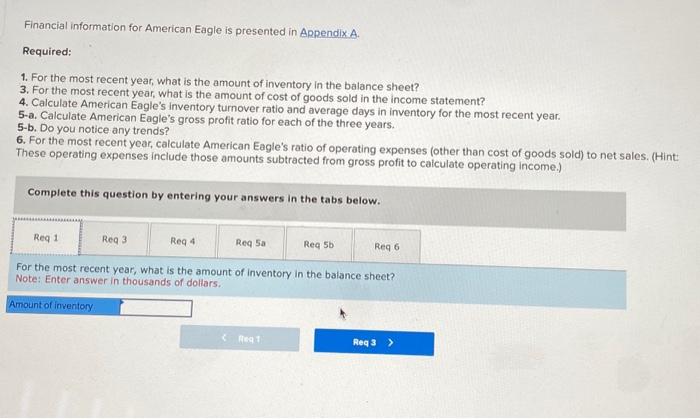

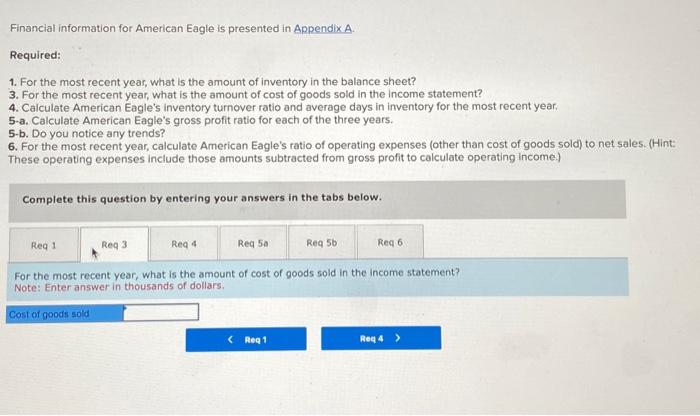

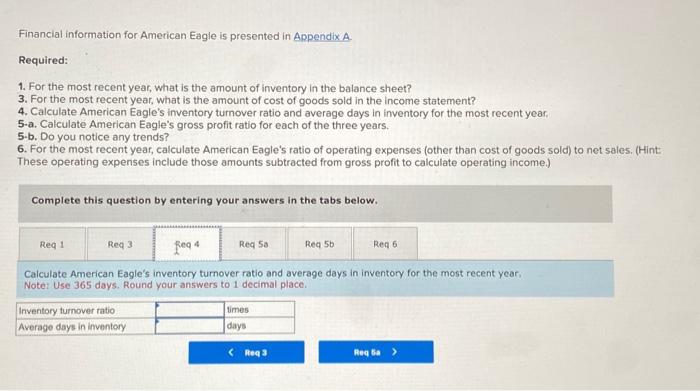

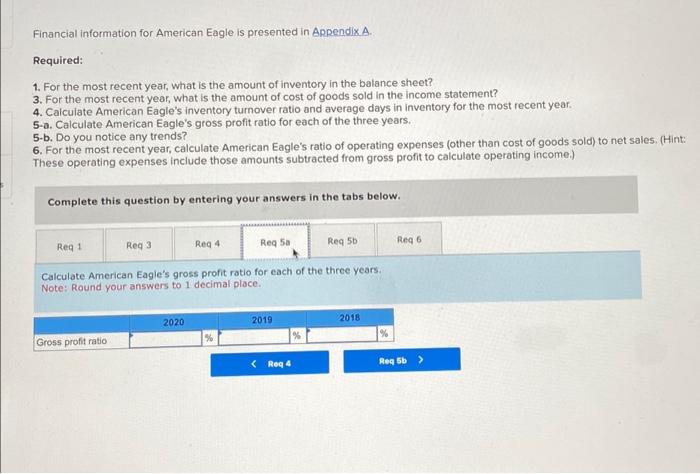

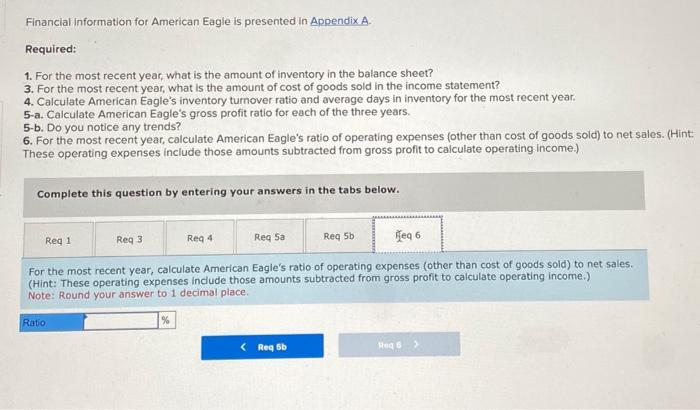

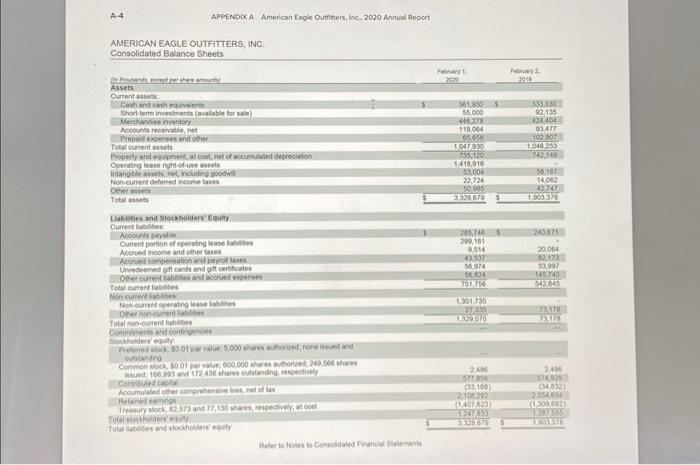

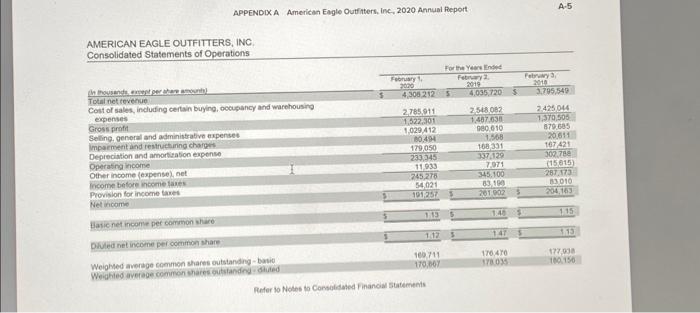

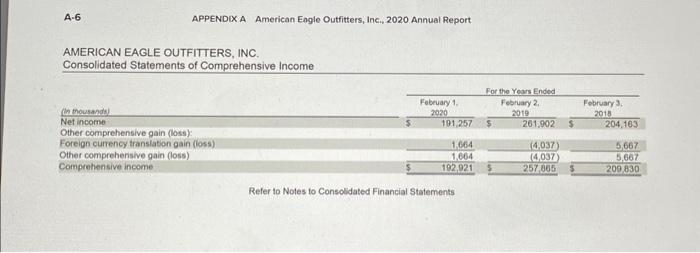

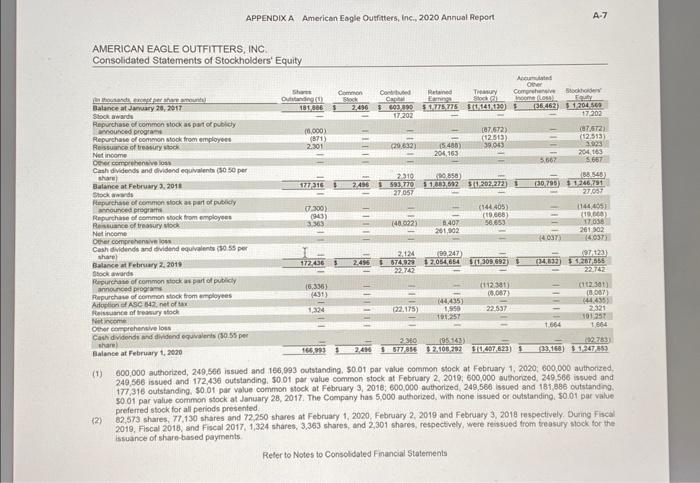

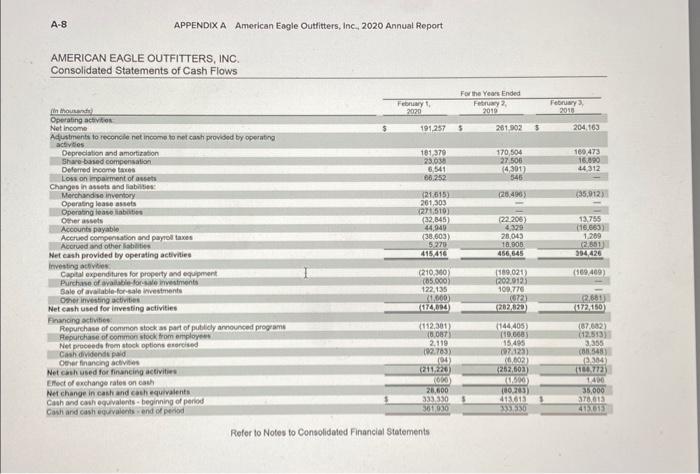

Financial information for American Eagle is presented in Appendix A. Required: 1. For the most recent year, what is the amount of inventory in the balance sheet? 3. For the most recent year, what is the amount of cost of goods sold in the income statement? 4. Calculate American Eagle's inventory turnover ratio and average days in inventory for the most recent year. 5-a. Calculate American Eagle's gross profit ratio for each of the three years. 5-b. Do you notice any trends? 6. For the most recent year, calculate American Eagle's ratio of operating expenses (other than cost of goods sold) to net sales. (Hint: These operating expenses include those amounts subtracted from gross profit to calculate operating income.) Complete this question by entering your answers in the tabs below. Calculate American Eagle's inventory tumover ratio and average days in inventory for the most recent year: Note: Use 365 days. Round your answers to 1 decimal place. Financial information for American Eagle is presented in Appendix. A. Required: 1. For the most recent year, what is the amount of inventory in the balance sheet? 3. For the most recent year, what is the amount of cost of goods sold in the income statement? 4. Calculate American Eagle's inventory turnover ratio and average days in inventory for the most recent year. 5-a. Calculate American Eagle's gross profit ratio for each of the three years. 5-b. Do you notice any trends? 6. For the most recent year, calculate American Eagle's ratio of operating expenses (other than cost of goods sold) to net sales. (Hint: These operating expenses include those amounts subtracted from gross profit to caiculate operating income.) Complete this question by entering your answers in the tabs below. For the most recent year, what is the amount of inventory in the balance sheet? Note: Enter answer in thousands of dollars. A.6 APPENDIX A American Engle Outfitters, Inc., 2020 Annual Report AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Comprehensive Income Refer to Notes to Consolidated Financial Statements Financial information for American Eagle is presented in Appendix A. Required: 1. For the most recent year, what is the amount of inventory in the balance sheet? 