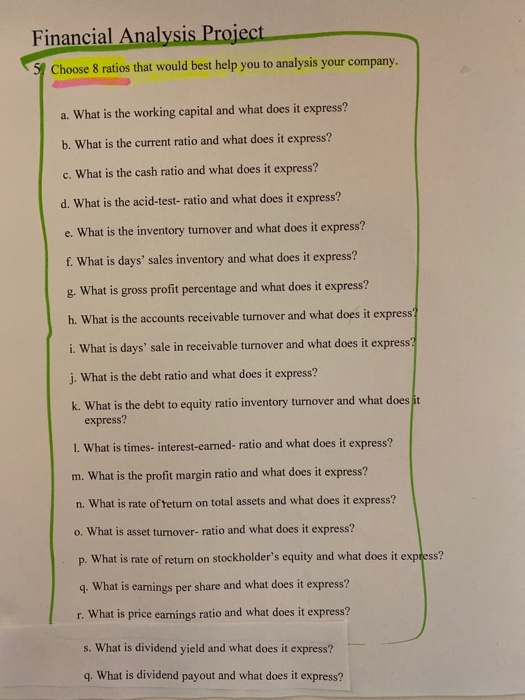

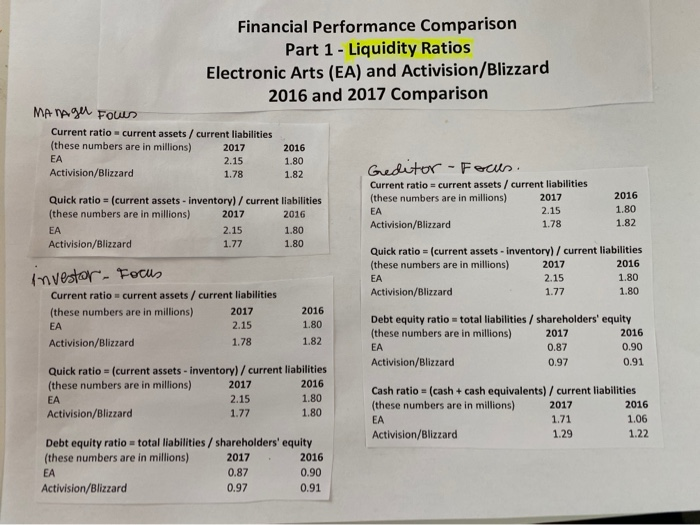

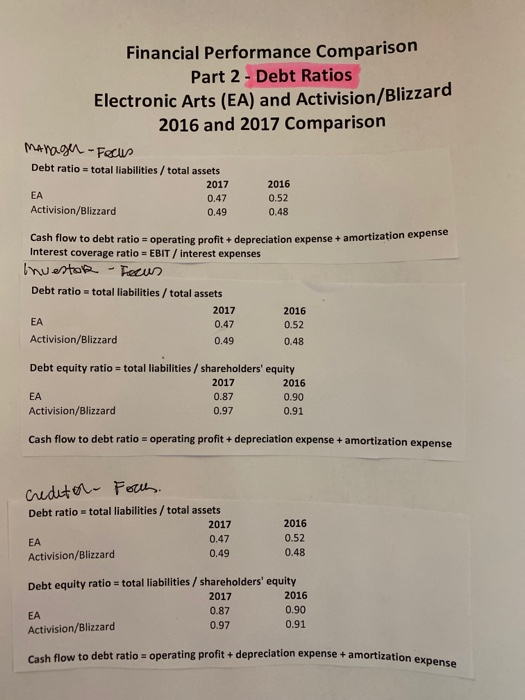

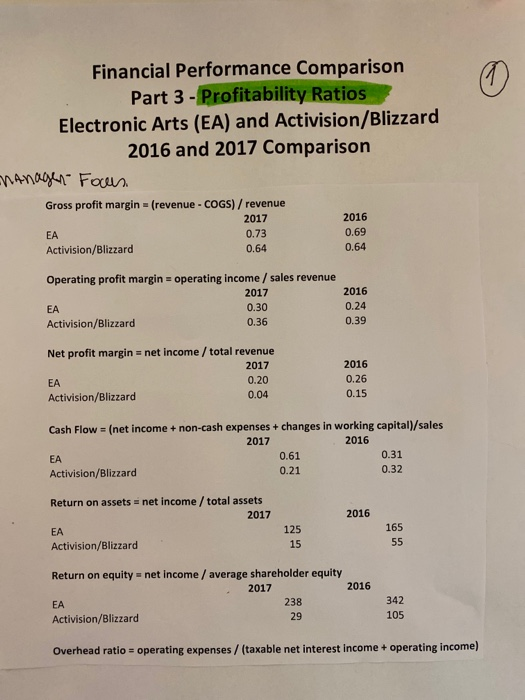

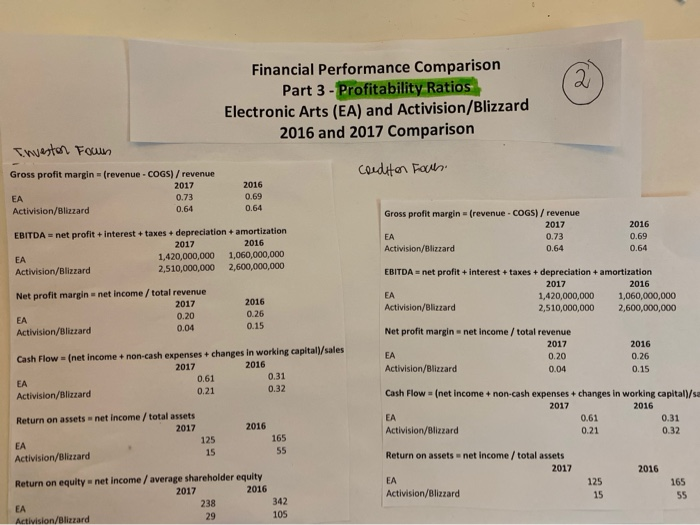

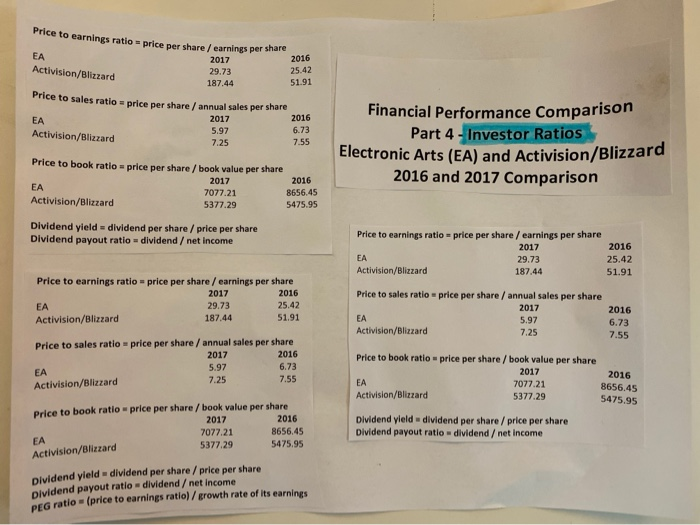

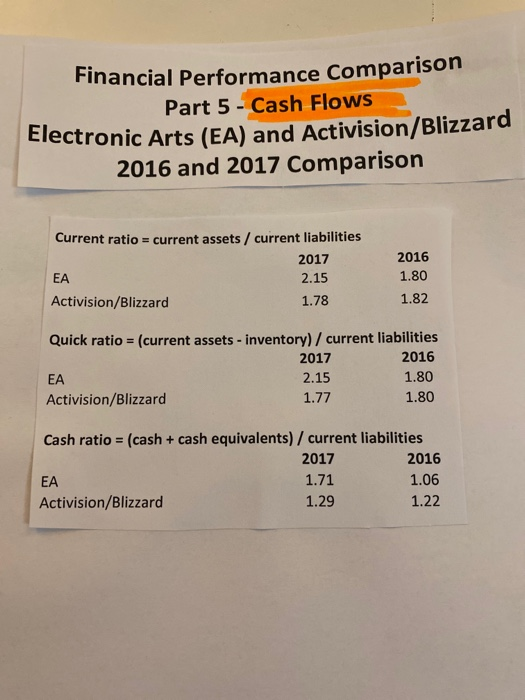

Financial Analysis Project 5. Choose 8 ratios that would best help you to analysis your company. a. What is the working capital and what does it express? b. What is the current ratio and what does it express? c. What is the cash ratio and what does it express? d. What is the acid-test-ratio and what does it express? e. What the inventory turnover and what does it express? f. What is days' sales inventory and what does it express? What is gross profit percentage and what does it express? h. What is the accounts receivable turnover and what does it express? i. What is days' sale in receivable turnover and what does it express? j. What is the debt ratio and what does it express? k. What is the debt to equity ratio inventory turnover and what does it express? 1. What is times-interest-earned-ratio and what does it express? m. What is the profit margin ratio and what does it express? n. What is rate of return on total assets and what does it express? o. What is asset turnover- ratio and what does it express? p. What is rate of return on stockholder's equity and what does it express? 4. What is earnings per share and what does it express? r. What is price earnings ratio and what does it express? s. What is dividend yield and what does it express? 4. What is dividend payout and what does it express? Financial Performance Comparison Part 1 - Liquidity Ratios Electronic Arts (EA) and Activision/Blizzard 2016 and 2017 Comparison Manager Fows Current ratio - current assets / current liabilities (these numbers are in millions) 2017 2016 EA 2.15 1.80 Activision/Blizzard Geditor-Focus. 1.78 1.82 Current ratio = current assets/ current liabilities Quick ratio = (current assets - inventory) / current liabilities (these numbers are in millions) 2017 2016 (these numbers are in millions) 2017 2016 EA 2.15 1.80 EA 2.15 1.82 Activision/Blizzard 1.80 1.78 Activision/Blizzard 1.77 1.80 Quick ratio- (current assets - inventory) / current liabilities (these numbers are in millions) 2017 2016 investor, Focus EA 2.15 1.80 Current ratio current assets/ current liabilities Activision/Blizzard 1.77 1.80 (these numbers are in millions) 2017 2016 EA 2.15 1.80 Debt equity ratio = total liabilities / shareholders' equity (these numbers are in millions) 2017 2016 Activision/Blizzard 1.78 1.82 EA 0.87 0.90 Activision/Blizzard 0.97 0.91 Quick ratio- (current assets - inventory/current liabilities (these numbers are in millions) 2017 2016 Cash ratio = (cash + cash equivalents) / current liabilities EA 2.15 1.80 (these numbers are in millions) 2017 2016 Activision/Blizzard 1.77 1.80 EA 1.71 Activision/Blizzard 1.29 1.22 Debt equity ratio = total liabilities / shareholders' equity (these numbers are in millions) 2017 2016 EA 0.87 0.90 Activision/Blizzard 0.97 0.91 1.06 Financial Performance Comparison Part 2 - Debt Ratios Electronic Arts (EA) and Activision/Blizzard 2016 and 2017 Comparison Manager - Focus Debt ratio = total liabilities / total assets 2017 EA 0.47 Activision/Blizzard 0.49 Cash flow to debt ratio = operating profit + depreciation expense + amortization expense Interest coverage ratio = EBIT / interest expenses Investor Fecus Debt ratio = total liabilities / total assets 2017 0.47 0.52 Activision/Blizzard 0.49 0.48 2016 0.52 0.48 2016 EA Debt equity ratio = total liabilities / shareholders' equity 2017 2016 EA 0.87 0.90 Activision/Blizzard 0.97 0.91 Cash flow to debt ratio = operating profit + depreciation expense + amortization expense creditor Foch. Debt ratio = total liabilities / total assets 2017 0.47 Activision/Blizzard 0.49 2016 0.52 0.48 Debt equity ratio = total liabilities / shareholders' equity 2017 2016 EA 0.87 0.90 Activision/Blizzard 0.97 0.91 Cash flow to debt ratio = operating profit + depreciation expense + amortization expense Financial Performance Comparison Part 3 - Profitability Ratios Electronic Arts (EA) and Activision/Blizzard 2016 and 2017 Comparison Manager Focus Gross profit margin (revenue - COGS) / revenue EA Activision/Blizzard 2017 0.73 0.64 2016 0.69 0.64 Operating profit margin = operating income / sales revenue 2017 EA 0.30 Activision/Blizzard 0.36 2016 0.24 0.39 Net profit margin = net income / total revenue 2017 EA 0.20 Activision/Blizzard 0.04 2016 0.26 0.15 Cash Flow = (net income + non-cash expenses + changes in working capital)/sales 2017 2016 EA 0.61 0.31 Activision/Blizzard 0.21 0.32 2016 Return on assets = net income / total assets 2017 EA Activision/Blizzard 125 15 165 55 Return on equity = net income / average shareholder equity 2017 2016 EA 238 Activision/Blizzard 342 105 29 Overhead ratio = operating expenses/ (taxable net interest income + operating income) 2 Financial Performance Comparison Part 3 - Profitability Ratios Electronic Arts (EA) and Activision/Blizzard 2016 and 2017 Comparison crediton Fores Investor Foun Gross profit margin = (revenue - COGS) / revenue 2017 EA 0.73 Activision/Blizzard 0.64 2016 0.69 0.64 Gross profit margin (revenue - COGS)/ revenue 2017 EA 0.73 Activision/Blizzard 0.64 2016 0.69 0.64 EBITDA = net profit + interest + taxes + depreciation + amortization 2017 2016 EA 1,420,000,000 1,060,000,000 Activision/Blizzard 2,510,000,000 2,600,000,000 EBITDA = net profit + interest + taxes + depreciation + amortization 2017 2016 EA 1,420,000,000 1,060,000,000 Activision/Blizzard 2,510,000,000 2,600,000,000 2016 Net profit margin = net income / total revenue 2017 EA 0.20 Activision/Blizzard 0.04 0.26 0.15 Net profit margin-net income / total revenue 2017 EA 0.20 Activision/Blizzard 0.04 2016 0.26 0.15 Cash Flow - (net income +non-cash expenses + changes in working capitall/sales 2017 2016 EA 0.31 Activision/Blizzard 0.21 0.32 0.61 Cash Flow = (net income + non-cash expenses + changes in working capital)/se 2017 2016 EA 0.61 0.31 Activision/Blizzard 0.21 0.32 2016 Return on assets net income / total assets 2017 EA 125 Activision/Blizzard 15 165 55 2016 Return on assets net income / total assets 2017 EA Activision/Blizzard 125 15 165 55 Return on equity - net income / average shareholder equity 2017 2016 EA 238 342 Activision/Blizzard 29 105 Price to earnings ratio - price per share / earnings per share EA Activision/Blizzard 2017 29.73 187.44 2016 25.42 51.91 Price to sales ratio = price per share / annual sales per share EA Activision/Blizzard 2017 5.97 7.25 2016 6.73 7.55 Financial Performance Comparison Part 4 - Investor Ratios Electronic Arts (EA) and Activision/Blizzard 2016 and 2017 Comparison Price to book ratio - price per share / book value per share 2017 2016 EA 7077.21 8656.45 Activision/Blizzard 5377.29 5475.95 Dividend yield = dividend per share / price per share Dividend payout ratio dividend / net income Price to earnings ratio - price per share / earnings per share 2017 2016 EA 29.73 25.42 Activision/Blizzard 187.44 51.91 Price to earnings ratio=price per share / earnings per share 2017 2016 EA 29.73 25.42 Activision/Blizzard 187.44 51.91 Price to sales ratio - price per share / annual sales per share 2017 2016 EA 5.97 6.73 Activision/Blizzard 7.25 7.55 Price to sales ratio price per share / annual sales per share 2017 2016 EA 5.97 6.73 Activision/Blizzard 7.25 7.55 Price to book ratio-price per share/ book value per share 2017 EA 7077.21 Activision/Blizzard 5377.29 2016 8656.45 5475.95 Price to book ratio - price per share / book value per share 2017 2016 7077.21 8656.45 5377.29 5475.95 Dividend yield - dividend per share / price per share Dividend payout ratio dividend / net income EA Activision/Blizzard Dividend yield - dividend per share / price per share Dividend payout ratio - dividend / net income PEG ratio - (price to earnings ratio) / growth rate of its earnings Financial Performance Comparison Electronic Arts (EA) and Activision/Blizzard Part 5 - Cash Flows 2016 and 2017 Comparison Current ratio = current assets/ current liabilities 2017 EA 2.15 Activision/Blizzard 1.78 2016 1.80 1.82 Quick ratio = (current assets - inventory)/ current liabilities 2017 2016 EA 2.15 