Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Management (Exercise 01 for 2020) (1) Keyser Materials paid $7,600 in dividends and $28,311 in interest over the past year while net working capital

Financial Management (Exercise 01 for 2020)

(1) Keyser Materials paid $7,600 in dividends and $28,311 in interest over the past year while net working capital increased from $13,506 to $18,219. The company purchased $42,000 in net new fixed assets and had depreciation expenses of $16,805. During the year, the firm issued $23,000 in net new equity and paid off $12,000 in long-term debt. What is the amount of the cash flow from assets? (Chapter 02)

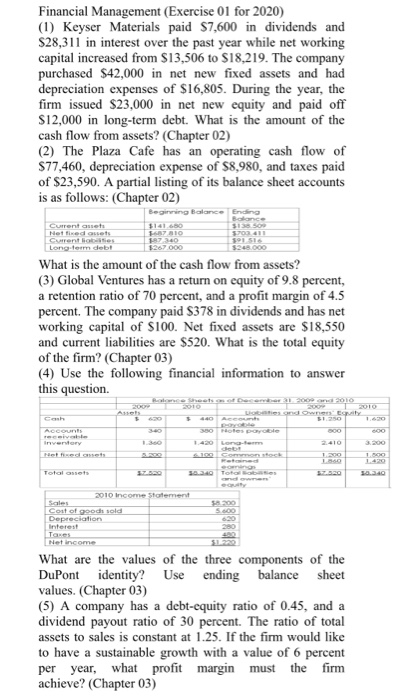

(2) The Plaza Cafe has an operating cash flow of $77,460, depreciation expense of $8,980, and taxes paid of $23,590. A partial listing of its balance sheet accounts is as follows: (Chapter 02)

What is the amount of the cash flow from assets?

(3) Global Ventures has a return on equity of 9.8 percent, a retention ratio of 70 percent, and a profit margin of 4.5 percent. The company paid $378 in dividends and has net working capital of $100. Net fixed assets are $18,550 and current liabilities are $520. What is the total equity of the firm? (Chapter 03)

(4) Use the following financial information to answer this question.

What are the values of the three components of the DuPont identity? Use ending balance sheet values. (Chapter 03)

(5) A company has a debt-equity ratio of 0.45, and a dividend payout ratio of 30 percent. The ratio of total assets to sales is constant at 1.25. If the firm would like to have a sustainable growth with a value of 6 percent per year, what profit margin must the firm achieve? (Chapter 03)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started