3. For the most recent year, what is the amount of cost of goods sold in the income statement? 4. Calculate American Eagle's inventory turnover ratio and average days in inventory for the most recent year. 5-a. Calculate American Eagle's gross profit ratio for each of the three years. 5-b. Do you notice any trends? 6. For the most recent year, calculate American Eagle's ratio of operating expenses (other than cost of goods sold) to net sales. (Hint: These operating expenses include those amounts subtracted from gross profit to calculate operating income.) Complete this question by entering your answers in the tabs below. Calculate American Eagle's gross profit ratio for each of the three years. Note: Round your answers to 1 decimal place. Financial information for American Eagle is presented in Appendix A. Required: 1. For the most recent year, what is the amount of inventory in the balance sheet? 3. For the most recent year, what is the amount of cost of goods sold in the income statement? 4. Calculate American Eagle's inventory turnover ratio and average days in inventory for the most recent year. 5-a. Calculate American Eagle's gross profit ratio for each of the three years. 5-b. Do you notice any trends? 6. For the most recent year, calculate American Eagle's ratio of operating expenses (other than cost of goods sold) to net sales. These operating expenses include those amounts subtracted from gross profit to calculate operating income.) Complete this question by entering your answers in the tabs below. For the most recent year, calculate American Eagle's ratio of operating expenses (other than cost of goods sold) to net sales. (Hint: These operating expenses include those amounts subtracted from gross profit to calculate operating income.) Note: Round your answer to 1 decimal place. A-8 APPENDIX A American Eagle Outlitters, Inc, 2020 Annual Report AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Cash Flows Rofor to Notes to Consolidated Financial Statements APPENOIXA American Eagle Outfitters, Inc, 2020 Annual Report Financial information for American Eagle is presented in Appendix A. Required: 1. For the most recent year, what is the amount of inventory in the balance sheet? 3. For the most recent year, what is the amount of cost of goods sold in the income statement? 4. Calculate American Eagle's inventory turnover ratio and average days in inventory for the most recent year. 5-a. Calculate American Eagle's gross profit ratio for each of the three years. 