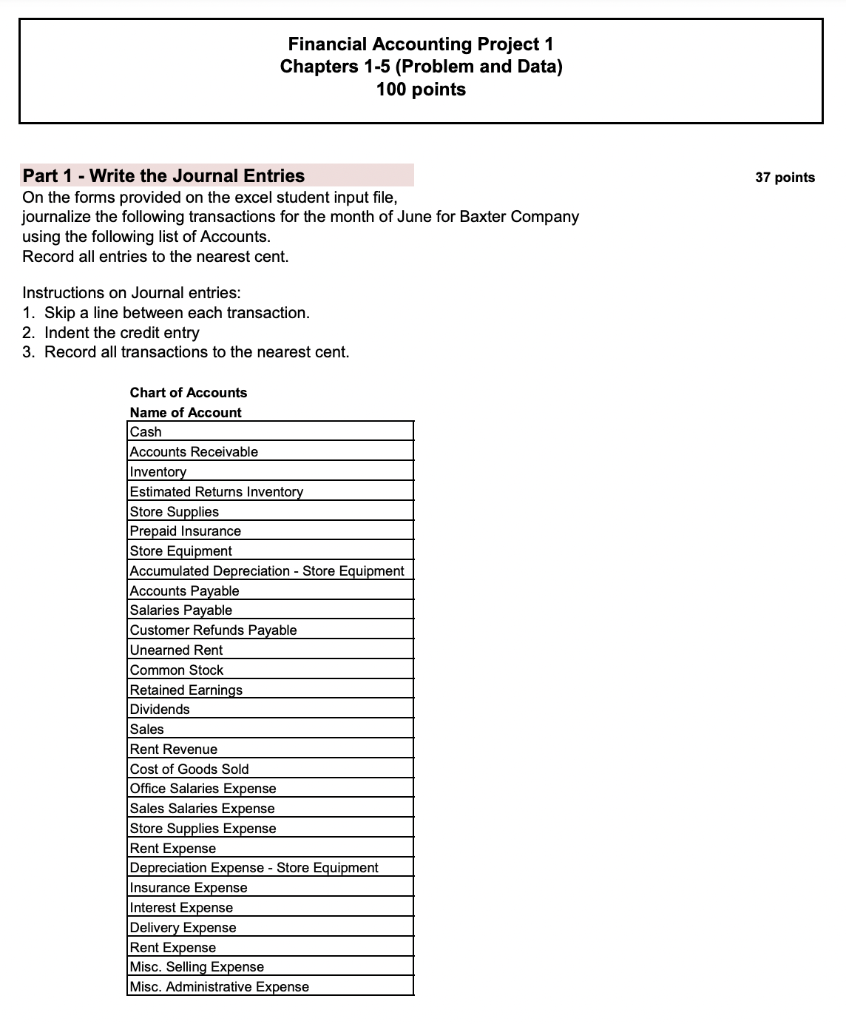

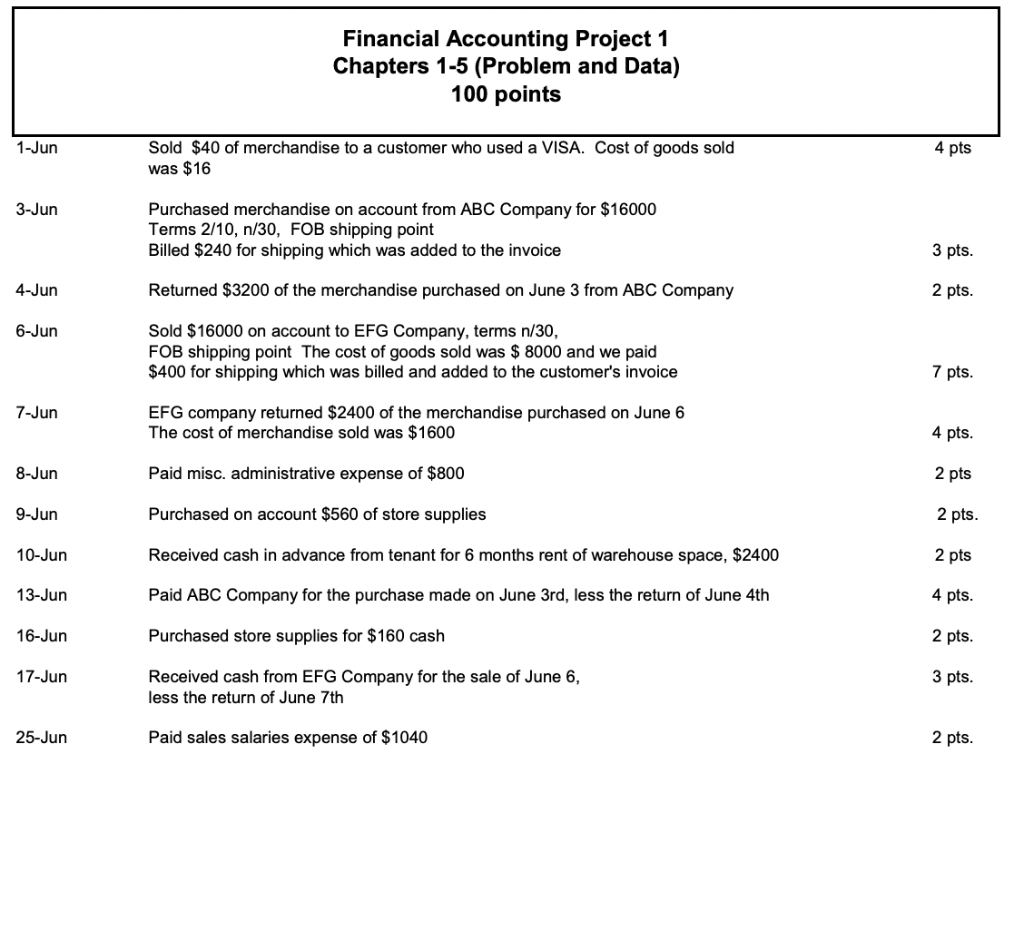

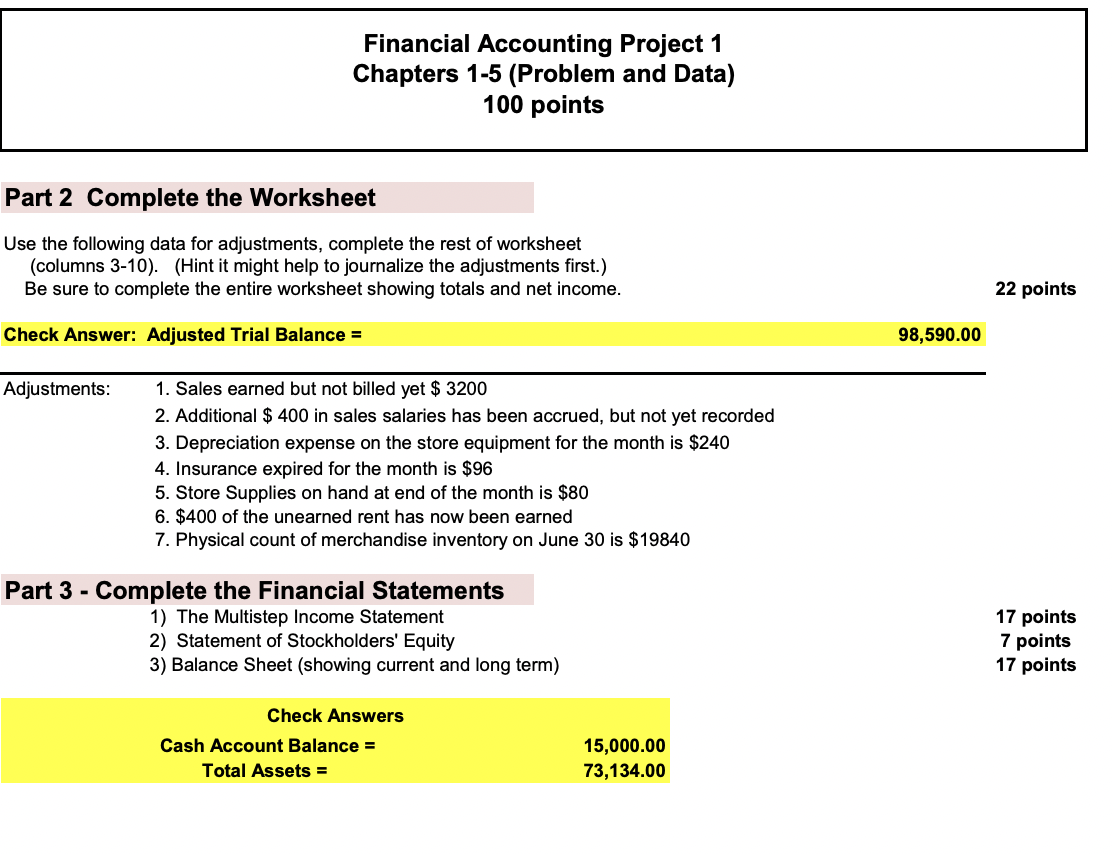

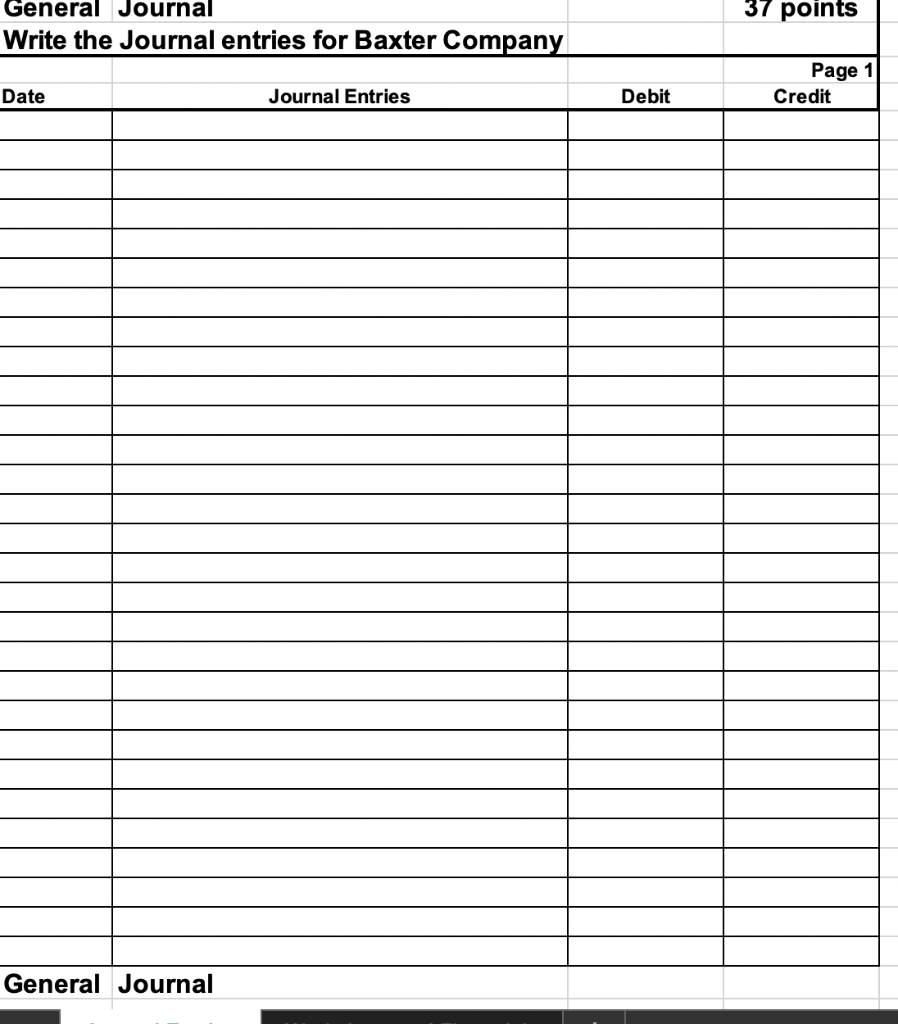

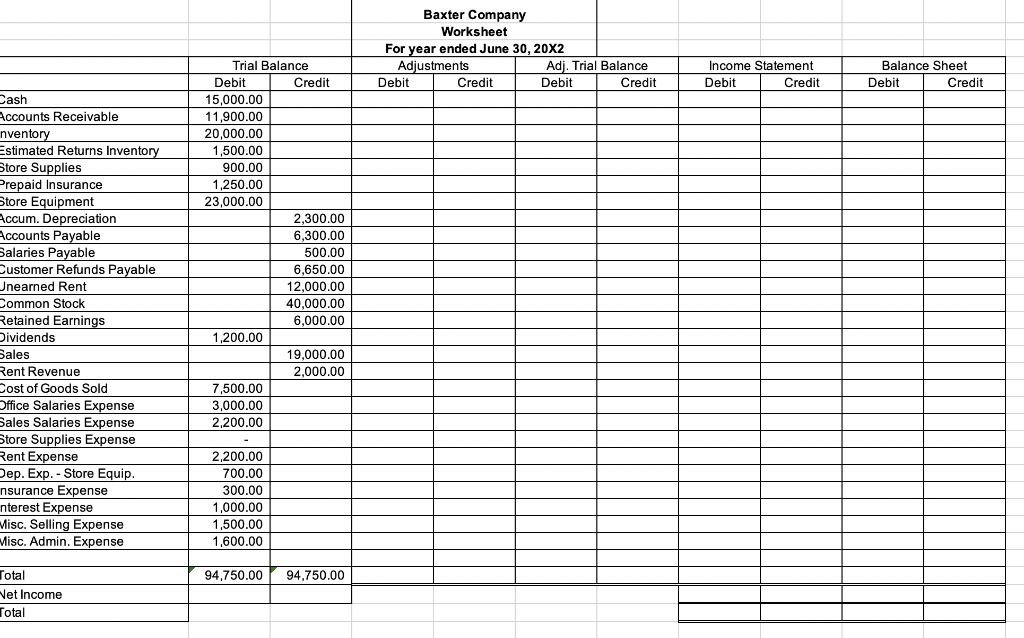

Financial Accounting Project 1 Chapters 1-5 (Problem and Data) 100 points 37 points Part 1 - Write the Journal Entries On the forms provided on the excel student input file, journalize the following transactions for the month of June for Baxter Company using the following list of Accounts. Record all entries to the nearest cent. Instructions on Journal entries: 1. Skip a line between each transaction. 2. Indent the credit entry 3. Record all transactions to the nearest cent. Chart of Accounts Name of Account Cash Accounts Receivable Inventory Estimated Returns Inventory Store Supplies Prepaid Insurance Store Equipment Accumulated Depreciation - Store Equipment Accounts Payable Salaries Payable Customer Refunds Payable Unearned Rent Common Stock Retained