Answered step by step

Verified Expert Solution

Question

1 Approved Answer

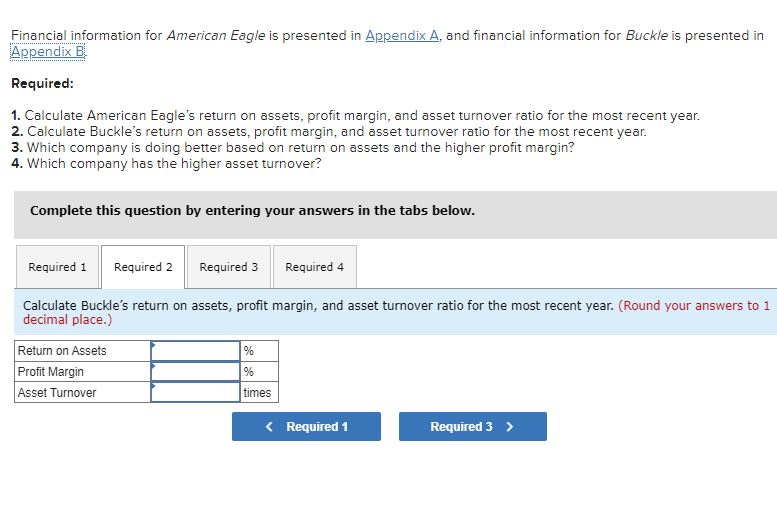

Financial information for American Eagle is presented in Appendix A, and financial information for Buckle is presented in Required: 1. Calculate American Eagle's return on