5-b. Do you notice any trends? 6. For the most recent year, calculate American Eagle's ratio of operating expenses (other than cost of goods sold) to net sales. (Hint These operating expenses include those amounts subtracted from gross profit to calculate operating income.) Complete this question by entering your answers in the tabs below. For the most recent year, what is the amount of cost of goods sold in the income statement? Note: Enter answer in thousands of dollars. APPENBXX A American Eagle Outriers, loc, 2020 Annuai Report TFITTERS; INC: APPENDIX A American Eagle Ousfitters, inc, 2020 Annual Report A.7 AMERICAN EAGLE OUTFITTERS, INC. (1) 600,000 authorized, 249,566 issued and 166,993 outstanding, 50.01 par valke common stock at February 1, 2020; 600,000 authorized. 249,566 issued and 172,436 outstanding. 50.01 par value common stock at February 2, 2019; 600,000 authorzed, 249,566 issued and 177,316 outstanding. 50.01 par value common sock at February 3, 2018; 600,000 authorized, 248,566 issued and 181,886 outstanding. 5001 par value common stock at January 28, 2017. The Company has 5,000 authorized. With none issued or oulstancing, $0.01 par vafue preferted stock for all periods presented. (2) 82,573 shares, 77,130 shares and 72,250 shares at February 1, 2020. February 2, 2019 and February 3,2018 respectrvely, During Fiscal issuance of share-based payments Reler to Notes to Consolidated Financial Statements Financial information for American Eagle is presented in Appendix A. Required: 1. For the most recent year, what is the amount of inventory in the balance sheet? 3. For the most recent year, what is the amount of cost of goods sold in the income statement? 4. Calculate American Eagle's inventory turnover ratio and average days in inventory for the most recent year. 5-a. Calculate American Eagle's gross profit ratio for each of the three years. 5-b. Do you notice any trends? 6. For the most recent year, calculate American Eagle's ratio of operating expenses (other than cost of goods sold) to net sales. (Hint: These operating expenses include those amounts subtracted from gross profit to calculate operating income.) Complete this question by entering your answers in the tabs below. Calculate American Eagle's inventory tumover ratio and average days in inventory for the most recent year: Note: Use 365 days. Round your answers to 1 decimal place. Financial information for American Eagle is presented in Appendix. A. Required: 1. For the most recent year, what is the amount of inventory in the balance sheet? 