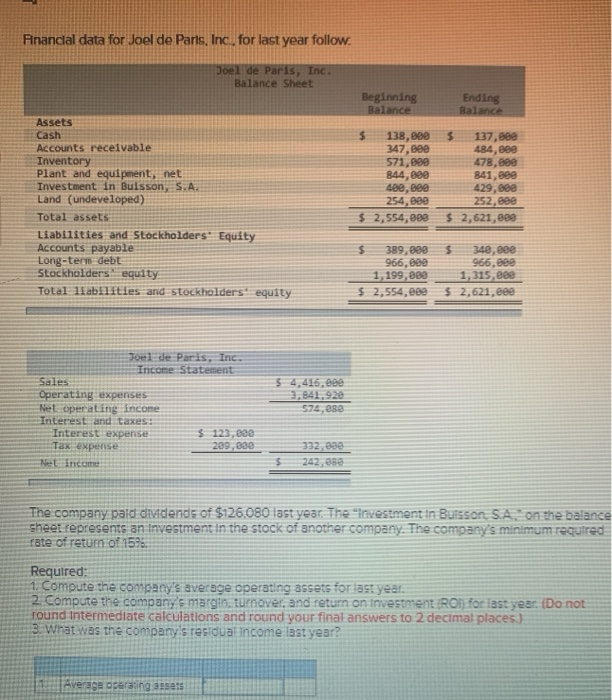

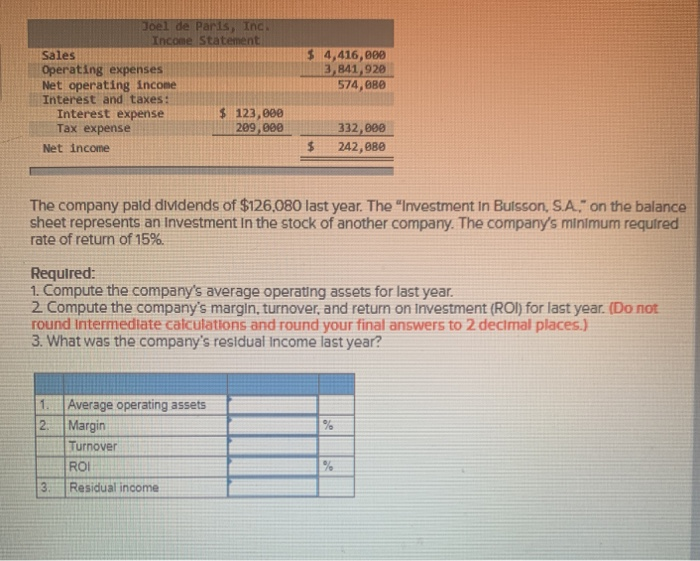

Financial data for Joel de Paris, Inc. for last year follow. Joel de Paris, Inc. Balance Sheet Beginning Balance Ending Balance Assets Cash Accounts receivable Inventory Plant and equipment, net Investment in Buisson, S.A. Land (undeveloped) Total assets Liabilities and Stockholders. Equity Accounts payable Long-term debt Stockholdersequity Total labilities and stockholders equity 138,888 347,680 571,689 844,880 480, Bee 254, 880 $ 2,554,080 $ 137,880 484,889 478,000 841,089 429,800 252,888 $ 2,621,889 389,899 966,800 1,199,880 $ 2,554,689 $ 348,888 966,680 1,315,888 $ 2,621, eee $ 4,416,00 Joel de Paris, Inc. Income Statement Sales Operating expenses Nel operating income Interest and taxes: Interest expense $ 123,888 Tax expense 209,000 Nel income 574,888 332,090 242,850 $ The company paid dividends of $126,080 last year. The "Investment in Buisson SA on the balance sheet represents an investment in the stock of another company. The company's minimum required rate of return of 1596 Required: 1. Compute the company's average operating assets for last year. 2. Compute the company's margto turnover, and return on investment (Rol) for last year. (Do not round Intermediate calculations and round your final answers to 2 decimal places) 3. What was the company's residual income last year? Average operating assets Joel de Paris, Inc Income Statement Sales Operating expenses Net operating income Interest and taxes: Interest expense $ 123,000 Tax expense 209,000 Net income $ 4,416,000 3,841,920 574,880 332,800 242,80 $ The company pald dividends of $126,080 last year. The Investment in Butsson, S.A." on the balance sheet represents an Investment in the stock of another company. The company's minimum required rate of return of 15%. Required: 1. Compute the company's average operating assets for last year. 2 Compute the company's margin, turnover, and return on investment (ROI) for last year. (Do not round Intermediate calculations and round your final answers to 2 decimal places.) 3. What was the company's residual income last year? 1. 2. % Average operating assets Margin Turnover ROI Residual income 3