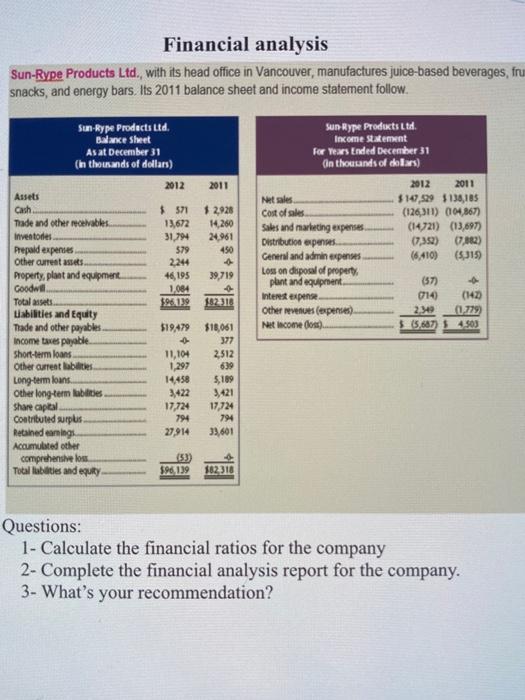

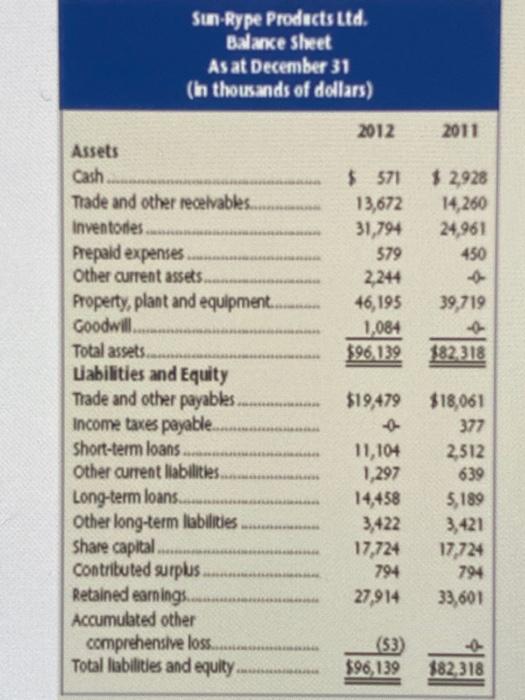

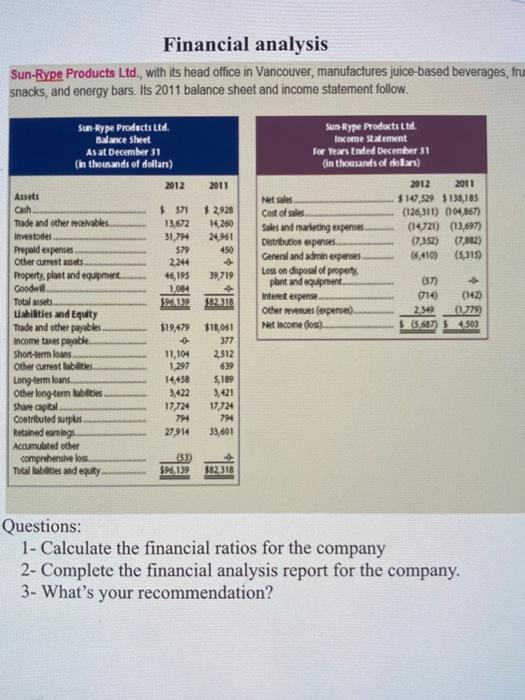

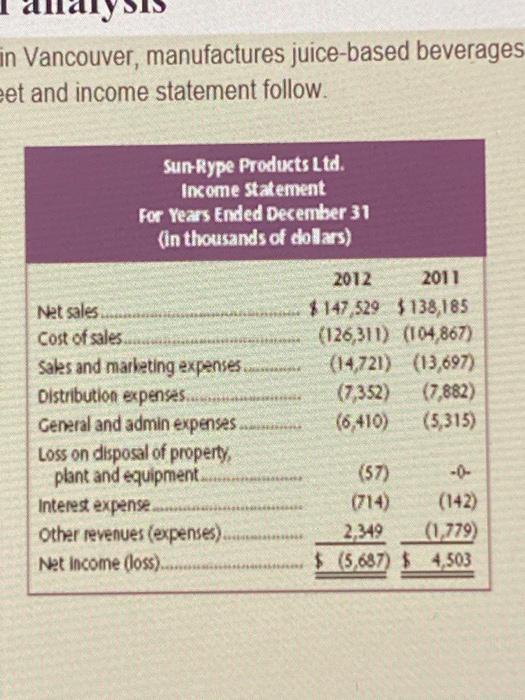

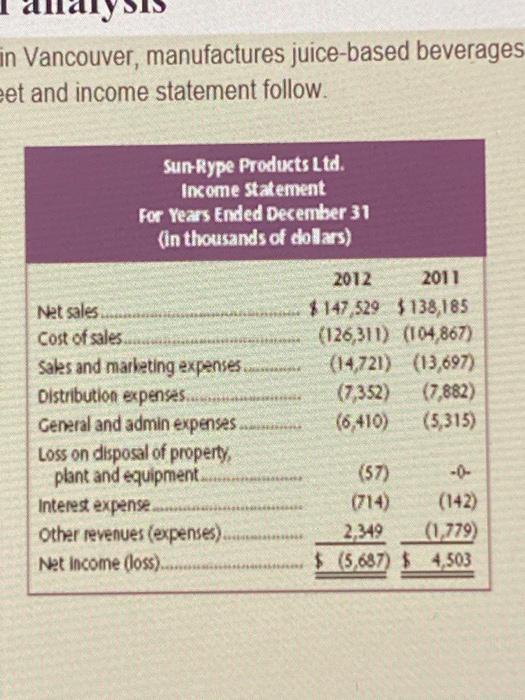

Financial analysis Sun-Rype Products Ltd., with its head office in Vancouver, manufactures juice-based beverages, fru snacks, and energy bars. Its 2011 balance sheet and income statement follow. Sun Rype Products Ltd Income statement For Years Ended December 31 Onthounds of dolars) 2011 $ 2,928 14.260 24.961 450 2012 2011 $14,529 5138,185 (126,311) 1104,867) (14721) (13,697) (7,352) 0,12) (6,410) (5.315) Net sales Cost of sales Sales and marketing expenses Distribution expenses General and admin penses Loss on disposal of property, plant and equipient interest expens Other revenues (expenses) Net Income (os) Sun-kype Products Ltd. Balance Sheet As at December 31 (In thousands of dollars) 2012 Assets Cash $571 Trade and other recevables 13,672 investores 31,794 Prepaid expenses 579 Other current assets 2,244 Property, plant and equipment 46,195 Goodwill 1,084 Totalsts $9519 uabilities and Equity Trade and other payables 519479 Income taxes payable Short-term loans 11,104 Other current abilities 1,297 Long-term loans 14458 Other long-term bles 3,422 Share capital 17,724 Contributed surplus 794 Retained earnings 27,914 Accumulated other comprehensive los Total batles and equity 596,139 39,719 182318 (57) 014 (142) 2.349 (0.779 $ 65,687) $ 4.500 $18,061 377 2512 639 5,189 9,421 17,724 794 33,601 162318 Questions: 1- Calculate the financial ratios for the company 2- Complete the financial analysis report for the company. 3- What's your recommendation? Sun-Rype Products Ltd. Balance Sheet As at December 31 (In thousands of dollars) 2012 2011 $ 2,928 14,260 24,961 450 $571 13,672 31,794 579 2.244 46,195 1,084 596 139 39,719 0- 182318 Assets Cash Trade and other receivables Inventores Prepaid expenses Other current assets Property, plant and equipment... Goodwill Total assets.. Labilities and Equity Trade and other payables Income taxes payable Short-term loans Other current liabilities Long-term loans Other long-term labilities Share capital Contributed surplus Retained earnings