Financial Accounting Study Guide 11th edition

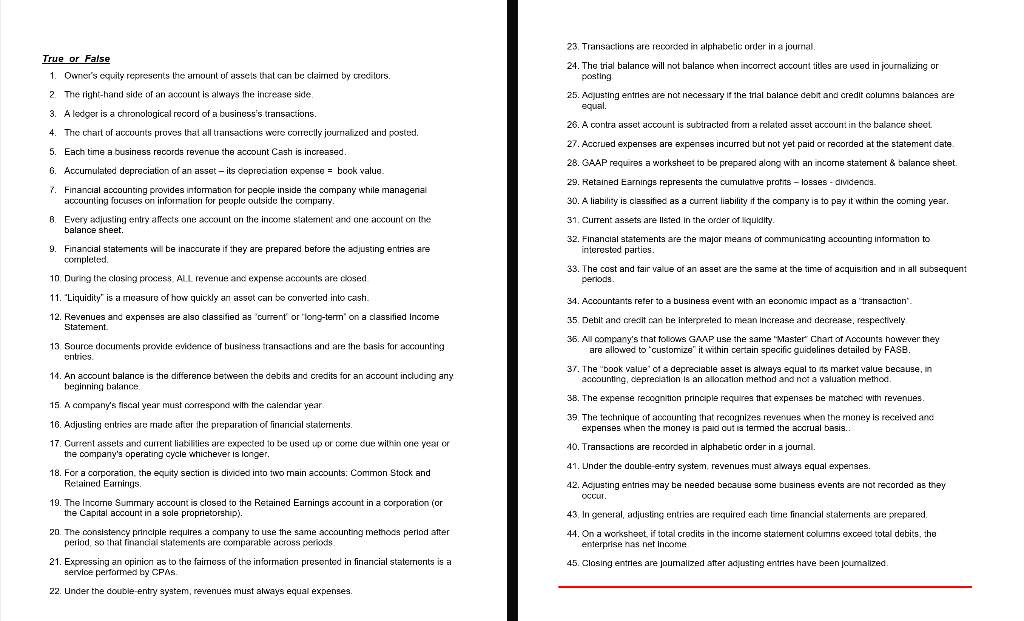

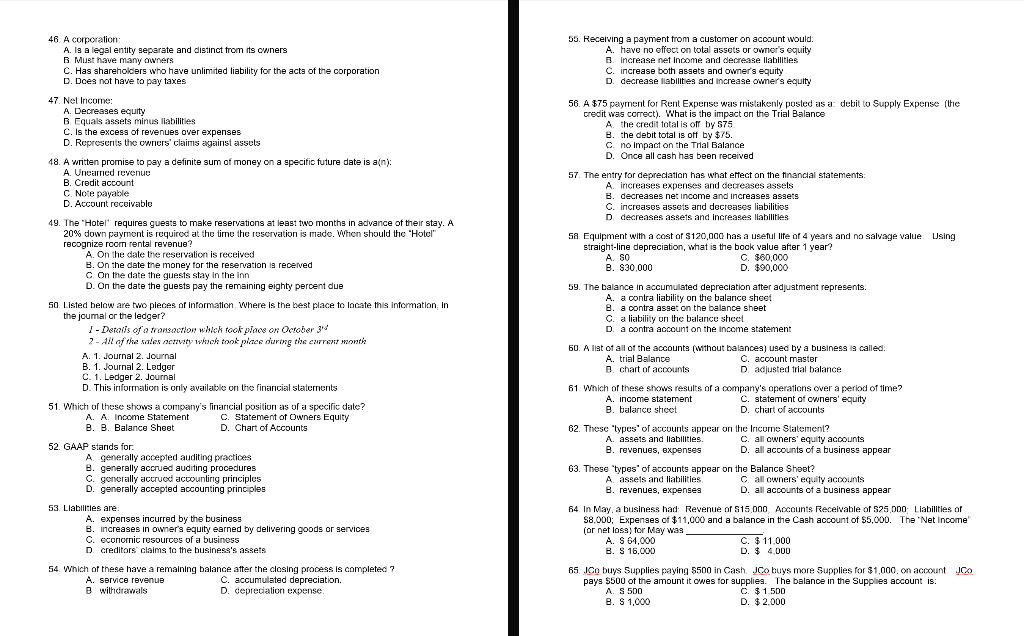

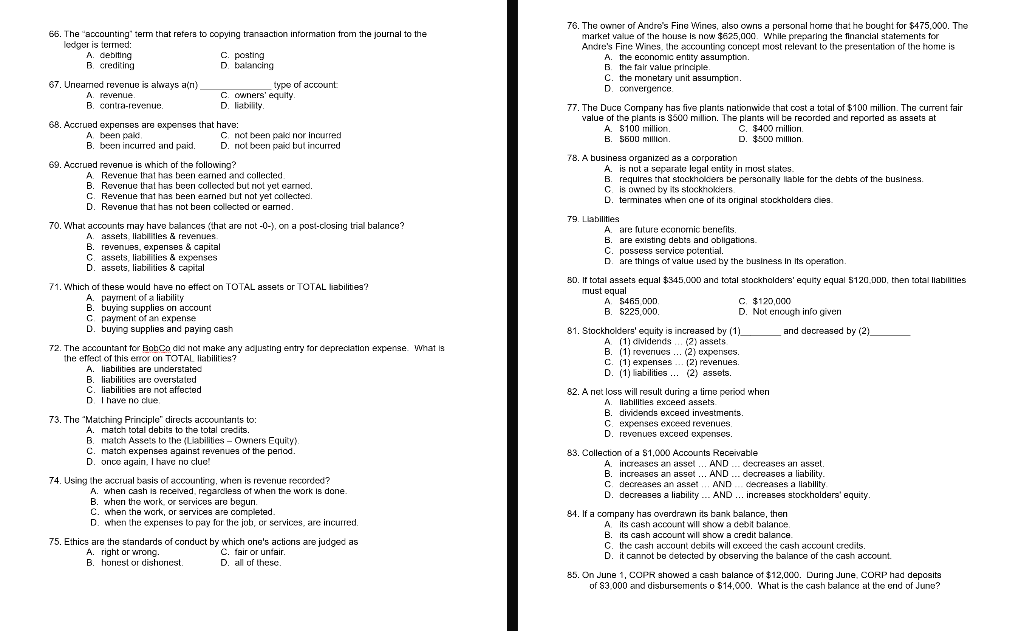

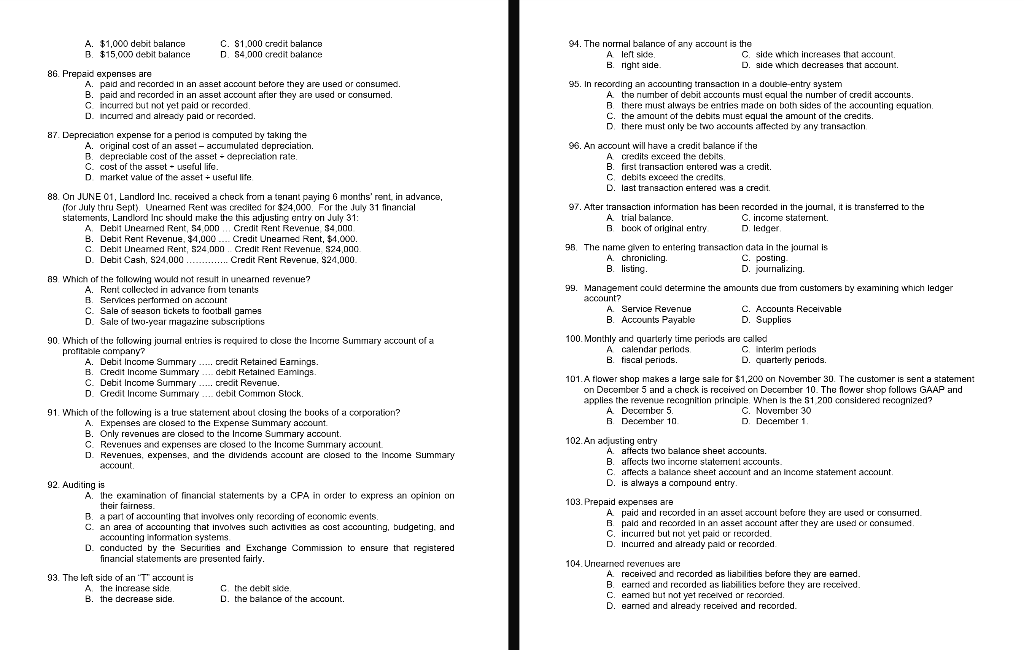

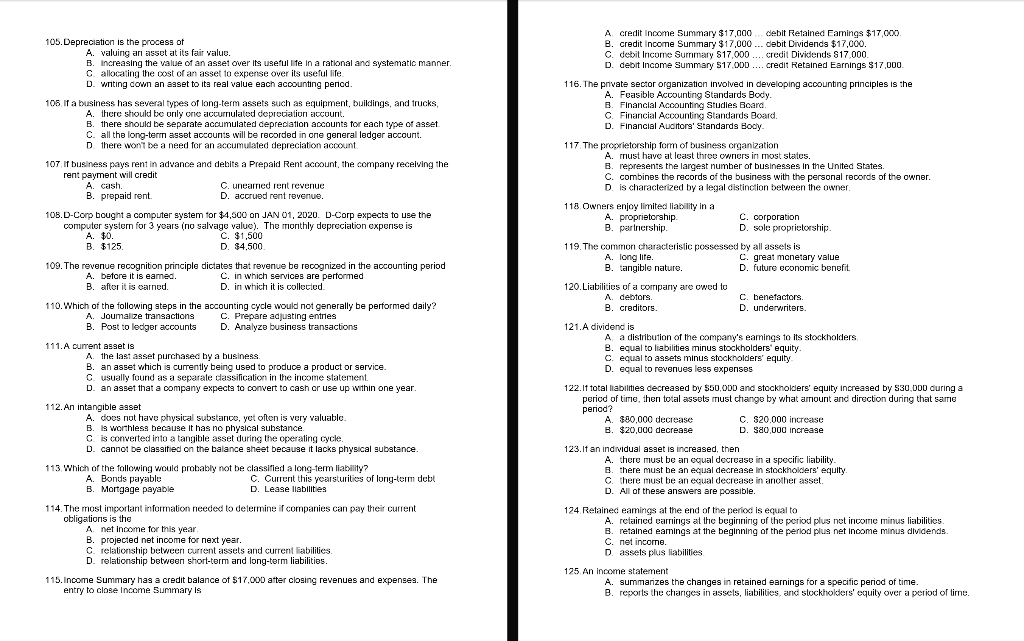

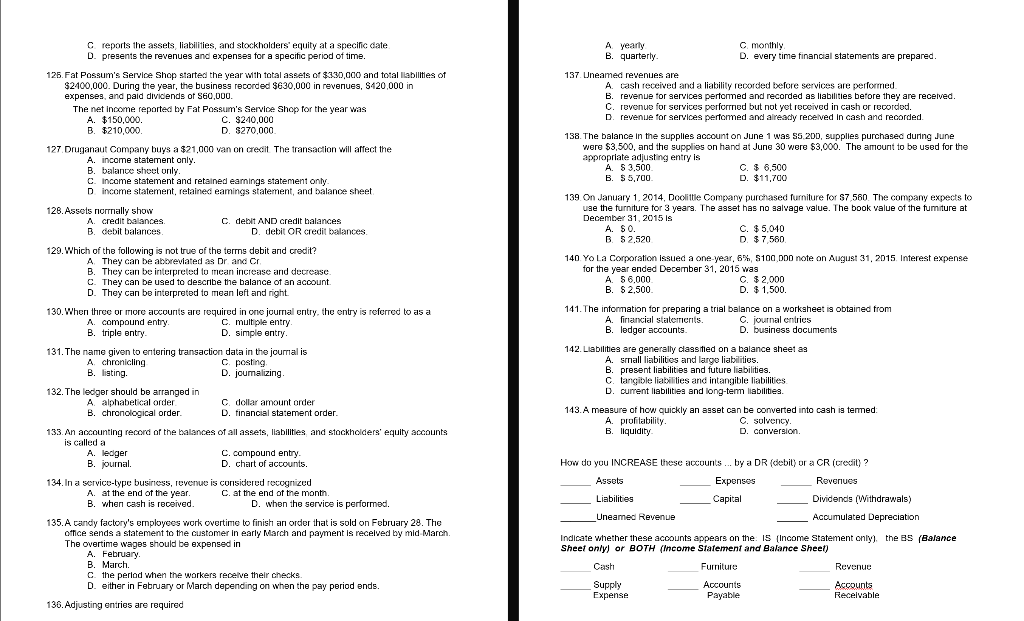

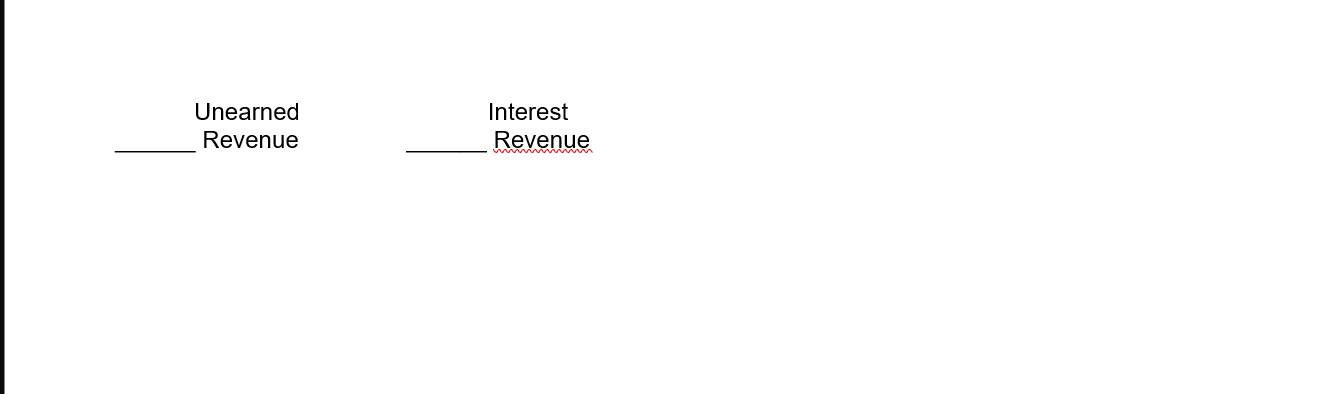

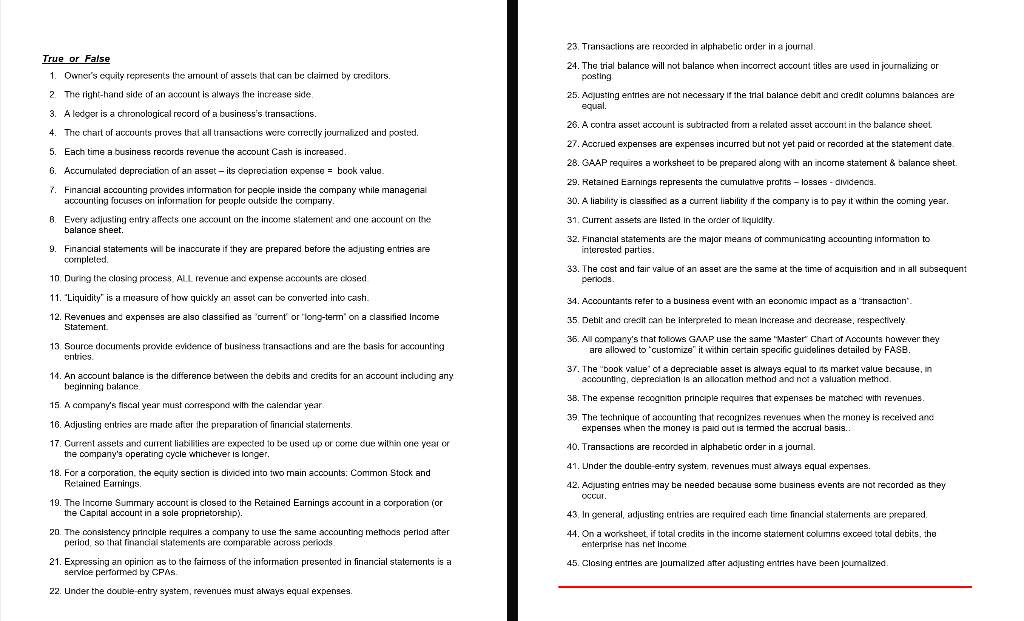

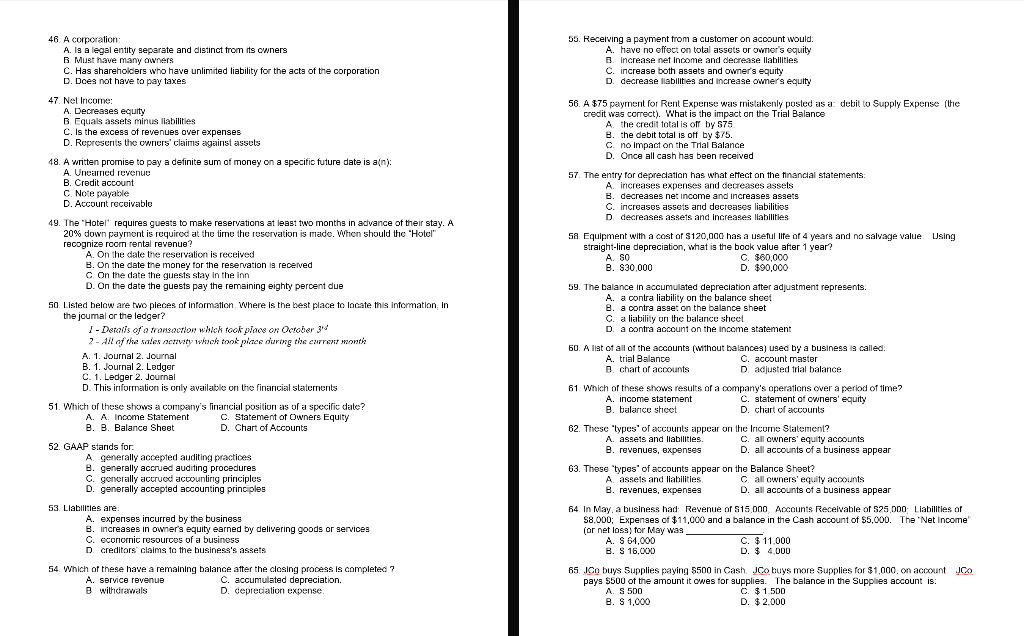

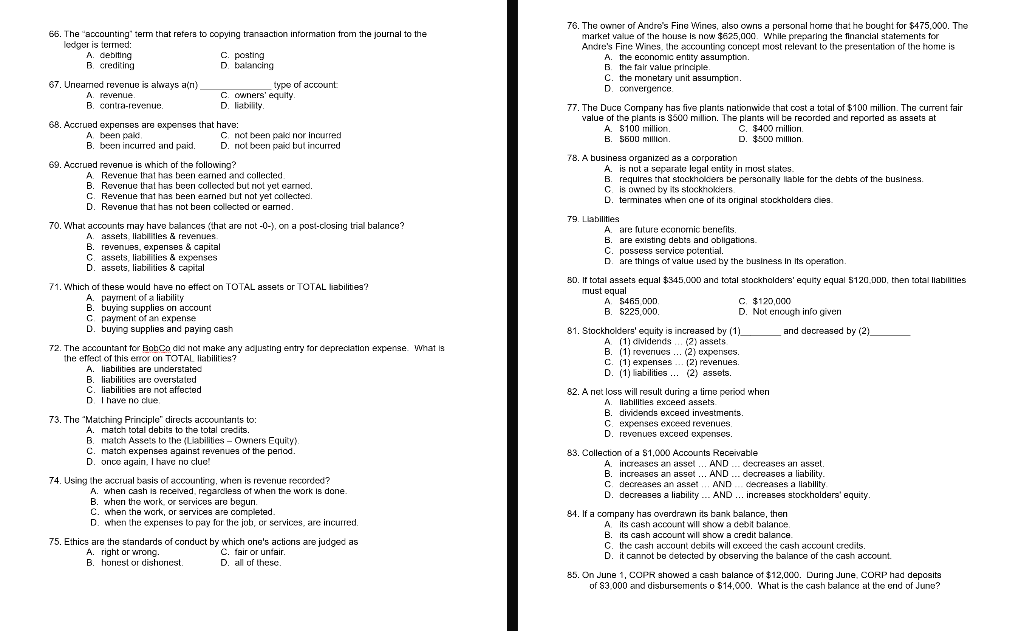

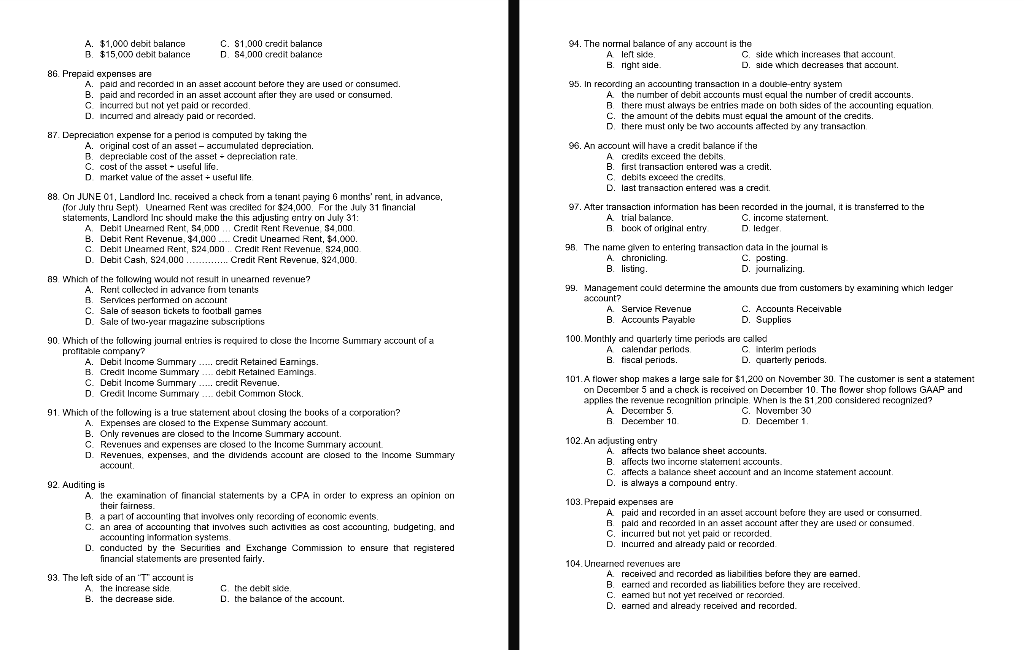

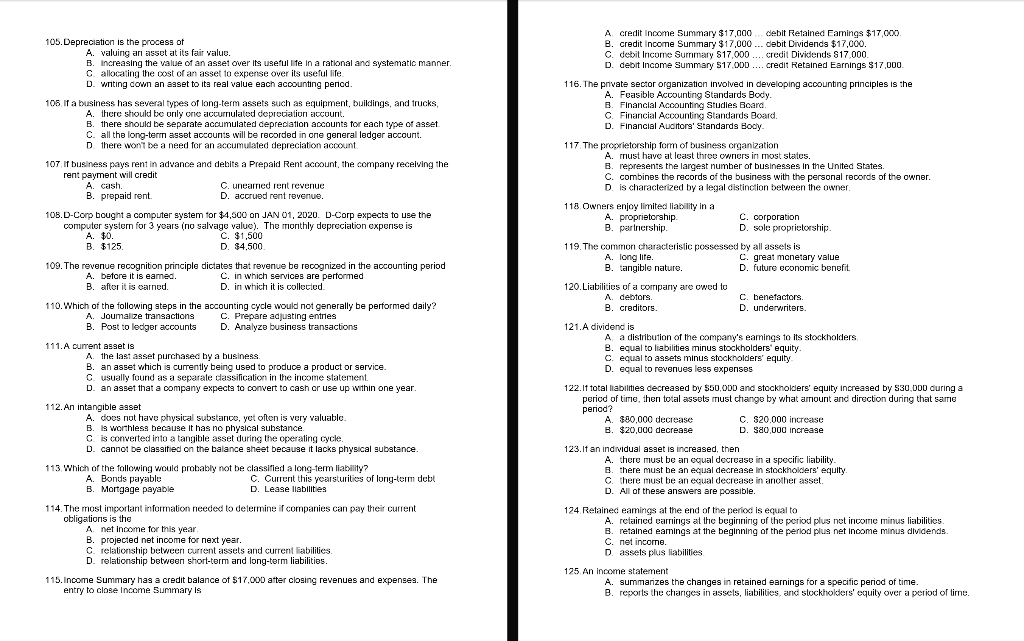

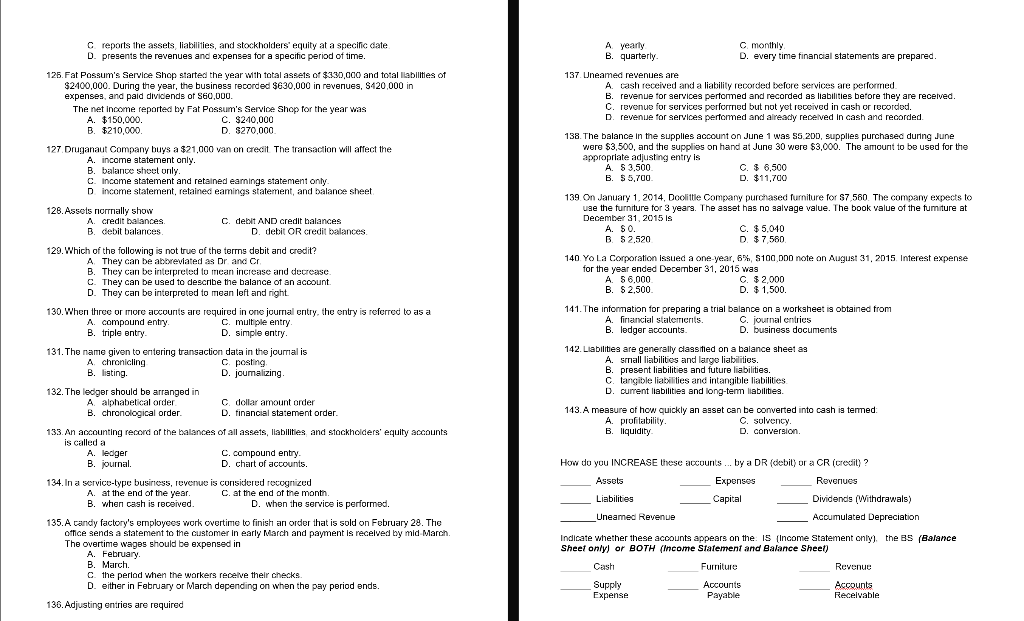

23. Transactions are recorded in alphabetic order in a journal 24. The trial balance will not balance when incorrect account titles are used in journalizing or posting True or False 1. Owner's equily represents the amount of assets that can be claimed by cecilors. 2. The right-hand side of an account is always the increase side. -. 3. A ledger is a chronological record of a business's transactions. 4. The chart of accounts proves that all transactions were correctly journalized and posted. 5. Each time a business records revenue the account Cash is increased. . 6. Accumulated depreciation of an asset - its depreciation expense = book value 7. Financial accounting provides information for people inside the company while managerial accounting focuses on information for people outside the company. 8. Every adjusting entry affects one account on the income statement and one account on the balance sheet 25. Adjusting entries are not necessary if the trial balance debit and credit columns balances are equal. 26. A contra asset account is subtracted from a related asset account in the balance sheet. 27. Accrued expenses are expenses incurred but not yet paid or recorded at the statement date 28. GAAP requires a worksheet to be prepared along with an income statement & balance sheet 29. Retained Earnings represents the cumulative profits - losses - dividenda. 30. A liability is classified as a current liability if the company is to pay it within the coming year. 31. Current assets are listed in the order of liquidity. 9. Financial statements will be inaccurate if they are prepared before the adjusting entries are completed 32. Financial statements are the major means of communicating accounting information to interested parties. 33. The cost and fair value of an asset are the same at the time of acquisition and in all subsequent periods 10 During the closing process. ALL revenue and expense accounts are closed 11. "Liquidity is a measure of how quickly an asset can be converted into cash. 12. Revenues and expenses are also classified as "current or long-term on a classified Income Statement 13 Source documents provide evidence of business transactions and are the basis for accounting entries 14. An account balance is the difference between the debits and credits for an account including any ! beginning balance 15. A company's fiscal year must correspond with the calendar year 16. Adjusting entries are made after the preparation of financial staternents. 17. Current assets and current liabilities are expected to be used up or comme due within one year or the company's operating cycle whichever is longer. 18. For a corporation, the equity section is divided into two main accounts: Common Stock and Retained Earnings 19. The Income Summary account is closed to the Retained Earnings account in a corporation (or the Capital account in a sole proprietorship). 