Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial information for American Eagle is presented in Appendix A, and financial information for Buckle is presented in Appendix B. Required: 1-a. Calculate the following

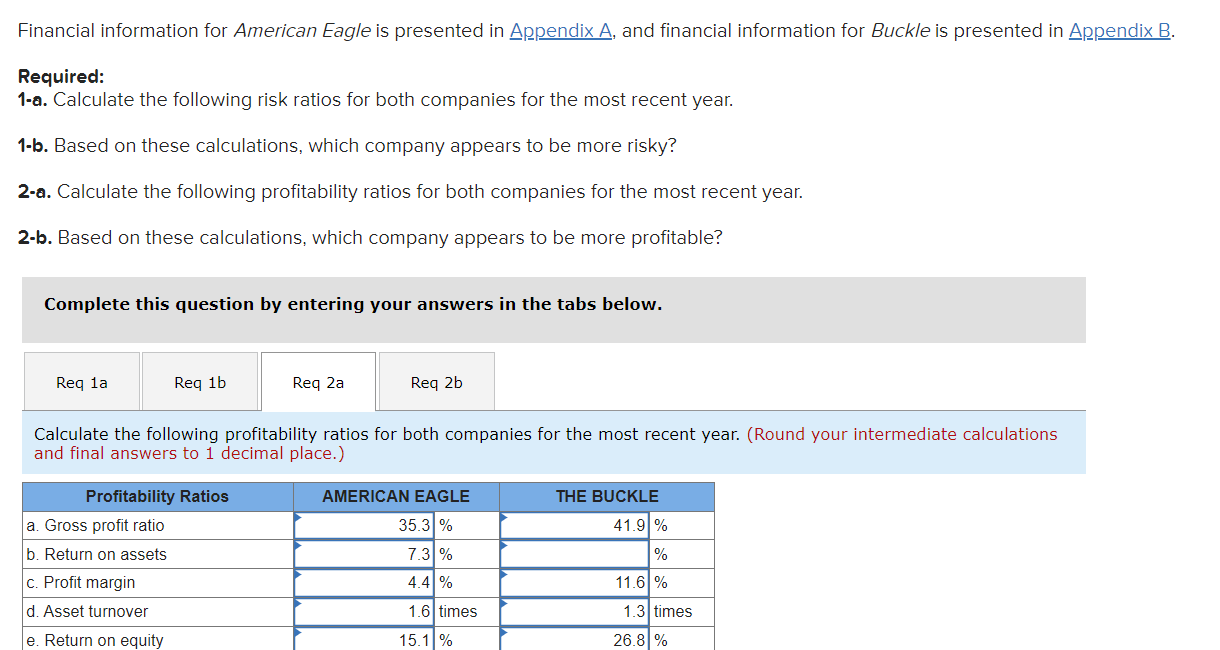

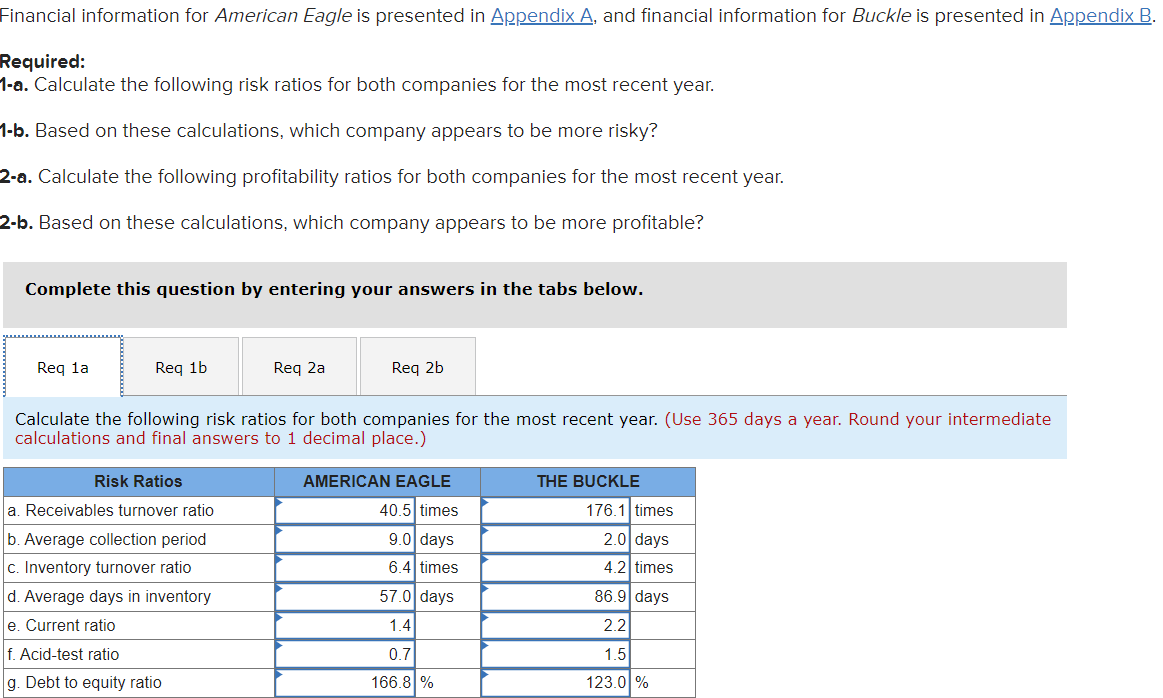

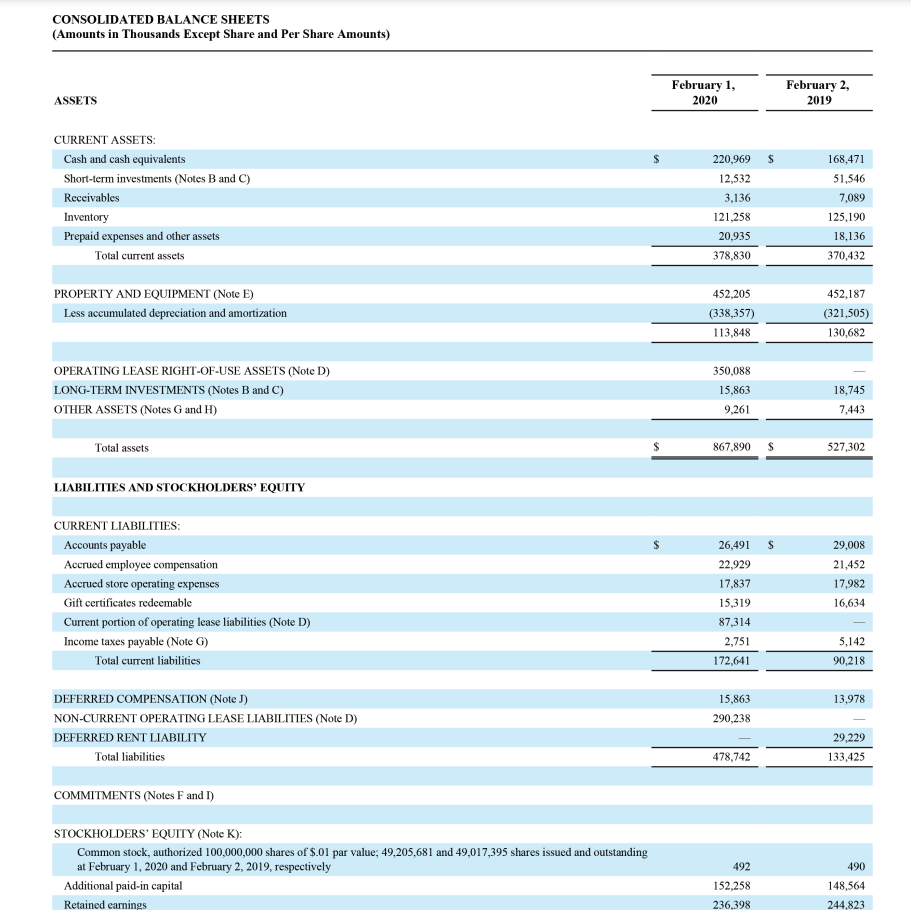

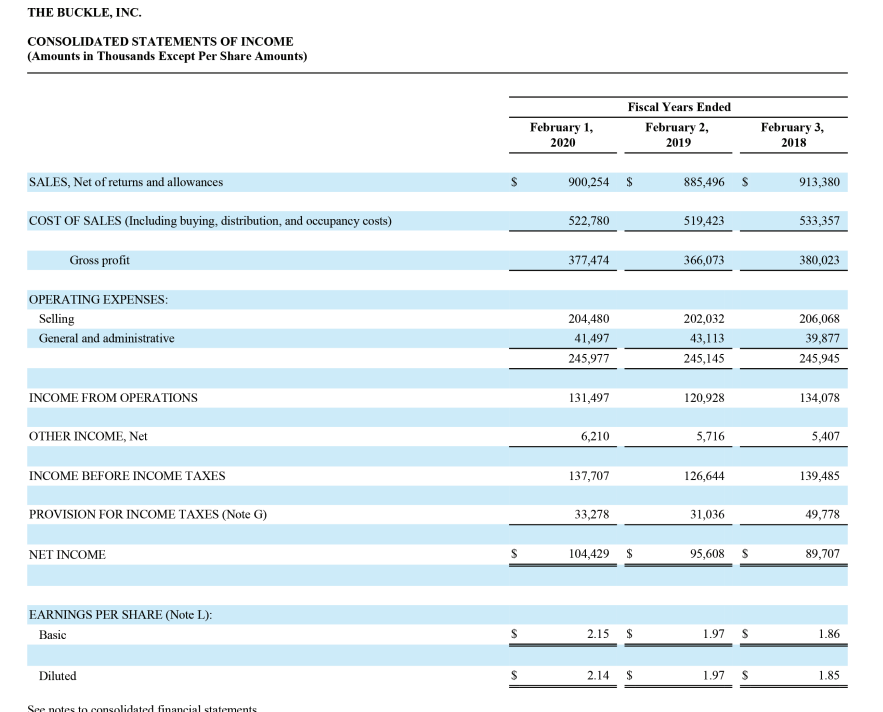

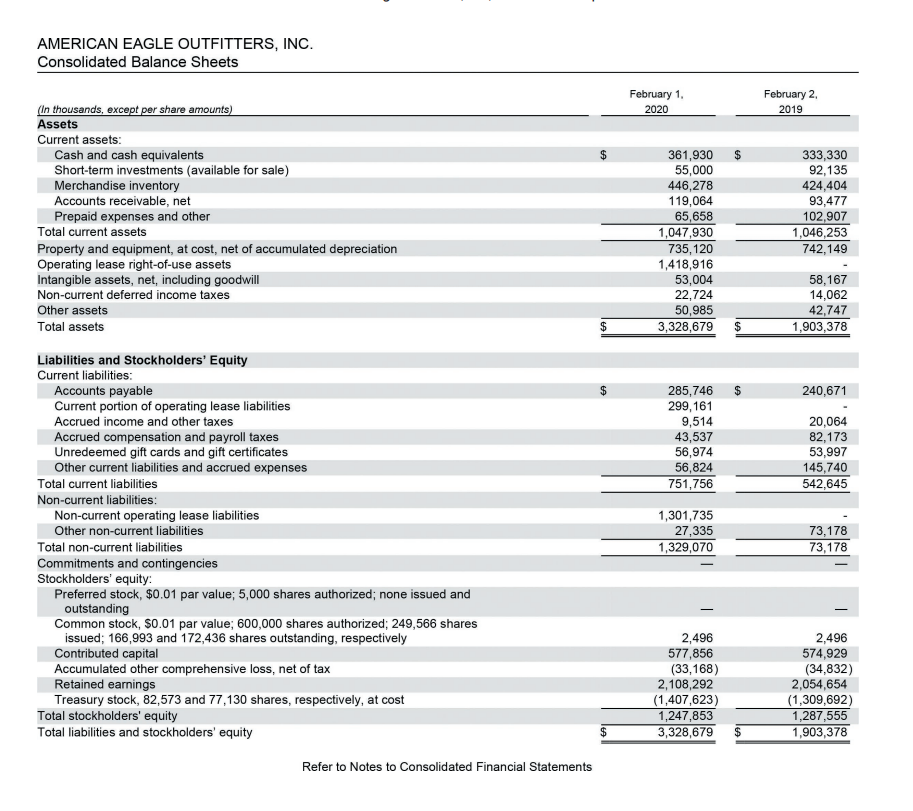

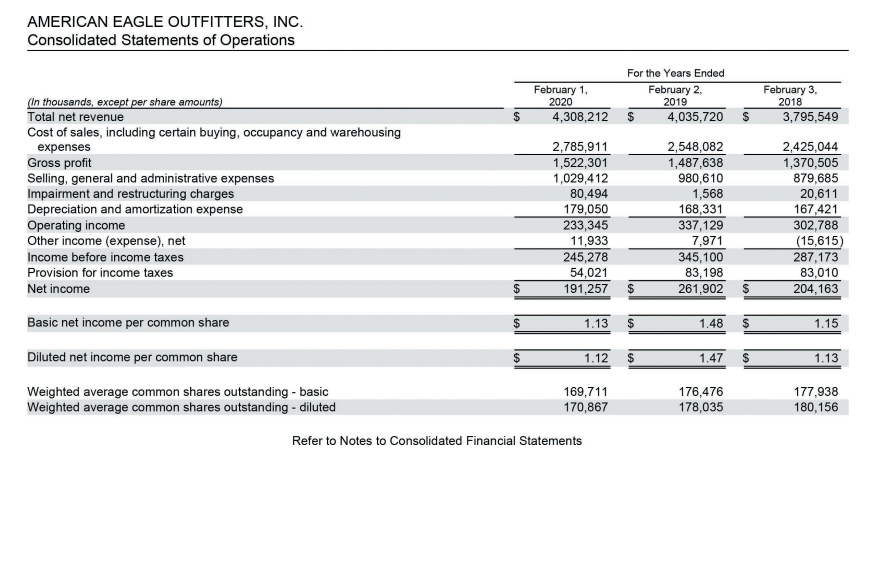

Financial information for American Eagle is presented in Appendix A, and financial information for Buckle is presented in Appendix B. Required: 1-a. Calculate the following risk ratios for both companies for the most recent year. 1-b. Based on these calculations, which company appears to be more risky? 2-a. Calculate the following profitability ratios for both companies for the most recent year. 2-b. Based on these calculations, which company appears to be more profitable? Complete this question by entering your answers in the tabs below. Calculate the following profitability ratios for both companies for the most recent year. (Round your intermediate calculations and final answers to 1 decimal place.) Financial information for American Eagle is presented in Appendix A, and financial information for Buckle is presented in Appendix Required: -a. Calculate the following risk ratios for both companies for the most recent year. -b. Based on these calculations, which company appears to be more risky? 