3. For the most recent year, what is the amount of cost of goods sold in the income statement? 4. Calculate American Eagle's inventory turnover ratio and average days in inventory for the most recent year. 5-a. Calculate American Eagle's gross profit ratio for each of the three years. 5-b. Do you notice any trends? 6. For the most recent year, calculate American Eagle's ratio of operating expenses (other than cost of goods sold) to net sales. (Hint: These operating expenses include those amounts subtracted from gross profit to caiculate operating income.) Complete this question by entering your answers in the tabs below. For the most recent year, what is the amount of inventory in the balance sheet? Note: Enter answer in thousands of dollars. A.6 APPENDIX A American Engle Outfitters, Inc., 2020 Annual Report AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Comprehensive Income Refer to Notes to Consolidated Financial Statements Financial information for American Eagle is presented in Appendix A. Required: 1. For the most recent year, what is the amount of inventory in the balance sheet? 3. For the most recent year, what is the amount of cost of goods sold in the income statement? 4. Calculate American Eagle's inventory turnover ratio and average days in inventory for the most recent year. 5-a. Calculate American Eagle's gross profit ratio for each of the three years. 5-b. Do you notice any trends? 6. For the most recent year, calculate American Eagle's ratio of operating expenses (other than cost of goods sold) to net sales. (Hint: These operating expenses include those amounts subtracted from gross profit to calculate operating income.) Complete this question by entering your answers in the tabs below. Calculate American Eagle's gross profit ratio for each of the three years. Note: Round your answers to 1 decimal place. Financial information for American Eagle is presented in Appendix A. Required: 1. For the most recent year, what is the amount of inventory in the balance sheet? 3. For the most recent year, what is the amount of cost of goods sold in the income statement? 4. Calculate American Eagle's inventory turnover ratio and average days in inventory for the most recent year. 5-a. Calculate American Eagle's gross profit ratio for each of the three years. 5-b. Do you notice any trends? 