Answered step by step

Verified Expert Solution

Question

1 Approved Answer

financial data for US division of Harvey Corporation for last year follow: Financial data for US division of Harvey Corporation for last year follow: Harvey

financial data for US division of Harvey Corporation for last year follow:

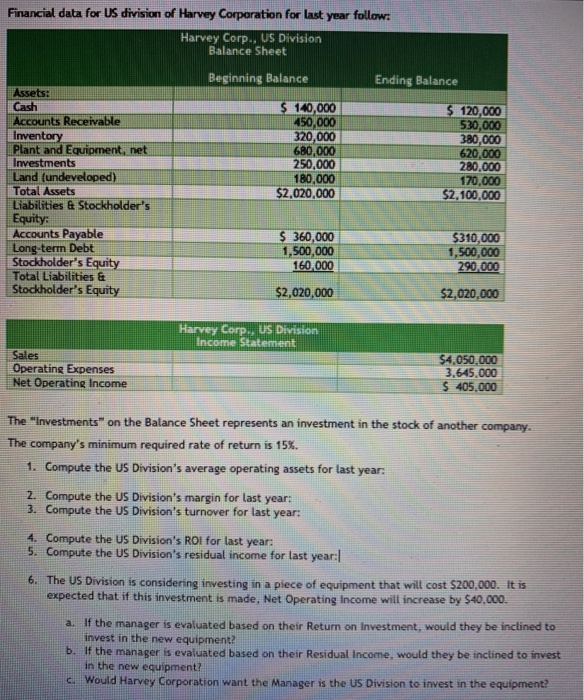

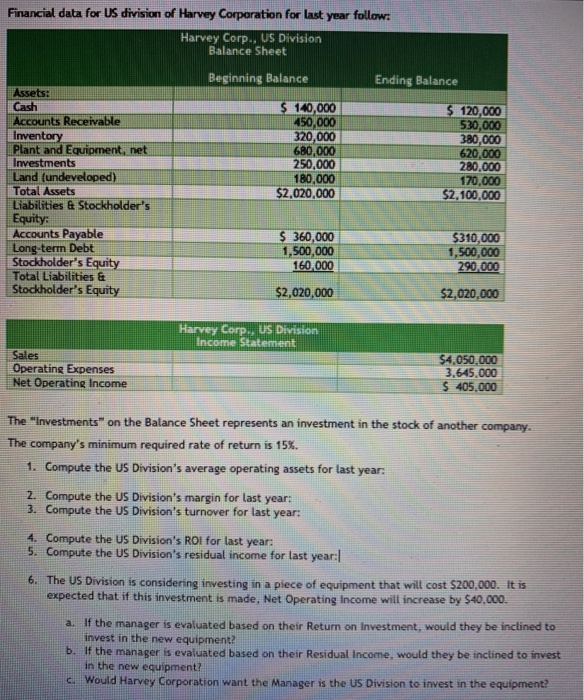

Financial data for US division of Harvey Corporation for last year follow: Harvey Corp., US Division Balance Sheet Beginning Balance Ending Balance Assets Cash $ 140,000_____ 450,000 320,000 680,000 250,000 180.000 $2.020,000 $ 120,000 530,000 380,000 620.000 280.000 170.000 $2,100,000 Accounts Receivable Inventory Plant and Equipment, net Investments Land fundeveloped) Total Assets Liabilities & Stockholder's Equity: Accounts Payable Long-term Debt Stockholder's Equity Total Liabilities & Stockholder's Equity $360,000 1,500,000 160.000 $310,000 1,500,000 290.000 TE $2,020,000 $2,020,000 Harvey Corp., US Division Sales Operating Expenses Net Operating Income $4,050,000 3.645.000 $405.000 The "Investments" on the Balance Sheet represents an investment in the stock of another company. The company's minimum required rate of return is 15%. 1. Compute the US Division's average operating assets for last year: 2. Compute the US Division's margin for last year: 3. Compute the US Division's turnover for last year: 4. Compute the US Division's ROI for last year: 5. Compute the US Division's residual income for last year: 6. The US Division is considering investing in a piece of equipment that will cost $200.000. It is expected that if this investment is made, Net Operating Income will increase by S40,000. a. If the manager is evaluated based on their Return on Investment, would they be inclined to invest in the new equipment? b. If the manager is evaluated based on their Residual income, would they be inclined to invest in the new equipment? 6. Would Harvey Corporation want the Manager is the US Division to invest in the equipment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started