Answered step by step

Verified Expert Solution

Question

1 Approved Answer

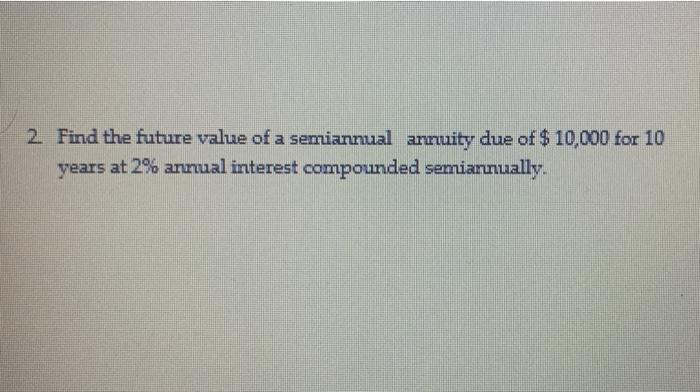

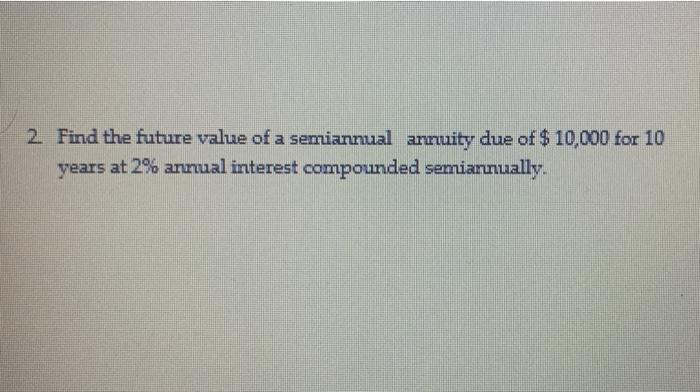

financial math calculation needed 2. Find the future value of a semiannual annuity due of $ 10,000 for 10 years at 2% annual interest compounded

financial math calculation needed

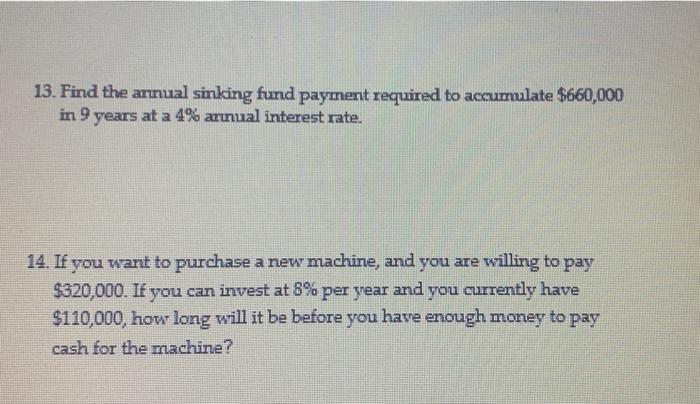

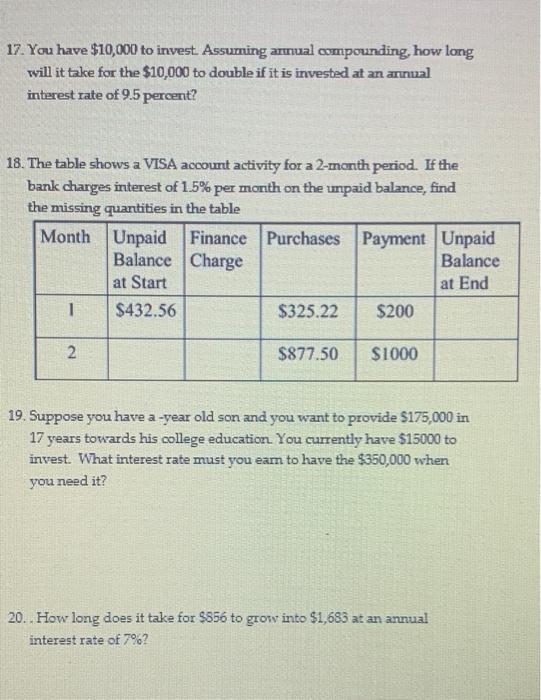

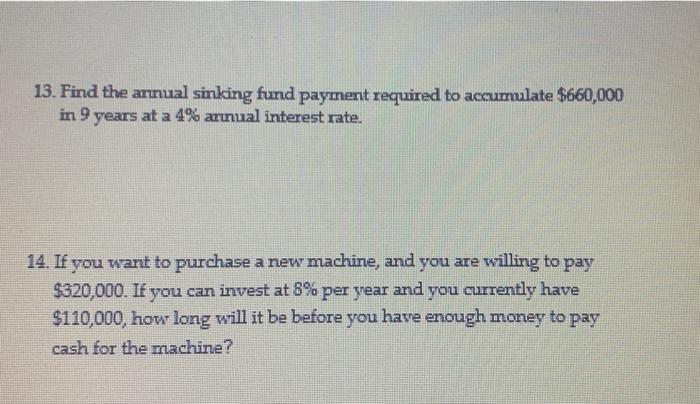

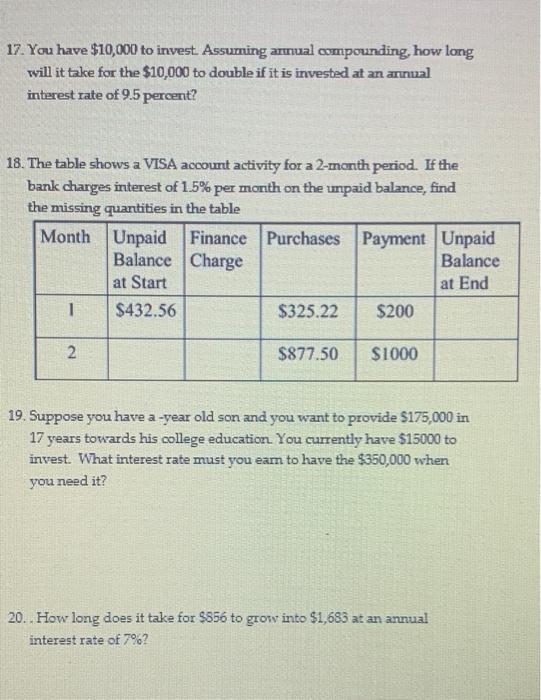

2. Find the future value of a semiannual annuity due of $ 10,000 for 10 years at 2% annual interest compounded semiannually. 13. Find the annual sinking fund payment required to accumulate $660,000 in 9 years at a 4% annual interest rate. 14. If you want to purchase a new machine, and you are willing to pay $320,000. If you can invest at 8% per year and you currently have $110,000, how long will it be before you have enough money to pay cash for the machine? 17. You have $10,000 to invest Assuming annual compounding, how long will it take for the $10,000 to double if it is invested at an annual interest rate of 9.5 percent? 18. The table shows a VISA account activity for a 2-month period. If the bank charges interest of 1.5% per month on the unpaid balance, find the missing quantities in the table Month Unpaid Finance Purchases Payment Unpaid Balance Charge Balance at Start at End 1 $432.56 $325.22 $200 2 $877.50 $1000 19. Suppose you have a -year old son and you want to provide $175,000 in 17 years towards his college education. You currently have $15000 to invest. What interest rate must you eam to have the $350,000 when you need it? 20. How long does it take for $856 to grow into $1,683 at an annual interest rate of 7%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started