Question

Financial characteristics of companies vary for many reasons. The two most prominent drivers are industry economics and firm strategy. Each industry has a financial norm

Financial characteristics of companies vary for many reasons. The two most prominent drivers are industry economics and firm strategy. Each industry has a financial norm around which companies within the industry tend to operate. An airline, for example, would naturally be expected to have a high proportion of fixed assets (airplanes), while a consulting firm would not. A steel manufacturer would be expected to have a lower gross margin than a pharmaceutical manufacturer because commodities such as steel are subject to strong price competition, while highly differentiated products like patented drugs enjoy much more pricing freedom. Because of each industrys unique economic features, average financial statements will vary from one industry to the next. Similarly, companies within industries have different financial characteristics, in part because of the diverse strategies that can be employed. Executives choose strategies that will position their company favorably in the competitive jockeying within an industry. Strategies typically entail making important choices in how a product is made (e.g., capital intensive versus labor intensive), how it is marketed (e.g., direct sales versus the use of distributors), and how the company is financed (e.g., the use of debt or equity). Strategies among companies in the same industry can differ dramatically. Different strategies can produce striking differences in financial results for firms in the same industry. The following paragraphs describe pairs of participants in a number of different industries. Their strategies and market niches provide clues as to the financial condition and performance that one would expect of them. The companies common-sized financial statements and operating data, as of early 2016, are presented in a standardized format in Exhibit 1. It is up to you to match the financial data with the company descriptions. Also, try to explain the differences in financial results across industries. Airlines Companies A and B are airline companies. One firm is a major airline that flies both domestically and internationally and offers additional services including travel packages and airplane repair. The company owns a refinery to supply its own jet fuel as a hedge to fuel-price volatility. In 2008, this company merged with one of the largest airline carriers in the United States. The other company operates primarily in the United States, with some routes to the Caribbean and Latin America. It is the leading low-cost carrier in the United States. One source of operating efficiency is the fact that the company carries only three different aircraft in its fleet, making maintenance much simpler than for legacy airlines that might need to service 20 or 30 different aircraft models. This companys growth has been mostly organicit expands its routes by purchasing new aircraft and the rights to fly into new airports. Beer Of the beer companies, C and D, one is a national brewer of mass-market consumer beers sold under a variety of brand names. This company operates an extensive network of breweries and distribution systems. The firm also owns a number of beer-related businessessuch as snack-food and aluminum-container manufacturing companiesand several major theme parks. Over the past 12 years, it has acquired several large brewers from around the globe. The other company is the largest craft brewer in the United States. Like most craft brewers, this company produces higher-quality beers than the mass-market brands, but production is at a lower volume and the beers carry premium prices. The firm is financially conservative. Computers Companies E and F sell computers and related equipment. One company sells high-performance computing systems (supercomputers) to government agencies, universities, and commercial businesses. It has experienced considerable growth due to an increasing customer base. The company is financially conservative. The other company sells personal computers as well as handheld devices and software. The firm has been able to differentiate itself by using its own operating system for its computers and by creating new and innovative designs for all its products. These products carry premium prices domestically and globally. The company follows a vertical integration strategy starting with owning chip manufacturers and ending with owning its own retail stores. Hospitality Companies G and H are both in the hospitality business. One company operates hotels and residential complexes. Rather than owning the hotels, this firm chooses to manage or franchise its hotels. The company receives its revenues each month based on long-term contracts with the hotel owners, who pay a percentage of the hotel revenues as a management fee or franchise fee. Much of this companys growth is inorganicthe company buys the rights to manage existing hotel chains and also the rights to use the hotels brand name. This company has also pursued a strategy of repurchasing a significant percentage of the shares of its own common stock. The other company owns and operates several chains of upscale, full-service hotels and resorts. The firms strategy is to maintain market presence by owning all of its properties, which contributes to the high recognition of its industry-leading brands. Newspapers Companies I and J are newspaper companies. One company owns and operates two newspapers in the southwestern United States. Due to the transition of customer preference from print to digital, the company has begun offering marketing and digital-advertising services and acquiring firms in more profitable industries. The company has introduced cost controls to address cost-structure issues such as personnel expenses. Founded in 1851, the other company is renowned for its highly circulated newspaper offered both in print and online formats. This paper is sold and distributed domestically as well as around the world. Because the company is focused largely on one product, it has strong central controls that have allowed it to remain profitable despite the fierce competition for subscribers and advertising revenues. Pharmaceuticals Companies K and L manufacture and market pharmaceuticals. One firm is a diversified company that sells both human pharmaceuticals as well as health products for animals. This companys strategy is to stay ahead of the competition by investing in the discovery and development of new and innovative drugs. The other company focuses on generic pharmaceuticals and medical devices. Most of this companys growth has been inorganicthe growth strategy has been to engage in highly leveraged acquisitions, and it has participated in more than 100 during the past eight years. The goal of acquiring new businesses is to enhance the value of the proven drugs in the companys portfolio rather than gamble on discoveries of new drugs for the future. Power Companies M and N are in the power-generation industry. One company focuses on solar power. This includes the manufacturing and selling of power systems as well as maintenance services for those systems. The other company owns large, mostly coal-powered electric-power-generation plants in countries around the world. Most of its revenues result from power-purchase agreements with a countrys government that buy the power generated. Some of its U.S. assets include regulated public utilities. Retail Companies O and P are retailers. One is a leading e-commerce company that sells a broad range of products, including media (books, music, and videos) and electronics, which together account for 92% of revenues. One-third of revenues are international and 20% of sales come from third-party sellers (i.e., sellers who transact through the companys website to sell their own products rather than those owned by the company). A growing portion of operating profit comes from the companys cloud-computing business. With its desire to focus on customer satisfaction, this company has invested considerably in improving its online technologies. The other company is a leading retailer in apparel and fashion accessories for men, women, and children. The company sells mostly through its upscale brick-and-mortar department stores.

