Answered step by step

Verified Expert Solution

Question

1 Approved Answer

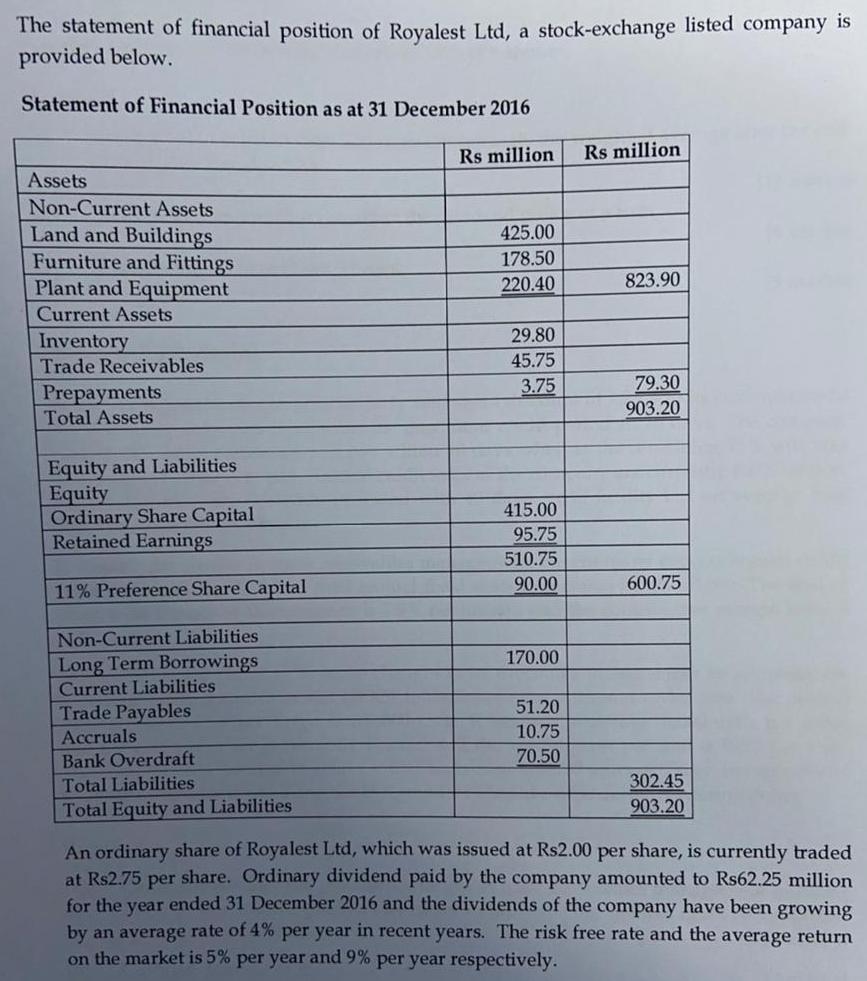

The statement of financial position of Royalest Ltd, a stock-exchange listed company is provided below. Statement of Financial Position as at 31 December 2016

The statement of financial position of Royalest Ltd, a stock-exchange listed company is provided below. Statement of Financial Position as at 31 December 2016 Rs million Rs million Assets Non-Current Assets Land and Buildings Furniture and Fittings Plant and Equipment 425.00 178.50 220.40 823.90 Current Assets 29.80 Inventory Trade Receivables 45.75 79.30 903.20 3.75 Prepayments Total Assets Equity and Liabilities Equity Ordinary Share Capital Retained Earnings 415.00 95.75 510.75 11% Preference Share Capital 90.00 600.75 Non-Current Liabilities Long Term Borrowings Current Liabilities Trade Payables 170.00 51.20 10.75 Accruals Bank Overdraft 70.50 Total Liabilities 302.45 Total Equity and Liabilities 903.20 An ordinary share of Royalest Ltd, which was issued at Rs2.00 per share, is currently traded at Rs2.75 per share. Ordinary dividend paid by the company amounted to Rs62.25 million for the year ended 31 December 2016 and the dividends of the company have been growing by an average rate of 4% per year in recent years. The risk free rate and the average return on the market is 5% per year and 9% per year respectively. Interest on bank overdraft is calculated every month and the nominal interest on bank overdraft is 8.4% per annum. Royalest Ltd pays tax on profit at the rate of 20% per annum. Using market values where appropriate, calculate the weighted average after tax cost of capital of Royalest Ltd. (a) (b) Explain four factors that can affect the dividend policy of a firm. (c) Explain the Pecking Order Theory.

Step by Step Solution

★★★★★

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

A weighted average cost of capital WACC weighted average cost of capital WACC WACC EVxRe DVxRd x1Tc ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started