6. For the most recent year, calculate American Eagle's ratio of operating expenses (other than cost of goods sold) to net sales. These operating expenses include those amounts subtracted from gross profit to calculate operating income.) Complete this question by entering your answers in the tabs below. For the most recent year, calculate American Eagle's ratio of operating expenses (other than cost of goods sold) to net sales. (Hint: These operating expenses include those amounts subtracted from gross profit to calculate operating income.) Note: Round your answer to 1 decimal place. A-8 APPENDIX A American Eagle Outlitters, Inc, 2020 Annual Report AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Cash Flows Rofor to Notes to Consolidated Financial Statements APPENOIXA American Eagle Outfitters, Inc, 2020 Annual Report Financial information for American Eagle is presented in Appendix A. Required: 1. For the most recent year, what is the amount of inventory in the balance sheet? 3. For the most recent year, what is the amount of cost of goods sold in the income statement? 4. Calculate American Eagle's inventory turnover ratio and average days in inventory for the most recent year. 5-a. Calculate American Eagle's gross profit ratio for each of the three years. 5-b. Do you notice any trends? 6. For the most recent year, calculate American Eagle's ratio of operating expenses (other than cost of goods sold) to net sales. (Hint These operating expenses include those amounts subtracted from gross profit to calculate operating income.) Complete this question by entering your answers in the tabs below. For the most recent year, what is the amount of cost of goods sold in the income statement? Note: Enter answer in thousands of dollars. APPENBXX A American Eagle Outriers, loc, 2020 Annuai Report TFITTERS; INC: APPENDIX A American Eagle Ousfitters, inc, 2020 Annual Report A.7 AMERICAN EAGLE OUTFITTERS, INC. (1) 600,000 authorized, 249,566 issued and 166,993 outstanding, 50.01 par valke common stock at February 1, 2020; 600,000 authorized. 249,566 issued and 172,436 outstanding. 50.01 par value common stock at February 2, 2019; 600,000 authorzed, 249,566 issued and 177,316 outstanding. 50.01 par value common sock at February 3, 2018; 600,000 authorized, 248,566 issued and 181,886 outstanding. 5001 par value common stock at January 28, 2017. The Company has 5,000 authorized. With none issued or oulstancing, $0.01 par vafue preferted stock for all periods presented. (2) 82,573 shares, 77,130 shares and 72,250 shares at February 1, 2020. February 2, 2019 and February 3,2018 respectrvely, During Fiscal issuance of share-based payments Reler to Notes to Consolidated Financial Statements