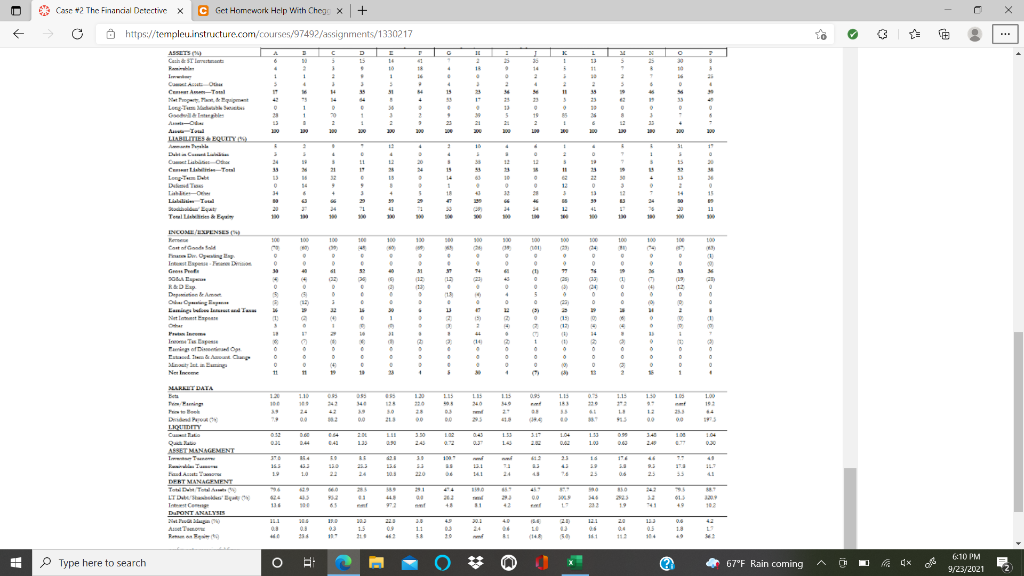

This case provides common-sized financial data and ratios for 8 pairs of unidentified companies.

1. Match the financial information with the correct company.

2. Support your answers with data from each firms common sized Balance Sheet, Income Statement, calculated ratios, and other data. Include at least 4 data points for each pair of companies to support your answer. Explain why the data point supports your conclusion and include the actual number for each data point you use.