1.80 Activision/Blizzard 1.77 1.80 Cash ratio = (cash + cash equivalents) / current liabilities 2017 2016 EA 1.71 1.06 Activision/Blizzard 1.29 1.22 Financial Analysis Project 5. Choose 8 ratios that would best help you to analysis your company. a. What is the working capital and what does it express? b. What is the current ratio and what does it express? c. What is the cash ratio and what does it express? d. What is the acid-test-ratio and what does it express? e. What the inventory turnover and what does it express? f. What is days' sales inventory and what does it express? What is gross profit percentage and what does it express? h. What is the accounts receivable turnover and what does it express? i. What is days' sale in receivable turnover and what does it express? j. What is the debt ratio and what does it express? k. What is the debt to equity ratio inventory turnover and what does it express? 1. What is times-interest-earned-ratio and what does it express? m. What is the profit margin ratio and what does it express? n. What is rate of return on total assets and what does it express? o. What is asset turnover- ratio and what does it express? p. What is rate of return on stockholder's equity and what does it express? 4. What is earnings per share and what does it express? r. What is price earnings ratio and what does it express? s. What is dividend yield and what does it express? 4. What is dividend payout and what does it express? Financial Performance Comparison Part 1 - Liquidity Ratios Electronic Arts (EA) and Activision/Blizzard 2016 and 2017 Comparison Manager Fows Current ratio - current assets / current liabilities (these numbers are in millions) 2017 2016 EA 2.15 1.80 Activision/Blizzard Geditor-Focus. 1.78 1.82 Current ratio = current assets/ current liabilities Quick ratio = (current assets - inventory) / current liabilities (these numbers are in millions) 2017 2016 (these numbers are in millions) 2017 2016 EA 2.15 1.80 EA 2.15 1.82 Activision/Blizzard 1.80 1.78 Activision/Blizzard 1.77 1.80 Quick ratio- (current assets - inventory) / current liabilities (these numbers are in millions) 2017 2016 investor, Focus EA 2.15 1.80 Current ratio current assets/ current liabilities Activision/Blizzard 1.77 1.80 (these numbers are in millions) 2017 2016 EA 2.15 1.80 Debt equity ratio = total liabilities / shareholders' equity (these numbers are in millions) 2017 2016 Activision/Blizzard 1.78 1.82 EA 0.87 0.90 Activision/Blizzard 0.97 0.91 Quick ratio- (current assets - inventory/current liabilities (these numbers are in millions) 2017 2016 Cash ratio = (cash + cash equivalents) / current liabilities EA 2.15 1.80 (these numbers are in millions) 2017 2016 Activision/Blizzard 1.77 1.80 EA 1.71 Activision/Blizzard 