Question

Financial Decision-Making You are an intern financial analyst. In referring to the Xero Ltd for 2022 (https://www.xero.com/content/dam/xero/pdfs/investors-financial-information/xero-limited-annual-report-fy22.pdf ), you are tasked by your supervisor to

Financial Decision-Making

You are an intern financial analyst. In referring to the Xero Ltd for 2022 (https://www.xero.com/content/dam/xero/pdfs/investors-financial-information/xero-limited-annual-report-fy22.pdf ), you are tasked by your supervisor to present a report evaluating the financial performance of the company from different perspectives by addressing the questions listed below.

*Australian Financial year: 1 July 2021 to 30 June 2022

Important:

- You must use their own words when presenting relevant information taken from the provided annual report, instead of just copying and pasting.

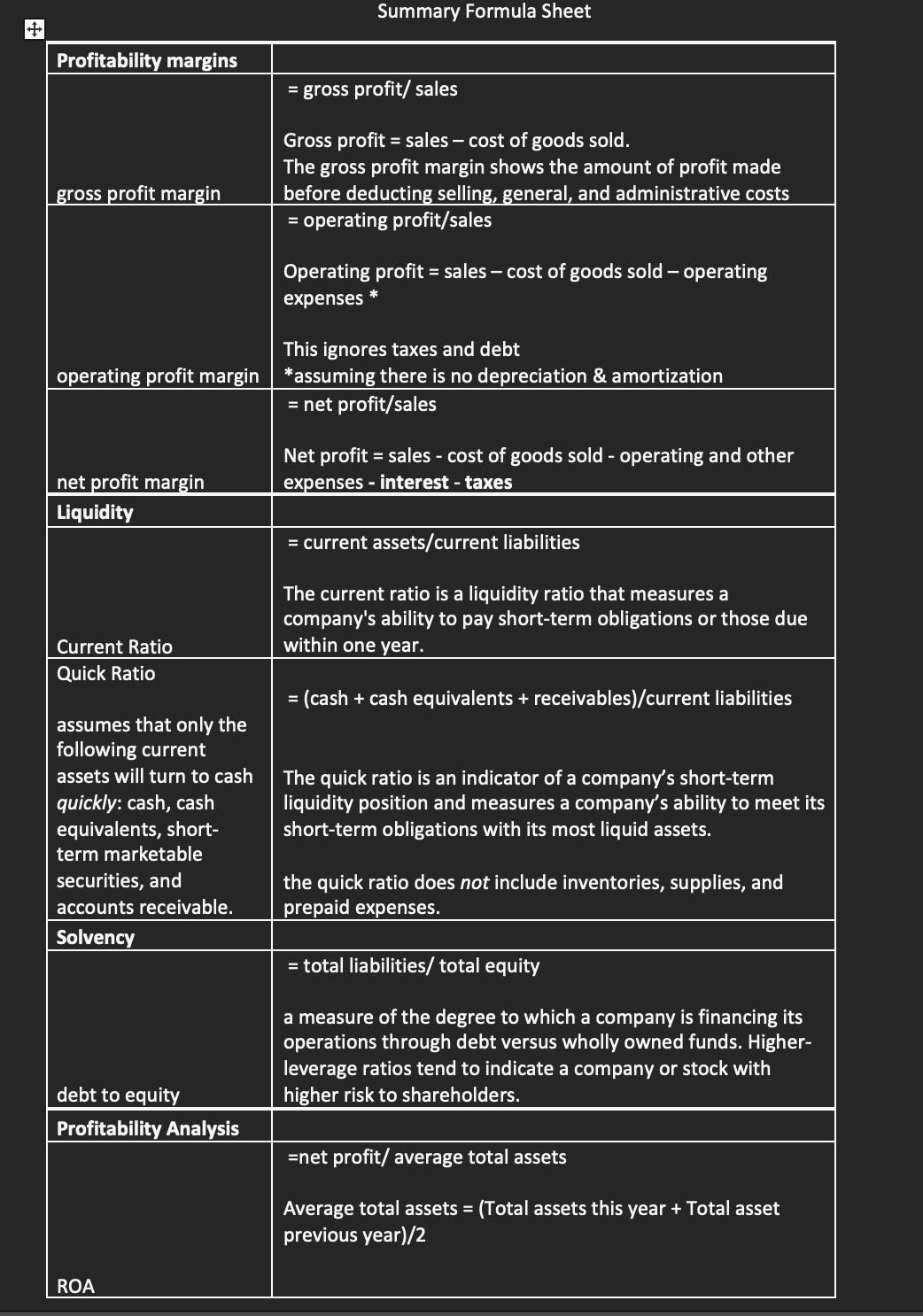

- Please keep 4 decimal points for all the calculation questions.

Here is the Link of information to answers the question:

https://www.xero.com/content/dam/xero/pdfs/investors-financial-information/xero-limited-annual-report-fy22.pdf

Question:

1. State the full name of the Chairman and the CEO of Xero Ltd. As reported in the Annual Report provided, what was the CEOs total remuneration package in 2022? In which business sector of the economy does Xero operate in? Explain the reasoning of your answer.

2. Describe the purpose of the 1) income statement and the 2) balance sheet. Which accounting elements appear in each financial statement. Explain in which section of the balance sheet profit is represented.

3. Describe how the cash rate set by the RBA has changed (if at all) between April 2022 and April 2023? Present evidence to support your answer. In answering this, you are to refer to the relevant source within the RBA website. Specify the link of the source you used.

