Answered step by step

Verified Expert Solution

Question

1 Approved Answer

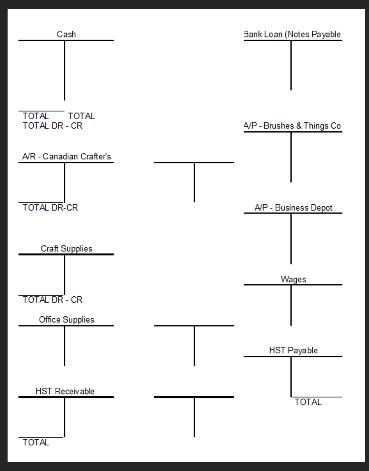

Financial Accounting: Using the following information add the transactions to T-accounts and Journal transactions. Scenario: You are the administrative assistant to the Real Art Studio

Financial Accounting: Using the following information add the transactions to T-accounts and Journal transactions.

Scenario: You are the administrative assistant to the Real Art Studio and are required to input financial data into the journal and T-accounts.

Here is the financial data you are working with for the month of November

| Date | Transaction |

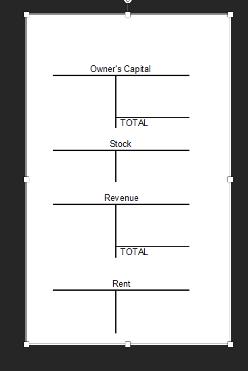

| nov 1 | Owner put in $15,000 to begin art studio business |

| nov 2 | Investors input $8,000, were granted company stock |

| nov 3 | Bank approved $10,000 loan |

| nov 4 | Canadian Crafter bought craft supplies on account for $499.00 plus tax, invoice number 18-210; 30 days to pay |

| nov 4 | Cash received for creating a business sign for Three Ladies Stained Glass Craft Company for $300 plus tax, invoice number 18-211 |

| nov 5 | Paid wages of $800.00 |

| nov 9 | Bought supplies from Brushes and Things Co. $700 plus tax on account, PO # 3-781 |

| nov 10 | Received partial payment from Canadian Crafters for $200 |

| nov 15 | Purchased supplies for $300 plus tax from Business Depot on account, PO # 3-782, 30 days to pay |

| nov 21 | Owner withdrew $1000 for personal use |

| nov 29 | Ran an evening art studio paint class, $900 cash from participants plus tax |

| nov 30 | Paid rent of $1500 plus tax in cash |

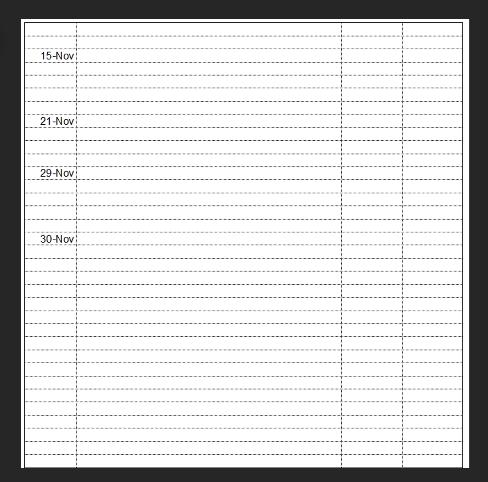

Date 01-Nov 02 Nov 03-Nov 04-Nov 04-Nov 05-Nov 09-Nov 10-Nov Details Particulars Real Art Studio Debit Credit

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started