20. The consistency principle requires a company to use the same accounting methods perlod after period, so that financial statements are comparable across periods 21. Expressing an opinion as to the fairness of the information presented in financial statements is a service performed by CPAS. 22. Under the double entry system, revenues must always equal expenses 34. Accountants refer to a business event with an economic impact as a transaction. 35. Debit and credit can be interpreted to mean increase and decrease, respectively 36. All company's that follows GAAP use the same "Master" Chart of Accounts however they are allowed to customize it within certain specific guidelines detailed by FASE. 37. The "book value of a depreciable asset is always equal to its market value because, in accounting, depreciation is an allocation method and not a valuation method. 38. The expense recognition principle requires that expenses be matched with revenues. 39. The technique of accounting that recognizes revenues when the money is received and expenses when the money is paid out is termed the accrual basis.. 10. Transactions are recorded in alphabetic order in a journal 41. Under the double-entry system, revenues must always equal expenses. 42. Adjusting entries may be needed because some business events are not recorded as they occur. 43. In general, adjusting entries are required each time financial statements are prepared. 44. On a worksheet, if total credits in the income statement columns exceed total debits, the enterprise has net income 45. Closing entries are joumalized after adjusting entries have been journalized. 55. Receiving a payment from a customer on account would A. have no effect on total assets or owner's equity B increase net income and decrease liabilities C. increase both assets and owner's equity D. decrease liabilities and increase owner's equity 46. A corporation: A. Is a legal entity separate and distinct from its owners B Must have many owners C. Has shareholders who have unlimited liability for the acts of the corporation D. Does not have to pay taxes 47 Net Income: A. Decreases equity B Equals assets minus liabilities C. Is the excess of revenues over expenses D. Represents the owners' claims against assets 48. A written promise to pay a definite sum of money on a specific future date is any A Uncained revenue B. Credit account C. Note payable D. Account receivable 56. A $75 payment for Rent Expense was mistakenly posted as a debit to Supply Expense (the credit was correct). What is the impact on the Trial Balance A the credit totalis off by 875 B. the debit total is off by $75. c. no Impact on the Trial Balance D. Once all cash has been received Nese decon 57. The entry for depredation has what effect on the financial statements: A increases expenses and decreases assels B. decreases net income and increases assets C. increases assets and decreases liabilitios D. decreases assets and increases liabilities 58. Equipment with a cost of $120.000 has a useful life of 4 years and no salvage value. Using straight-line depreciation, what is the book value after 1 year? A SO C. $60,000 B. $30,000 D. $90,000 59. The balance in accumulated depreciation after adjustment represents A. a contra liability on the balance sheet B. a contra asset on the balance sheet 6. a liability on the balance sheet D. a contra account on the income statement 50. A list of all of the accounts without balances, used by a business is called A trial Balance C. account master B chart of accounts D. adjusted trial balance 49. The "Hotel' requires guests to make reservations at least two months in advance of their stay. A 20% down payment is required at the time the reservation is made. When should the "Hotel" recognize room rental revenue? A On the date the reservation is received B. On the date the money for the reservation is received C On the date the guests stay in the inn D. On the date the guests pay the remaining eighty percent due 50 Listed below are two pieces of information. Where is the best place to locate this information in the journal or the ledger? 