Answered step by step

Verified Expert Solution

Question

1 Approved Answer

financial derivatives - subject briefly pls - I need to submit 1-2 handwritten A4 pages. QUESTION 1 (A) Given the following information, discuss how you

financial derivatives - subject briefly pls - I need to submit 1-2 handwritten A4 pages.

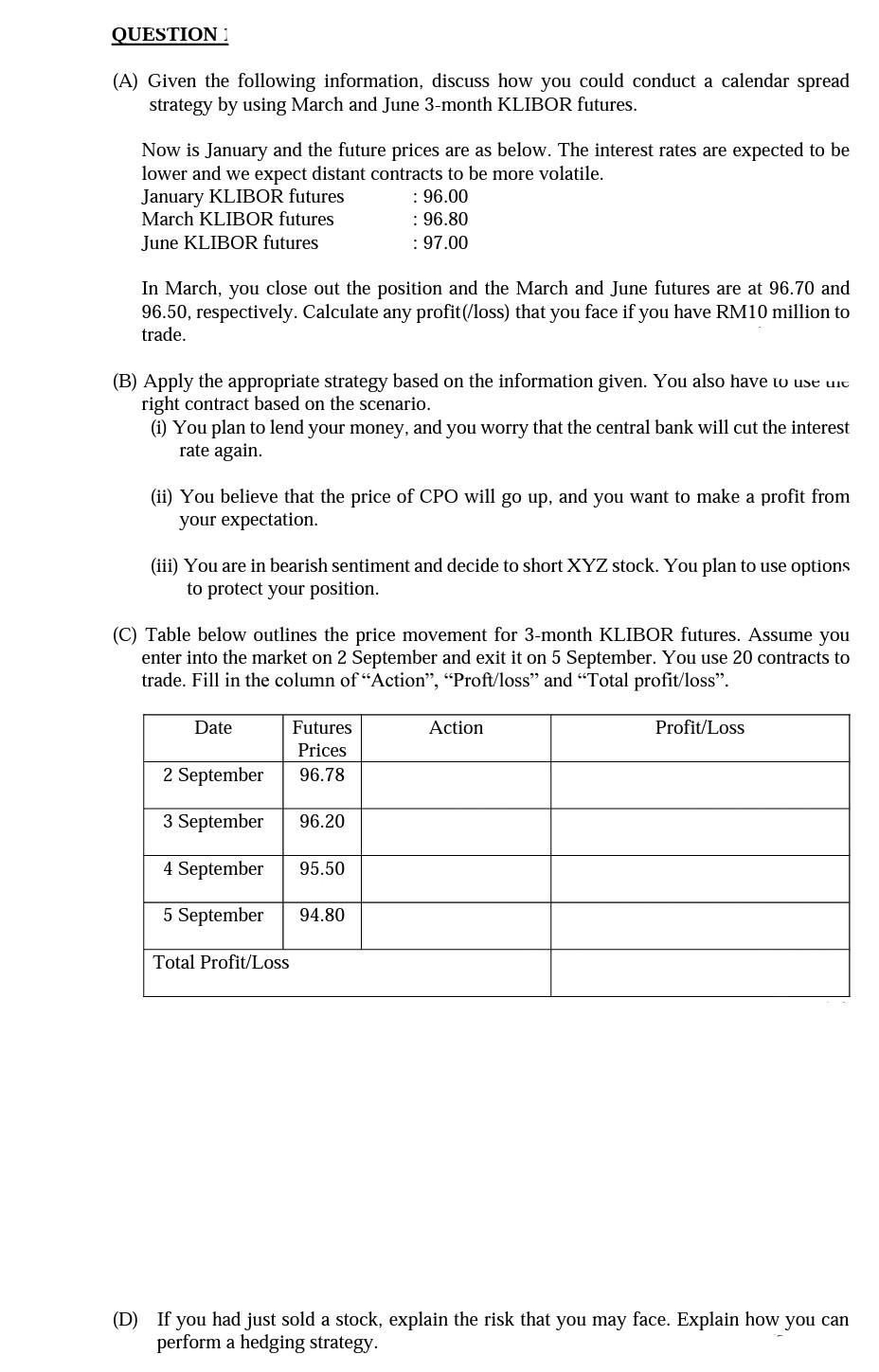

QUESTION 1 (A) Given the following information, discuss how you could conduct a calendar spread strategy by using March and June 3-month KLIBOR futures. Now is January and the future prices are as below. The interest rates are expected to be lower and we expect distant contracts to be more volatile. January KLIBOR futures : 96.00 March KLIBOR futures : 96.80 June KLIBOR futures : 97.00 In March, you close out the position and the March and June futures are at 96.70 and 96.50, respectively. Calculate any profit (/loss) that you face if you have RM10 million to trade. (B) Apply the appropriate strategy based on the information given. You also have to use uit right contract based on the scenario. (i) You plan to lend your money, and you worry that the central bank will cut the interest rate again. (ii) You believe that the price of CPO will go up, and you want to make a profit from your expectation. (iii) You are in bearish sentiment and decide to short XYZ stock. You plan to use options to protect your position. (C) Table below outlines the price movement for 3-month KLIBOR futures. Assume you enter into the market on 2 September and exit it on 5 September. You use 20 contracts to trade. Fill in the column of "Action", "Proft/loss" and "Total profit/loss". Date Action Profit/Loss Futures Prices 2 September 96.78 3 September 96.20 4 September 95.50 5 September 94.80 Total Profit/Loss (D) If you had just sold a stock, explain the risk that you may face. Explain how you can perform a hedging strategy. QUESTION 1 (A) Given the following information, discuss how you could conduct a calendar spread strategy by using March and June 3-month KLIBOR futures. Now is January and the future prices are as below. The interest rates are expected to be lower and we expect distant contracts to be more volatile. January KLIBOR futures : 96.00 March KLIBOR futures : 96.80 June KLIBOR futures : 97.00 In March, you close out the position and the March and June futures are at 96.70 and 96.50, respectively. Calculate any profit (/loss) that you face if you have RM10 million to trade. (B) Apply the appropriate strategy based on the information given. You also have to use uit right contract based on the scenario. (i) You plan to lend your money, and you worry that the central bank will cut the interest rate again. (ii) You believe that the price of CPO will go up, and you want to make a profit from your expectation. (iii) You are in bearish sentiment and decide to short XYZ stock. You plan to use options to protect your position. (C) Table below outlines the price movement for 3-month KLIBOR futures. Assume you enter into the market on 2 September and exit it on 5 September. You use 20 contracts to trade. Fill in the column of "Action", "Proft/loss" and "Total profit/loss". Date Action Profit/Loss Futures Prices 2 September 96.78 3 September 96.20 4 September 95.50 5 September 94.80 Total Profit/Loss (D) If you had just sold a stock, explain the risk that you may face. Explain how you can perform a hedging strategyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started