financial management

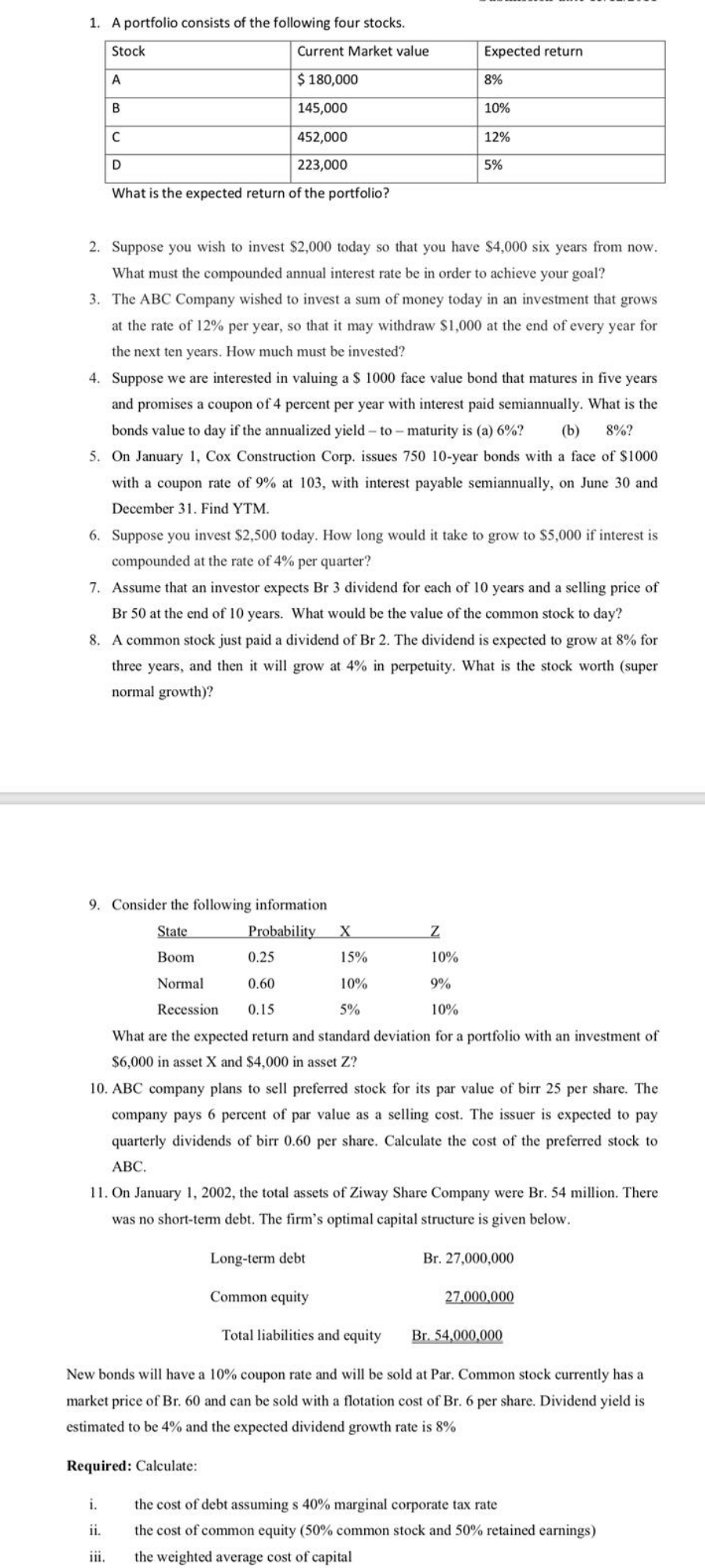

1. A portfolio consists of the following four stocks. Stock Current Market value Expected return A $ 180,000 8% B 145,000 10% 452,000 12% D 223,000 5% What is the expected return of the portfolio? 2. Suppose you wish to invest $2,000 today so that you have $4,000 six years from now. What must the compounded annual interest rate be in order to achieve your goal? 3. The ABC Company wished to invest a sum of money today in an investment that grows at the rate of 12% per year, so that it may withdraw $1,000 at the end of every year for the next ten years. How much must be invested? 4. Suppose we are interested in valuing a $ 1000 face value bond that matures in five years and promises a coupon of 4 percent per year with interest paid semiannually. What is the bonds value to day if the annualized yield - to - maturity is (a) 6%? (b) 8%? 5. On January 1, Cox Construction Corp. issues 750 10-year bonds with a face of $1000 with a coupon rate of 9% at 103, with interest payable semiannually, on June 30 and December 31. Find YTM. 6. Suppose you invest $2,500 today. How long would it take to grow to $5,000 if interest is compounded at the rate of 4% per quarter? 7. Assume that an investor expects Br 3 dividend for each of 10 years and a selling price of Br 50 at the end of 10 years. What would be the value of the common stock to day? 8. A common stock just paid a dividend of Br 2. The dividend is expected to grow at 8% for three years, and then it will grow at 4% in perpetuity. What is the stock worth (super normal growth)? 9. Consider the following information State Probability X Z Boom 0.25 15% 10% Normal 0.60 10% 9% Recession 0.15 5% 10% What are the expected return and standard deviation for a portfolio with an investment of $6,000 in asset X and $4,000 in asset Z? 10. ABC company plans to sell preferred stock for its par value of birr 25 per share. The company pays 6 percent of par value as a selling cost. The issuer is expected to pay quarterly dividends of birr 0.60 per share. Calculate the cost of the preferred stock to ABC. 11. On January 1, 2002, the total assets of Ziway Share Company were Br. 54 million. There was no short-term debt. The firm's optimal capital structure is given below. Long-term debt Br. 27,000,000 Common equity 27.000.000 Total liabilities and equity Br. 54,000,000 New bonds will have a 10% coupon rate and will be sold at Par. Common stock currently has a market price of Br. 60 and can be sold with a flotation cost of Br. 6 per share. Dividend yield is estimated to be 4% and the expected dividend growth rate is 8% Required: Calculate: i. the cost of debt assuming s 40% marginal corporate tax rate ii. the cost of common equity (50% common stock and 50% retained earnings) ifi. the weighted average cost of capital