Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Economics ~ Insurance Question 1. (25 Marks) In class we studied an insurance problem in the contingent claims graph. In this question, you are

Financial Economics ~ Insurance

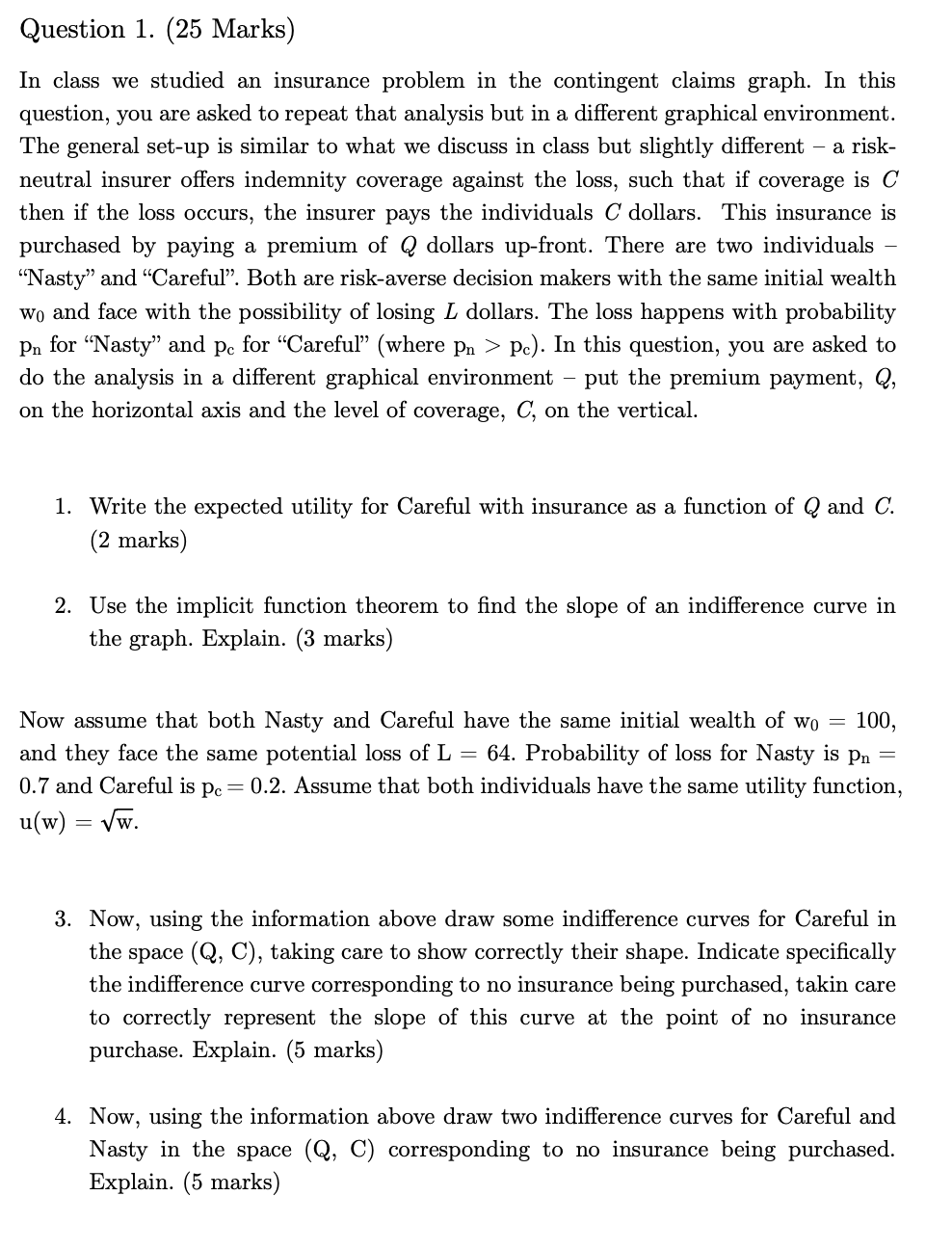

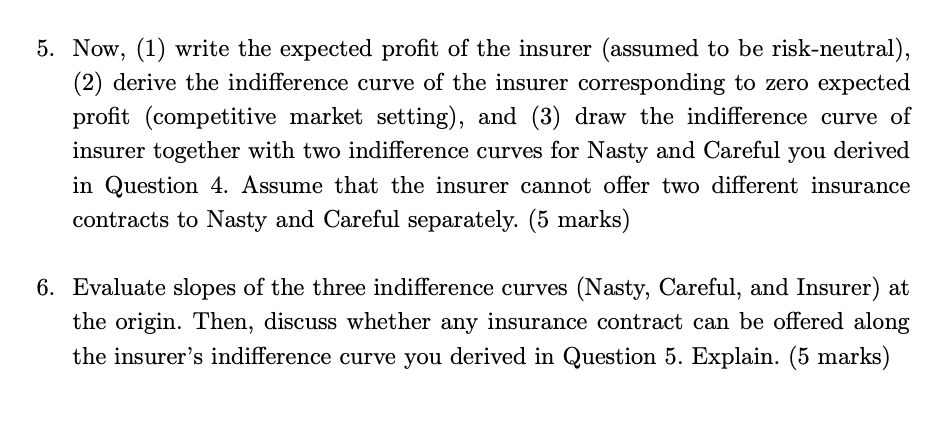

Question 1. (25 Marks) In class we studied an insurance problem in the contingent claims graph. In this question, you are asked to repeat that analysis but in a different graphical environment. The general set-up is similar to what we discuss in class but slightly different - a riskneutral insurer offers indemnity coverage against the loss, such that if coverage is C then if the loss occurs, the insurer pays the individuals C dollars. This insurance is purchased by paying a premium of Q dollars up-front. There are two individuals "Nasty" and "Careful". Both are risk-averse decision makers with the same initial wealth w0 and face with the possibility of losing L dollars. The loss happens with probability pn for "Nasty" and pc for "Careful" (where pn>pc ). In this question, you are asked to do the analysis in a different graphical environment - put the premium payment, Q, on the horizontal axis and the level of coverage, C, on the vertical. 1. Write the expected utility for Careful with insurance as a function of Q and C. (2 marks) 2. Use the implicit function theorem to find the slope of an indifference curve in the graph. Explain. (3 marks) Now assume that both Nasty and Careful have the same initial wealth of w0=100, and they face the same potential loss of L=64. Probability of loss for Nasty is pn= 0.7 and Careful is pc=0.2. Assume that both individuals have the same utility function, u(w)=w. 3. Now, using the information above draw some indifference curves for Careful in the space (Q,C), taking care to show correctly their shape. Indicate specifically the indifference curve corresponding to no insurance being purchased, takin care to correctly represent the slope of this curve at the point of no insurance purchase. Explain. (5 marks) 4. Now, using the information above draw two indifference curves for Careful and Nasty in the space (Q, C) corresponding to no insurance being purchased. Explain. (5 marks) 5. Now, (1) write the expected profit of the insurer (assumed to be risk-neutral), (2) derive the indifference curve of the insurer corresponding to zero expected profit (competitive market setting), and (3) draw the indifference curve of insurer together with two indifference curves for Nasty and Careful you derived in Question 4. Assume that the insurer cannot offer two different insurance contracts to Nasty and Careful separately. (5 marks) 6. Evaluate slopes of the three indifference curves (Nasty, Careful, and Insurer) at the origin. Then, discuss whether any insurance contract can be offered along the insurer's indifference curve you derived in Question 5. Explain