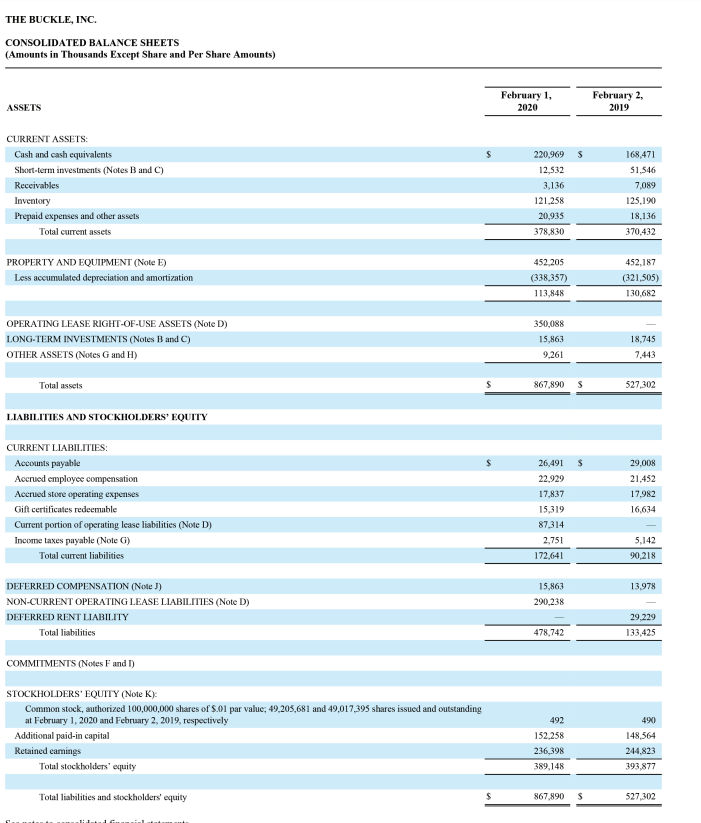

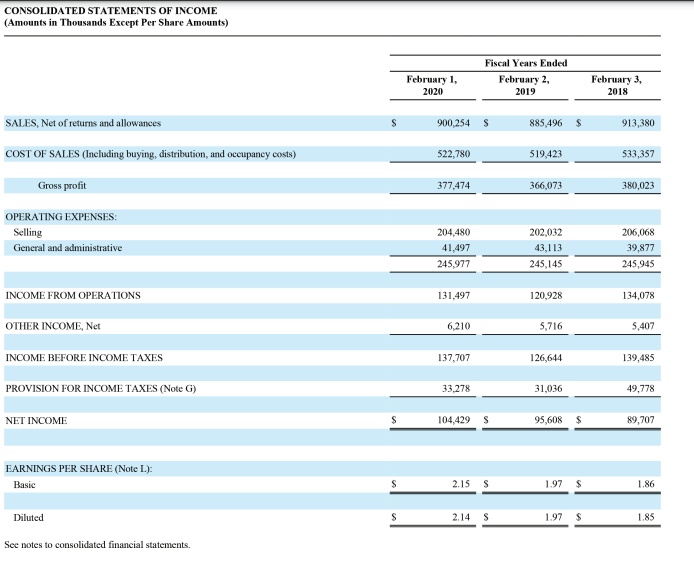

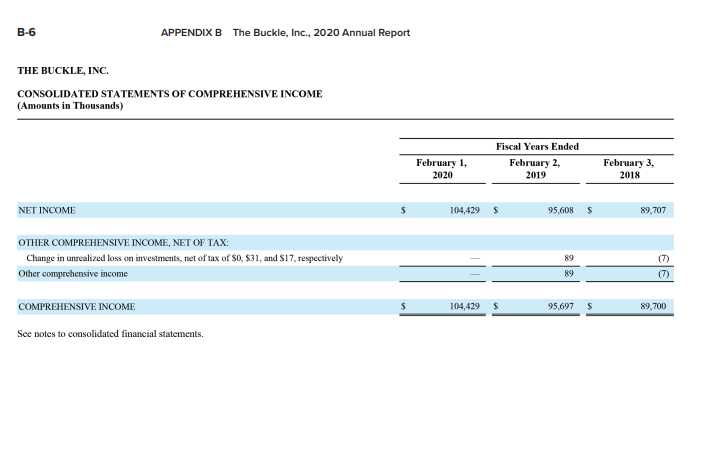

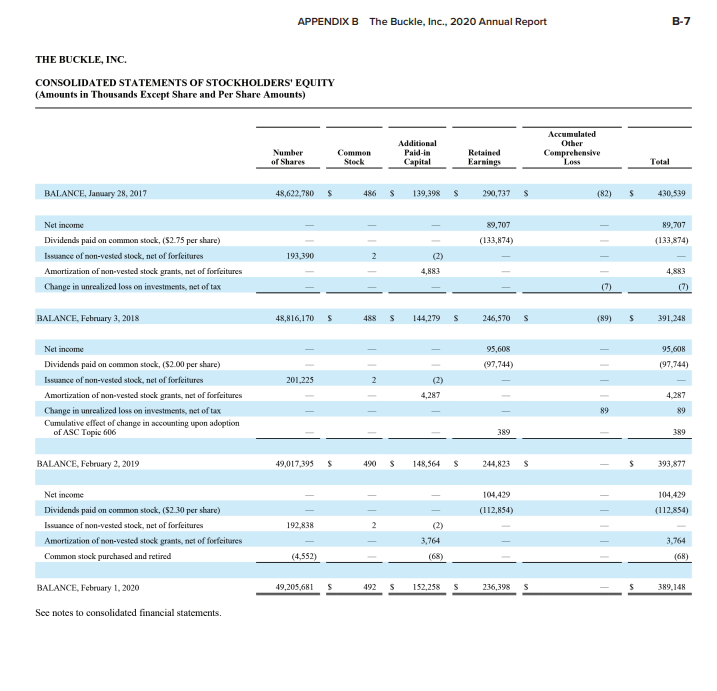

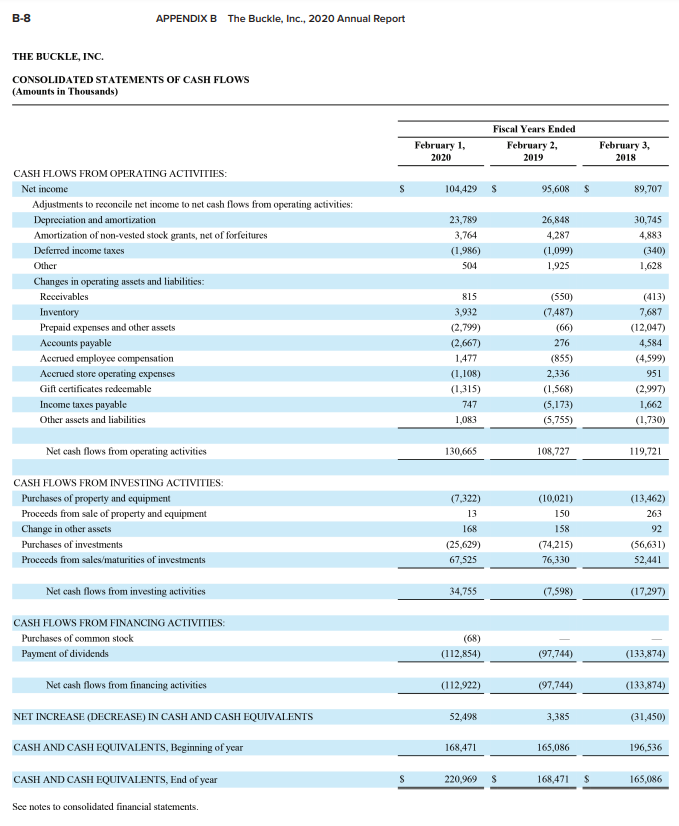

Financial information for American Eagle is presented in Appendix A, and financial information for Buckle is presented in Required: 1. Calculate American Eagle's return on assets, profit margin, and asset turnover ratio for the most recent year. 2. Calculate Buckle's return on assets, profit margin, and asset turnover ratio for the most recent year. 3. Which company is doing better based on return on assets and the higher profit margin? 4. Which company has the higher asset turnover? Complete this question by entering your answers in the tabs below. Calculate Buckle's return on assets, profit margin, and asset turnover ratio for the most recent year. (Round your answers to 1 decimal place.) THE BUCKLE, INC. CONSOLIDATED BALANCE SHEETS (Amounts in Thousands Except Share and Per Share Amounts) \begin{tabular}{|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{l} ASSETS \\ CURRIENT ASSETS: \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} February 1, \\ 2020 \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} February 2, \\ 2019 \\ \end{tabular}} \\ \hline & & & & \\ \hline Cash and cash equivalents & $ & 220,969 & $ & 168,471 \\ \hline Short-term investments (Notes B and C) & & 12,532 & & 51,546 \\ \hline Receivables & & 3,136 & & 7,089 \\ \hline Inventory & & 121,258 & & 125,190 \\ \hline Prepaid expenses and ocher assets & & 20,935 & & 18,136 \\ \hline Total current assets & & 378,830 & & 370,432 \\ \hline PROPERTY AND EQUIPMENT (Note E) & & 452,205 & & 452,187 \\ \hline \multirow[t]{2}{*}{ Less accumulated depreciation and amortization } & & (338,357) & & (321,505) \\ \hline & & 113,848 & & 130,682 \\ \hline OPERATING LEASE RIGHT-OF-USE ASSETS (Note D) & & 350,088 & & \\ \hline L.ONG-TERM INVESTMENTS (Notes B and C) & & 15,863 & & 18,745 \\ \hline OTHER ASSETS (Notes G and H) & & 9,261 & & 7,443 \\ \hline Total assets & $ & 867,890 & $ & 527,302 \\ \hline \end{tabular} LIABILITIES AND STOCKIIOLDERS' EQUITY CURRENT LIABILITIES: \begin{tabular}{|c|c|c|} \hline Accounts payable & 26,491 & 29,008 \\ \hline Accrued employee compensation & 22,929 & 21,452 \\ \hline Accrued store operating expenses & 17,837 & 17,982 \\ \hline Gift certificates redeemable & 15,319 & 16,634 \\ \hline Current portion of operating lease liabilities (Note D) & 87,314 & - \\ \hline Income