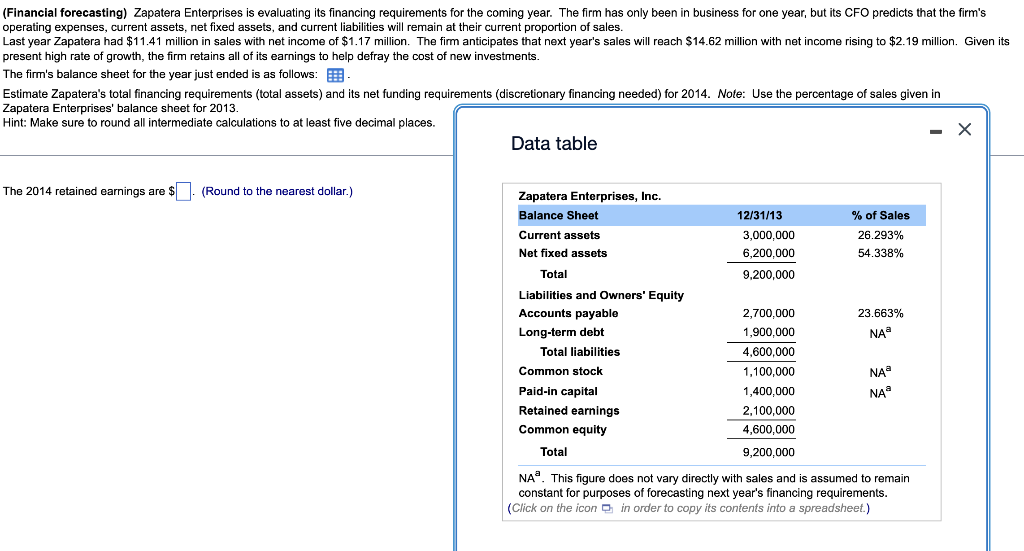

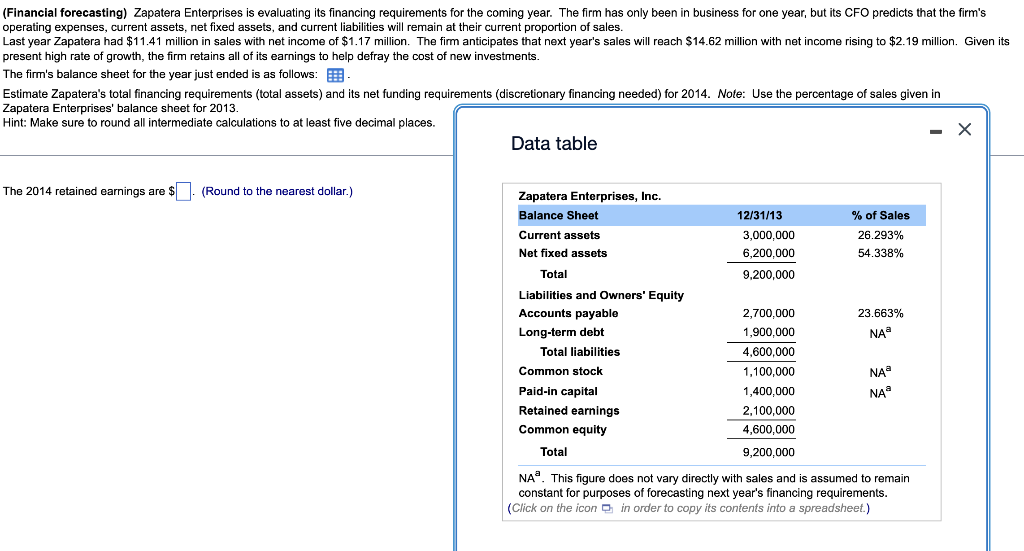

(Financial forecasting) Zapatera Enterprises is evaluating its financing requirements for the coming year. The firm has only been in business for one year, but its CFO predicts that the firm's operating expenses, current assets, net fixed assets, and current liabilities will remain at their current proportion of sales. Last year Zapatera had $11.41 million in sales with net income of $1.17 million. The firm anticipates that next year's sales will reach $14.62 million with net income rising to $2.19 million. Given its present high rate of growth, the firm retains all of its earnings to help defray the cost of new investments. The firm's balance sheet for the year just ended is as follows: Estimate Zapatera's total financing requirements (total assets) and its net funding requirements (discretionary financing needed) for 2014. Note: Use the percentage of sales given in Zapatera Enterprises' balance sheet for 2013. Hint: Make sure to round all intermediate calculations to at least five decimal places. Data table The 2014 retained earnings are $ (Round to the nearest dollar.) NA a. This figure does not vary directly with sales and is assumed to remain constant for purposes of forecasting next year's financing requirements. (Click on the icon p in order to copy its contents into a spreadsheet.) (Financial forecasting) Zapatera Enterprises is evaluating its financing requirements for the coming year. The firm has only been in business for one year, but its CFO predicts that the firm's operating expenses, current assets, net fixed assets, and current liabilities will remain at their current proportion of sales. Last year Zapatera had $11.41 million in sales with net income of $1.17 million. The firm anticipates that next year's sales will reach $14.62 million with net income rising to $2.19 million. Given its present high rate of growth, the firm retains all of its earnings to help defray the cost of new investments. The firm's balance sheet for the year just ended is as follows: Estimate Zapatera's total financing requirements (total assets) and its net funding requirements (discretionary financing needed) for 2014. Note: Use the percentage of sales given in Zapatera Enterprises' balance sheet for 2013. Hint: Make sure to round all intermediate calculations to at least five decimal places. Data table The 2014 retained earnings are $ (Round to the nearest dollar.) NA a. This figure does not vary directly with sales and is assumed to remain constant for purposes of forecasting next year's financing requirements. (Click on the icon p in order to copy its contents into a spreadsheet.)