Question 1. (25 Marks) In class we studied an insurance problem in the contingent claims graph. In this question, you are asked to repeat that analysis but in a different graphical environment. The general set-up is similar to what we discuss in class but slightly different - a riskneutral insurer offers indemnity coverage against the loss, such that if coverage is C then if the loss occurs, the insurer pays the individuals C dollars. This insurance is purchased by paying a premium of Q dollars up-front. There are two individuals "Nasty" and "Careful". Both are risk-averse decision makers with the same initial wealth w0 and face with the possibility of losing L dollars. The loss happens with probability pn for "Nasty" and pc for "Careful" (where pn>pc ). In this question, you are asked to do the analysis in a different graphical environment - put the premium payment, Q, on the horizontal axis and the level of coverage, C, on the vertical. 1. Write the expected utility for Careful with insurance as a function of Q and C. (2 marks) 2. Use the implicit function theorem to find the slope of an indifference curve in the graph. Explain. (3 marks) Now assume that both Nasty and Careful have the same initial wealth of w0=100, and they face the same potential loss of L=64. Probability of loss for Nasty is pn= 0.7 and Careful is pc=0.2. Assume that both individuals have the same utility function, u(w)=w. 3. Now, using the information above draw some indifference curves for Careful in the space (Q,C), taking care to show correctly their shape. Indicate specifically the indifference curve corresponding to no insurance being purchased, takin care to correctly represent the slope of this curve at the point of no insurance purchase. Explain. (5 marks) 4. Now, using the information above draw two indifference curves for Careful and Nasty in the space (Q, C) corresponding to no insurance being purchased. Explain. (5 marks) 5. Now, (1) write the expected profit of the insurer (assumed to be risk-neutral), (2) derive the indifference curve of the insurer corresponding to zero expected profit (competitive market setting), and (3) draw the indifference curve of insurer together with two indifference curves for Nasty and Careful you derived in Question 4. Assume that the insurer cannot offer two different insurance contracts to Nasty and Careful separately. (5 marks) 6. Evaluate slopes of the three indifference curves (Nasty, Careful, and Insurer) at the origin. Then, discuss whether any insurance contract can be offered along the insurer's indifference curve you derived in Question 5. Explain Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started