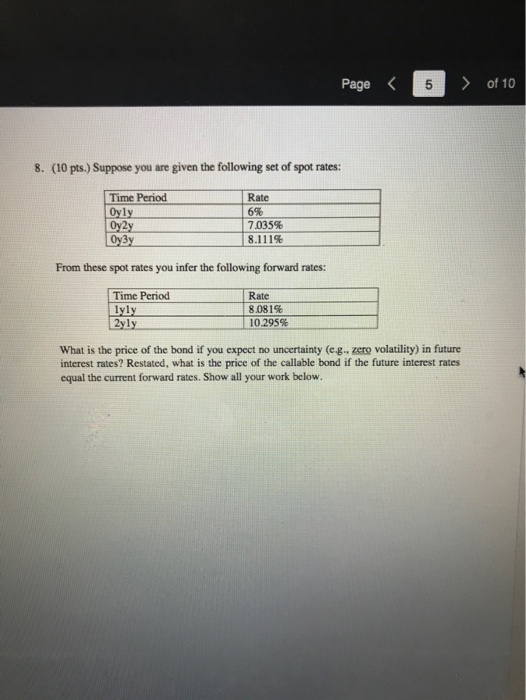

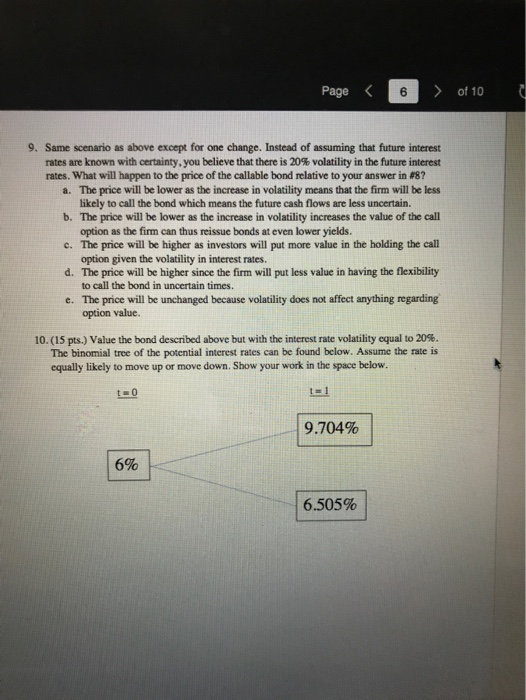

Use the following information for questions 6-11. A BB+ rated firm (0.8., a high yield or non-investment grade) has issued a callable bond with the following features: Exactly 2 years to maturity 9% annual coupon $100 par value The bond is callable in exactly one year for par value. 6. Relative to a non-callable bond with identical features, the price of the callable bond will be a. Lower, because the buyer of the bond is also "long" the call option which makes the bond less valuable for its buyer. b. Lower, because the buyer of the bond is also "short" the call option which makes the bond less valuable for its buyer. c. Higher, because the issuer of the bond is also "long the call option which makes it more valuable to the buyer. d. Higher, because the issuer of the bond is also "short" the call option which makes it more valuable to the buyer. e. Equal, because the call option is worthless. 7. High yield, or non-investment grade, rated firms are likely to issue callable bonds than are investment grade firms because a. Less; they expect their credit ratings to continue to fall making the option worthless b. Less, they expect their credit ratings to improve making the call option less valuable c. More their credit ratings have more room to improve making it more likely they are able to exercise the call option d. More their bond prices are more likely to fall making the call option more valuable to them e. Equally, there is simply no difference in these two types of firms so there will be no difference in their likelihood of issuing callable bonds. MacBook Pro Page of 10 8. (10 pts.) Suppose you are given the following set of spot rates: 6 Time Period Oyly Oy2y Oy3y Rate % 7.035% .111% 8 From these spot rates you infer the following forward rates: S Time Period lyly 2yly Rate 8.081% 10.2959 S What is the price of the bond if you expect no uncertainty (e.g.. zero volatility) in future interest rates? Restated, what is the price of the callable bond if the future interest rates equal the current forward rates. Show all your work below. Page of 10 9. Same scenario as above except for one change. Instead of assuming that future interest rates are known with certainty, you believe that there is 20% volatility in the future interest rates. What will happen to the price of the callable bond relative to your answer in 8? a. The price will be lower as the increase in volatility means that the firm will be less likely to call the bond which means the future cash flows are less uncertain. b. The price will be lower as the increase in volatility increases the value of the call option as the firm can thus reissue bonds at even lower yields. e. The price will be higher as investors will put more value in the holding the call option given the volatility in interest rates. d. The price will be higher since the firm will put less value in having the flexibility to call the bond in uncertain times. e. The price will be unchanged because volatility does not affect anything regarding option value. 10.(15 pts.) Value the bond described above but with the interest rate volatility equal to 20%. The binomial tree of the potential interest rates can be found below. Assume the rate is equally likely to move up or move down. Show your work in the space below. 9.704% 6% 6.505% Page of 10 11. The duration of a callable bond is the duration of an otherwise equal non- callable bond because a. Equal to; they have the same cash flows, same tenor, and same yield. b. Greater than; if the bond is called it increases the tenor of the bond which mechanically increases its duration c. Greater than; callable bonds have higher cash flows making their durations longer. d. Less than; callable bonds are often not called which makes their durations less than that of comparable non-callable bonds. e. Less than the duration of a callable bond can only be less than or equal to that of a comparable non-callable bond because calling a bond moves the final cash flow of the bond earlier in time