taxes payable (Note G ) & 2,751 & 5,142 \\ \hline Total current liabilities & 172,641 & 90,218 \\ \hline DEFERRED COMPENSATION (Note J) & 15,863 & 13,978 \\ \hline NON-CURRENT OPERATING LEASE LIABILITIES (Note D) & 290,238 & - \\ \hline DEFERRED RENT LIABIIITY & - & 29,229 \\ \hline Total liabilities & 478,742 & 133,425 \\ \hline \end{tabular} COMMITMENTS (Notes F and I) STOCKHOLDERS' EQUTIY (Note K): CONSOLIDATED STATEMENTS OF INCOME (Amounts in Thousands Except Per Share Amounts) \begin{tabular}{|c|c|c|c|c|c|c|} \hline & \multicolumn{6}{|c|}{ Fiscal Years Ended } \\ \hline & \multicolumn{2}{|c|}{\begin{tabular}{c} February 1, \\ 2020 \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} February 2, \\ 2019 \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} February 3, \\ 2018 \end{tabular}} \\ \hline SALES, Net of returns and allowances & $ & 900,254 & s & 885,496 & $ & 913,380 \\ \hline COST OF SALES (Including buying, distribution, and occupancy costs) & & 522,780 & & 519,423 & & 533,357 \\ \hline Gross profit & & 377,474 & & 366,073 & & 380,023 \\ \hline \multicolumn{7}{|l|}{ OPERATING EXPENSES: } \\ \hline Selling & & 204,480 & & 202,032 & & 206,068 \\ \hline \multirow[t]{2}{*}{ General and administrative } & & 41,497 & & 43,113 & & 39,877 \\ \hline & & 245,977 & & 245,145 & & 245,945 \\ \hline INCOME FROM OPERATIONS & & 131,497 & & 120,928 & & 134,078 \\ \hline OTHER INCOME, Net & & 6,210 & & 5,716 & & 5,407 \\ \hline INCOME BEFORE INCOME TAXES & & 137,707 & & 126,644 & & 139,485 \\ \hline PROVISION FOR INCOME TAXES (Note G) & & 33,278 & & 31,036 & & 49,778 \\ \hline NET INCOME & $ & 104,429 & s & 95,608 & $ & 89,707 \\ \hline \multicolumn{7}{|l|}{ EARNINGS PER SHARE (Note L): } \\ \hline Basic & $ & 2.15 & s & 1.97 & $ & 1.86 \\ \hline Diluted & $ & 2.14 & $ & 1.97 & $ & 1.85 \\ \hline \end{tabular} See notes to consolidated financial statements. THE BUCKLE, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Amounts in Thousands) THE BUCKLE, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (Amounts in Thousands Except Share and Per Share Amounts) B-8 APPENDIX B The Buckle, Inc., 2020 Annual Report THE BUCKLE, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (Amounts in Thousands) \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{3}{*}{ CASH FLOWS FROM OPERATING ACTIVTTIES: } & \multicolumn{6}{|c|}{ Fiscal Years Ended } \\ \hline & \multicolumn{2}{|c|}{\begin{tabular}{c} February 1, \\ 2020 \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} February 