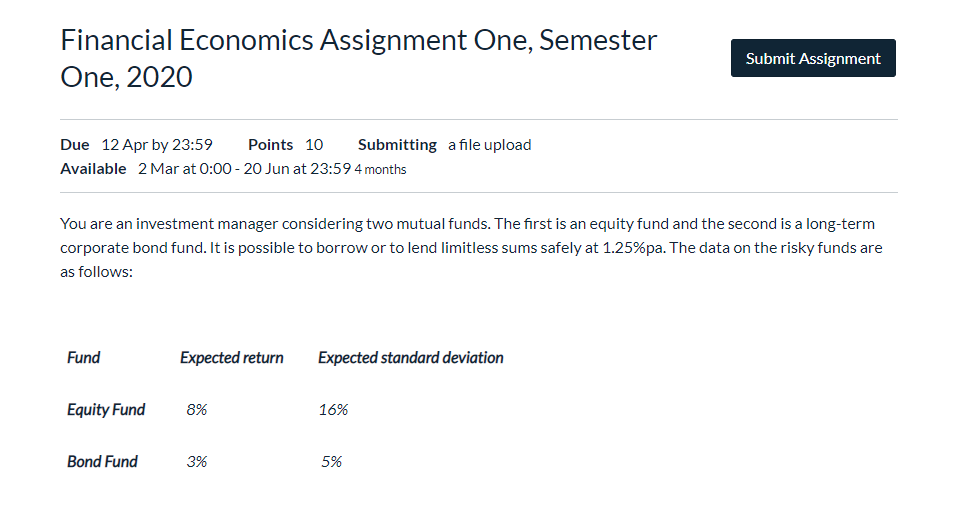

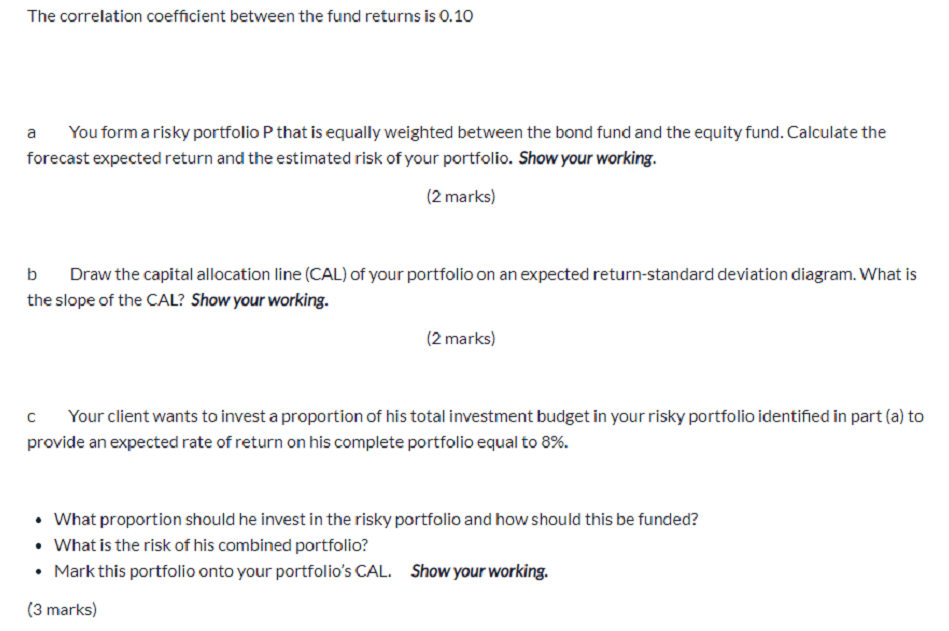

Financial Economics Assignment One, Semester One, 2020 Submit Assignment Due 12 Apr by 23:59 Points 10 Submitting a file upload Available 2 Mar at 0:00 - 20 Jun at 23:59 4 months You are an investment manager considering two mutual funds. The first is an equity fund and the second is a long-term corporate bond fund. It is possible to borrow or to lend limitless sums safely at 1.25%pa. The data on the risky funds are as follows: Fund Expected return Expected standard deviation Equity Fund 8% 16% Bond Fund 3% 5% The correlation coefficient between the fund returns is 0.10 a You forma risky portfolio P that is equally weighted between the bond fund and the equity fund. Calculate the forecast expected return and the estimated risk of your portfolio. Show your working. (2 marks) b Draw the capital allocation line (CAL) of your portfolio on an expected return-standard deviation diagram. What is the slope of the CAL? Show your working. (2 marks) C Your client wants to invest a proportion of his total investment budget in your risky portfolio identified in part (a) to provide an expected rate of return on his complete portfolio equal to 8%. What proportion should he invest in the risky portfolio and how should this be funded? What is the risk of his combined portfolio? Mark this portfolio onto your portfolio's CAL. Show your working. (3 marks) Financial Economics Assignment One, Semester One, 2020 Submit Assignment Due 12 Apr by 23:59 Points 10 Submitting a file upload Available 2 Mar at 0:00 - 20 Jun at 23:59 4 months You are an investment manager considering two mutual funds. The first is an equity fund and the second is a long-term corporate bond fund. It is possible to borrow or to lend limitless sums safely at 1.25%pa. The data on the risky funds are as follows: Fund Expected return Expected standard deviation Equity Fund 8% 16% Bond Fund 3% 5% The correlation coefficient between the fund returns is 0.10 a You forma risky portfolio P that is equally weighted between the bond fund and the equity fund. Calculate the forecast expected return and the estimated risk of your portfolio. Show your working. (2 marks) b Draw the capital allocation line (CAL) of your portfolio on an expected return-standard deviation diagram. What is the slope of the CAL? Show your working. (2 marks) C Your client wants to invest a proportion of his total investment budget in your risky portfolio identified in part (a) to provide an expected rate of return on his complete portfolio equal to 8%. What proportion should he invest in the risky portfolio and how should this be funded? What is the risk of his combined portfolio? Mark this portfolio onto your portfolio's CAL. Show your working