1 - Details of a transaction which took place on October 30 ? - All of the sales activity which took place during the current month A. 1. Journal 2. Journal B. 1. Journal 2. Ledger C. 1. Ledger 2. Journal D. This information is only available on the financial statements 51. Which of these shows a company's financial position as of a specific date? A. A. Income Statement C. Statement of Owners Equity B. B. Balance Sheet D. Chart of Accounts 52. GAAP stands for A generally accepted auditing practices B. generally accrued auditing procedures C. generally accrued accounting principles D. generally accepted accounting principles 53. Liabilities are A. expenses incurred by the business B. increases in owner's equity earned by delivering goods or services C. economic resources of a business a D. creditors claims to the business's assets 61 Which of these shows results of a company's operations over a period of time? A. income statement C. statement of owners' equity B. balance sheet D. chart of accounts 62. These types of accounts appear on the Income Statement? A. assets and liabilities. C. all owners' equity accounts B. revenues, expenses D. all accounts of a business appear 63. These types of accounts appear on the Balance Sheet? A assets and liabilities Call owners' equity accounts B. revenues, expenses D. all accounts of a business appear 64 In May, a business had: Revenue of $15.000, Accounts Receivable of 525.000 Liabilities of $8.000; Expenses of $11,000 and a balance in the Cash account of $5,000. The 'Net Income (or net loss) for May was A. S 64,000 C. $ 11,000 B. S 15.000 D. $ 4 DOO 65 Co buys Supplies paying 5500 in Cash JCo buys more Supplies for $1,000, on account JCO pays $500 of the amount it owes for supplies. The balance in the Supplies account is: A S 500 C. $1.500 B. S 1.000 D. $2.000 54. Which of these have a remaining balance after the closing process is completed ? A. service revenue C. accumulated depreciation. B withdrawals D. depreciation expense. 66. The accounting term that refers to copying transaction information from the journal to the ledger is termed: A. debiting C. posting B crediting D. balancing 67. Unearried revenue is always an) type of account A revenue C owners' equity B. contra-revenue D. liability 76. The owner of Andre's Fine Wines, also owns a personal home that he bought for $475,000. The market value of the house is now $625,000. While preparing the financial statements for Andie's Fine Wines, the accounting concept most relevant to the presentation of the home is A. the economic entity assumption. B. the fair value principle C. the monetary unit assumption. Donvergence 77. The Duce Company has five plants nationwide that cost a total of $100 million. The current fair value of the plants is $600 million. The plants will be recorded and reported as assets at A. S100 million C. $400 million B. 5500 million D. $1900 million 68. Accrued expenses are expenses that have: A been paid C not been paid nor incurred be B. been incurred and paid. D. not been paid but incurred 69. Accrued revenue is which of the following? A Revenue that has been earned and collected B. Revenue that has been collected but not yet carnod. C. Revenue that has been earned but not yet collected. D. Revenue that has not been collected or earned. 