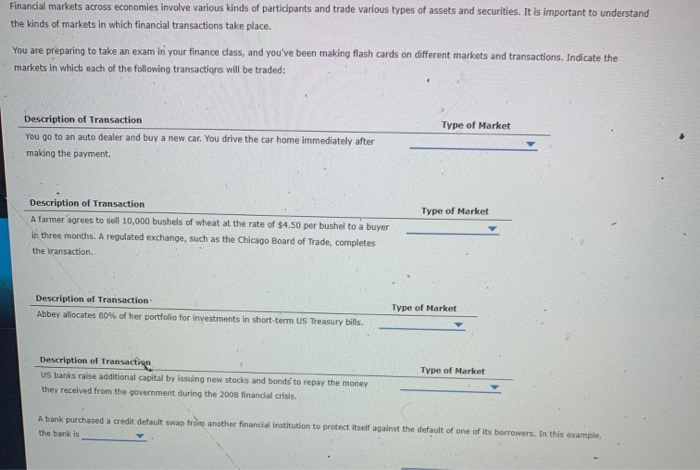

Financial markets across economies involve various kinds of participants and trade various types of assets and securities. It is important to understand the kinds of markets in which financial transactions take place. You are preparing to take an exam in your finance cass, and you've been making flash cards on different markets and transactions. Indicate the markets in which each of the following transactions will be traded: Type of Market Description of Transaction You go to an auto dealer and buy a new car. You drive the car home immediately after making the payment. Type of Market Description of Transaction A farmer agrees to sell 10,000 bushels of wheat at the rate of $4.50 per bushel to a buyer in three months. A regulated exchange, such as the Chicago Board of Trade, completes the transaction Description of Transaction Type of Market Abbey allocates 80% of her portfolio for investments in short-term US Treasury bills. Description of Transaction US banks raise additional capital by issuing new stocks and bonds to repay the money they received from the government during the 2008 financial crisis. Type of Market A bank purchased a credit default swap from another financial institution to protect itself against the default of one of its borrowers. In this the bank is cample, Financial markets across economies involve various kinds of participants and trade various types of assets and securities. It is important to understand the kinds of markets in which financial transactions take place. You are preparing to take an exam in your finance cass, and you've been making flash cards on different markets and transactions. Indicate the markets in which each of the following transactions will be traded: Type of Market Description of Transaction You go to an auto dealer and buy a new car. You drive the car home immediately after making the payment. Type of Market Description of Transaction A farmer agrees to sell 10,000 bushels of wheat at the rate of $4.50 per bushel to a buyer in three months. A regulated exchange, such as the Chicago Board of Trade, completes the transaction Description of Transaction Type of Market Abbey allocates 80% of her portfolio for investments in short-term US Treasury bills. Description of Transaction US banks raise additional capital by issuing new stocks and bonds to repay the money they received from the government during the 2008 financial crisis. Type of Market A bank purchased a credit default swap from another financial institution to protect itself against the default of one of its borrowers. In this the bank is cample