Answered step by step

Verified Expert Solution

Question

1 Approved Answer

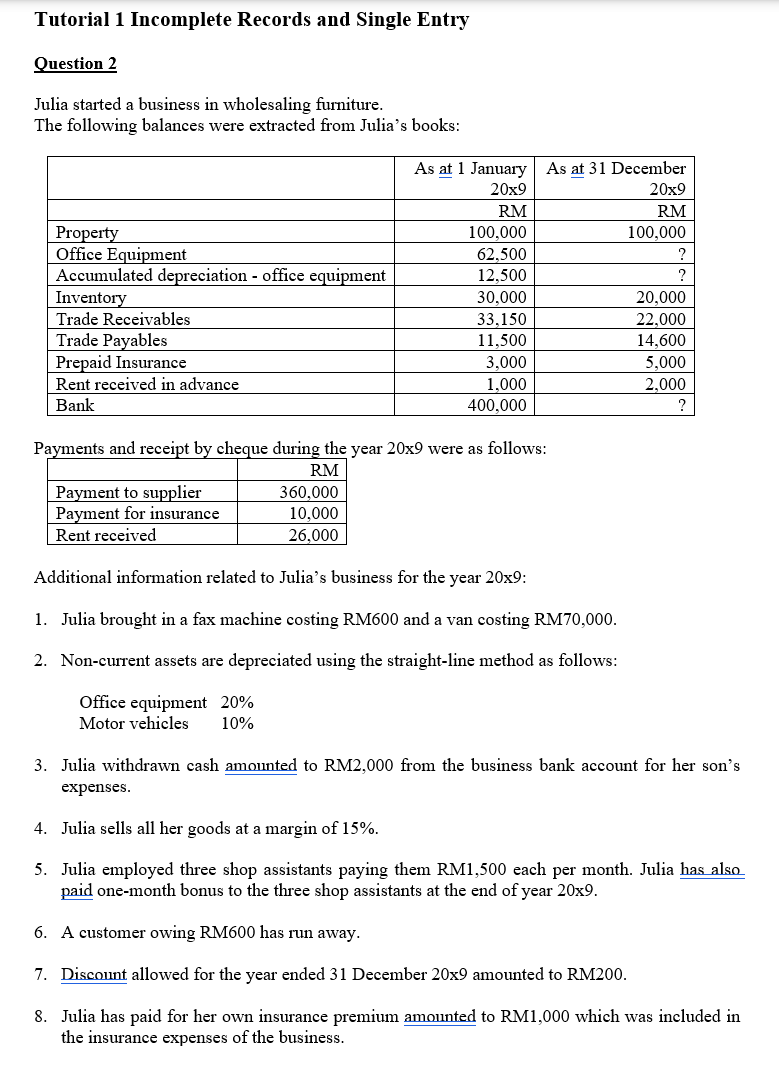

Financial Accounting Tutorial 1 Incomplete Records and Single Entry Question 2 Julia started a business in wholesaling furniture. The following balances were extracted from Julia's

Financial Accounting

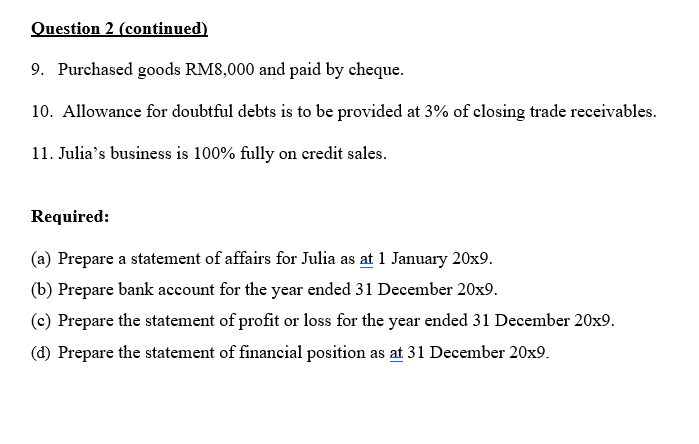

Tutorial 1 Incomplete Records and Single Entry Question 2 Julia started a business in wholesaling furniture. The following balances were extracted from Julia's books: Payments and receipt by cheque during the year 20x9 were as follows: Additional information related to Julia's business for the year 20x9: 1. Julia brought in a fax machine costing RM600 and a van costing RM70,000. 2. Non-current assets are depreciated using the straight-line method as follows: Office equipment 20% Motor vehicles 10% 3. Julia withdrawn cash amounted to RM2,000 from the business bank account for her son's expenses. 4. Julia sells all her goods at a margin of 15%. 5. Julia employed three shop assistants paying them RM1,500 each per month. Julia has also paid one-month bonus to the three shop assistants at the end of year 20x9. 6. A customer owing RM600 has run away. 7. Discount allowed for the year ended 31 December 209 amounted to RM200. 8. Julia has paid for her own insurance premium amounted to RM1,000 which was included in the insurance expenses of the business. Question 2 (continued) 9. Purchased goods RM8,000 and paid by cheque. 10. Allowance for doubtful debts is to be provided at 3% of closing trade receivables. 11. Julia's business is 100% fully on credit sales. Required: (a) Prepare a statement of affairs for Julia as at 1 January 20x9. (b) Prepare bank account for the year ended 31 December 20x9. (c) Prepare the statement of profit or loss for the year ended 31 December 20x9. (d) Prepare the statement of financial position as at 31 December 20x9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started