78. A business organized as a corporation A. is not a separate legal entity in most states. B. requires that stockholders be personally liable for the debts of the business. C is owned by its stockhokers D. terminates when one of its original stockholders dies. 70. What accounts may have balances that are not-O-), on a post-closing trial balance? A assets. liabilities & revenues B. revenues, expenses & capital Cassets, liabilities & expenses D. assets, liabilities & capital 71. Which of these would have no effect on TOTAL assets or TOTAL liabilities? A. payment of a liability B. buying supplies on account C payment of an expenser D. buying supplies and paying cash 72. The accountant for BobCo did not make any adjusting entry for depreciation expense. What is the effect of this error on TOTAL liabilities? A. liabilities are understated B. liabilities are overstatud C. liabilities are not affected D. I have no clue 79. Llabilities A are future economic benefits B. are existing debts and obligations. C. possess service potential. D. are things of value used by the business in its operation 80. If total assets equal $345.000 and total stockholders' equity equal $120,000, then total liabilities must equal A S465 ODD C$120,000 B. $225,000 D. Not enough info given 81. Stockholders' equity is increased by (1) and decreased by (2) A (1) dividends...(2) assets B. (1) revenues... (2) expenses. C. (1) expenses (2) revenues D. (1) abilities ... (2) assets. 82. A net loss will result during a tirne period when Allabilities exceed assets B. dividends exceed investments C. expenses exceed revenues. D. rovonuos exceed expenses. 83. Collection of a $1,000 Accounts Receivable A increases an assel ... AND ... decreases an asset. B. increases an asset ... AND ... decreases a liability. C decreases an asset AND decreases a liability D. decreases a liability ... AND ... increases stockholders' equity. 84. If a company has overdrawn its bank balance, then A its cash account will show a debit balance B. its cash account will show a credit balance C. the cast account debits will exceed the cash account credits. D. it cannot be detected by observing the balance of the cash account. 85. On June 1, COPR showed a cash balance of $12,000. During June, CORP had deposits of $3.000 and disbursements o $14,000. What is the cash balance at the end of June? 73. The "Matching Principle" directs accountants to: A. match total debits to the total credits B. match Assets to the (Liabilities - Owners Equity). C. match expenses against revenues of the penod. D. once again. I have no clue! 74. Using the accrual basis of accounting, when is revenue recorded? A. when cash is received, regardless of when the work is done B. when the work or services are begun. C. when the work, or services are completed. D. when the expenses to pay for the job, or services are incurred. 75. Ethics are the standards of conduct by which one's actions are judged as A. right or wrong. C. fair or unfair B. honest or dishonest D, all of these 94. The normal balance of any account is the A left side. G. side which increases that account. Bright side D. side which decreases that account. 