Answered step by step

Verified Expert Solution

Question

1 Approved Answer

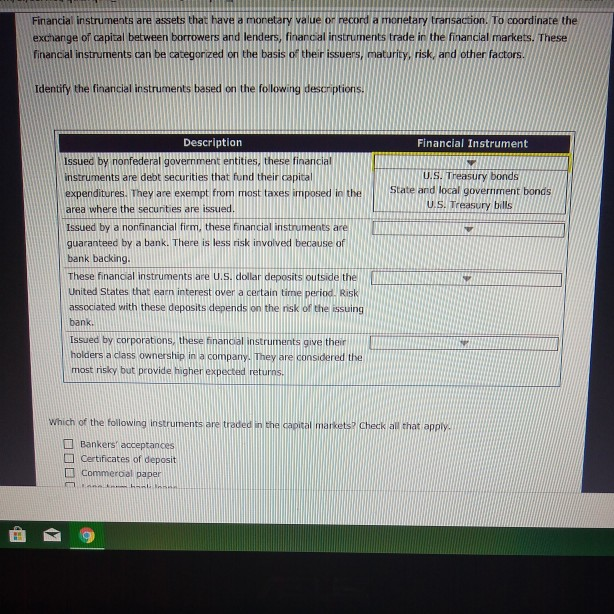

Financial instruments are assets that have a monetary value or record a monetary transaction. To coordinate the exchange of capital between borrowers and lenders, financial

Financial instruments are assets that have a monetary value or record a monetary transaction. To coordinate the exchange of capital between borrowers and lenders, financial instruments trade in the financial markets. These financial instruments can be categorzed or the basis of their issuers, maturity, risk, and other factors Identify the financial instruments based on the folowing descriptions Description Financial Instrument Issued by nonfederal government entities, these finaricial instruments are debt securities that fund their capitalC expenditures. They are exempt from most taxes imposed in theState and local government bonds area where the secunties are issued Issued by a nonfinancial firm, these financial instruments are guaranteed by a bank. There is less risk involved because of bank backing These financial instruments are u.S. dollar deposits outside the United States that earn interest over a certain time period. Rishk associated with these deposits depends on the risk of the issuing bank. U.S. Treasury bonds U.S. Treasury bills Issued by corporations, these finanoal instruments give their holders a class ownership in a company. They are considered the most risky but provide higher expected returns Which of the following instruments are traded in the capital markets Check all that apply Bankers acceptances Certificates of deposit Commeroal paper

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started