Answered step by step

Verified Expert Solution

Question

1 Approved Answer

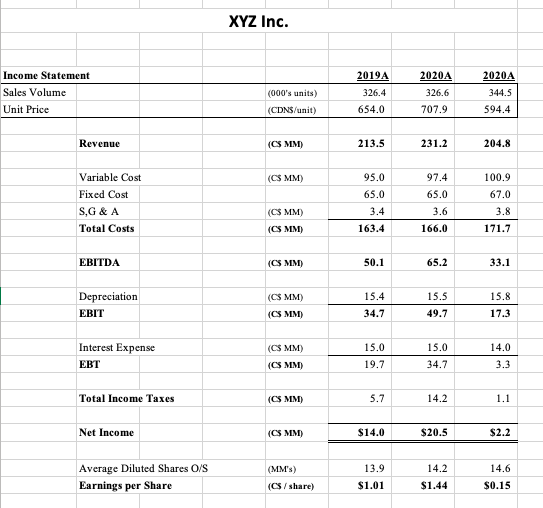

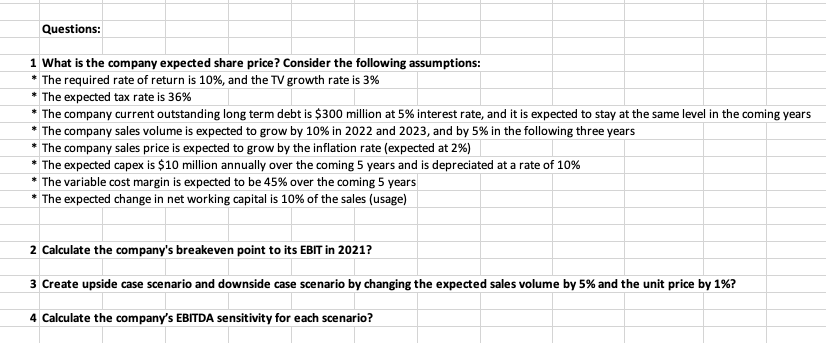

FINANCIAL CONTROLLERSHIP Please show work. Thank you! XYZ Inc. Income Statement Sales Volume Unit Price (000's units) (CDN$/unit) 2019A 326.4 654.0 2020A 326.6 707.9 2020A

FINANCIAL CONTROLLERSHIP

Please show work. Thank you!

XYZ Inc. Income Statement Sales Volume Unit Price (000's units) (CDN$/unit) 2019A 326.4 654.0 2020A 326.6 707.9 2020A 344.5 594.4 Revenue (CS MM) 213.5 231.2 204.8 (C$ MM) 97.4 Variable Cost Fixed Cost S,G & A Total Costs 95.0 65.0 3.4 163.4 100.9 67.0 3.8 171.7 65.0 3.6 166.0 (CS MM) (CS MM) EBITDA (CS MM) 50.1 65.2 33.1 Depreciation EBIT (CS MM) (CS MM) 15.4 34.7 15.5 49.7 15.8 17.3 Interest Expense EBT (CS MM) (CS MM) 15.0 19.7 15.0 34.7 14.0 3.3 Total Income Taxes (CS MM) 5.7 14.2 1.1 Net Income (CS MM) $14.0 $20.5 $2.2 Average Diluted Shares O/S Earnings per Share (MM's) (CS/share) 13.9 $1.01 14.2 $1.44 14.6 $0.15 Questions: 1 What is the company expected share price? Consider the following assumptions: * The required rate of return is 10%, and the TV growth rate is 3% The expected tax rate is 36% The company current outstanding long term debt is $300 million at 5% interest rate, and it is expected to stay at the same level in the coming years The company sales volume is expected to grow by 10% in 2022 and 2023, and by 5% in the following three years The company sales price is expected to grow by the inflation rate (expected at 2%) The expected capex is $10 million annually over the coming 5 years and is depreciated at a rate of 10% The variable cost margin is expected to be 45% over the coming 5 years * The expected change in net working capital is 10% of the sales (usage) 2 Calculate the company's breakeven point to its EBIT in 2021? 3 Create upside case scenario and downside case scenario by changing the expected sales volume by 5% and the unit price by 1%? 4 Calculate the company's EBITDA sensitivity for each scenario? XYZ Inc. Income Statement Sales Volume Unit Price (000's units) (CDN$/unit) 2019A 326.4 654.0 2020A 326.6 707.9 2020A 344.5 594.4 Revenue (CS MM) 213.5 231.2 204.8 (C$ MM) 97.4 Variable Cost Fixed Cost S,G & A Total Costs 95.0 65.0 3.4 163.4 100.9 67.0 3.8 171.7 65.0 3.6 166.0 (CS MM) (CS MM) EBITDA (CS MM) 50.1 65.2 33.1 Depreciation EBIT (CS MM) (CS MM) 15.4 34.7 15.5 49.7 15.8 17.3 Interest Expense EBT (CS MM) (CS MM) 15.0 19.7 15.0 34.7 14.0 3.3 Total Income Taxes (CS MM) 5.7 14.2 1.1 Net Income (CS MM) $14.0 $20.5 $2.2 Average Diluted Shares O/S Earnings per Share (MM's) (CS/share) 13.9 $1.01 14.2 $1.44 14.6 $0.15 Questions: 1 What is the company expected share price? Consider the following assumptions: * The required rate of return is 10%, and the TV growth rate is 3% The expected tax rate is 36% The company current outstanding long term debt is $300 million at 5% interest rate, and it is expected to stay at the same level in the coming years The company sales volume is expected to grow by 10% in 2022 and 2023, and by 5% in the following three years The company sales price is expected to grow by the inflation rate (expected at 2%) The expected capex is $10 million annually over the coming 5 years and is depreciated at a rate of 10% The variable cost margin is expected to be 45% over the coming 5 years * The expected change in net working capital is 10% of the sales (usage) 2 Calculate the company's breakeven point to its EBIT in 2021? 3 Create upside case scenario and downside case scenario by changing the expected sales volume by 5% and the unit price by 1%? 4 Calculate the company's EBITDA sensitivity for each scenarioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started