2-a. Calculate the following profitability ratios for both companies for the most recent year. 2-b. Based on these calculations, which company appears to be more profitable? Complete this question by entering your answers in the tabs below. Calculate the following risk ratios for both companies for the most recent year. (Use 365 days a year. Round your intermediate calculations and final answers to 1 decimal place.) CONSOLIDATED BALANCE SHEETS (Amounts in Thousands Except Share and Per Share Amounts) ASSETS \begin{tabular}{cc} \hline February 1, & February 2, \\ 2020 & 2019 \\ \hline \end{tabular} CURRENT ASSETS: \begin{tabular}{|c|c|c|c|c|} \hline Cash and cash equivalents & $ & 220,969 & $ & 168,471 \\ \hline Short-term investments (Notes B and C) & & 12,532 & & 51,546 \\ \hline Receivables & & 3,136 & & 7,089 \\ \hline Inventory & & 121,258 & & 125,190 \\ \hline Prepaid expenses and other assets & & 20,935 & & 18,136 \\ \hline Total current assets & & 378,830 & & 370,432 \\ \hline PROPERTY AND EQUIPMENT (Note E) & & 452,205 & & 452,187 \\ \hline \multirow[t]{2}{*}{ Less accumulated depreciation and amortization } & & (338,357) & & (321,505) \\ \hline & & 113,848 & & 130,682 \\ \hline OPERATING LEASE RIGHT-OF-USE ASSETS (Note D) & & 350,088 & & - \\ \hline LONG-TERM INVESTMENTS (Notes B and C) & & 15,863 & & 18,745 \\ \hline OTHER ASSETS (Notes G and H ) & & 9,261 & & 7,443 \\ \hline Total assets & $ & 867,890 & $ & 527,302 \\ \hline \end{tabular} LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES: \begin{tabular}{|c|c|c|} \hline Accounts payable & 26,491 & 29,008 \\ \hline Accrued employee compensation & 22,929 & 21,452 \\ \hline Accrued store operating expenses & 17,837 & 17,982 \\ \hline Gift certificates redecmable & 15,319 & 16,634 \\ \hline Current portion of operating lease liabilities (Note D) & 87,314 & - \\ \hline Income taxes