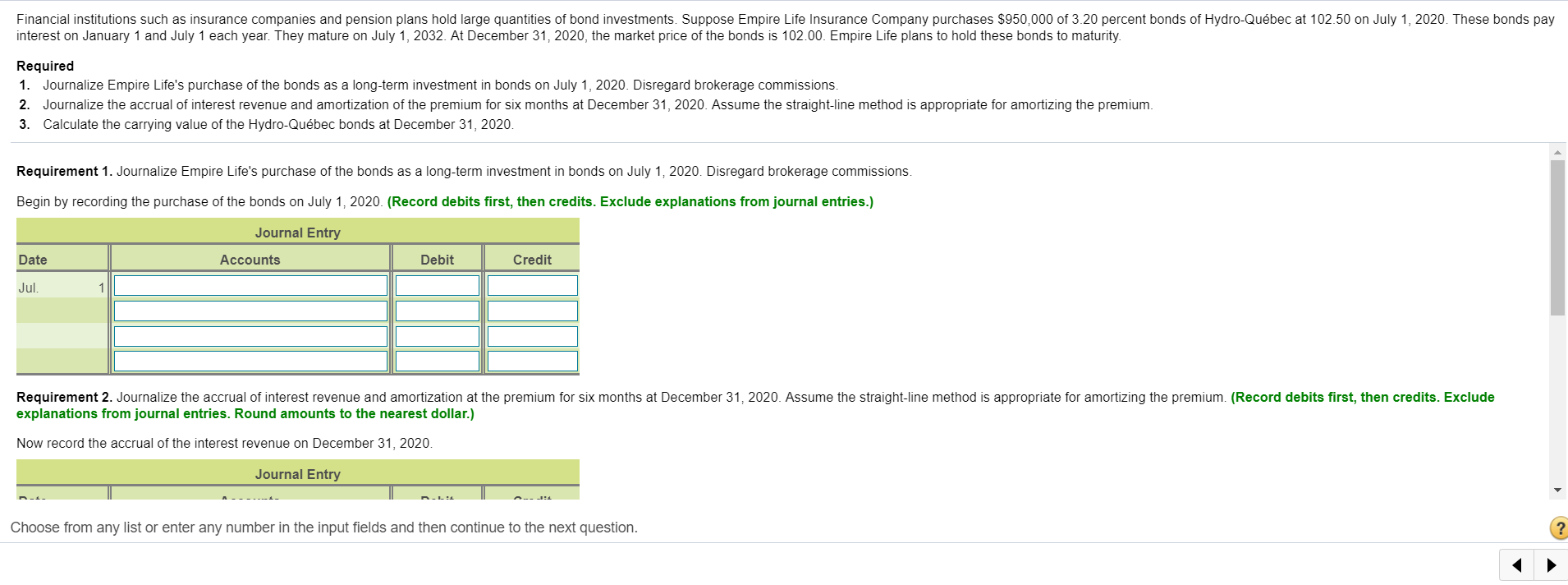

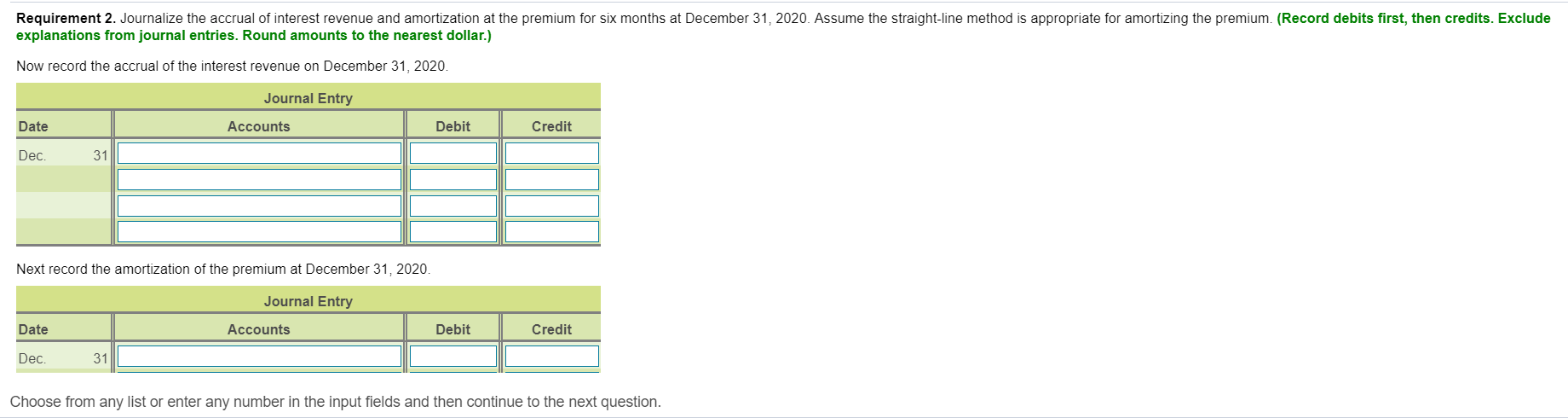

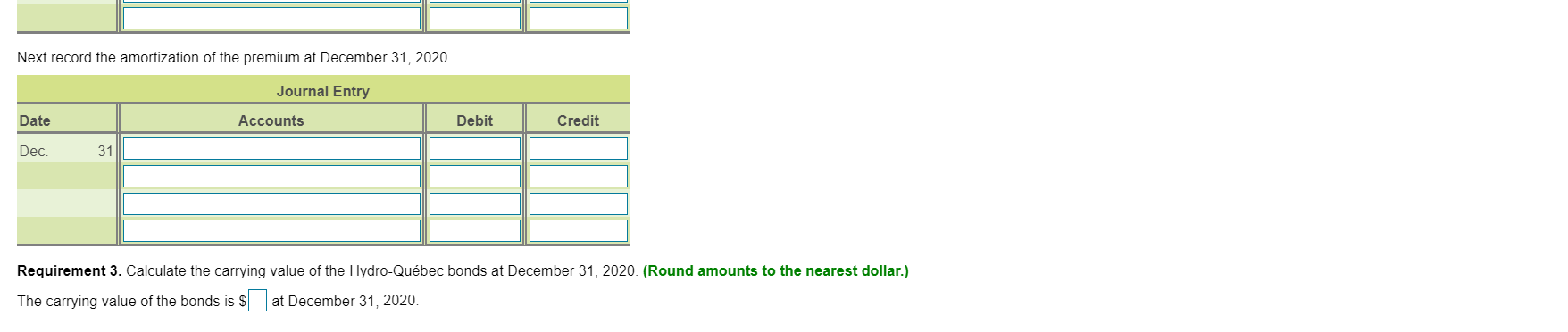

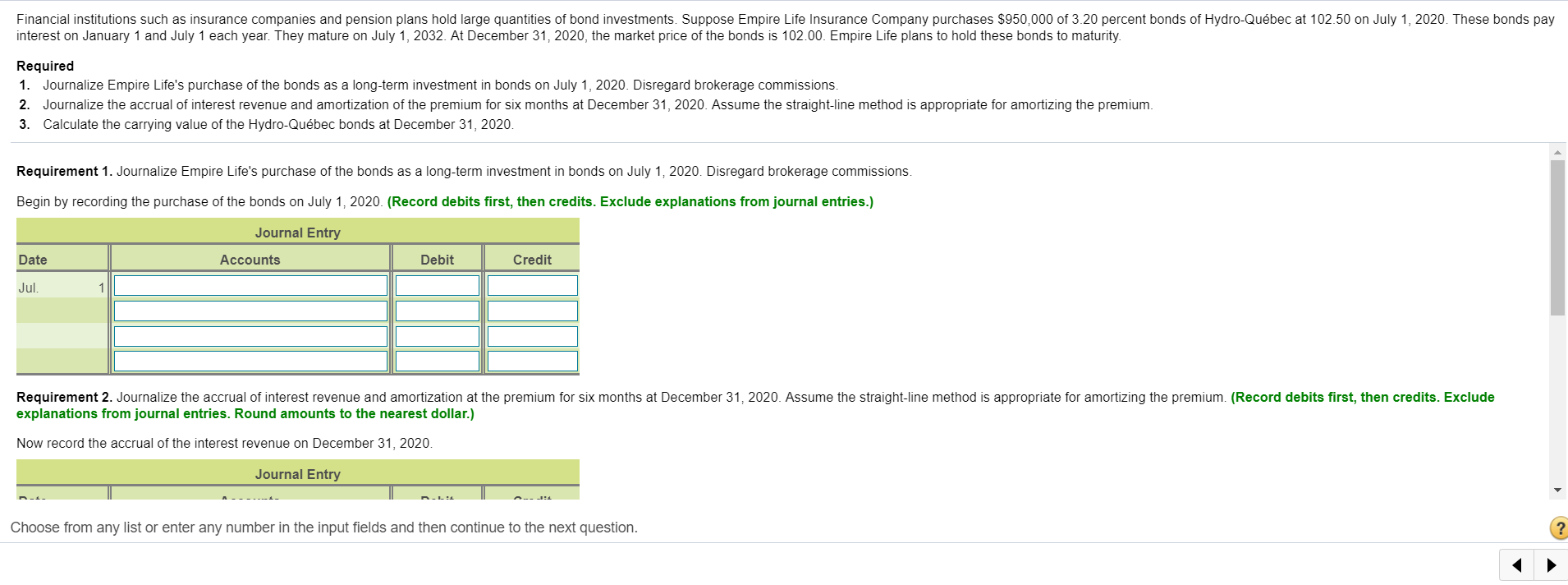

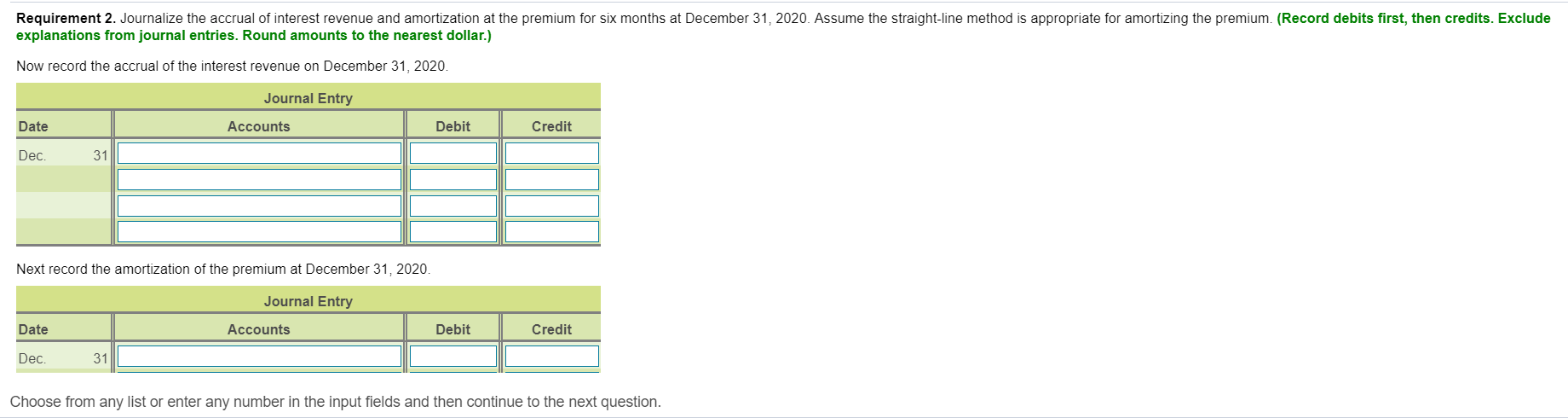

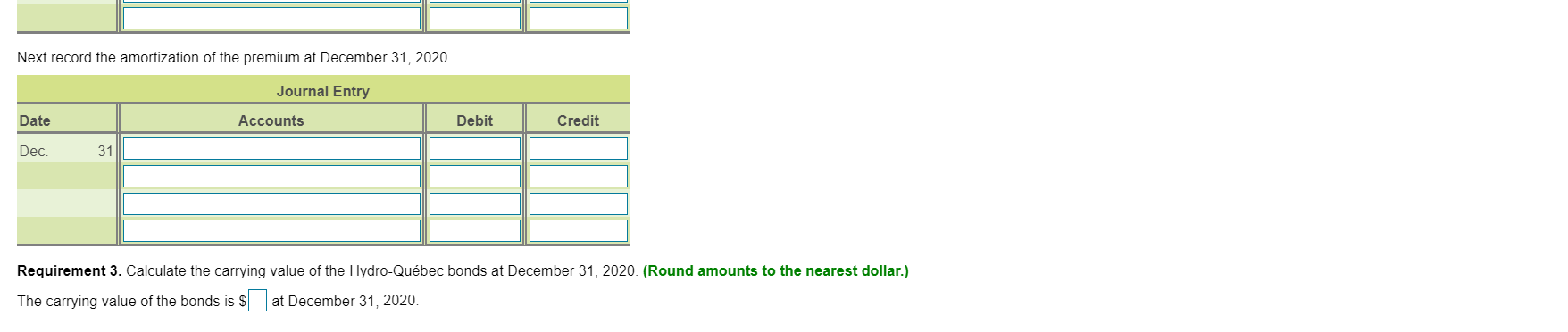

Financial institutions such as insurance companies and pension plans hold large quantities of bond investments. Suppose Empire Life Insurance Company purchases $950,000 of 3.20 percent bonds of Hydro-Qubec at 102.50 on July 1, 2020. These bonds pay interest on January 1 and July 1 each year. They mature on July 1, 2032. At December 31, 2020, the market price of the bonds is 102.00. Empire Life plans to hold these bonds to maturity Required 1. Journalize Empire Life's purchase of the bonds as a long-term investment in bonds on July 1, 2020. Disregard brokerage commissions. 2. Journalize the accrual of interest revenue and amortization of the premium for six months at December 31, 2020. Assume the straight-line method is appropriate for amortizing the premium. Calculate the carrying value of the Hydro-Qubec bonds at December 31, 2020. 3. Requirement 1. Journalize Empire Life's purchase of the bonds as a long-term investment in bonds on July 1, 2020. Disregard brokerage commissions. Begin by recording the purchase of the bonds on July 1, 2020. (Record debits first, then credits. Exclude explanations from journal