Answered step by step

Verified Expert Solution

Question

1 Approved Answer

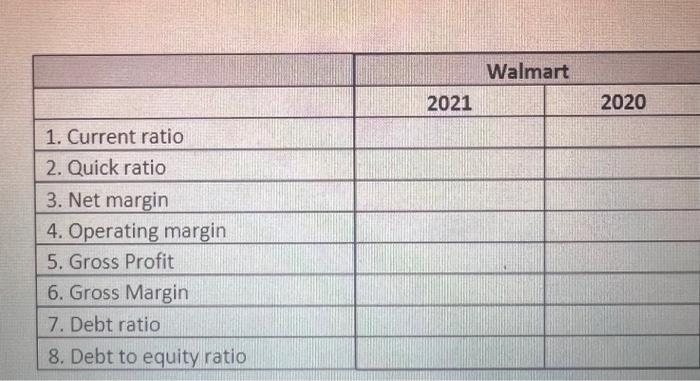

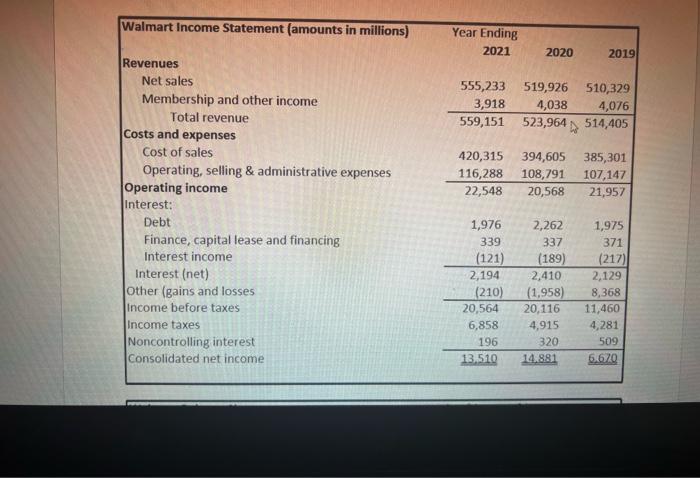

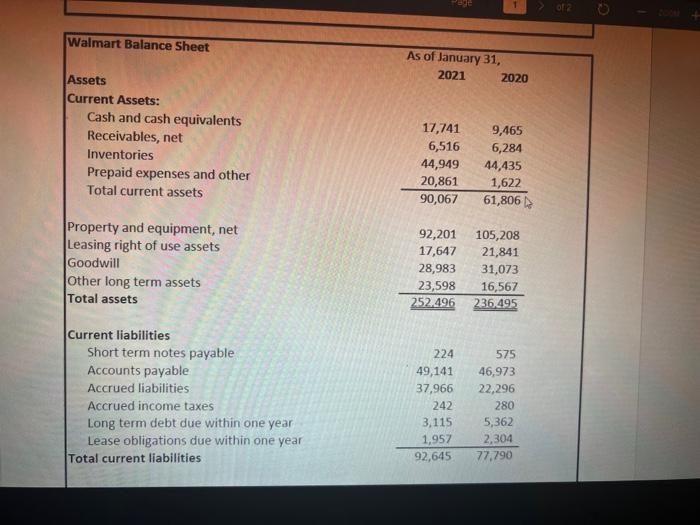

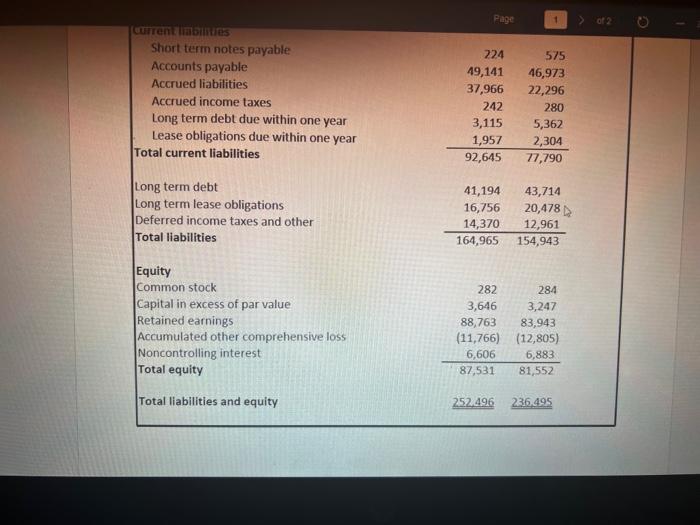

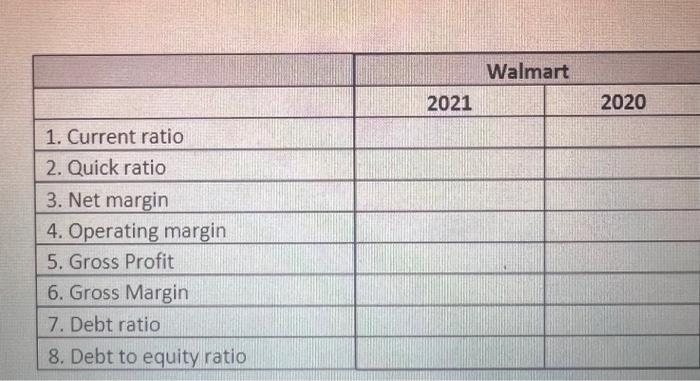

Financial Analysis Calculate the following ratios for Walmart 2020-2021 Walmart Balance Sheet Assets As of January 31, 20212020 Current Assets: Cash and cash equivalents Receivables,

