Question

Financial Decision-Making You are an intern financial analyst. In referring to the Xero Ltd for 2022 (provided in link below), you are tasked by your

Financial Decision-Making

You are an intern financial analyst. In referring to the Xero Ltd for 2022 (provided in link below), you are tasked by your supervisor to present a report evaluating the financial performance of the company from different perspectives by addressing the questions listed on pages 2 and 3 below.

*Australian Financial year: 1 July 2021 to 30 June 2022

- You must use their own words when presenting relevant information taken from the provided annual report, instead of just copying and pasting.

- Please keep 4 decimal points for all the calculation questions.

Link: https://learning.griffithcollege.edu.au/pluginfile.php/673728/mod_resource/content/1/fy22-xero.pdf

Question:

1. State the full name of the Chairman and the CEO of Xero Ltd. As reported in the Annual Report provided, what was the CEO's total remuneration package in 2022?

2. What are Xero's total assets, total liabilities, and total equity in 2021 and 2022?

3. Based on your answers in Question 2, undertake a horizontal analysis by calculating the percentage change (from 2021 to 2022) for total assets, total liabilities, and total equity.

4. Complete the gross profit margin, operating profit margin and net profit margin for Xero in 2021 and 2022.

5. Based on your answer in Question 4, are gross profit margin and operating margin changing in the same direction or not and why?

6. Please calculate the current ratio and quick ratio of Xero in 2022 and comment on the results.

7. Please calculate the debt-to-equity ratio of Xero in 2022 and comment on the result. (Assuming the industry average is 0.5)

8. Please calculate the ROE of Xero in 2021 and 2022. (Total equity at the end of 2020 is $422,366,000)

9. Decompose the calculated 2021 and 2022 ROE from Question 8 to ROA and Equity multiplier, and comment on your result. (Total assets at the end of 2020 is $1,153,688,000)

10. Based on your analysis so far and your research, what are your suggestions for the future operation of the company?

- Using the formula below to caclculate, show full of the calculation and the explain, provide step by step clearly.