4. a) Suppose the Australian economy experiences a period where inflation is much lower than normal, what kind of monetary policy should the Reserve Bank of Australia (RBA) implement? With the use of an appropriate drawing of money demand and money supply diagram, explain the open market operation process that RBA will undertake in implementing such policy. Further, explain how this policy will likely impact on Xeros financing cost. Also explain how the policy will likely impact household consumption, business investment, aggregate demand, GDP, unemployment and the inflation rate in the economy.

5. What are Xeros total assets, total liabilities, and total equity in 2021 and 2022?

6. Based on your answers in Question 5, undertake a horizontal analysis by calculating the percentage change (from 2021 to 2022) for total assets, total liabilities, and total equity.

7. Complete the gross profit margin, operating profit margin and net profit margin for Xero in 2021 and 2022.

8. Based on your answer in Question 7, are gross profit margin and operating margin changing in the same direction or not and why?

9. Please calculate the current ratio and quick ratio of Xero in 2022 and comment on the results.

10. Please calculate the debt-to-equity ratio of Xero in 2022 and comment on the result. (Assuming the industry average is 0.5)

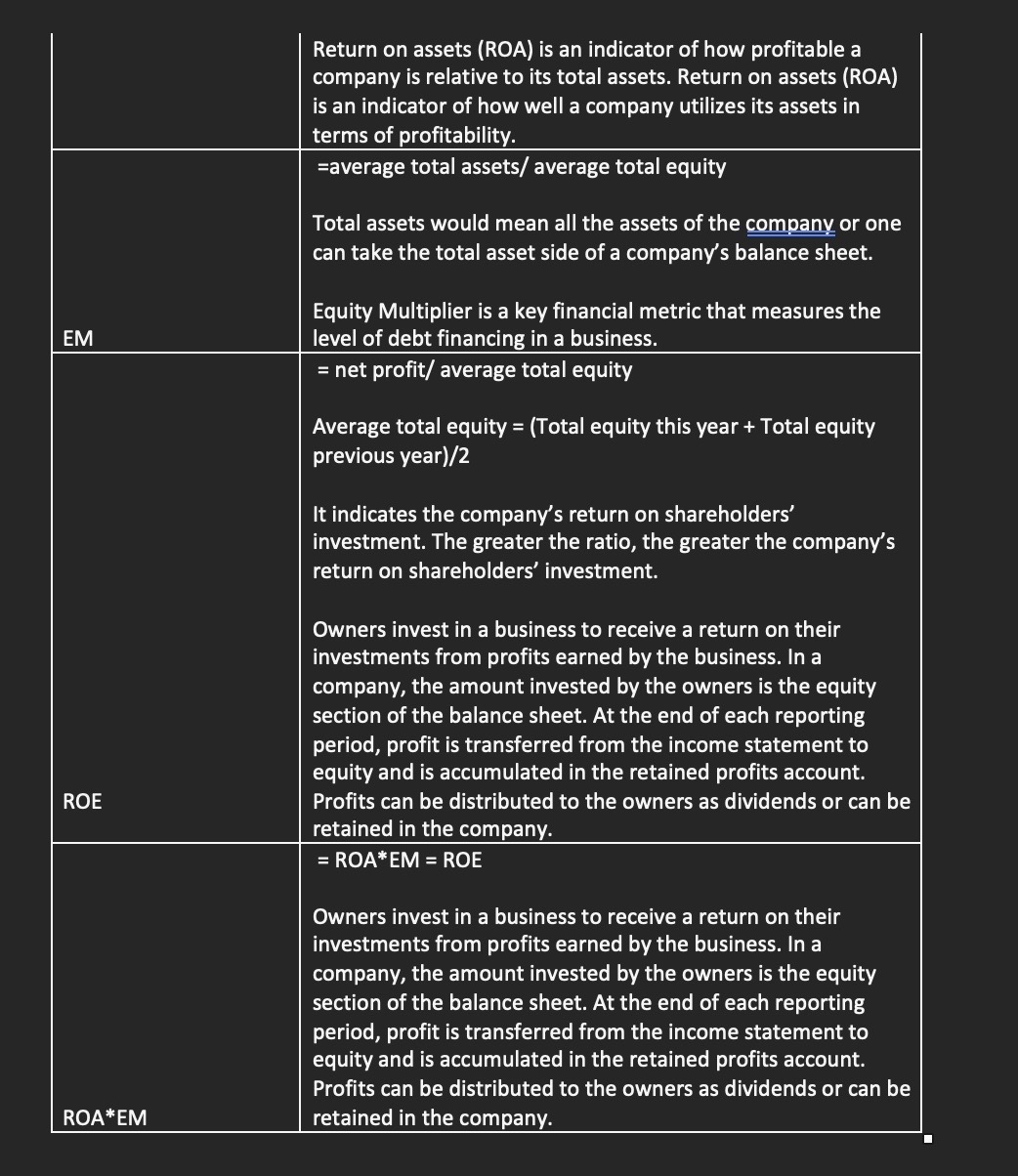

11. Please calculate the ROE of Xero in 2021 and 2022. (Total equity at the end of 2020 is $422,366,000)

12. Decompose the calculated 2021 and 2022 ROE from Question 11 to ROA and Equity multiplier, and comment on your result. (Total assets at the end of 2020 is $1,153,688,000)

13. Based on your analysis so far and your research, what are your suggestions for the future operation of the company?

Please show full of the calculation, step by step clearly, please!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started