1.29 1.22 Debt equity ratio = total liabilities / shareholders' equity (these numbers are in millions) 2017 2016 EA 0.87 0.90 Activision/Blizzard 0.97 0.91 1.06 Financial Performance Comparison Part 2 - Debt Ratios Electronic Arts (EA) and Activision/Blizzard 2016 and 2017 Comparison Manager - Focus Debt ratio = total liabilities / total assets 2017 EA 0.47 Activision/Blizzard 0.49 Cash flow to debt ratio = operating profit + depreciation expense + amortization expense Interest coverage ratio = EBIT / interest expenses Investor Fecus Debt ratio = total liabilities / total assets 2017 0.47 0.52 Activision/Blizzard 0.49 0.48 2016 0.52 0.48 2016 EA Debt equity ratio = total liabilities / shareholders' equity 2017 2016 EA 0.87 0.90 Activision/Blizzard 0.97 0.91 Cash flow to debt ratio = operating profit + depreciation expense + amortization expense creditor Foch. Debt ratio = total liabilities / total assets 2017 0.47 Activision/Blizzard 0.49 2016 0.52 0.48 Debt equity ratio = total liabilities / shareholders' equity 2017 2016 EA 0.87 0.90 Activision/Blizzard 0.97 0.91 Cash flow to debt ratio = operating profit + depreciation expense + amortization expense Financial Performance Comparison Part 3 - Profitability Ratios Electronic Arts (EA) and Activision/Blizzard 2016 and 2017 Comparison Manager Focus Gross profit margin (revenue - COGS) / revenue EA Activision/Blizzard 2017 0.73 0.64 2016 0.69 0.64 Operating profit margin = operating income / sales revenue 2017 EA 0.30 Activision/Blizzard 0.36 2016 0.24 0.39 Net profit margin = net income / total revenue 2017 EA 0.20 Activision/Blizzard 0.04 2016 0.26 0.15 Cash Flow = (net income + non-cash expenses + changes in working capital)/sales 2017 2016 EA 0.61 0.31 Activision/Blizzard 0.21 0.32 2016 Return on assets = net income / total assets 2017 EA Activision/Blizzard 125 15 165 55 Return on equity = net income / average shareholder equity 2017 2016 EA 238 Activision/Blizzard 342 105 29 Overhead ratio = operating expenses/ (taxable net interest income + operating income) 2 Financial Performance Comparison Part 3 - Profitability Ratios Electronic Arts (EA) and Activision/Blizzard 2016 and 2017 Comparison crediton Fores Investor Foun Gross profit margin = (revenue - COGS) / revenue 2017 EA 0.73 Activision/Blizzard 0.64 2016 0.69 0.64 Gross profit margin (revenue - COGS)/ revenue 2017 EA 0.73 Activision/Blizzard 0.64 2016 0.69 0.64 EBITDA = net profit + interest + taxes + depreciation + amortization 2017 2016 EA 1,420,000,000 1,060,000,000 Activision/Blizzard 2,510,000,000 2,600,000,000 EBITDA = net profit + interest + taxes + depreciation + amortization 2017 2016 EA 1,420,000,000 1,060,000,000 Activision/Blizzard 2,510,000,000 2,600,000,000 2016 Net profit margin = net income / total revenue 2017 EA 0.20 Activision/Blizzard 0.04 0.26 0.15 Net profit margin-net income / total revenue 2017 EA 0.20 Activision/Blizzard 0.04 2016 0.26 0.15 Cash Flow - (net income +non-cash expenses + changes in working capitall/sales 2017 2016 EA 0.31 Activision/Blizzard 0.21 0.32 0.61 Cash Flow = (net income + non-cash expenses + changes in working capital)/se 2017 2016 EA 0.61 0.31 Activision/Blizzard 0.21 0.32 2016 Return on assets net income / total assets 2017 EA 125 Activision/Blizzard 15 165 55 2016 Return on assets net income / total assets 2017 EA Activision/Blizzard 125 15 165 55 Return on equity - net income / average shareholder equity 2017 2016 EA 238 342 Activision/Blizzard 29 105 Price to earnings ratio - price per share / earnings per share EA Activision/Blizzard 2017 29.73 187.44 2016 25.42 51.91 Price to sales ratio = price per share / annual sales per share EA Activision/Blizzard 2017 5.97 7.25 2016 6.73 7.55 Financial Performance Comparison Part 4 - Investor Ratios Electronic Arts (EA) and Activision/Blizzard 2016 and 2017 Comparison Price to book ratio - price per share / book value per share 2017 2016 EA 7077.21 8656.45 Activision/Blizzard 5377.29 5475.95 Dividend yield = dividend per share / price per share Dividend payout ratio dividend / net income Price to earnings ratio - price per share / earnings per share 2017 2016 EA 29.73 25.42 Activision/Blizzard 187.44 51.91 Price to earnings ratio=price per share / earnings per share 2017 2016 EA 29.73 25.42 Activision/Blizzard 187.44 51.91 Price to sales ratio - price per share / annual sales per share 2017 2016 EA 5.97 6.73 Activision/Blizzard 7.25 7.55 Price to sales ratio price per share / annual sales per share 2017 2016 EA 5.97 6.73 Activision/Blizzard 7.25 7.55 Price to book ratio-price per share/ book value per share 2017 EA 7077.21 Activision/Blizzard 5377.29 2016 8656.45 5475.95 Price to book ratio - price per share / book value per share 2017 2016 7077.21 8656.45 5377.29 5475.95 Dividend yield - dividend per share / price per share Dividend payout ratio dividend / net income EA Activision/Blizzard Dividend yield - dividend per share / price per share Dividend payout ratio - dividend / net income PEG ratio - (price to earnings ratio) / growth rate of its earnings Financial Performance Comparison Electronic Arts (EA) and Activision/Blizzard Part 5 - Cash Flows 2016 and 2017 Comparison Current ratio = current assets/ current liabilities 2017 EA 2.15 Activision/Blizzard 1.78 2016 1.80 1.82 Quick ratio = (current assets - inventory)/ current liabilities 2017 2016 EA 2.15 1.80 Activision/Blizzard 1.77 1.80 Cash ratio = (cash + cash equivalents) / current liabilities 2017 2016 EA 1.71 1.06 Activision/Blizzard 1.29 1.22