Answered step by step

Verified Expert Solution

Question

1 Approved Answer

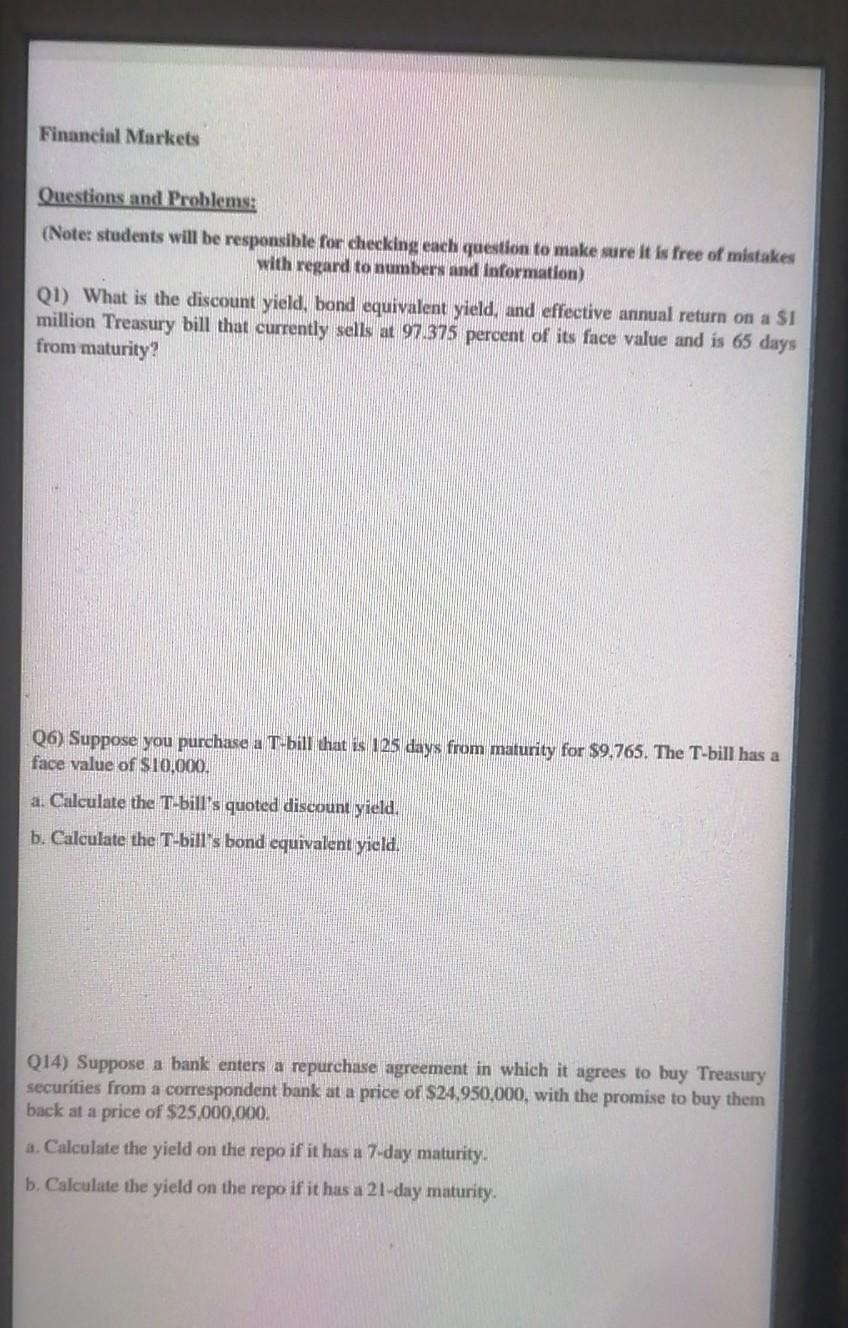

Financial Markets Questions and Problems (Note: students will be responsible for checking each question to make sure it is free of mistakes with regard to

Financial Markets Questions and Problems (Note: students will be responsible for checking each question to make sure it is free of mistakes with regard to numbers and Information) QI) What is the discount yield, bond equivalent yield, and effective annual return on a SI million Treasury bill that currently sells at 97.375 percent of its face value and is 65 days from maturity? 06) Suppose you purchase a T-bill that is 125 days from maturity for $9.765. The T-bill has a face value of $10,000 a. Calculate the T-bill's quoted discount yield, b. Calculate the T-bill's bond equivalent yield. Q14) Suppose a bank enters a repurchase agreement in which it agrees to buy Treasury securities from a correspondent bank at a price of $24,950,000, with the promise to buy them back at a price of $25,000,000. a. Calculate the yield on the repo if it has a 7-day maturity b. Calculate the yield on the repo if it has a 21-day maturity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started