2, \\ 2019 \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} February 3, \\ 2018 \end{tabular}} \\ \hline & & & & & & \\ \hline Net income & s & 104,429 & s & 95,608 & $ & 89,707 \\ \hline \multicolumn{7}{|l|}{ Adjustments to reconcile net income to net cash flows from operating activities: } \\ \hline Depreciation and amortization & & 23,789 & & 26,848 & & 30,745 \\ \hline Amortization of non-vested stock grants, net of forfeitures & & 3,764 & & 4,287 & & 4,883 \\ \hline Deferred income taxes & & (1,986) & & (1,099) & & (340) \\ \hline Other & & 504 & & 1,925 & & 1,628 \\ \hline \multicolumn{7}{|l|}{ Changes in operating assets and liabilities: } \\ \hline Receivables & & 815 & & (550) & & (413) \\ \hline Inventory & & 3,932 & & (7,487) & & 7,687 \\ \hline Prepaid expenses and other assets & & (2,799) & & (66) & & (12,047) \\ \hline Accounts payable & & (2,667) & & 276 & & 4,584 \\ \hline Accrued employee compensation & & 1,477 & & (855) & & (4,599) \\ \hline Accrued store operating expenses & & (1,108) & & 2,336 & & 951 \\ \hline Gift certificates redeemable & & (1,315) & & (1,568) & & (2,997) \\ \hline Income taxes payable & & 747 & & (5,173) & & 1,662 \\ \hline Other assets and liabilities & & 1,083 & & (5,755) & & (1,730) \\ \hline Net cash flows from operating activities & & 130,665 & & 108,727 & & 119,721 \\ \hline \multicolumn{7}{|l|}{ CASH FLOWS FROM INVESTING ACTIVITIES: } \\ \hline Purchases of property and equipment & & (7,322) & & (10,021) & & (13,462) \\ \hline Proceeds from sale of property and equipment & & 13 & & 150 & & 263 \\ \hline Change in other assets & & 168 & & 158 & & 92 \\ \hline Purchases of investments & & (25,629) & & (74,215) & & (56,631) \\ \hline Proceeds from sales/maturities of investments & & 67,525 & & 76,330 & & 52,441 \\ \hline Net cash flows from investing activities & & 34,755 & & (7,598) & & (17,297) \\ \hline \multicolumn{7}{|l|}{ CASH FLOWS FROM FINANCING ACTIVITIES: } \\ \hline Purchases of common stock & & (68) & & - & & - \\ \hline Payment of dividends & & (112,854) & & (97,744) & & (133,874) \\ \hline Net cash flows from financing activities & & (112,922) & & (97,744) & & (133,874) \\ \hline NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS & & 52,498 & & 3,385 & & (31,450) \\ \hline CASH AND CASH EQUIVALENTS, Beginning of year & & 168,471 & & 165,086 & & 196,536 \\ \hline CASH AND CASH EQUIVALENTS, End of year & s & 220,969 & \$ & 168,471 & $ & 165,086 \\ \hline \end{tabular} See notes to consolidated financial statements