Earnings Dividends Sales Rent Revenue Cost of Goods Sold Office Salaries Expense Sales Salaries Expense Store Supplies Expense Rent Expense Depreciation Expense - Store Equipment Insurance Expense Interest Expense Delivery Expense Rent Expense Misc. Selling Expense Misc. Administrative Expense Financial Accounting Project 1 Chapters 1-5 (Problem and Data) 100 points 1-Jun Sold $40 of merchandise to a customer who used a VISA. Cost of goods sold was $16 4 pts 3-Jun Purchased merchandise on account from ABC Company for $16000 Terms 2/10, n/30, FOB shipping point Billed $240 for shipping which was added to the invoice 3 pts. 4-Jun Returned $3200 of the merchandise purchased on June 3 from ABC Company 2 pts. 6-Jun Sold $16000 on account to EFG Company, terms n/30, FOB shipping point The cost of goods sold was $ 8000 and we paid $400 for shipping which was billed and added to the customer's invoice 7 pts. 7-Jun EFG company returned $2400 of the merchandise purchased on June 6 The cost of merchandise sold was $1600 4 pts. 8-Jun Paid misc. administrative expense of $800 2 pts 9-Jun Purchased on account $560 of store supplies 2 pts. 10-Jun Received cash in advance from tenant for 6 months rent of warehouse space, $2400 2 pts 13-Jun Paid ABC Company for the purchase made on June 3rd, less the return of June 4th 4 pts. 16-Jun Purchased store supplies for $160 cash 2 pts. 17-Jun 3 pts. Received cash from EFG Company for the sale of June 6, less the return of June 7th 25-Jun Paid sales salaries expense of $1040 2 pts. Financial Accounting Project 1 Chapters 1-5 (Problem and Data) 100 points Part 2 Complete the Worksheet Use the following data for adjustments, complete the rest of worksheet (columns 3-10). (Hint it might help to journalize the adjustments first.) Be sure to complete the entire worksheet showing totals and net income. 