Case 2 The Financial Detective X C Get Homework Help With Chogo x + LE I 3 DE 2 13 1 33 . 4 . 18 26 14 1 1 11 30 3 2 > - 1 - @ https://templeu.instructure.com/courses/97492/assignments/1330217 ASSETS D E Cash & ST Last 30 14 2 10 1 Cost Act Ou 3 Cerem-Tom 33 Metropers het, met Long The Man 0 1 Gilles Random 100 TIESER Amal Delia 24 Cse-T C 39 Leny Date . 17 . 1 . . 2 100 100 130 99 30 34 15 20 100 30 46 11 1 theo ais T . Tesla INCOM/EXPENSES Casa Grande | m. Og 300 100 130 300 30 100 100 LOO 30 10 300 034 100 20 O . 61 31 14 0 6 05 5 26 . 19 12 o 0 0 3 SOAL RAD Depois de Amor Onge Early talam latatus Taa Nint lear 9 0 14 Peter TexTube Tof 0 3 0 0 11 0 0 11 . anai New O 3 10 10 1 4 MARKET DATA Bot 1.30 LES 15 0.95 LIS 0.3 100 1.10 100 100 280 1.15 292 100 151 . 28 23 00 00 DO 90 0.30 2.0 102 0:43 153 LIQUITY Care Qual ASSET MANAGEMENT TT D.GE 2.44 6.54 6.4 0.90 1.04 DUGE 1.53 100 0.95 DUGO 2.40 104 030 BE 30 www 1974 11 23 23 43 33 18 32 23 46 23 2 LO 303 141 06 35 MO BO 24 88 90 DENT MANAGEMENT Torta LTD Cam DUPONT ANALYSIS 2. Auto 489 23 42 00 14 23 11 900 65 43 31 17 19 40 102 121 30 03 30 11 06 1.8 0 462 20 04 11 3 10 1. 10 14 50 111 11 Type here to search O O * 67F Rain coming x 6:10 PM 9/23/2021 Case 2 The Financial Detective X C Get Homework Help With Chogo x + LE I 3 DE 2 13 1 33 . 4 . 18 26 14 1 1 11 30 3 2 > - 1 - @ https://templeu.instructure.com/courses/97492/assignments/1330217 ASSETS D E Cash & ST Last 30 14 2 10 1 Cost Act Ou 3 Cerem-Tom 33 Metropers het, met Long The Man 0 1 Gilles Random 100 TIESER Amal Delia 24 Cse-T C 39 Leny Date . 17 . 1 . . 2 100 100 130 99 30 34 15 20 100 30 46 11 1 theo ais T . Tesla INCOM/EXPENSES Casa Grande | m. Og 300 100 130 300 30 100 100 LOO 30 10 300 034 100 20 O . 61 31 14 0 6 05 5 26 . 19 12 o 0 0 3 SOAL RAD Depois de Amor Onge Early talam latatus Taa Nint lear 9 0 14 Peter TexTube Tof 0 3 0 0 11 0 0 11 . anai New O 3 10 10 1 4 MARKET DATA Bot 1.30 LES 15 0.95 LIS 0.3 100 1.10 100 100 280 1.15 292 100 151 . 28 23 00 00 DO 90 0.30 2.0 102 0:43 153 LIQUITY Care Qual ASSET MANAGEMENT TT D.GE 2.44 6.54 6.4 0.90 1.04 DUGE 1.53 100 0.95 DUGO 2.40 104 030 BE 30 www 1974 11 23 23 43 33 18 32 23 46 23 2 LO 303 141 06 35 MO BO 24 88 90 DENT MANAGEMENT Torta LTD Cam DUPONT ANALYSIS 2. Auto 489 23 42 00 14 23 11 900 65 43 31 17 19 40 102 121 30 03 30 11 06 1.8 0 462 20 04 11 3 10 1. 10 14 50 111 11 Type here to search O O * 67F Rain coming x 6:10 PM 9/23/2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started