Answered step by step

Verified Expert Solution

Question

1 Approved Answer

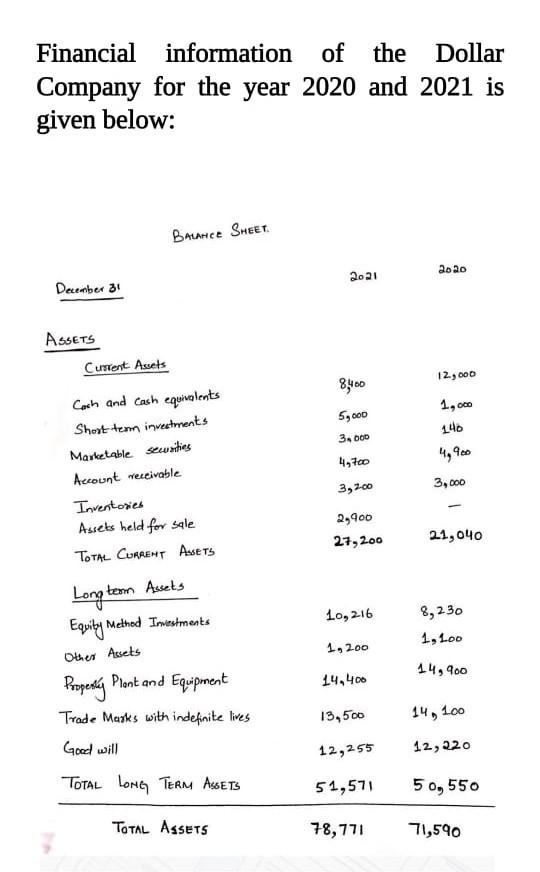

Financial information of of the Dollar Company for the year 2020 and 2021 is given below: BALANCE SHEET 2020 2.21 December 31 ASSETS Current Assets

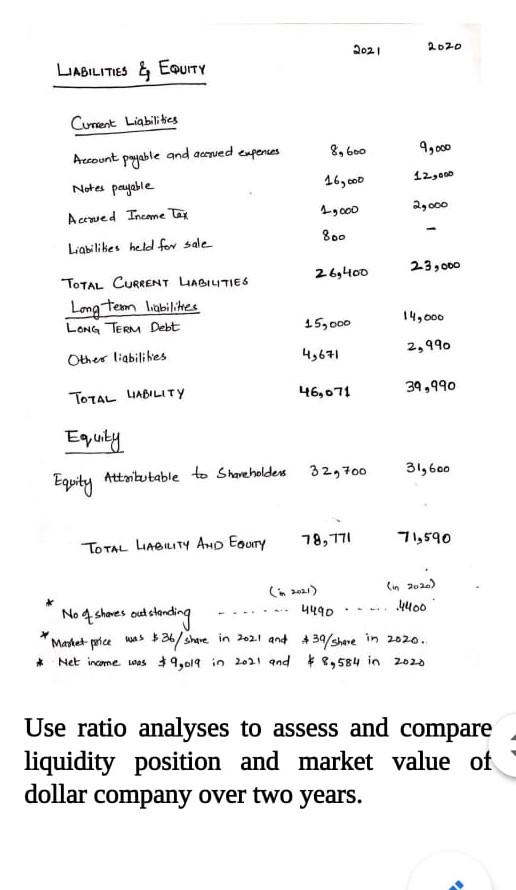

Financial information of of the Dollar Company for the year 2020 and 2021 is given below: BALANCE SHEET 2020 2.21 December 31 ASSETS Current Assets 12,000 8,400 59000 1,000 1.40 3. DOD 4,760 4,90 Cash and cash equivalents Shest tem investments Marketable sewsities Account receivable Inventories Assets held for sale TOTAL CURRENT Assets 3,200 3,000 2,900 27,200 21,040 10,216 Long te teom Assets Equity Method Investments Other Assets Property Plont and Equipment 8,230 1, 100 1.2.00 14,900 14,400 13,500 14, 1.00 Trade Marks with indefinite lives Good will 12,255 12,220 TOTAL LONG TERM ASSETS 51,571 50g 550 TOTAL ASSETS 78,771 71,590 2021 2020 LIABILITIES EQUITY 8,600 9,000 Cunient Liabilities Account payable and acued expenses Notes payable Accued Income Tex 16,000 12,600 1,000 2,000 800 Liabilikes held for sale 269400 23,000 TOTAL CURRENT LABILITIES Long tem liabilities LONG TERM Debt 15,000 14,000 4, 671 Other liabilihes 2,990 46,071 39, TOTAL LABILITY Equity Equity Attributable to shareholders 32,700 31,600 TOTAL LABILITY AND Ecurry 78, 771 71,590 (in 2020) * 4490 .4400 No q shares outstanding $36/ share in 2021 and #39sheve in 2020. * Net income was 9,019 in 2021 and 2,584 in 2020 x Market price was $36 Use ratio analyses to assess and compare liquidity position and market value of dollar company over two years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started