Answered step by step

Verified Expert Solution

Question

1 Approved Answer

financial derivatives - subject briefly pls - I need to submit 1-2 handwritten A4 pages. QUESTION (A) The curren. stock price is at RM8 with

financial derivatives - subject briefly pls - I need to submit 1-2 handwritten A4 pages.

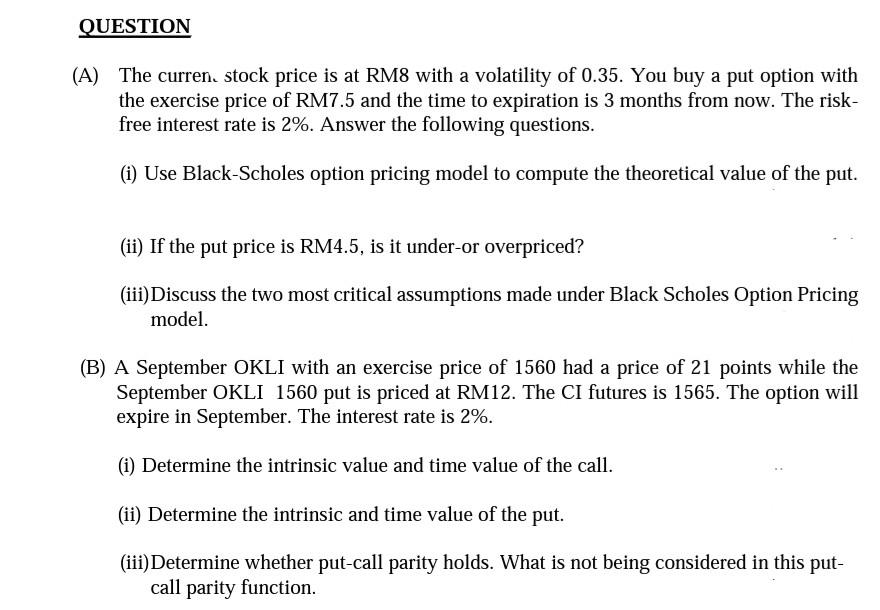

QUESTION (A) The curren. stock price is at RM8 with a volatility of 0.35. You buy a put option with the exercise price of RM7.5 and the time to expiration is 3 months from now. The risk- free interest rate is 2%. Answer the following questions. (i) Use Black-Scholes option pricing model to compute the theoretical value of the put. (ii) If the put price is RM4.5, is it under-or overpriced? (iii) Discuss the two most critical assumptions made under Black Scholes Option Pricing model. (B) A September OKLI with an exercise price of 1560 had a price of 21 points while the September OKLI 1560 put is priced at RM12. The CI futures is 1565. The option will expire in September. The interest rate is 2%. (i) Determine the intrinsic value and time value of the call. (ii) Determine the intrinsic and time value of the put. (iii) Determine whether put-call parity holds. What is not being considered in this put- call parity function. QUESTION (A) The curren. stock price is at RM8 with a volatility of 0.35. You buy a put option with the exercise price of RM7.5 and the time to expiration is 3 months from now. The risk- free interest rate is 2%. Answer the following questions. (i) Use Black-Scholes option pricing model to compute the theoretical value of the put. (ii) If the put price is RM4.5, is it under-or overpriced? (iii) Discuss the two most critical assumptions made under Black Scholes Option Pricing model. (B) A September OKLI with an exercise price of 1560 had a price of 21 points while the September OKLI 1560 put is priced at RM12. The CI futures is 1565. The option will expire in September. The interest rate is 2%. (i) Determine the intrinsic value and time value of the call. (ii) Determine the intrinsic and time value of the put. (iii) Determine whether put-call parity holds. What is not being considered in this put- call parity functionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started