95. In recording an accounting transaction in a double-entry system A the number of debit accounts must equal the number of credit accounts. B. there must always be entries made on both sides of the accounting equation. C. the amount of the debits must equal the amount of the credits D. there must only be two accounts affected by any transaction 96. An account will have a credit balance if the Acredits exceed the detits B. first transaction entered was a credit Cdebits exceed the credits D. last transaction entered was a credit 97. After transaction information has been recorded in the joumal, it is transterred to the A trial balance C. income statornont. B book of original entry D ledger A. $1,000 debit balance C. $1.000 credit balance B. $15,000 debit balance D. S4000 credit balance 86. Prepaid expenses are A. paid and recorded in an asset account before they are used or consumed. B. paid and recorded in an asset account after they are used or consumed. Cincurred but not yet paid or recorded. D. incurred and already paid or recorded. 87. Depreciation expense for a period is computed by taking the A. original cost of an asset - accumulated depreciation. B. depreciable cost of the asset - depreciation rate C. cost of the asset - useful life. D market value of the asset - useful life 88. On JUNE 01, Landlord Inc. received a check from a tenant paying 6 months' rent in advance, (for July thru Sept). Uneamed Rent was credited for $24,000. For the July 31 financial statements, Landlord Inc should make the this adjusting entry on July 31: , A Debit Uneamed Rent, S4 ODD Credit Rent Revenue $4.000 B. Debit Rent Revenue, $4,000 ... Credit Uneamed Rent, $4,000. C. Debit Uneamed Rent, 524 DDO. Credit Rent Revenue $24,000 D. Debit Cash, S24,000 Credit Rent Revenue, S24,000 89 Which of the following would not result in unearned revenue? A. Rent collected in advance from tenants B. Services performed on account C. Sale of season tickets to football games D. Sale of two-year magazine subscriptions 90. Which of the following journal entries is required to close the Income Summary account of a profitable company? A. Debit Income Summary ..... credit Retained Earnings. B. Credit Income Summary .... debit Retained Eamings Debit Income Summary ..... credit Revenue. D. Credit Income Surrimary ... debit Common Slock. 91. Which of the following is a true statement about closing the books of a corporation? A. Expenses are closed to the Expense Summary account. B. Only revenues are closed to the Income Summary account. C. Revenues and expenses are closed to the Income Surrirnary account. D. Revenues, expenses, and the dividends account are closed to the Income Summary account 92. Auditing is A. the examination of financial statements by a CPA in order to express an opinion on their fairness. B. a part of accounting that involves only recording of economic events. C. an area of accounting that involves such activities as cost accounting, budgeting, and accounting information systems D. conducted by the Securities and Exchange Commission to ensure that registered financial statements are presented fairly, 93 Tho left side of an "T account is A the increase side Cthe debit side B. the decrease side. D. the balance of the account. 96 The name given to entering transaction data in the journal is A. chronicling C. posting Blisting. D. journalizing 99. Management could determine the amounts due from customers by examining which ledger account? A. Service Revenue C. Accounts Receivable B. Accounts Payable D. Supplies 100. Monthly and quarterly time periods are called A calendar periods Cinterim periods B. fiscal periods. D. quarterly periods. 