Financial information for American Eagle is presented in Appendix A, and financial information for Buckle is presented in Required: 1. Calculate American Eagle's return on assets, profit margin, and asset turnover ratio for the most recent year. 2. Calculate Buckle's return on assets, profit margin, and asset turnover ratio for the most recent year. 3. Which company is doing better based on return on assets and the higher profit margin? 4. Which company has the higher asset turnover? Complete this question by entering your answers in the tabs below. Calculate Buckle's return on assets, profit margin, and asset turnover ratio for the most recent year. (Round your answers to 1 decimal place.) THE BUCKLE, INC. CONSOLIDATED BALANCE SHEETS (Amounts in Thousands Except Share and Per Share Amounts) \begin{tabular}{|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{l} ASSETS \\ CURRIENT ASSETS: \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} February 1, \\ 2020 \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} February 2, \\ 2019 \\ \end{tabular}} \\ \hline & & & & \\ \hline Cash and cash equivalents & $ & 220,969 & $ & 168,471 \\ \hline Short-term investments (Notes B and C) & & 12,532 & & 51,546 \\ \hline Receivables & & 3,136 & & 7,089 \\ \hline Inventory & & 121,258 & & 125,190 \\ \hline Prepaid expenses and ocher assets & & 20,935 & & 18,136 \\ \hline Total current assets & & 378,830 & & 370,432 \\ \hline PROPERTY AND EQUIPMENT (Note E) & & 452,205 & & 452,187 \\ \hline \multirow[t]{2}{*}{ Less accumulated depreciation and amortization } & & (338,357) & & (321,505) \\ \hline & & 113,848 & & 130,682 \\ \hline OPERATING LEASE RIGHT-OF-USE ASSETS (Note D) & & 350,088 & & \\ \hline L.ONG-TERM INVESTMENTS (Notes B and C) & & 15,863 & & 18,745 \\ \hline OTHER ASSETS (Notes G and H) & & 9,261 & & 7,443 \\ \hline Total assets & $ & 867,890 & $ & 527,302 \\ \hline \end{tabular} LIABILITIES AND STOCKIIOLDERS' EQUITY CURRENT LIABILITIES: \begin{tabular}{|c|c|c|} \hline Accounts payable & 26,491 & 29,008 \\ \hline Accrued employee compensation & 22,929 & 21,452 \\ \hline Accrued store operating expenses & 17,837 & 17,982 \\ \hline Gift certificates redeemable & 15,319 & 16,634 \\ \hline Current portion of operating lease liabilities (Note D) & 87,314 & - \\ \hline Income taxes payable (Note G ) & 2,751 & 5,142 \\ \hline Total current liabilities & 172,641 & 90,218 \\ \hline DEFERRED COMPENSATION (Note J) & 15,863 & 13,978 \\ \hline NON-CURRENT OPERATING LEASE LIABILITIES (Note D) & 290,238 & - \\ \hline DEFERRED RENT LIABIIITY & - & 29,229 \\ \hline Total liabilities & 478,742 & 133,425 \\ \hline \end{tabular} COMMITMENTS (Notes F and I) STOCKHOLDERS' EQUTIY (Note K): CONSOLIDATED STATEMENTS OF INCOME (Amounts in Thousands Except Per Share Amounts) \begin{tabular}{|c|c|c|c|c|c|c|} \hline & \multicolumn{6}{|c|}{ Fiscal Years Ended } \\ \hline & \multicolumn{2}{|c|}{\begin{tabular}{c} February 1, \\ 2020 \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} February 2, \\ 2019 \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} February 3, \\ 2018 \end{tabular}} \\ \hline SALES, Net of returns and allowances & $ & 900,254 & s & 885,496 & $ & 913,380 \\ \hline COST OF SALES (Including buying, distribution, and occupancy costs) & & 522,780 & & 519,423 & & 533,357 \\ \hline Gross profit & & 377,474 & & 366,073 & & 380,023 \\ \hline \multicolumn{7}{|l|}{ OPERATING EXPENSES: } \\ \hline Selling & & 204,480 & & 202,032 & & 206,068 \\ \hline \multirow[t]{2}{*}{ General and administrative } & & 41,497 & & 43,113 & & 39,877 \\ \hline & & 245,977 & & 245,145 & & 245,945 \\ \hline INCOME FROM OPERATIONS & & 131,497 & & 120,928 & & 134,078 \\ \hline