Answered step by step

Verified Expert Solution

Question

1 Approved Answer

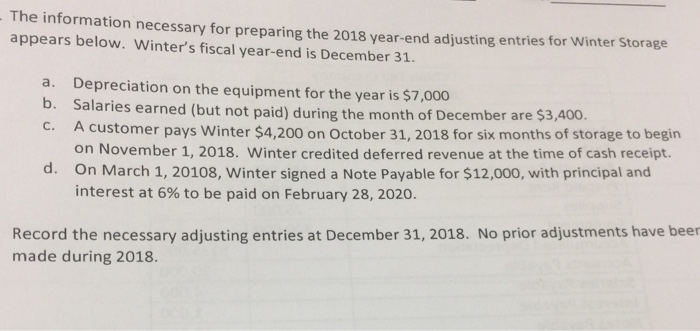

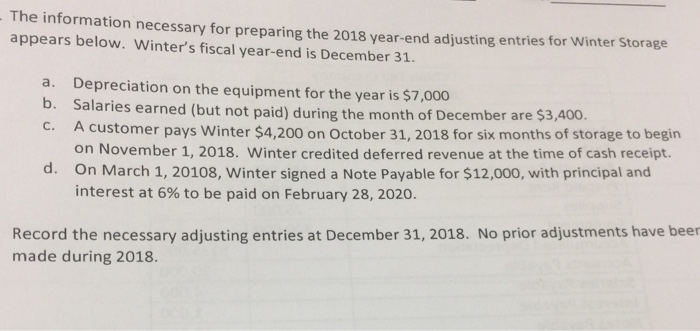

Financial accounting The information necessary for preparing the 2018 year-end adjusting entries for Winter Storage appears below. Winter's fiscal year-end is December 31. a. Depreciation

Financial accounting

The information necessary for preparing the 2018 year-end adjusting entries for Winter Storage appears below. Winter's fiscal year-end is December 31. a. Depreciation on the equipment for the year is $7,000 b. Salaries earned (but not paid) during the month of December are $3,400. c. A customer pays Winter $4,200 on October 31, 2018 for six months of storage to begin on November 1, 2018. Winter credited deferred revenue at the time of cash receipt. On March 1, 20108, Winter signed a Note Payable for $12,000, with principal and interest at 6% to be paid on February 28, 2020. d. Record the necessary adjusting entries at December 31, 2018. No prior adjustments have beer made during 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started