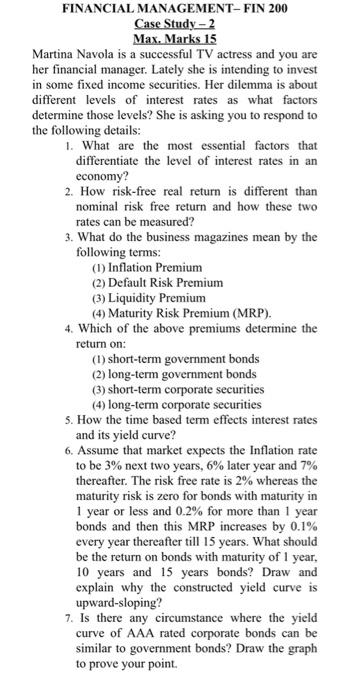

FINANCIAL MANAGEMENT- FIN 200 Case Study - 2 Max. Marks 15 Martina Navola is a successful TV actress and you are her financial manager. Lately she is intending to invest in some fixed income securities. Her dilemma is about different levels of interest rates as what factors determine those levels? She is asking you to respond to the following details: 1. What are the most essential factors that differentiate the level of interest rates in an economy? 2. How risk-free real return is different than nominal risk free return and how these two rates can be measured? 3. What do the business magazines mean by the following terms: (1) Inflation Premium (2) Default Risk Premium (3) Liquidity Premium (4) Maturity Risk Premium (MRP). 4. Which of the above premiums determine the return on: (1) short-term government bonds (2) long-term government bonds (3) short-term corporate securities (4) long-term corporate securities 5. How the time based term effects interest rates and its yield curve? 6. Assume that market expects the Inflation rate to be 3% next two years, 6% later year and 7% thereafter. The risk free rate is 2% whereas the maturity risk is zero for bonds with maturity in 1 year or less and 0.2% for more than 1 year bonds and then this MRP increases by 0.1% every year thereafter till 15 years. What should be the return on bonds with maturity of 1 year, 10 years and 15 years bonds? Draw and explain why the constructed yield curve is upward-sloping? 7. Is there any circumstance where the yield curve of AAA rated corporate bonds can be similar to government bonds? Draw the graph to prove your point. FINANCIAL MANAGEMENT- FIN 200 Case Study - 2 Max. Marks 15 Martina Navola is a successful TV actress and you are her financial manager. Lately she is intending to invest in some fixed income securities. Her dilemma is about different levels of interest rates as what factors determine those levels? She is asking you to respond to the following details: 1. What are the most essential factors that differentiate the level of interest rates in an economy? 2. How risk-free real return is different than nominal risk free return and how these two rates can be measured? 3. What do the business magazines mean by the following terms: (1) Inflation Premium (2) Default Risk Premium (3) Liquidity Premium (4) Maturity Risk Premium (MRP). 4. Which of the above premiums determine the return on: (1) short-term government bonds (2) long-term government bonds (3) short-term corporate securities (4) long-term corporate securities 5. How the time based term effects interest rates and its yield curve? 6. Assume that market expects the Inflation rate to be 3% next two years, 6% later year and 7% thereafter. The risk free rate is 2% whereas the maturity risk is zero for bonds with maturity in 1 year or less and 0.2% for more than 1 year bonds and then this MRP increases by 0.1% every year thereafter till 15 years. What should be the return on bonds with maturity of 1 year, 10 years and 15 years bonds? Draw and explain why the constructed yield curve is upward-sloping? 7. Is there any circumstance where the yield curve of AAA rated corporate bonds can be similar to government bonds? Draw the graph to prove your point