101. A flower shop makes a large sale for $1,200 on November 30. The customer is sent a statement on December 5 and a check is received on December 10. The flower shop follows GAAP and applies the revenue recognition principle When is the 51 200 considered recognized? A December 5. C. November 30 B December 10 D December 1 102. An adjusting entry A. affects two balance sheet accounts. B. affects two income statement accounts C. affects a balance sheet account and an income statement account. D. is always a compound entry 103. Prepaid expenses are A paid and recorded in an asset account before they are used or consumed. B paid and recorded in an asset account after they are used or consumed. C. incurred but not yet paid or recorded. D. Incurred and already paid or recorded 104. Unearned revenues are A received and recorded as liabilities before they are earned. B. varned and recorded as liabilities before they are received. C. eamed but not yet received or recorded. D. earned and already received and recorded. 105. Depreciation is the process of A. valuing an asset at its fair value. B. Increasing the value of an asset over its useful life in a rational and systematic manner. C allocating the cost of an asset to expense over its useful life D. writing down an asset to its real value each accounting period. 105 If a business has several types of long-term assets such as equipment, buildings, and trucks, A. there should be only one accurrulated depreciation account. B. there should be separate accumulated depreciation accounts for each type of asset C. all the long-term asset accounts will be recorded in one general ledger account. D. there won't be a need for an accumulated depreciation account 107 If business pays rent in advance and debits a Prepaid Rent account, the company receiving the rent payment will credit A cash. C. unearned rent revenue B. prepaid rent D. accrued rent revenue. 106.D-Corp bought a computer system for $4,500 on JAN 01, 2020. D-Corp expects to use the computer system for 3 years (no salvage value). The monthly depreciation expense is A. $0. C. $1,500 B. $125 D. $4,500 A credit Income Summary $17.000 debit Retained Eamings $17,000 B. credit Income Summary $17,000 ... debit Dividends $17,000. C. debil Income Surrimary S17,000 .... credit Dividends $17.000 D. debit Income Summary 517.000 .... credit Retained Earnings $17,000 116. The private sector organization involved in developing accounting principles is the A. Feasible Accounting Standards Body. B. Financial Accounting Studies Board c. Financial Accounting Standards Board D. Financial Auditors' Standards Body 117. The proprietorship form of business crganization A. trust have at least three owners in most states. B. represents the largest number of businesses in the United States C. combines the records of the business with the personal records of the owner. D. is characterized by a legal distinction between the owner 118 Owners enjoy limited liability in a A. proprietorship C. corporation B. partnership D. sole proprietorship 119. The common characteristic possessed by all assets is A. long life. C. great monetary value B. tangible nature D. future economic benefit 120.Liabilities of a company are owed to A. debtors . C. benefactors. B. creditors. D. underwriters. 