payable (Note G) & 2,751 & 5,142 \\ \hline Total current liabilities & 172,641 & 90,218 \\ \hline DEFERRED COMPENSATION (Note J) & 15,863 & 13,978 \\ \hline NON-CURRENT OPERATING LEASE LIABILITIES (Note D) & 290,238 & - \\ \hline DEFERRED RENT LIABILITY & - & 29,229 \\ \hline Total liabilities & 478,742 & 133,425 \\ \hline \multicolumn{3}{|l|}{ COMMITMENTS (Notes F and I) } \\ \hline \multicolumn{3}{|l|}{ STOCKHOLDERS' EQUITY (Note K): } \\ \hline \begin{tabular}{l} Common stock, authorized 100,000,000 shares of $.01 par value; 49,205,681 and 49,017,395 shares issued and outstanding \\ at February 1, 2020 and February 2,2019, respectively \end{tabular} & 492 & 490 \\ \hline Additional paid-in capital & 152,258 & 148,564 \\ \hline Retained earnings & 236,398 & 244,823 \\ \hline \end{tabular} THE BUCKLE, INC. CONSOLIDATED STATEMENTS OF INCOME (Amounts in Thousands Except Per Share Amounts) AMERICAN EAGLE OUTFITTERS. INC. AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Operations Refer to Notes to Consolidated Financial Statements

Financial information for American Eagle is presented in Appendix A, and financial information for Buckle is presented in Appendix B. Required: 1-a. Calculate the following risk ratios for both companies for the most recent year. 1-b. Based on these calculations, which company appears to be more risky? 2-a. Calculate the following profitability ratios for both companies for the most recent year. 2-b. Based on these calculations, which company appears to be more profitable? Complete this question by entering your answers in the tabs below. Calculate the following profitability ratios for both companies for the most recent