OTHER INCOME, Net & & 6,210 & & 5,716 & & 5,407 \\ \hline INCOME BEFORE INCOME TAXES & & 137,707 & & 126,644 & & 139,485 \\ \hline PROVISION FOR INCOME TAXES (Note G) & & 33,278 & & 31,036 & & 49,778 \\ \hline NET INCOME & $ & 104,429 & s & 95,608 & $ & 89,707 \\ \hline \multicolumn{7}{|l|}{ EARNINGS PER SHARE (Note L): } \\ \hline Basic & $ & 2.15 & s & 1.97 & $ & 1.86 \\ \hline Diluted & $ & 2.14 & $ & 1.97 & $ & 1.85 \\ \hline \end{tabular} See notes to consolidated financial statements. THE BUCKLE, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Amounts in Thousands) THE BUCKLE, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (Amounts in Thousands Except Share and Per Share Amounts) B-8 APPENDIX B The Buckle, Inc., 2020 Annual Report THE BUCKLE, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (Amounts in Thousands) \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{3}{*}{ CASH FLOWS FROM OPERATING ACTIVTTIES: } & \multicolumn{6}{|c|}{ Fiscal Years Ended } \\ \hline & \multicolumn{2}{|c|}{\begin{tabular}{c} February 1, \\ 2020 \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} February 2, \\ 2019 \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} February 3, \\ 2018 \end{tabular}} \\ \hline & & & & & & \\ \hline Net income & s & 104,429 & s & 95,608 & $ & 89,707 \\ \hline \multicolumn{7}{|l|}{ Adjustments to reconcile net income to net cash flows from operating activities: } \\ \hline Depreciation and amortization & & 23,789 & & 26,848 & & 30,745 \\ \hline Amortization of non-vested stock grants, net of forfeitures & & 3,764 & & 4,287 & & 4,883 \\ \hline Deferred income taxes & & (1,986) & & (1,099) & & (340) \\ \hline Other & & 504 & & 1,925 & & 1,628 \\ \hline \multicolumn{7}{|l|}{ Changes in operating assets and liabilities: } \\ \hline Receivables & & 815 & & (550) & & (413) \\ \hline Inventory & & 3,932 & & (7,487) & & 7,687 \\ \hline Prepaid expenses and other assets & & (2,799) & & (66) & & (12,047) \\ \hline Accounts payable & & (2,667) & & 276 & & 4,584 \\ \hline Accrued employee compensation & & 1,477 & & (855) & & (4,599) \\ \hline Accrued store operating expenses & & (1,108) & & 2,336 & & 951 \\ \hline Gift certificates redeemable & & (1,315) & & (1,568) & & (2,997) \\ \hline Income taxes payable & & 747 & & (5,173) & & 1,662 \\ \hline Other assets and liabilities & & 1,083 & & (5,755) & & (1,730) \\ \hline Net cash flows from operating activities & & 130,665 & & 108,727 & & 119,721 \\ \hline \multicolumn{7}{|l|}{ CASH FLOWS FROM INVESTING ACTIVITIES: } \\ \hline Purchases of property and equipment & & (7,322) & & (10,021) & & (13,462) \\ \hline Proceeds from sale of property and equipment & & 13 & & 150 & & 263 \\ \hline Change in other assets & & 168 & & 158 & & 92 \\ \hline Purchases of investments & & (25,629) & & (74,215) & & (56,631) \\ \hline Proceeds from sales/maturities of investments & & 67,525 & & 76,330 & & 52,441 \\ \hline Net cash flows from investing activities & & 34,755 & & (7,598) & & (17,297) \\ \hline \multicolumn{7}{|l|}{ CASH FLOWS FROM FINANCING ACTIVITIES: } \\ \hline Purchases of common stock & & (68) & & - & & - \\ \hline Payment of dividends & & (112,854) & & (97,744) & & (133,874) \\ \hline Net cash flows from financing activities & & (112,922) & & (97,744) & & (133,874) \\ \hline NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS & & 52,498 & & 3,385 & & (31,450) \\ \hline CASH AND CASH EQUIVALENTS, Beginning of year & & 168,471 & & 165,086 & & 196,536 \\ \hline CASH AND CASH EQUIVALENTS, End of year & s & 220,969 & \$ & 168,471 & $ & 165,086 \\ \hline \end{tabular} See notes to consolidated financial statements Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started