Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial management financial forecasting and planning. plese use to table to answer. thank u in advanced. Media.com is currently plan to pay the dividend 40%

Financial management

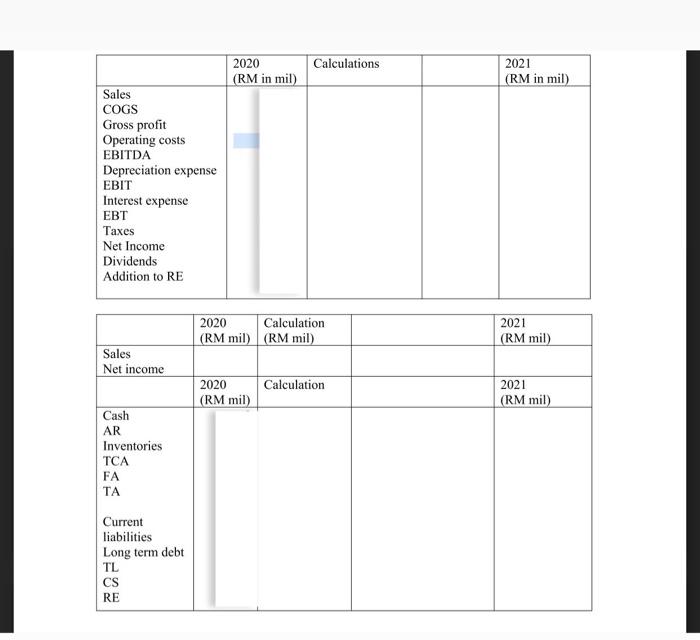

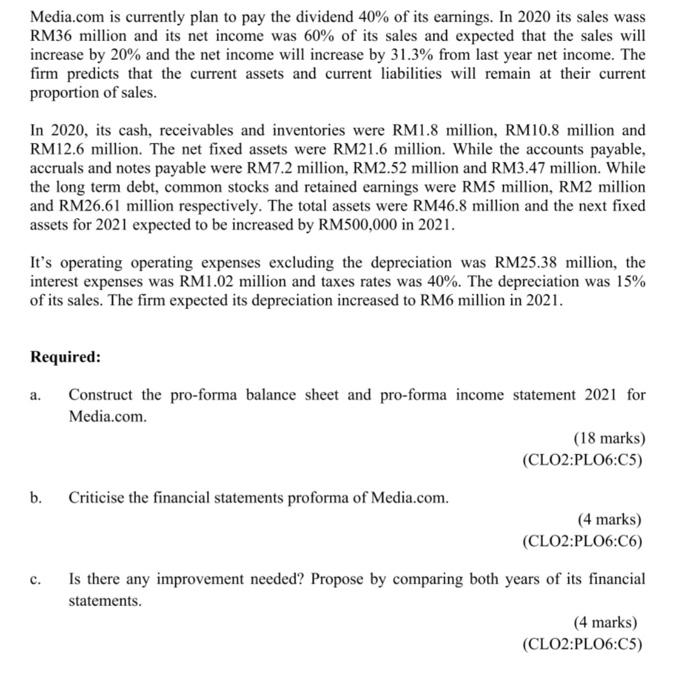

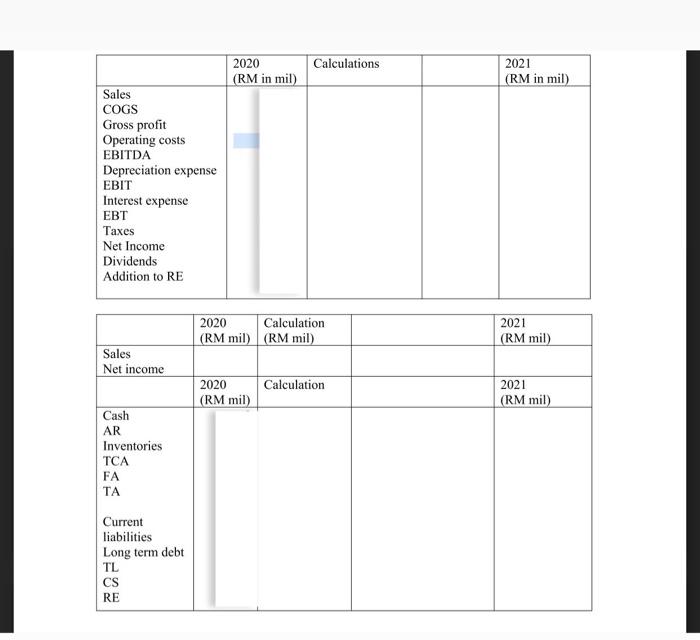

Media.com is currently plan to pay the dividend 40% of its earnings. In 2020 its sales wass RM36 million and its net income was 60% of its sales and expected that the sales will increase by 20% and the net income will increase by 31.3% from last year net income. The firm predicts that the current assets and current liabilities will remain at their current proportion of sales. In 2020, its cash, receivables and inventories were RM1.8 million, RM10.8 million and RM12.6 million. The net fixed assets were RM21.6 million. While the accounts payable, accruals and notes payable were RM7.2 million, RM2.52 million and RM3.47 million. While the long term debt, common stocks and retained earnings were RM5 million, RM2 million and RM26.61 million respectively. The total assets were RM46.8 million and the next fixed assets for 2021 expected to be increased by RM500,000 in 2021. It's operating operating expenses excluding the depreciation was RM25.38 million, the interest expenses was RM1.02 million and taxes rates was 40%. The depreciation was 15% of its sales. The firm expected its depreciation increased to RM6 million in 2021. a. Required: Construct the pro-forma balance sheet and pro-forma income statement 2021 for Media.com (18 marks) (CLO2:PL06:05) b. Criticise the financial statements proforma of Media.com. (4 marks) (CLO2:PLO6:06) Is there any improvement needed? Propose by comparing both years of its financial statements. (4 marks) (CLO2:PLO6:C5) c. 2020 (RM in mil) Calculations 2021 (RM in mil) Sales COGS Gross profit Operating costs EBITDA Depreciation expense EBIT Interest expense EBT Taxes Net Income Dividends Addition to RE 2020 Calculation (RM mil) (RM mil) 2021 (RM mil) Sales Net income Calculation 2020 (RM mil) 2021 (RM mil) Cash AR Inventories TCA FA TA Current liabilities Long term debt TL CS RE "financial forecasting and planning.

plese use to table to answer.

thank u in advanced.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started