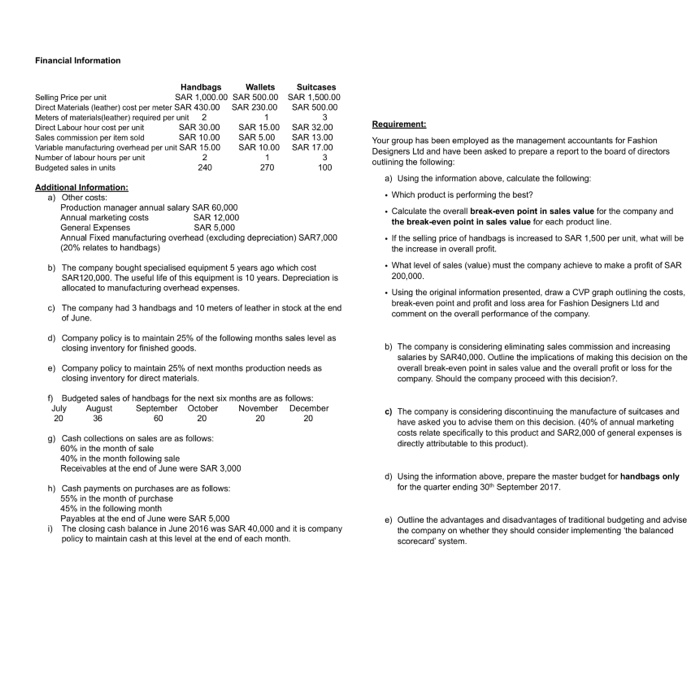

Financial Information Handbags Wallets Suitcases SAR 1,000.00 SAR 500.00 SAR 1,500.00 Seling Price per unit Direct Materials (leather) cost per meter SAR 430.00 Meters of materials leather) required per unit 2 Direct Labour hour cost per unit Sales commission per tem sold Variable manufacturing overhead per unit SAR 15.00 Number of labour hours per unit Budgeted sales in units SAR 230.00 SAR 500.00 SAR 30,00 SAR 10.00 SAR 15.00 SAR 5.00 SAR 32.00 SAR 13.00 SAR 17.00 Your group has been employed as the management accountants for Fashion Designers Lid and have been asked to prepare a report to the board of directors outining the following SAR 1000 240 270 100 a) Using the information above, calculate the following a) Other costs Which product is performing the best? Production manager annual salary SAR 60,000 Annual marketing costs General Expenses Annual Fixed manufacturing overhead (excluding depreciation) SAR7,000 (20% relates to handbags) SAR 12.000 SAR 5,000 Calculate the overall break-even point in sales value for the company and the break-even point in sales value for each product line. If the selling price of handbags is increased to SAR 1,500 per unit, what will be he increase in overall profit What level of sales (value) must the company achieve to make a profit of SAR 200,000. b) The company bought specialised equipment 5 years ago which cost SAR120,000. The useful lide of this equipment is 10 years. Depreciation is allocated to manufacturing overhead expenses. Using the original information presented, draw a CVP graph outlining the costs, break-even point and profit and loss area for Fashion Designers Ltd and comment on the overall performance of the company c) The company had 3 handbags and 10 meters of leather in stock at the end d) Company policy is to maintain 25% of the following months sales level as e) Company policy to maintain 25% of next months production needs as 1 Budgeted sales of handbags for the next six months are as follows: of June. closing inventory for finished goods. b) The company is considering eiminating sales commission and increasing salaries by SAR40,000. Outine the impications of making this decision on the overall break-even point in sales value and the overall profit or loss for the company. Should the company proceed with this decision? closing inventory for direct materials. July AugustSeptember October November December c) The company is considering discontinuing the manufacture of suitcases and 20 36 60 20 20 20 have asked you to advise them on this decision. (40% of annual marketing costs relate specifically to this product and SAR2,000 of general expenses is directly attributable to this product). g) Cash collections on sales are as follows: 60% in the month of sale 40% in the month following sale Receivables at the end of June were SAR 3,000 d) Using the information above, prepare the master budget for handbags only h) for the quarter ending 30h September 2017 Cash payments on purchases are as follows 55% in the month of purchase 45% in th@ following month Payables at the end of June were SAR 5,000 e) Outline the advantages and disadvantages of traditional budgeting and advise The closing cash balance in June 2016 was SAR 40.000 and it is company the company on whether they should consider implementing the balanced scorecard' system. policy to maintain cash at this level at the end of each month