121. A dividend is A a distribution of the company's eamings to its stockholders B. equal to liabilities minus stockholders' equity C. equal to assets minus stockholders' equity D. equal to revenues less expensos 122. If total liabilities decreased by $50,000 and stockholders' equity increased by $30,000 during a period of time, then total assets must change by what amount and direction during that same period? A. $80,000 decrease C. $20.000 increase B. $20,000 decrease D. $80,000 increase 109. The revenue recognition principle dictates that revenue be recognized in the accounting period A. before it is eamed. C. in which services are performed B. after it is earned D. in which it is collected 110. Which of the following steps in the accounting cycle would not generally be performed daily? A. Joumalize transactions C. Prepare adjusting entries B. Post to lodgor accounts D. Analyze business transactions 111. A current asset is A the last asset purchased by a business B. an asset which is currently being used to produce a product or service. c. usually found as a separate dassification in the income statement. D. an asset that a company expects to convert to cash or use up within one year. 112. An intangible asset A. does not have physical substance, yet often is very valuable. B. is worthless because it has no physical substance. C is converted into a tangible asset during the operating cycle D. cannot be classified on the balance sheet because it lacks physical substance. 113. Which of the following would probably not be classified a long-term liability? A. Bonds payable C. Current this yearsturities of long-term debt B. Mortgage payable D. Lease liabilities 114. The most important information needed to determine if companies can pay their current obligations is the A net income for this year B. projected net income for next year. c relationship between current assets and current abililies. D. relationship between short-term and long-term liabilities. 115. Income Summary has a credit balance of $17,000 after closing revenues and expenses. The entry to close Income Summary is 123.If an individual asset is increased, then A. there must be an equal decrease in a specific liability. B. there must be an equal decrease in stockholders' equity. c. there must be an equal decrease in another asset. D. All of these answers are possible. 124 Retained earings at the end of the period is equal to A. rctaired earrings at the beginning of the period plus net income minus liabilities B. retained eamings at the beginning of the period plus net income minus dividends. C. net income. D. assets plus liabilities 125 An income statement A. summarizes the changes in retained earnings for a specific period of time. B. reports the changes in assets, liabilities, and stockholders' equily over a period of time. Creports the assets, liabilities, and stockholders' equity at a specific date D. presents the revenues and expenses for a specific period of time. 125. Fat Possum's Service Shop started the year with total assets of $330,000 and total liabilities of $2400,000. During the year, the business recorded $630,000 in revenues, S420,000 in expenses, and paid dividends of S60,000. The net income reported by Fat Possum's Service Shop for the year was A. $150,000 C. $240,000 B. $210.000 D. $270,000 127 Druganaut Company buys a $21.000 van on credit. The transaction will affect the A. income statement only. B. balance sheet only C. Income statement and retained earnings statement only Dincome statement, retained eamings statement, and balance sheet 128. Assets normally show A. credit balances C. debit AND credit balances B. debit balances D. debit OR credit balances 129. Which of the following is not true of the terms debit and credit? A They can be abbreviated as Dr and or B. They can be interpreted to mean increase and decrease C. They can be used to describe the balance of an account. D. They can be interpreted to mean left and right. 