year. (Round your intermediate calculations and final answers to 1 decimal place.) Financial information for American Eagle is presented in Appendix A, and financial information for Buckle is presented in Appendix Required: -a. Calculate the following risk ratios for both companies for the most recent year. -b. Based on these calculations, which company appears to be more risky? 2-a. Calculate the following profitability ratios for both companies for the most recent year. 2-b. Based on these calculations, which company appears to be more profitable? Complete this question by entering your answers in the tabs below. Calculate the following risk ratios for both companies for the most recent year. (Use 365 days a year. Round your intermediate calculations and final answers to 1 decimal place.) CONSOLIDATED BALANCE SHEETS (Amounts in Thousands Except Share and Per Share Amounts) ASSETS \begin{tabular}{cc} \hline February 1, & February 2, \\ 2020 & 2019 \\ \hline \end{tabular} CURRENT ASSETS: \begin{tabular}{|c|c|c|c|c|} \hline Cash and cash equivalents & $ & 220,969 & $ & 168,471 \\ \hline Short-term investments (Notes B and C) & & 12,532 & & 51,546 \\ \hline Receivables & & 3,136 & & 7,089 \\ \hline Inventory & & 121,258 & & 125,190 \\ \hline Prepaid expenses and other assets & & 20,935 & & 18,136 \\ \hline Total current assets & & 378,830 & & 370,432 \\ \hline PROPERTY AND EQUIPMENT (Note E) & & 452,205 & & 452,187 \\ \hline \multirow[t]{2}{*}{ Less accumulated depreciation and amortization } & & (338,357) & & (321,505) \\ \hline & & 113,848 & & 130,682 \\ \hline OPERATING LEASE RIGHT-OF-USE ASSETS (Note D) & & 350,088 & & - \\ \hline LONG-TERM INVESTMENTS (Notes B and C) & & 15,863 & & 18,745 \\ \hline OTHER ASSETS (Notes G and H ) & & 9,261 & & 7,443 \\ \hline Total assets & $ & 867,890 & $ & 527,302 \\ \hline \end{tabular} LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES: \begin{tabular}{|c|c|c|} \hline Accounts payable & 26,491 & 29,008 \\ \hline Accrued employee compensation & 22,929 & 21,452 \\ \hline Accrued store operating expenses & 17,837 & 17,982 \\ \hline Gift certificates redecmable & 15,319 & 16,634 \\ \hline Current portion of operating lease liabilities (Note D) & 87,314 & - \\ \hline Income taxes payable (Note G) & 2,751 & 5,142 \\ \hline Total current liabilities & 172,641 & 90,218 \\ \hline DEFERRED COMPENSATION (Note J) & 15,863 & 13,978 \\ \hline NON-CURRENT OPERATING LEASE LIABILITIES (Note D) & 290,238 & - \\ \hline DEFERRED RENT LIABILITY & - & 29,229 \\ \hline Total liabilities & 478,742 & 133,425 \\ \hline \multicolumn{3}{|l|}{ COMMITMENTS (Notes F and I) } \\ \hline \multicolumn{3}{|l|}{ STOCKHOLDERS' EQUITY (Note K): } \\ \hline \begin{tabular}{l} Common stock, authorized 100,000,000 shares of $.01 par value; 49,205,681 and 49,017,395 shares issued and outstanding \\ at February 1, 2020 and February 2,2019, respectively \end{tabular} & 492 & 490 \\ \hline Additional paid-in capital & 152,258 & 148,564 \\ \hline Retained earnings & 236,398 & 244,823 \\ \hline \end{tabular} THE BUCKLE, INC. CONSOLIDATED STATEMENTS OF INCOME (Amounts in Thousands Except Per Share Amounts) AMERICAN EAGLE OUTFITTERS. INC. AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Operations Refer to Notes to Consolidated Financial Statements Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started