22 points Check Answer: Adjusted Trial Balance = 98,590.00 Adjustments: 1. Sales earned but not billed yet $ 3200 2. Additional $ 400 in sales salaries has been accrued, but not yet recorded 3. Depreciation expense on the store equipment for the month is $240 4. Insurance expired for the month is $96 5. Store Supplies on hand at end of the month is $80 6. $400 of the unearned rent has now been earned 7. Physical count of merchandise inventory on June 30 is $19840 Part 3 - Complete the Financial Statements 1) The Multistep Income Statement 2) Statement of Stockholders' Equity 3) Balance Sheet (showing current and long term) 17 points 7 points 17 points Check Answers Cash Account Balance = Total Assets = 15,000.00 73,134.00 Name Financial Accounting Project 1 Chapters 1-5 (Student Input Forms) 100 points General Journal Write the Journal entries for Baxter Company 37 points Page 1 Credit Date Journal Entries Debit 37 points General Journal Write the Journal entries for Baxter Company Page 1 Date Journal Entries Debit Credit General Journal General Journal Page 2 Credit Date Journal Entries Debit Baxter Company Worksheet For year ended June 30, 20X2 Adjustments Adj. Trial Balance Debit Credit Debit Credit Income Statement Debit Credit Balance Sheet Debit Credit Cash Accounts Receivable Inventory Estimated Returns Inventory Store Supplies Prepaid Insurance Store Equipment Accum. Depreciation Accounts Payable Salaries Payable Customer Refunds Payable Jnearned Rent Common Stock Retained Earnings Dividends Sales Rent Revenue Cost of Goods Sold Office Salaries Expense Sales Salaries Expense Store Supplies Expense Rent Expense Dep. Exp. - Store Equip. nsurance Expense interest Expense Misc. Selling Expense Misc. Admin. Expense Trial Balance Debit Credit 15,000.00 11,900.00 20,000.00 1,500.00 900.00 1,250.00 23,000.00 2,300.00 6,300.00 500.00 6,650.00 12,000.00 40,000.00 6,000.00 1,200.00 19,000.00 2,000.00 7,500.00 3,000.00 2,200.00 2,200.00 700.00 300.00 1,000.00 1,500.00 1,600.00 94,750.00 94,750.00 Total Vet Income Total