Financial Analysis

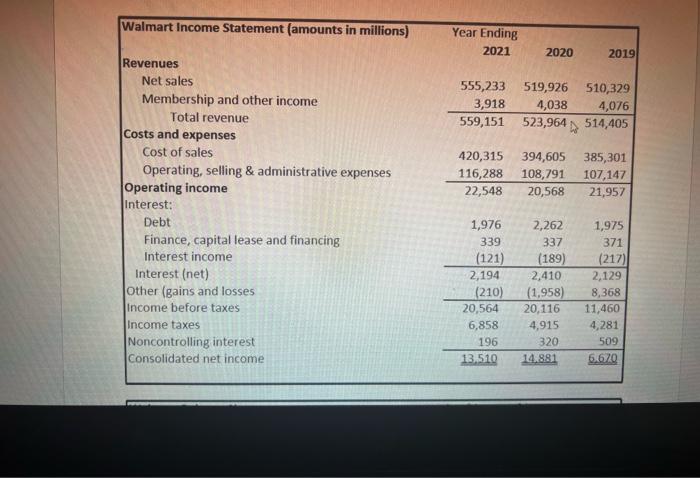

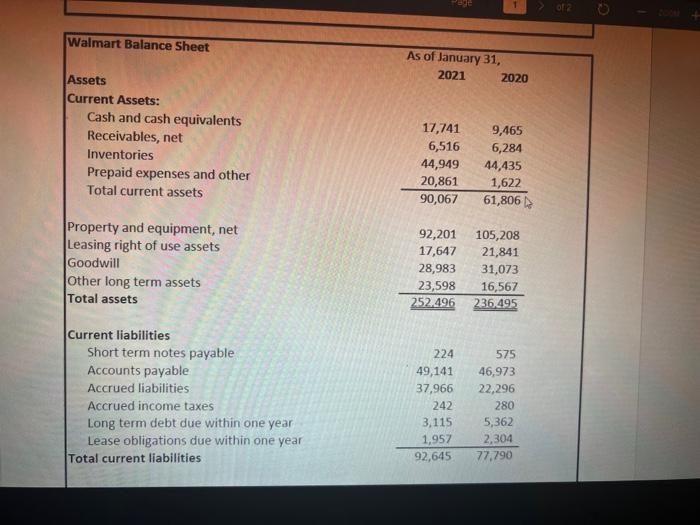

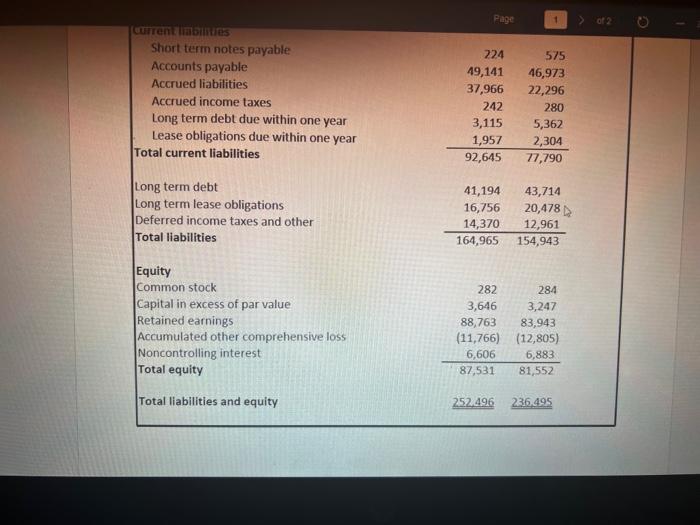

Walmart Balance Sheet Assets As of January 31, 20212020 Current Assets: Cash and cash equivalents Receivables, net Inventories Prepaid expenses and other Total current assets \begin{tabular}{rr} 17,741 & 9,465 \\ 6,516 & 6,284 \\ 44,949 & 44,435 \\ 20,861 & 1,622 \\ \hline 90,067 & 61,806 \end{tabular} Property and equipment, net Leasing right of use assets Goodwill Other long term assets Total assets \begin{tabular}{rr} 92,201 & 105,208 \\ 17,647 & 21,841 \\ 28,983 & 31,073 \\ 23,598 & 16,567 \\ \hline252,496 & 236,495 \\ \hline \end{tabular} Current liabilities Short term notes payable Accounts payable Accrued liabilities Accrued income taxes Long term debt due within one year Lease obligations due within one year Total current liabilities \begin{tabular}{rr} 224 & 575 \\ 49,141 & 46,973 \\ 37,966 & 22,296 \\ 242 & 280 \\ 3,115 & 5,362 \\ 1,957 & 2,304 \\ \hline 92,645 & 77,790 \end{tabular} courentiabinies Equity Common stock Capital in excess of par value Retained earnings Accumulated other comprehensive loss Noncontrolling interest Total equity \begin{tabular}{rr} 282 & 284 \\ \hline 3,646 & 3,247 \\ 88,763 & 83,943 \\ (11,766) & (12,805) \\ 6,606 & 6,883 \\ \hline 87,531 & 81,552 \end{tabular} Total liabilities and equity 252,496236,495 Calculate the following ratios for Walmart 2020-2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started