financial derivatives, Could you please help to figure out the correct answers for the last four question (pretty much the same type)? Thanks a lot for your kind help.

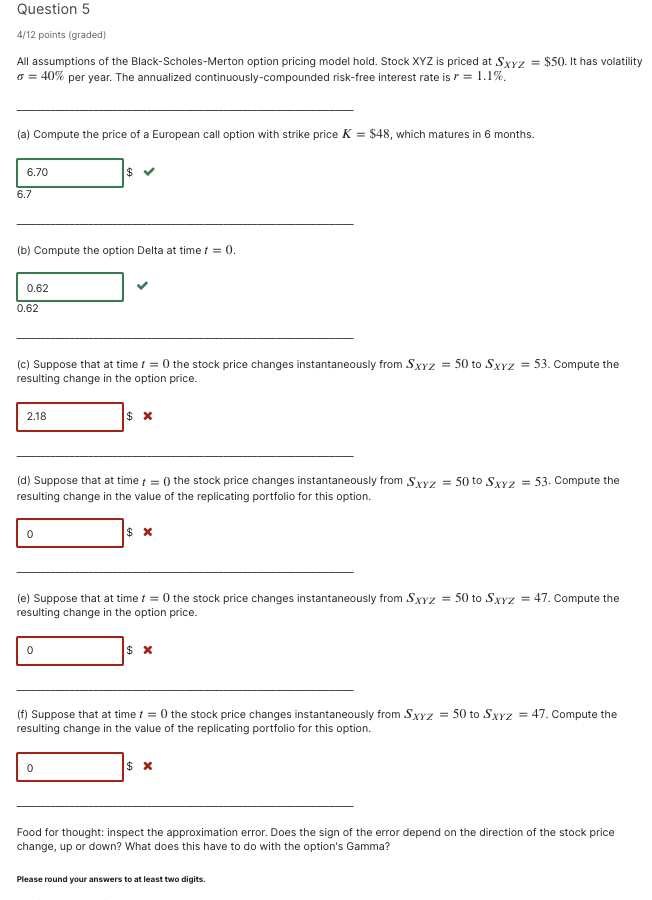

Question 5 4/12 points (graded) All assumptions of the Black-Scholes-Merton option pricing model hold. Stock XYZ is priced at Sxyz o = 40% per year. The annualized continuously-compounded risk-free interest rate is r = 1.1%. = $50. It has volatility (a) Compute the price of a European call option with strike price K = $48, which matures in 6 months. 6.70 $ 6.7 (b) Compute the option Delta at time t = 0. 0.62 0.62 (c) Suppose that at time t = 0 the stock price changes instantaneously from SXyz resulting change in the option price. = 50 to Sxyz = 53. Compute the 2.18 (d) Suppose that at time t = 0) the stock price changes instantaneously from Sxyz = 50 to Sxyz = 53. Compute the resulting change in the value of the replicating portfolio for this option. 0 (e) Suppose that at time t = 0 the stock price changes instantaneously from Sxyz = 50 to Sxyz resulting change in the option price. = 47. Compute the 0 (f) Suppose that at time t = 0 the stock price changes instantaneously from Sxyz = 50 to Sxyz = 47. Compute the resulting change in the value of the replicating portfolio for this option. 0 Food for thought: inspect the approximation error. Does the sign of the error depend on the direction of the stock price change, up or down? What does this have to do with the option's Gamma? Please round your answers to at least two digits. Question 5 4/12 points (graded) All assumptions of the Black-Scholes-Merton option pricing model hold. Stock XYZ is priced at Sxyz o = 40% per year. The annualized continuously-compounded risk-free interest rate is r = 1.1%. = $50. It has volatility (a) Compute the price of a European call option with strike price K = $48, which matures in 6 months. 6.70 $ 6.7 (b) Compute the option Delta at time t = 0. 0.62 0.62 (c) Suppose that at time t = 0 the stock price changes instantaneously from SXyz resulting change in the option price. = 50 to Sxyz = 53. Compute the 2.18 (d) Suppose that at time t = 0) the stock price changes instantaneously from Sxyz = 50 to Sxyz = 53. Compute the resulting change in the value of the replicating portfolio for this option. 0 (e) Suppose that at time t = 0 the stock price changes instantaneously from Sxyz = 50 to Sxyz resulting change in the option price. = 47. Compute the 0 (f) Suppose that at time t = 0 the stock price changes instantaneously from Sxyz = 50 to Sxyz = 47. Compute the resulting change in the value of the replicating portfolio for this option. 0 Food for thought: inspect the approximation error. Does the sign of the error depend on the direction of the stock price change, up or down? What does this have to do with the option's Gamma? Please round your answers to at least two digits