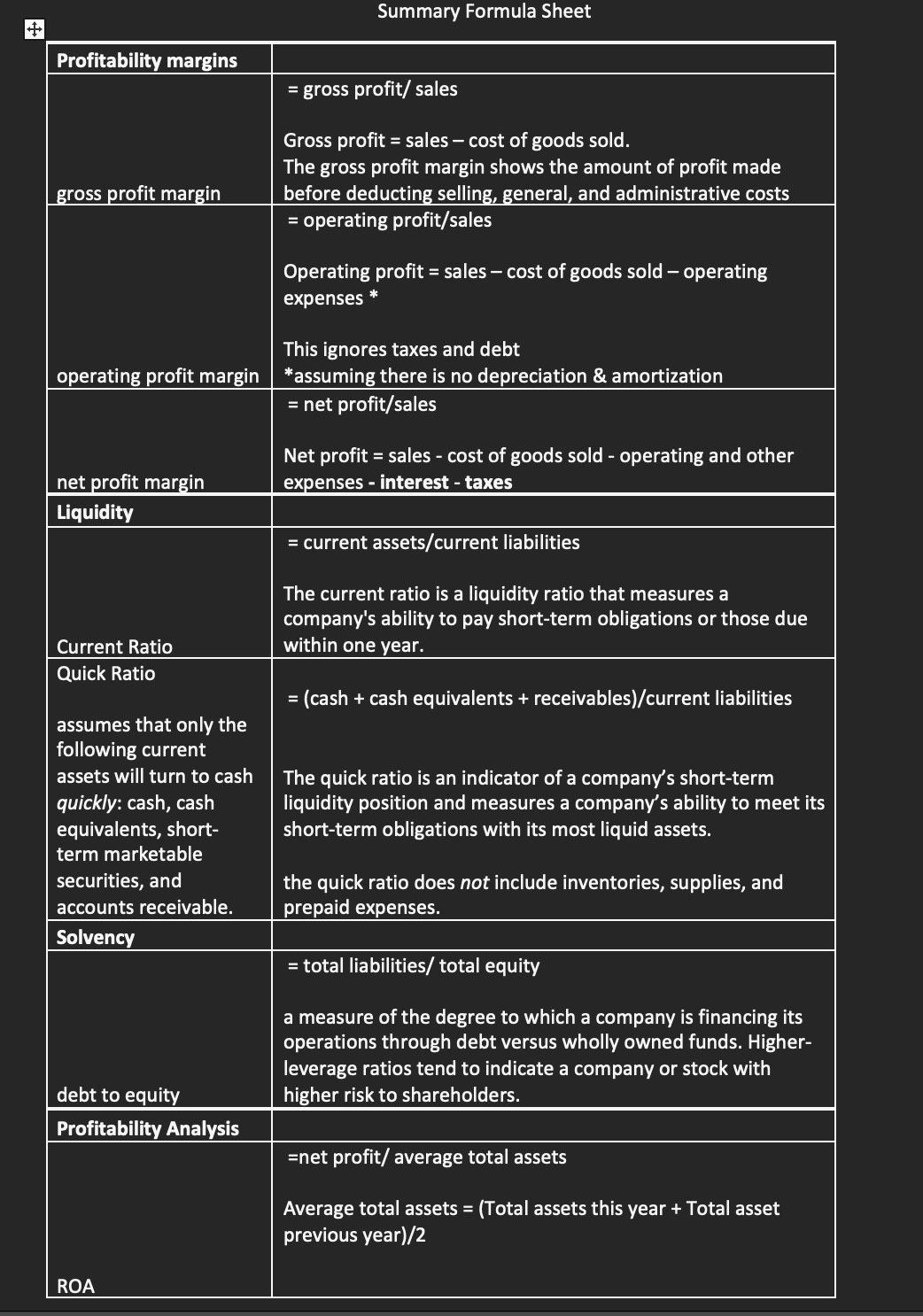

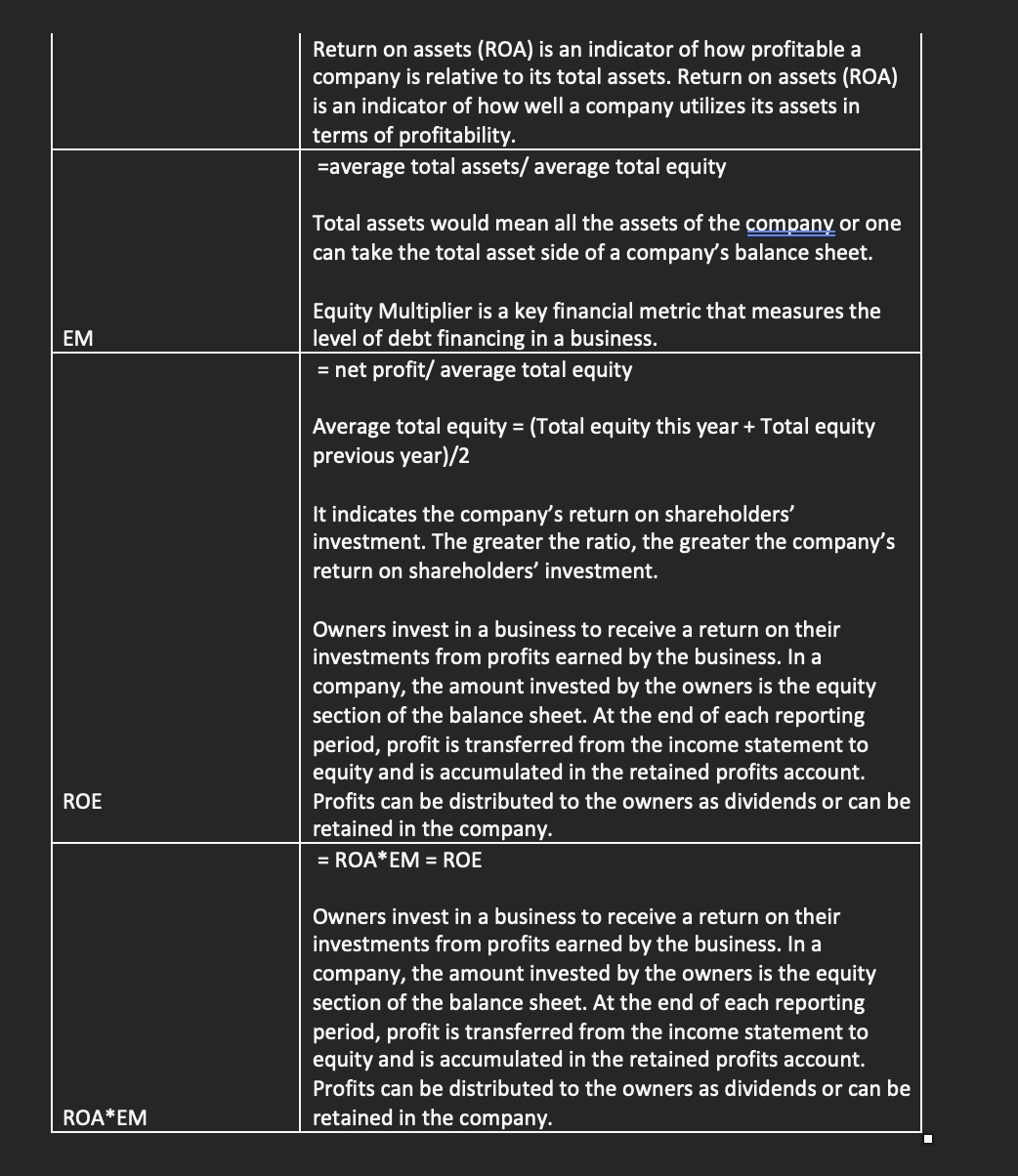

Summary Formula Sheet Return on assets (ROA) is an indicator of how profitable a company is relative to its total assets. Return on assets (ROA) is an indicator of how well a company utilizes its assets in terms of profitability. =average total assets/ average total equity Total assets would mean all the assets of the company or one can take the total asset side of a company's balance sheet. Equity Multiplier is a key financial metric that measures the level of debt financing in a business. = net profit/ average total equity Average total equity = (Total equity this year + Total equity previous year)/2 It indicates the company's return on shareholders' investment. The greater the ratio, the greater the company's return on shareholders' investment. Owners invest in a business to receive a return on their investments from profits earned by the business. In a company, the amount invested by the owners is the equity section of the balance sheet. At the end of each reporting period, profit is transferred from the income statement to equity and is accumulated in the retained profits account. Profits can be distributed to the owners as dividends or can be retained in the company. =REM=ROE Owners invest in a business to receive a return on their investments from profits earned by the business. In a company, the amount invested by the owners is the equity section of the balance sheet. At the end of each reporting period, profit is transferred from the income statement to equity and is accumulated in the retained profits account. Profits can be distributed to the owners as dividends or can be retained in the company

Summary Formula Sheet Return on assets (ROA) is an indicator of how profitable a company is relative to its total assets. Return on assets (ROA) is an indicator of how well a company utilizes its assets in terms of profitability. =average total assets/ average total equity Total assets would mean all the assets of the company or one can take the total asset side of a company's balance sheet. Equity Multiplier is a key financial metric that measures the level of debt financing in a business. = net profit/ average total equity Average total equity = (Total equity this year + Total equity previous year)/2 It indicates the company's return on shareholders' investment. The greater the ratio, the greater the company's return on shareholders' investment. Owners invest in a business to receive a return on their investments from profits earned by the business. In a company, the amount invested by the owners is the equity section of the balance sheet. At the end of each reporting period, profit is transferred from the income statement to equity and is accumulated in the retained profits account. Profits can be distributed to the owners as dividends or can be retained in the company. =REM=ROE Owners invest in a business to receive a return on their investments from profits earned by the business. In a company, the amount invested by the owners is the equity section of the balance sheet. At the end of each reporting period, profit is transferred from the income statement to equity and is accumulated in the retained profits account. Profits can be distributed to the owners as dividends or can be retained in the company Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started