Accumulated other comprehensive loss Total abilities and equity $19,479 $18,061 377 11,104 2,512 1,297 639 14,458 3,422 3,421 17,724 17,724 794 27,914 33,601 5.189 794 (53) $96,139 $82.38 $82,318 Financial analysis Sun-Rype Products Ltd., with its head office in Vancouver, manufactures juice-based beverages, fru snacks, and energy bars. Its 2011 balance sheet and income statement follow. Sun Rype Products Ltd Income statement For Years Ended December 31 Onthounds of dolars) 2011 $ 2,928 14.260 24.961 450 2012 2011 $14,529 5138,185 (126,311) 1104,867) (14721) (13,697) (7,352) 0,12) (6,410) (5.315) Net sales Cost of sales Sales and marketing expenses Distribution expenses General and admin penses Loss on disposal of property, plant and equipient interest expens Other revenues (expenses) Net Income (os) Sun-kype Products Ltd. Balance Sheet As at December 31 (In thousands of dollars) 2012 Assets Cash $571 Trade and other recevables 13,672 investores 31,794 Prepaid expenses 579 Other current assets 2,244 Property, plant and equipment 46,195 Goodwill 1,084 Totalsts $9519 uabilities and Equity Trade and other payables 519479 Income taxes payable Short-term loans 11,104 Other current abilities 1,297 Long-term loans 14458 Other long-term bles 3,422 Share capital 17,724 Contributed surplus 794 Retained earnings 27,914 Accumulated other comprehensive los Total batles and equity 596,139 39,719 182318 (57) 014 (142) 2.349 (0.779 $ 65,687) $ 4.500 $18,061 377 2512 639 5,189 9,421 17,724 794 33,601 162318 Questions: 1- Calculate the financial ratios for the company 2- Complete the financial analysis report for the company. 3- What's your recommendation? in Vancouver, manufactures juice-based beverages eet and income statement follow. Sun-Rype Products Ltd. Income Statement For Year's Ended December 31 (in thousands of dollars) 2012 2011 $147 529 $138,185 (126,311) (104,867) (14,721) (13,697) ) (7,352) (7.882) (6 410) (5,315) Net sales Cost of sales Sales and marleting expenses Distribution expenses General and admin expenses... Loss on disposal of property, plant and equipment Interest expense Other revenues (expenses) Net Income (loss).... (57) -0- (714) (142) 2,349 (1,779) $(5,687) $ 4,503