Question

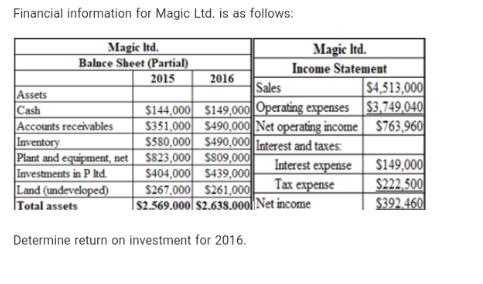

Financial information for Magic Ltd. is as follows: Magic Itd. Balnce Sheet (Partial) 2015 Assets Cash Accounts receivables Inventory 2016 Land (undeveloped) Total assets

Financial information for Magic Ltd. is as follows: Magic Itd. Balnce Sheet (Partial) 2015 Assets Cash Accounts receivables Inventory 2016 Land (undeveloped) Total assets Plant and equipment, net $823,000 $809,000 Investments in P ltd. $404,000 $439,000 Magic Itd. Income Statement Sales $149,000 Operating expenses $490,000 Net operating income $763,960 $144,000 $351,000 $580,000 $490,000 Interest and taxes: Determine return on investment for 2016. Interest expense Tax expense $267,000 $261,000 $2.569.000 $2.638.000 Net income $4,513,000 $3,749,040 $149,000 $222,500 $392.460

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Given Investments in P ltd 2016 404000 Net income 2016 261000 To calculate Return on Invest...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting for Managers

Authors: Eric Noreen, Peter Brewer, Ray Garrison

3rd edition

78025427, 978-0077736460, 007773646X, 978-0078025426

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App