130. When three or more accounts are required in one journal entry, the entry is referred to as a A. compound entry C. multiple entry B. triple entry D. simple entry 131. The name given to entering transaction data in the joumalis A chronicling C posting B. listing. . Djoumalizing 132. The ledger should be arranged in A alphabetical order dollar amount order B. chronological order. D. financial statement order. 133. An accounting record of the balances of all assets, liabilities and stockholders' equity accounts is called a A. ledger C. compound entry. B. journal. D. chart of accounts. 134. In a service-type business, revenue is considered recognized A. at the end of the year. C. at the end of the month B. when cash is received D. when the service is performed. 135. A candy factory's employees work overtime to finish an order that is sold on February 28. The office sends a statement to the customer in early March and payment is received by mid March. The overtime wagos should be expensed in A. February B. March C. the period when the workers receive their checks D. either in February or March depending on when the pay period ends. 136. Adjusting entries are required A yearly 6 monthly B. quarterly D. every time financial statements are prepared. 137. Uneamed revenues are A cash received and a liability recorded before services are performed. B. revenue for services performed and recorded as liabilities before they are received. C. revenue for services performed but not yet received in cash or recorded. D. revenue for services performed and already received in cash and recorded. 138. The balance in the supplies account on June 1 was SS, 200, supplies purchased during June were $3,500, and the supplies on hand at June 30 were $3,000. The amount to be used for the appropriate adjusting entry is A. $ 3.500 C. $ 6,500 B. 55,700 D. $11,700 139 On January 1, 2014, Doolittle Company purchased furniture for S7580. The company expects to use the furniture for 3 years. The asset has no salvage value. The book value of the fumiture at December 31, 2015 IS A. SO. C. $ 5,040 BS 2,520 D. $ 7560 140 Yo La Corporation issued a one year, 5% S100 000 note on August 31, 2015. Interest expense for the year ended December 31, 2015 was A $ 6.000 G. $2,000 B. $2,500 D. $1,500 141. The information for preparing a trial balance on a worksheet is obtained from A financial statements C. journal entries B. ledger accounts D. business documents 142. Liabilities are generally classified on a balance sheet as A. small liabilities and large liabilities. B. present liabilities and future liabilities. c. tangible liabilities and intangible liabilities D. current liabilities and long-term liabilities. 143.A measure of how quickly an asset can be converted into cash is termed: A. profitability C. solvency. B. liquidity D. conversion. How do you INCREASE these accounts ... by a DR (debil) or a CR (credit)? Assets Expenses Revenues Liabilities Capital Dividends (Withdrawals) Uneamed Revenue Accumulated Depreciation Indicate whether these accounts appears on the IS (Income Statement only the BS (Balance Sheet only) or BOTH (Income Statement and Balance Sheet) Cashi Revenue Supply Expense Furniture Accounts Payable Accounts Receivable Unearned Revenue Interest Revenue