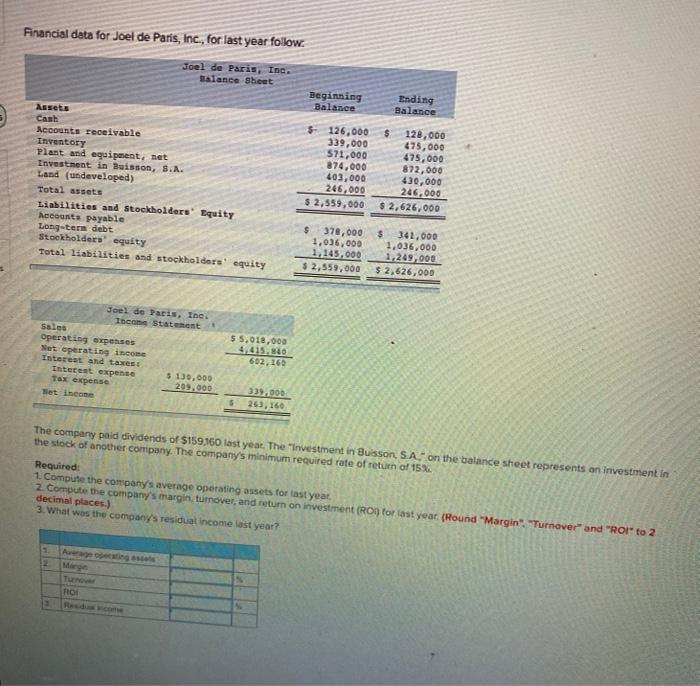

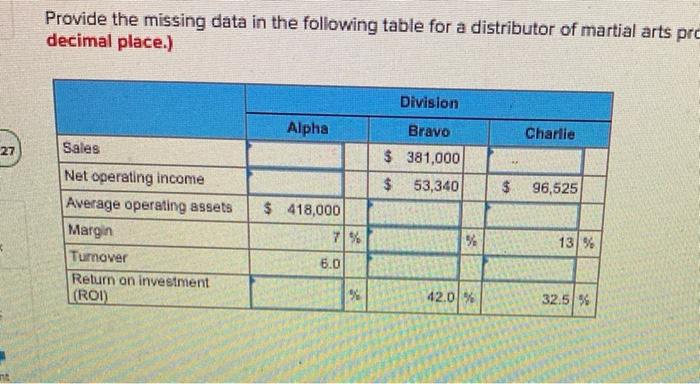

Financial data for Joel de Paris, Inc., for last year follow. Joel de Paris, Inc. Balance Sheet Beginning Balance Ending Balance Assets Cash Accounts receivable Inventory Plant and equipment, net Investment in Buisson, S.A. Land (undeveloped) Total assets Liabilities and Stockholders' Equity Accounts payable Long-term debt Stockholders equity Total liabilities and stockholders' equity $ 126,000 339,000 571,000 874,000 403,000 246,000 $ 2,559,000 $ 128,000 475,000 475,000 872,000 430,000 246,000 $ 2,626,000 $ 378,000 1,036,000 1,145,000 $ 2,559,000 $ 341,000 1,036,000 1.249,000 $ 2,526,000 Joel de Paris, Tac. The Statement Sales Operating speses Net operating income Interest and taxes Interest expense $ 130,000 Tax expense 209,000 Set income 5 5.012,000 4.415.40 602,165 39.000 263, 160 5 The company paid dividends of $159,160 last year. The "Investment in Buisson, SA," on the balance sheet represents an investment in the stock of another company. The company's minimum required rate of return of 15% Required: 1. Compare the company's average operating assets for last year. 2. Compute the company's margin turnover and return on investment (Rom for last year. (Round "Margin", "Turnover" and "Rorto 2 decimal places.) 3. What was the company's residual income last year? 2 (Roi 3 Selected operating data for two divisions of Outback Brewing, Ltd., of Australia are given below: Sales Average operating assets Net operating income Property, plant, and equipment (net) Division New South Queensland Wales $ 2,176,000 $ 3,445,000 $ 640,000 $ 650.000 $ 250, 240 $ 275,600 264,000 S 214,000 Required: 1. Compute each division's margin, turnover, and return on investment (ROI. 2. Which divisional manager seems to be doing the better job? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the rate of return for each division using the return on investment (ROI) formula stated in terms of margin and turnover. (Round your answers to 2 decimal places) Margin Turnover ROI usenstand division New South Wales avion 54 Required 2 > Provide the missing data in the following table for a distributor of martial arts pre decimal place.) Division Alpha Charlie 27 Bravo $ 381,000 $ 53,340 $ 96,525 Sales Net operating income Average operating assets Margin Turnover Return on investment (ROI) $ 418,000 7% % 13% 6.0 % 42.01% 32.5%