Question

You are buying an investment property. It is November 15th. You get the following information from the seller: He says he gets rent of

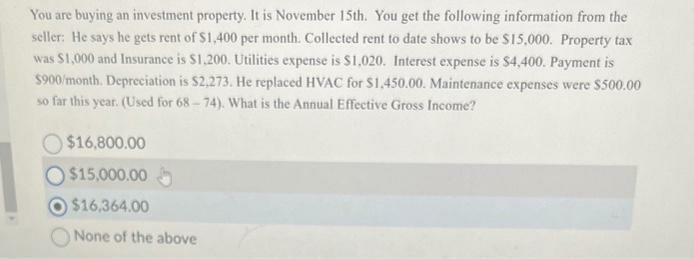

You are buying an investment property. It is November 15th. You get the following information from the seller: He says he gets rent of $1,400 per month. Collected rent to date shows to be $15,000. Property tax was $1,000 and Insurance is $1,200. Utilities expense is $1,020. Interest expense is $4,400. Payment is $900/month. Depreciation is $2,273. He replaced HVAC for $1,450.00. Maintenance expenses were $500.00 so far this year. (Used for 68-74). What is the Annual Effective Gross Income? $16,800.00 $15,000.00 $16,364.00 None of the above

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

The answer is c 16364 explain using calculations 1400 ren...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: J. David Spiceland, Wayne Thomas, Don Herrmann

3rd edition

9780077506902, 78025540, 77506901, 978-0078025549

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App