Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial and Managerial Accounting 12 Countinuing Problem Chapter 4 Pg 207-208 The unadjusted trial balance of Ps Music as of July 31, 2014, along with

Financial and Managerial Accounting 12

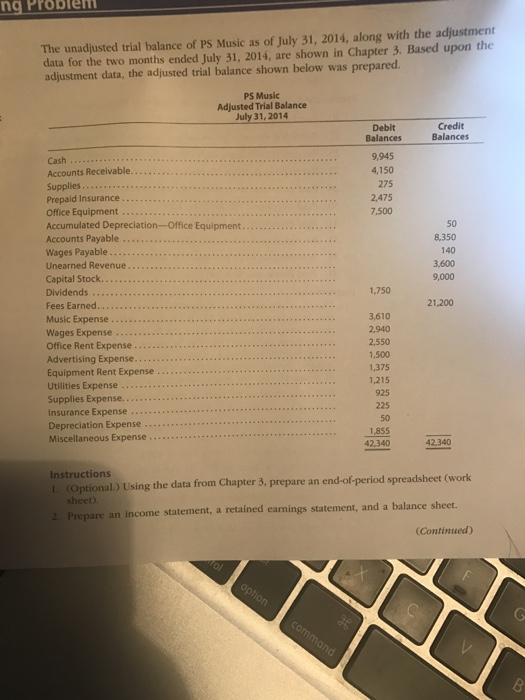

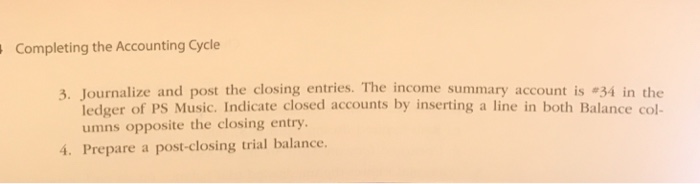

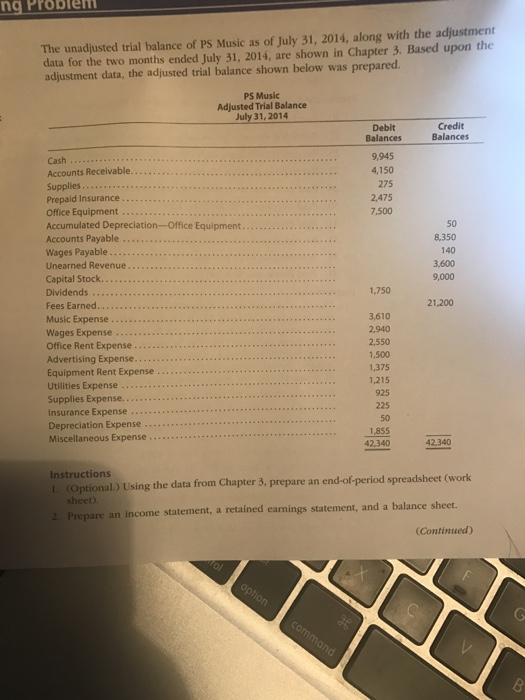

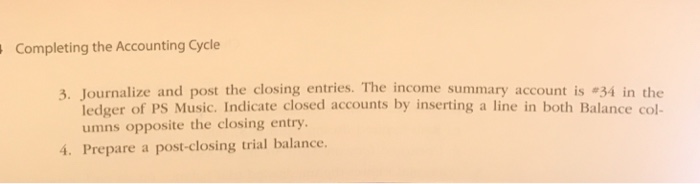

The unadjusted trial balance of Ps Music as of July 31, 2014, along with the adjustment data for the two months ended July 31, 2014, are shown in Chapter 3, Based upon the adjustment data, the adjusted trial balance shown below was prepared PS Music Adjusted Trial Balance July 31, 2014 Credit Balances Balances Cash 4,150 Accounts Receivable 275 Supplies Prepaid Insurance 2,475 7,500 Office Equipment 50 Accumulated Depreciation Office Equipment. 8.350 Accounts Payable Wages Payable Unearned Revenue Capital Stock. 1,750 21.200 Fees Earned Music Expense Wages Expense Office Rent Expense Advertising Expense Equipment Rent Expense 1,215 Utilities Expense Supplies Expense. Insurance Expense Depreciation Expense 1855 Miscellaneous Expense 42,340 42,340 Instructions Chapter 3, prepare an end-ofperiod spreadsheet (work (optional.) Using the data from Prepare an income statement, a retained earnings statement, and a balance sheet. (Continued) Countinuing Problem Chapter 4 Pg 207-208

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started