entries.) Journal Entry Date Accounts Debit Credit Jul 1 Requirement 2. Journalize the accrual of interest revenue and amortization at the premium for six months at December 31, 2020. Assume the straight-line method is appropriate for amortizing the premium. (Record debits first, then credits. Exclude explanations from journal entries. Round amounts to the nearest dollar.) Now record the accrual of the interest revenue on December 31, 2020. Journal Entry Choose from any list or enter any number in the input fields and then continue to the next question. ? Requirement 2. Journalize the accrual of interest revenue and amortization at the premium for six months at December 31, 2020. Assume the straight-line method is appropriate for amortizing the premium. (Record debits first, then credits. Exclude explanations from journal entries. Round amounts to the nearest dollar.) Now record the accrual of the interest revenue on December 31, 2020. Journal Entry Date Accounts Debit Credit Dec. 31 Next record the amortization of the premium at December 31, 2020. Journal Entry Date Accounts Debit Credit Dec. 31 Choose from any list or enter any number in the input fields and then continue to the next question. Next record the amortization of the premium at December 31, 2020. Journal Entry Date Accounts Debit Credit Dec. 31 Requirement 3. Calculate the carrying value of the Hydro-Qubec bonds at December 31, 2020. (Round amounts to the nearest dollar.) The carrying value of the bonds is $ at December 31, 2020. Financial institutions such as insurance companies and pension plans hold large quantities of bond investments. Suppose Empire Life Insurance Company purchases $950,000 of 3.20 percent bonds of Hydro-Qubec at 102.50 on July 1, 2020. These bonds pay interest on January 1 and July 1 each year. They mature on July 1, 2032. At December 31, 2020, the market price of the bonds is 102.00. Empire Life plans to hold these bonds to maturity Required 1. Journalize Empire Life's purchase of the bonds as a long-term investment in bonds on July 1, 2020. Disregard brokerage commissions. 2. Journalize the accrual of interest revenue and amortization of the premium for six months at December 31, 2020. Assume the straight-line method is appropriate for amortizing the premium. Calculate the carrying value of the Hydro-Qubec bonds at December 31, 2020. 3. Requirement 1. Journalize Empire Life's purchase of the bonds as a long-term investment in bonds on July 1, 2020. Disregard brokerage commissions. Begin by recording the purchase of the bonds on July 1, 2020. (Record debits first, then credits. Exclude explanations from journal entries.) Journal Entry Date Accounts Debit Credit Jul 1 Requirement 2. Journalize the accrual of interest revenue and amortization at the premium for six months at December 31, 2020. Assume the straight-line method is appropriate for amortizing the premium. (Record debits first, then credits. Exclude explanations from journal entries. Round amounts to the nearest dollar.) Now record the accrual of the interest revenue on December 31, 2020. Journal Entry Choose from any list or enter any number in the input fields and then continue to the next question. ? Requirement 2. Journalize the accrual of interest revenue and amortization at the premium for six months at December 31, 2020. Assume the straight-line method is appropriate for amortizing the premium. (Record debits first, then credits. Exclude explanations from journal entries. Round amounts to the nearest dollar.) Now record the accrual of the interest revenue on December 31, 2020. Journal Entry Date Accounts Debit Credit Dec. 31 Next record the amortization of the premium at December 31, 2020. Journal Entry Date Accounts Debit Credit Dec. 31 Choose from any list or enter any number in the input fields and then continue to the next question. Next record the amortization of the premium at December 31, 2020. Journal Entry Date Accounts Debit Credit Dec. 31 Requirement 3. Calculate the carrying value of the Hydro-Qubec bonds at December 31, 2020. (Round amounts to the nearest dollar.) The carrying value of the bonds is $ at December 31, 2020