Answered step by step

Verified Expert Solution

Question

1 Approved Answer

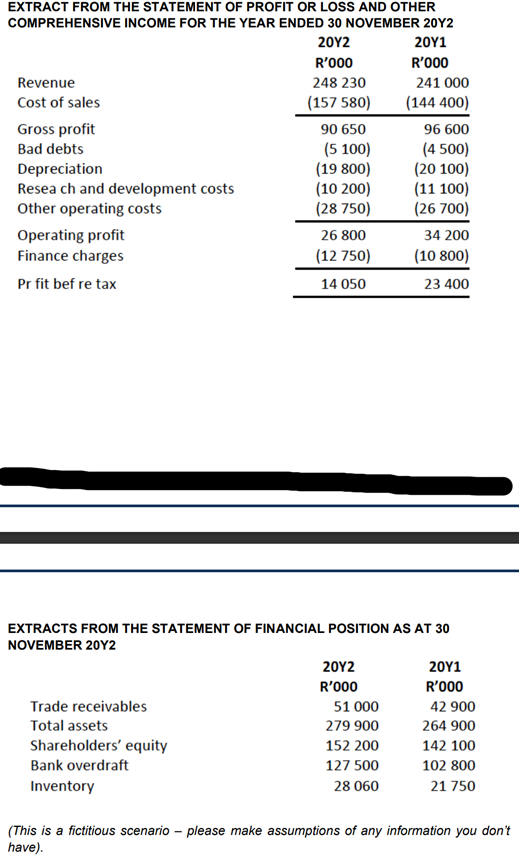

financial Analysis: Ithemba Engineering ( Pty ) Ltd ( Ithemba ) manufactures and distributes specialised products to customers in the construction industry. Every year, Ithemba

financial Analysis: Ithemba Engineering Pty Ltd Ithemba manufactures and distributes specialised products to customers in the construction industry. Every year, Ithemba invests significantly in research and development to improve existing product designs and to develop new products. Many of its products and designs have been patented to protect the companys intellectual property. Ithemba focuses on supplying South African customers. It has supported customers expansion into the rest of Africa and the Middle East and exports represent approximately of annual revenue. Foreign subsidiaries of South African groups are invoiced in US dollar.The construction industry in South Africa has been under significant pressure in recent years due to the slowdown in the global economy and limited infrastructure spend by the government. As a result, Ithemba has struggled to grow revenue during the past three financial years. Steel is the major raw material used by Ithemba in its manufacturing processes. The volatility of this commoditys price in recent years has placed additional pressure on the companys gross profit margin. Because of this situation working capital management has become increasingly important for Ithemba. More and more customers are placing orders at the last moment, which is forcing Ithemba to hold larger inventories. Customers are also delaying payment of accounts because of cash flow pressures. All sales are on credit and Ithemba allows customers days from invoice to pay amounts due. The result is that Ithembas overdraft balance has steadily increased in recent years, to the extent that this has become a permanent source of finance. Ithemba currently pays interest on its overdraft at per annum, compounded monthly.

Apart from the overdraft, Ithemba has had no other debt facilities since X Bankers are reluctant to grant Ithemba longer term finance due to concerns about the companys cash flow generation and the negative outlook for the construction industry in general.The following are extracts from the annual financial statements of Ithemba for the year

ended November Y:

Required:

Analyse and discuss thouroughly the profitability and working capital management of Ithemba during the financial years ended November Y and Y Support your answer with relevant calculations and ratios.

Note: Bank overdraft must be included in your analysis and discussion as it normally forms part

of working capital. Assume days in a year and round all days up to the next whole day.

Mark allocation: for analysis and for thorough discussion

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To analyze and discuss the profitability and working capital management of Ithemba for the financial years ending on November 30 20Y1 and 20Y2 we need to calculate key financial ratios and assess thei...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started