Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Analysis Project 4 ( 1 0 0 Points ) Background Financial Analysis Exercise # 4 will build on exercise # 2 . This exercise

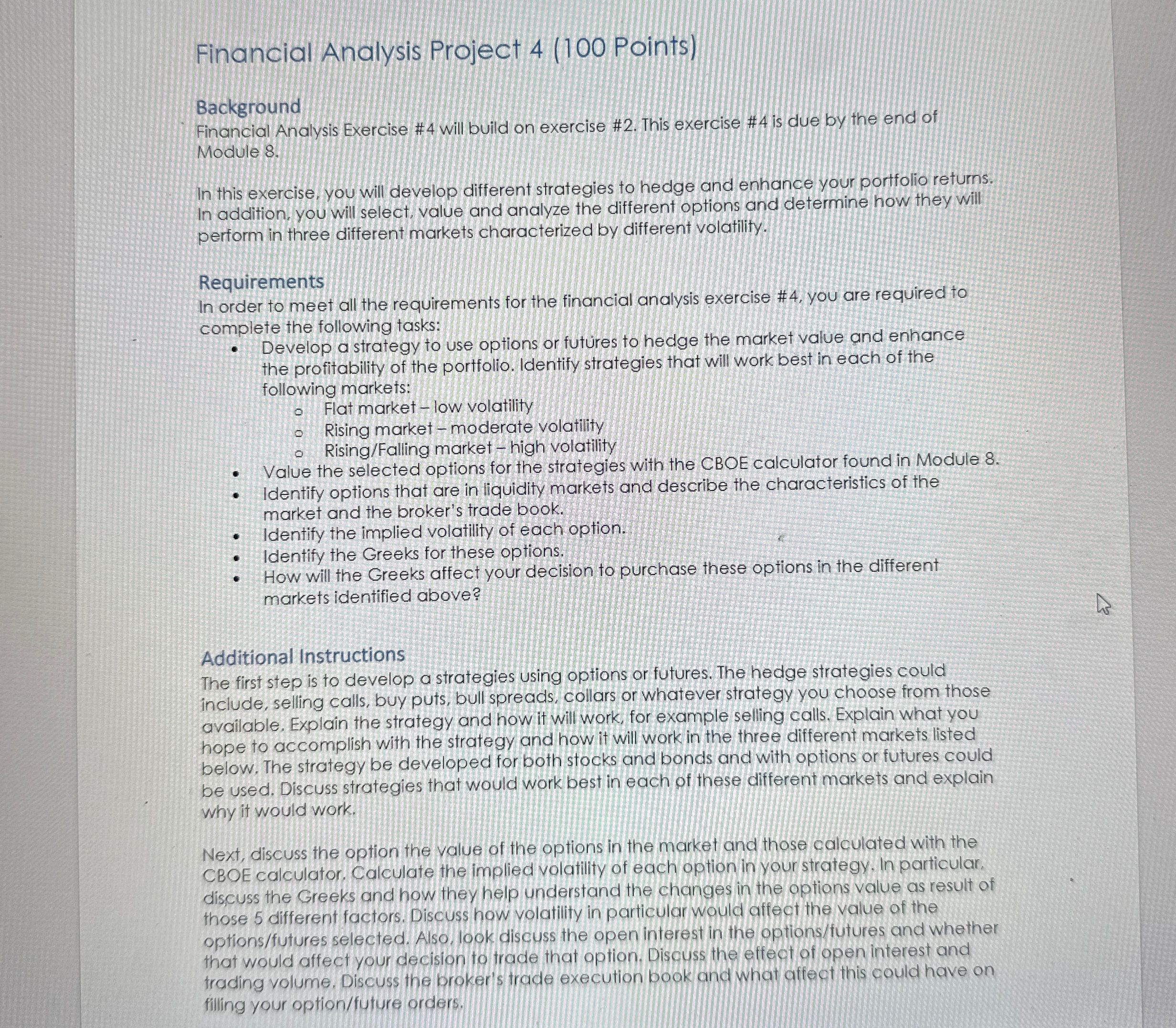

Financial Analysis Project Points

Background

Financial Analysis Exercise # will build on exercise # This exercise # is due by the end of Module

In this exercise. you will develop different strategies to hedge and enhance your portfolio returns. In addition, you will select, value and analyze the different options and determine how they will perform in three different markets characterized by different volatility.

Requirements

In order to meet all the requirements for the financial analysis exercise # you are required to complete the following tasks:

Develop a strategy to use options or futres to hedge the market value and enhance the profitability of the portfolio. Identify strategies that will work best in each of the following markets:

Flat market low volatility

Rising market moderate volatility

RisingFalling market high volatility

Value the selected options for the strategies with the CBOE calculator found in Module

Identify options that are in liquidity markets and describe the characteristics of the market and the broker's trade book.

Identify the implied volatility of each option.

Identify the Greeks for these options.

How will the Greeks affect your decision to purchase these options in the different markets identified above?

Additional Instructions

The first step is to develop a strategies using options or futures. The hedge strategies could include, selling calls, buy puts, bull spreads, collars or whatever strategy you choose from those available. Explain the strategy and how it will work, for example selling calls. Explain what you hope to accomplish with the strategy and how it will work in the three different markets listed below. The strategy be developed for both stocks and bonds and with options or futures could be used. Discuss strategies that would work best in each of these different markets and explain why it would work.

Next, discuss the option the yalue of the options in the market and those calculated with the CBOE calculator. Calculate the implied volatility of each option in your strategy. In particular. discuss the Greeks and how they help understand the changes in the options value as result of those different factors. Discuss how yolatility in particular would affect the value of the optionsfutures selected. Also, look discuss the open interest in the optionsfutures and whether that would affect your decision to trade that option. Discuss the effect of open interest and trading volume. Discuss the broker's trade execution book and what affeet this could have on filling your optionfuture orders. PLEASE GIVE A FULL EXAMPLE OF ENTIRE PROBLEM!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started